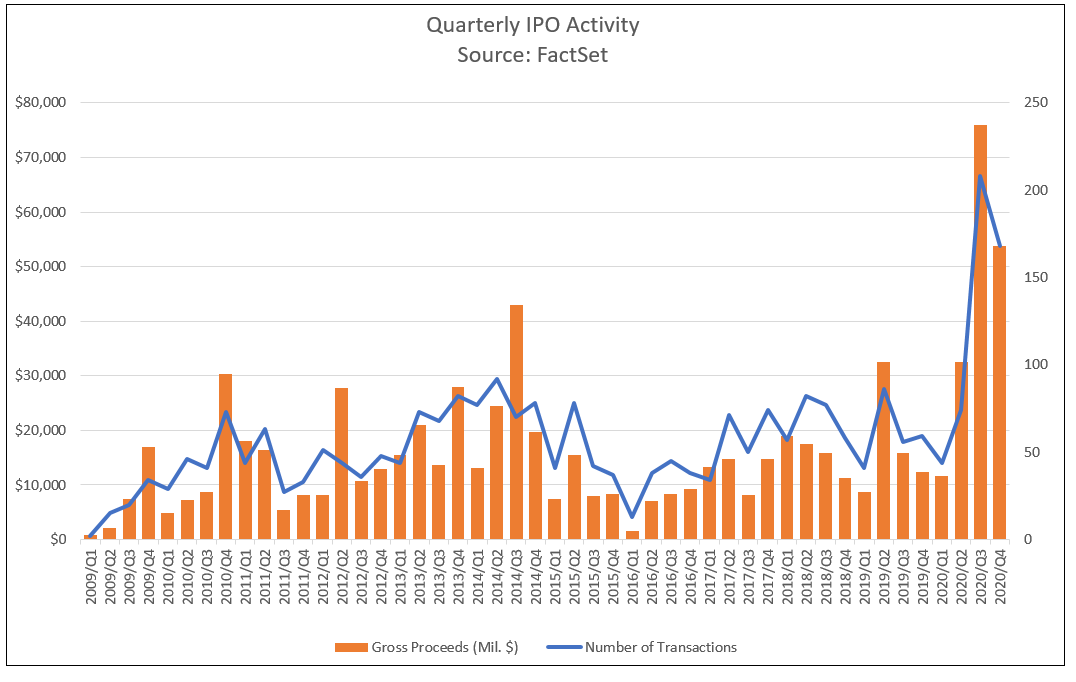

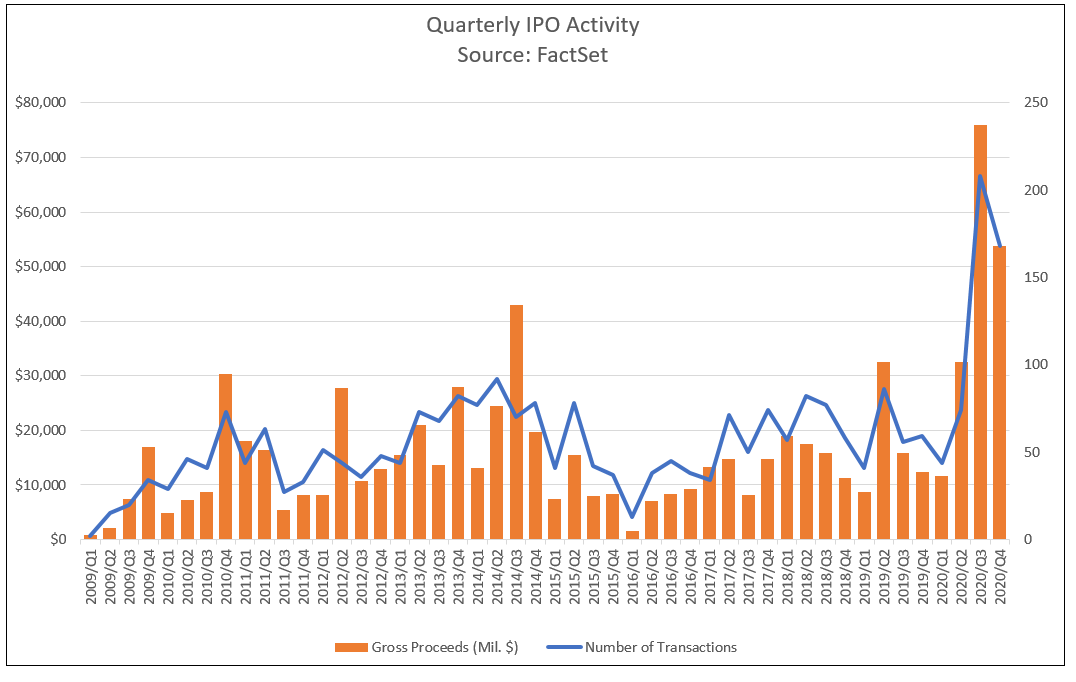

Impact Of Tariffs On IPO Activity: A Market Overview And Predictions

Table of Contents

The Direct Impact of Tariffs on IPO Decisions

Increased tariffs directly affect a company's bottom line, making it less attractive to potential investors during an IPO. This impact manifests in several key ways:

-

Reduced profit margins due to increased input costs: Tariffs raise the cost of imported goods, directly impacting businesses reliant on global supply chains. Manufacturing companies, for instance, may face significantly higher production costs, eating into their profit margins. This directly translates to a lower valuation during an IPO.

-

Uncertainty in future earnings projections due to unpredictable tariff policies: The volatile nature of tariff policies creates significant uncertainty. Companies struggle to accurately forecast future earnings when facing the potential for sudden tariff increases or changes in trade agreements. This uncertainty makes it difficult to provide the stable projections investors require.

-

Negative impact on investor sentiment and valuation: News of increased tariffs often negatively impacts investor confidence. The fear of decreased profitability and increased risk associated with tariff uncertainty can lead to lower valuations during an IPO, making it harder for companies to raise the capital they need.

-

Examples of companies postponing IPOs due to tariff concerns: Several companies, particularly in sectors heavily reliant on imported goods, have postponed their IPOs due to tariff-related concerns. This highlights the tangible impact of tariffs on real-world IPO decisions.

Specific sectors like manufacturing, technology (heavily reliant on imported components), and agriculture are particularly vulnerable to the direct impact of tariffs on their IPO prospects.

The Indirect Influence of Tariffs on Market Conditions

Beyond the direct impact on individual companies, tariffs create a ripple effect across the broader macroeconomic landscape, influencing overall market sentiment and investor behavior.

