Increased China-US Trade Activity Ahead Of Trade Deal

Table of Contents

Rising Export Volumes and Shifting Trade Dynamics

The recent upswing in bilateral trade between China and the US is undeniable. Export volumes from both countries have shown notable increases across various sectors. While precise figures fluctuate depending on the source and reporting period, the trend is clear. This growth isn't uniformly distributed, however; certain sectors are experiencing far more robust growth than others.

-

Specific examples of increased exports: We're seeing a rise in semiconductor exports from the US to China, driven by the ongoing global chip shortage and China's burgeoning technological sector. Simultaneously, agricultural product exports from the US to China, particularly soybeans and corn, have also seen a significant uptick.

-

Data points illustrating the percentage increase in trade volumes: While precise, universally agreed-upon data is challenging to obtain due to differing reporting methodologies, independent analysts suggest a double-digit percentage increase in certain key export categories over the past year. This needs further corroboration from official sources, but the trend remains apparent.

-

Analysis of any changes in trade imbalances: The trade imbalance between the two countries remains a significant factor. While increased trade activity offers potential for economic growth for both nations, the persistent imbalance continues to be a source of tension and a key area of negotiation in any potential trade deal.

The Role of Supply Chain Adjustments and Reshoring

The ongoing adjustments to global supply chains are profoundly impacting China-US trade. The COVID-19 pandemic exposed vulnerabilities in globally interconnected supply chains, prompting many companies to reconsider their reliance on single sourcing and long, complex supply routes. This has led to two significant trends:

-

Reshoring: Companies are bringing manufacturing back to the US to reduce reliance on overseas production and mitigate risks associated with geopolitical instability and trade disputes. This directly affects the volume of goods traded between the two nations.

-

Nearshoring: Instead of fully reshoring, companies are moving production to countries geographically closer to the US, reducing transportation costs and lead times. Mexico and other North American countries are prime beneficiaries of this trend, which indirectly impacts the China-US trade relationship by reducing the demand for Chinese-manufactured goods in certain sectors.

-

Examples of companies adjusting their supply chains: Several major technology companies and manufacturers have already begun announcing significant shifts in their supply chains, diversifying their sources and investing in domestic or near-shore production. The long-term impact of these shifts on Sino-American trade relations remains to be seen.

