Income Tax Investigation: HMRC Letters To High Earners In The UK

Table of Contents

Types of HMRC Letters High Earners Might Receive

HMRC correspondence can vary significantly in tone and implication. Understanding the nuances of these letters is crucial for a timely and appropriate response. High earners might receive several types of letters, each demanding a different level of attention and action.

-

Enquiry Letter: This is usually the first step. An HMRC enquiry letter typically requests clarification on specific aspects of your tax return, such as a particular expense or income source. It might ask for supporting documentation to verify the information provided. Keywords: HMRC enquiry letter, HMRC correspondence.

-

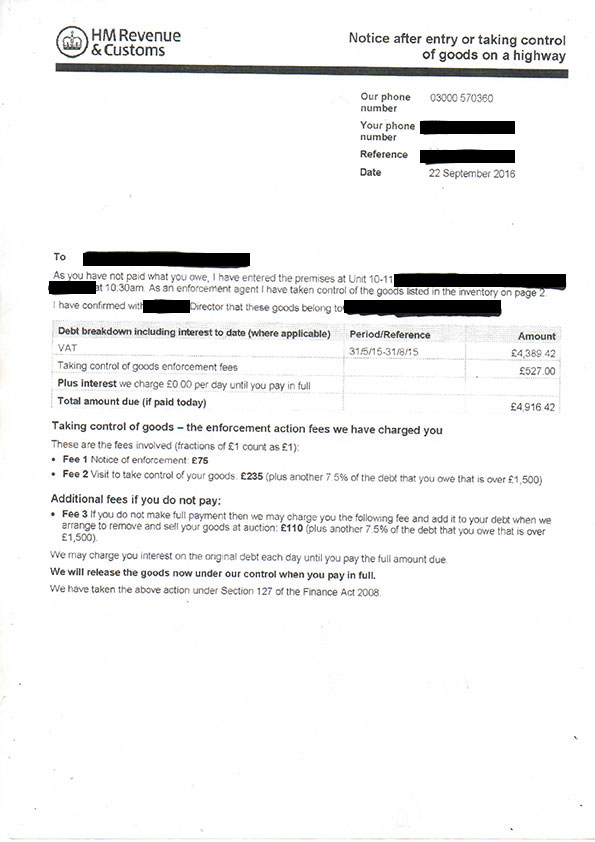

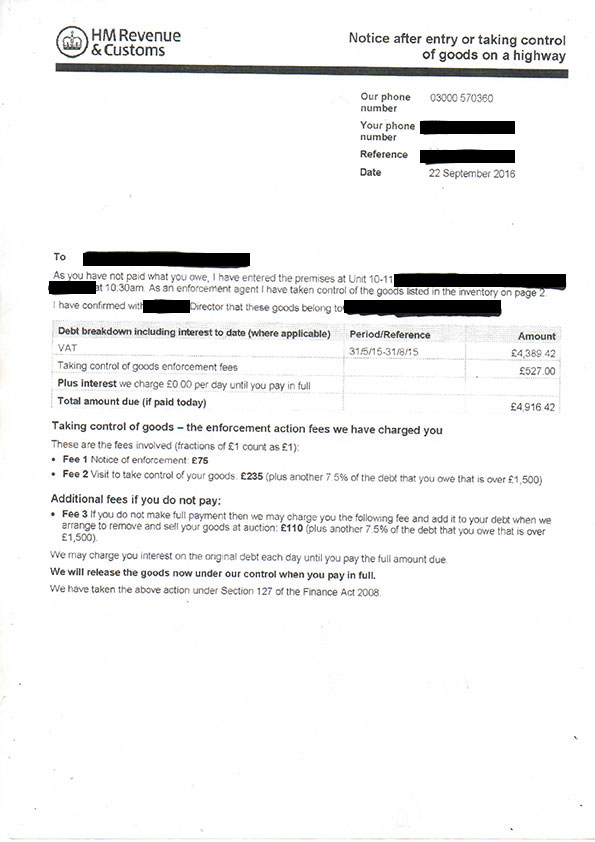

Formal Investigation Letter: This signifies a more serious step. A formal HMRC investigation letter indicates that a full investigation into your tax affairs has been initiated. This often involves a more thorough review of your tax records and potentially interviews. Keywords: HMRC investigation letter.

-

Penalty Notices: If HMRC finds discrepancies or evidence of non-compliance, you may receive a penalty notice detailing the potential financial penalties you face. These penalties can be substantial, depending on the severity of the infraction. Keywords: tax penalty UK, HMRC penalties.

Common Reasons for HMRC Scrutiny of High Earners

HMRC targets high-income individuals for several reasons. While perfectly legal tax planning is common, certain practices or circumstances raise red flags. Understanding these triggers can help high earners proactively manage their tax affairs and minimize the risk of an investigation.