-

Increased market volatility and uncertainty: Tariff disputes and trade wars introduce a significant level of uncertainty into the global economy, leading to increased market volatility. This makes it harder for investors to predict market trends and makes them more risk-averse.

-

Impact on overall investor risk appetite: The uncertainty generated by tariffs reduces overall investor risk appetite. Investors become more cautious, preferring safer investments and delaying riskier ventures like investing in newly public companies.

-

Potential for decreased investor confidence and reduced investment in general: A prolonged period of tariff uncertainty can severely damage investor confidence, leading to a decrease in overall investment, including IPO participation. This creates a negative feedback loop, further impacting economic growth.

-

Correlation between tariff increases and stock market indices: Studies have shown a correlation between increases in tariffs and negative movements in major stock market indices like the Dow Jones Industrial Average and the S&P 500, further illustrating the broad market impact.

The impact of global trade wars is far-reaching. Tariffs imposed by one country can trigger retaliatory tariffs, creating a chain reaction that impacts businesses and markets worldwide.

Geographic Variations in IPO Activity Related to Tariffs

The impact of tariffs on IPO activity isn't uniform across the globe. Different countries and regions experience varying levels of impact based on their involvement in international trade and their domestic economic conditions.

-

Impact of tariffs on domestic IPO markets versus international markets: Countries heavily reliant on exports might see a greater negative impact on their domestic IPO markets compared to countries with more diversified economies.

-

Analysis of IPO activity in countries heavily involved in international trade: Countries heavily engaged in international trade are more susceptible to the effects of tariff disputes. Their IPO markets often reflect the volatility created by these disputes.

