Improving Your Credit After Late Student Loan Payments

Table of Contents

Understanding the Impact of Late Student Loan Payments on Your Credit

Late student loan payments have serious consequences for your credit score. When you miss a payment, your loan servicer reports this delinquency to the three major credit bureaus: Experian, Equifax, and TransUnion. This negative information significantly impacts your creditworthiness, affecting your FICO score and VantageScore. These scores are crucial for obtaining loans, renting an apartment, and even securing certain jobs.

- Late payments lower your credit score significantly. The severity of the impact depends on the length of the delinquency and your overall credit history. Even one late payment can noticeably decrease your score.

- Negative marks can stay on your report for 7 years. This means the impact of a late payment can linger for a considerable time.

- Late payments can make it harder to get loans, rent an apartment, or even get a job. Lenders and landlords use credit scores to assess risk, and a poor credit score can severely limit your options.

Strategies to Improve Your Credit Score After Late Payments

Repairing your credit after late student loan payments takes time and effort, but it's achievable. The following strategies can help you improve your credit score and rebuild your financial standing.

Communicating with Your Loan Servicer

The first step is to contact your student loan servicer immediately. Open and honest communication is crucial. Explain your situation and explore options to avoid further late payments. They may offer solutions such as:

- Forbearance: A temporary suspension of your payments.

- Deferment: A postponement of payments, often due to specific circumstances.

- Income-driven repayment plans: Payment plans adjusted based on your income and family size.

Remember to document every conversation, including the date, time, and the person you spoke with. This documentation will be essential if any disputes arise.

- Negotiate a payment plan to avoid further late payments. A payment plan can help you manage your debt more effectively.

- Explore options for reducing your monthly payment. Lowering your monthly payment can make it easier to stay current.

- Keep detailed records of all conversations and agreements. This is crucial for protecting your rights.

Paying Down Existing Debt

Consistent on-time payments on all your accounts are vital for improving your credit score. Prioritize paying down your debt, and consider these strategies:

- Snowball method: Pay off your smallest debts first to gain momentum.

- Avalanche method: Focus on paying off the debts with the highest interest rates first to save money on interest.

Paying more than the minimum payment each month can significantly reduce your debt faster and improve your credit score more quickly.

- Prioritize paying down high-interest debt first. High-interest debt impacts your score more significantly.

- Automate payments to avoid missing deadlines. Set up automatic payments to ensure timely payments.

- Consider debt consolidation to simplify payments. Consolidating your debts into a single loan can simplify your payments and potentially lower your interest rate.

Monitoring Your Credit Report Regularly

Regularly checking your credit report is essential for identifying and resolving any errors. You can obtain your free credit reports annually from AnnualCreditReport.com. Review your reports carefully for inaccuracies and dispute any errors immediately.

- Review your credit report at least annually. Regular checks help you catch errors and track your progress.

- Correct any errors or inaccuracies promptly. Disputing errors can improve your credit score.

- Utilize credit monitoring services for added protection. Credit monitoring services can alert you to potential issues.

Preventing Future Late Payments

Preventing future late payments is just as important as repairing past ones. Implement these strategies to maintain a healthy credit score:

-

Set up automatic payments. This eliminates the risk of missed payments due to oversight.

-

Use budgeting tools and apps to track expenses. These tools can help you manage your finances and ensure you have enough money for your loan payments.

-

Create a realistic budget to ensure loan payments are prioritized. A well-structured budget helps ensure loan payments are prioritized.

-

Set reminders for payment due dates. Utilize calendar reminders or other methods to stay informed.

-

Link your bank account for automated payments. Automatic payments are a reliable way to stay current.

-

Create a dedicated savings account for loan payments. This account can act as a buffer for unexpected expenses.

Conclusion

Improving your credit after late student loan payments requires consistent effort and proactive steps. By communicating with your loan servicer, implementing effective debt repayment strategies, monitoring your credit report, and adopting preventative measures, you can significantly improve your credit score and financial well-being. Don't let late student loan payments define your financial future. Start improving your credit today by following these steps and reclaiming your financial well-being. Begin the process of improving your credit after late student loan payments now!

Featured Posts

-

Find The Best Crypto Casinos In 2025 Compare Bitcoin Casinos With Easy Withdrawals

May 17, 2025

Find The Best Crypto Casinos In 2025 Compare Bitcoin Casinos With Easy Withdrawals

May 17, 2025 -

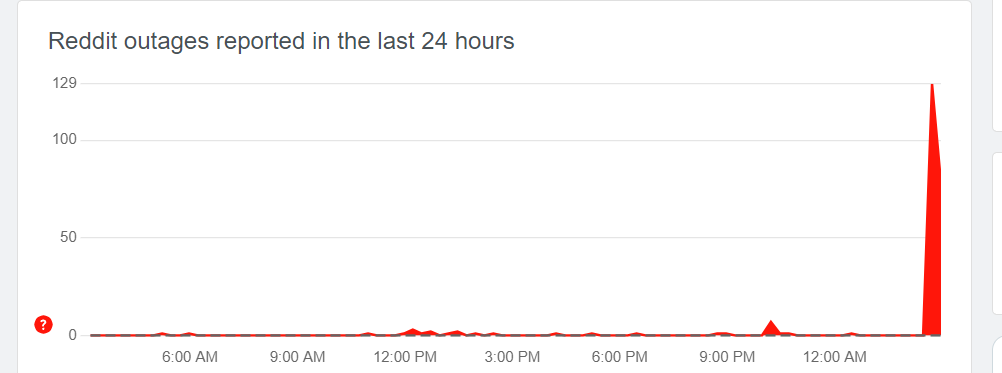

Reddit Service Disruption Affects Thousands Worldwide

May 17, 2025

Reddit Service Disruption Affects Thousands Worldwide

May 17, 2025 -

Mike Breens Lighthearted Rivalry With Mikal Bridges

May 17, 2025

Mike Breens Lighthearted Rivalry With Mikal Bridges

May 17, 2025 -

Nba Betting Knicks Vs Pistons Series Use Bet365 Bonus Code Nypbet

May 17, 2025

Nba Betting Knicks Vs Pistons Series Use Bet365 Bonus Code Nypbet

May 17, 2025 -

Granit Xhaka Mbreti I Pasimeve Ne Bundeslige Analiza E Performances Se Tij

May 17, 2025

Granit Xhaka Mbreti I Pasimeve Ne Bundeslige Analiza E Performances Se Tij

May 17, 2025