-

Undeclared Income: Failing to declare all sources of income, whether from employment, investments, or self-employment, is a major reason for HMRC scrutiny. Keywords: undeclared income HMRC, tax evasion UK.

-

Offshore Accounts: The use of offshore accounts, particularly those not properly declared, is a significant area of focus for HMRC. Stricter regulations and increased international cooperation make it increasingly difficult to hide assets or income offshore. Keywords: HMRC offshore accounts, high-net-worth individual tax.

-

Complex Tax Structures: While sophisticated tax planning is permissible, overly complex structures can raise suspicion. HMRC may investigate to ensure that these structures are legitimate and not designed to avoid paying the correct amount of tax.

-

Inconsistent Tax Returns: Significant variations in your tax returns from year to year without a clear explanation can trigger an HMRC investigation. Consistency in reporting is key to demonstrating compliance.

-

Suspicious Transactions: Large, unusual, or unexplained transactions can attract HMRC attention. This is particularly true for transactions involving offshore accounts or high-value assets.

Responding to an HMRC Letter: A Step-by-Step Guide

Receiving an HMRC letter can be stressful. However, a prompt and organized response is crucial. Here's a step-by-step guide on how to handle HMRC correspondence effectively:

-

Acknowledge the Letter Promptly: Confirm receipt of the letter and indicate you understand the request.

-

Gather All Relevant Documentation: Collect all supporting documents related to the issues raised in the letter. This may include bank statements, payslips, invoices, and investment records.

-

Seek Professional Tax Advice: This is arguably the most crucial step. A qualified tax advisor specializing in UK tax law can guide you through the process, ensuring you respond correctly and protect your interests. Keywords: HMRC response, tax advisor UK, tax specialist UK, income tax compliance.

-

Respond Within the Timeframe Specified: Adhere strictly to the deadlines set by HMRC. Failure to do so can have serious consequences.

-

Maintain Detailed Records: Keep meticulous records of all communication with HMRC, including copies of letters, emails, and any supporting documentation you have provided.

Potential Penalties and Consequences of Non-Compliance

Non-compliance with HMRC requests or discovery of tax evasion can lead to serious penalties and consequences.

-

Financial Penalties: HMRC can impose significant financial penalties, potentially reaching up to 100% of the unpaid tax. The penalty amount depends on the severity of the non-compliance and whether it was deliberate. Keywords: HMRC penalties, tax fraud penalties.

-

Criminal Prosecution: In cases of serious tax fraud or deliberate evasion, criminal prosecution can result in imprisonment and a criminal record.

-

Reputational Damage: An HMRC investigation can severely damage your reputation, affecting your business relationships and professional standing.

-

Loss of Business Opportunities: The negative publicity associated with an HMRC investigation can make it difficult to secure new business or investment opportunities. Keywords: tax evasion consequences UK.

Conclusion: Protecting Yourself from HMRC Income Tax Investigations

Proactive tax planning and compliance are essential for high earners in the UK. Understanding your tax obligations and maintaining accurate records significantly reduce the risk of an HMRC income tax investigation. Seeking professional advice from a qualified tax advisor is crucial, not only for navigating complex tax regulations but also for mitigating the potential risks and consequences of non-compliance. Don't wait until you receive an HMRC letter – contact a qualified tax advisor today to discuss your tax affairs and minimize your risk of an HMRC income tax investigation. Keywords: Avoid HMRC Income Tax Investigations, HMRC Tax Investigation Help, UK High Earner Tax Advice, HMRC Compliance for High Earners.

Featured Posts

-

Acquista Hercule Poirot Per Ps 5 Meno Di 10 E Su Amazon

May 20, 2025

Acquista Hercule Poirot Per Ps 5 Meno Di 10 E Su Amazon

May 20, 2025 -

Slavni Na Premijeri Jutarnji List Otkriva Sve Detalje

May 20, 2025

Slavni Na Premijeri Jutarnji List Otkriva Sve Detalje

May 20, 2025 -

Mainz 05 Leverkusen Complete Matchday 34 Report And Highlights

May 20, 2025

Mainz 05 Leverkusen Complete Matchday 34 Report And Highlights

May 20, 2025 -

2025 Money In The Bank Perez And Ripley Punch Their Tickets

May 20, 2025

2025 Money In The Bank Perez And Ripley Punch Their Tickets

May 20, 2025 -

Susan Lucci Splashes Water On Michael Strahan A Hilarious Moment

May 20, 2025

Susan Lucci Splashes Water On Michael Strahan A Hilarious Moment

May 20, 2025