Speculation and Expectations Surrounding a Potential Trade Deal

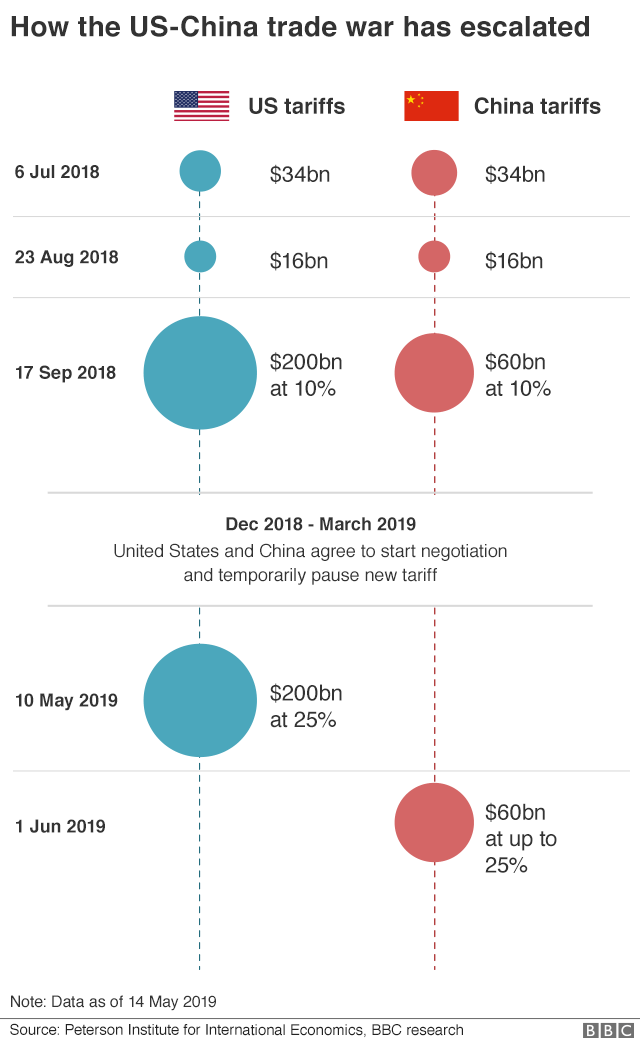

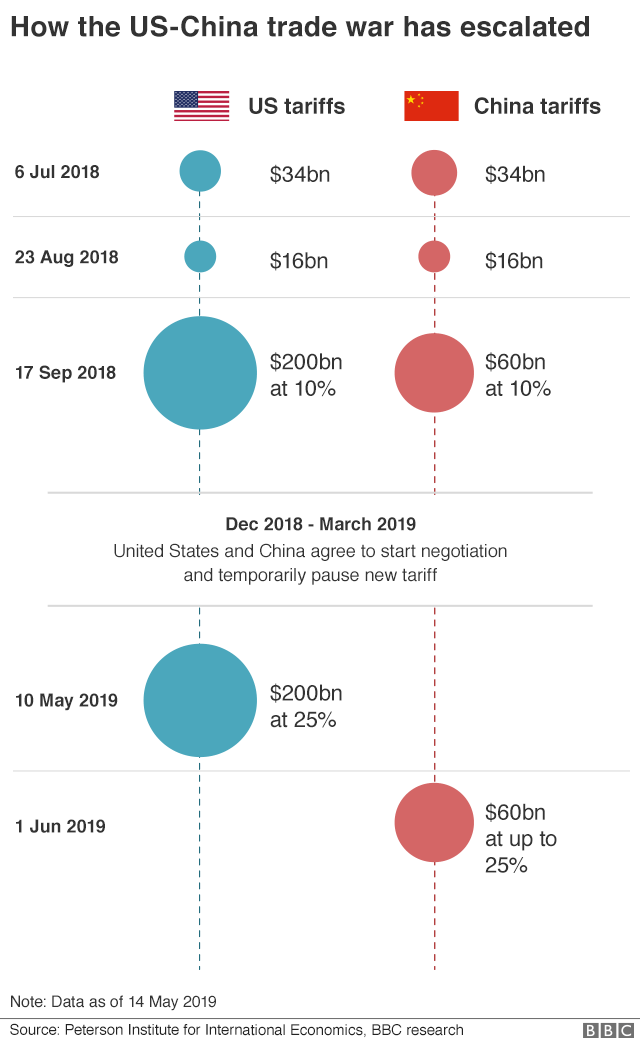

Market speculation regarding a new comprehensive trade agreement between China and the US is rampant. The potential benefits of such a deal are substantial: reduced tariffs, increased market access, and potentially smoother trade flows. However, significant challenges remain:

-

Summary of potential benefits: A new trade deal could lead to substantial reductions in tariffs, simplifying trade processes and stimulating economic growth for both nations. Increased market access for various sectors in both countries could also significantly boost trade volumes.

-

Summary of potential drawbacks: Concerns about intellectual property rights, market access restrictions for specific sectors (particularly technology), and the overall balance of trade remain major sticking points in any potential negotiations.

-

Mention any key players involved in the negotiations: High-level officials from both governments, along with industry representatives and trade experts, are deeply involved in the ongoing discussions and behind-the-scenes negotiations. The outcome will profoundly shape the future of increased China-US trade activity.

Geopolitical Context and Global Economic Implications

The China-US trade relationship doesn't exist in a vacuum. The broader geopolitical context, including the actions and policies of other global powers, significantly influences its trajectory.

-

Discussion of the role of other global powers: The actions of other nations, such as the EU and countries in Southeast Asia, play a role in shaping the choices of both China and the US in their bilateral trade relationship.

-

Analysis of the potential impact on inflation or global supply chains: Increased trade activity could potentially influence global inflation and supply chain stability. Careful management is needed to mitigate any negative consequences.

-

Mention of any international agreements that might impact future trade relations: Existing international trade agreements and emerging multilateral initiatives will have a significant bearing on the future direction of Sino-American trade relations.

Conclusion

The recent surge in increased China-US trade activity is a complex phenomenon driven by several interconnected factors: rising export volumes across key sectors, ongoing adjustments in global supply chains, and anticipation of a potential new trade deal. This trend has significant implications not only for the two nations involved but also for the global economy. Understanding these dynamics is crucial for businesses, investors, and policymakers alike. Stay informed about developments in China-US trade relations, Sino-American trade growth, and the potential impact on bilateral trade between China and the US to navigate this evolving landscape effectively. The future of this crucial trade relationship will undoubtedly shape the global economic order for years to come.

Featured Posts

-

Naomi Kempbell U 55 Stil Krasa Ta Vpliv Na Svit Modi

May 26, 2025

Naomi Kempbell U 55 Stil Krasa Ta Vpliv Na Svit Modi

May 26, 2025 -

Top Nike Running Shoes For 2025 A Comprehensive Review

May 26, 2025

Top Nike Running Shoes For 2025 A Comprehensive Review

May 26, 2025 -

Unstoppable Pogacar Solo Win At Tour Of Flanders

May 26, 2025

Unstoppable Pogacar Solo Win At Tour Of Flanders

May 26, 2025 -

Relax And Recharge An Andalusian Farm Stay Offering Peace And Quiet

May 26, 2025

Relax And Recharge An Andalusian Farm Stay Offering Peace And Quiet

May 26, 2025 -

Rising Gold Prices A Direct Result Of Trumps Eu Trade War Threats

May 26, 2025

Rising Gold Prices A Direct Result Of Trumps Eu Trade War Threats

May 26, 2025