-

Comparing IPO performance in tariff-affected sectors across different countries: By comparing IPO performance across various countries, we can observe the varying impacts of tariffs on specific sectors. For example, the impact of tariffs on the automotive industry might be more pronounced in some countries than others.

Geographic diversification can offer a degree of protection against the negative effects of tariffs. Companies with diversified international operations might be less susceptible to the impact of tariffs imposed on specific regions.

Predicting Future IPO Trends Based on Tariff Policies

Predicting future IPO trends requires careful consideration of current and anticipated tariff policies. Several scenarios are possible:

-

Scenarios based on different tariff outcomes (e.g., escalation, de-escalation, stability): An escalation of trade tensions could lead to a continued slowdown in IPO activity, while de-escalation or stabilization of tariff policies could potentially stimulate a recovery.

-

Forecasts for IPO activity in specific sectors under different tariff scenarios: Specific sectors heavily affected by tariffs, such as manufacturing and technology, will likely see their IPO activity fluctuate significantly depending on the evolving tariff landscape.

-

Potential for alternative fundraising methods to gain traction due to tariff uncertainty (e.g., private equity): In times of high uncertainty, companies might explore alternative fundraising methods like private equity financing to avoid the risks and volatility associated with public offerings.

These predictions, however, come with inherent risks and caveats. Unforeseen geopolitical events and changes in government policies can significantly alter the IPO landscape, making accurate predictions challenging.

Conclusion

Tariffs exert a significant and multifaceted influence on IPO activity. Their direct impact on company profitability and the indirect effect on market sentiment and investor behavior create a complex interplay that shapes the global IPO landscape. The geographic variations in the impact further highlight the complexities involved. Understanding the impact of tariffs on IPO activity is crucial for navigating the complexities of the global financial landscape. To make informed investment decisions, stay informed about evolving tariff policies and their potential implications for IPOs. Further research in this area can provide invaluable insights for investors, companies planning IPOs, and policymakers alike. Understanding the impact of tariffs on IPO activity is crucial for navigating the complexities of the global financial landscape.

Featured Posts

-

Captain America Brave New World Has The Mcus Darkest Chapter Ended

May 14, 2025

Captain America Brave New World Has The Mcus Darkest Chapter Ended

May 14, 2025 -

Cambios En El Banquillo Del Sevilla Pimienta Fuera Caparros Dentro

May 14, 2025

Cambios En El Banquillo Del Sevilla Pimienta Fuera Caparros Dentro

May 14, 2025 -

Is Parker Mc Collum The Next George Strait A Rising Stars Ambitious Goal

May 14, 2025

Is Parker Mc Collum The Next George Strait A Rising Stars Ambitious Goal

May 14, 2025 -

Swiateks Rome Defeat Drop From World No 2 Confirmed

May 14, 2025

Swiateks Rome Defeat Drop From World No 2 Confirmed

May 14, 2025 -

Eurovision 2025 Srf Details Three Week Broadcast Plan For Switzerland

May 14, 2025

Eurovision 2025 Srf Details Three Week Broadcast Plan For Switzerland

May 14, 2025

Latest Posts

-

Judd Family Docuseries Wynonna And Ashley Share Intimate Stories

May 14, 2025

Judd Family Docuseries Wynonna And Ashley Share Intimate Stories

May 14, 2025 -

The Latest Charming Film From Netflix A Weekend Must Watch

May 14, 2025

The Latest Charming Film From Netflix A Weekend Must Watch

May 14, 2025 -

Wynonna And Ashley Judd A Familys Untold Story In New Docuseries

May 14, 2025

Wynonna And Ashley Judd A Familys Untold Story In New Docuseries

May 14, 2025 -

Giant Hearted Movie On Netflix Must See Weekend Viewing

May 14, 2025

Giant Hearted Movie On Netflix Must See Weekend Viewing

May 14, 2025 -

A Heartfelt Netflix Film Your Perfect Weekend Plan

May 14, 2025

A Heartfelt Netflix Film Your Perfect Weekend Plan

May 14, 2025