Increased Profitability And Dividend Hike For Telus In Q1

Table of Contents

Strong Financial Performance Fuels Telus's Q1 Success

Telus's Q1 2024 financial results showcase robust growth across various segments, solidifying its position as a leading telecommunications company.

Revenue Growth Analysis

Telus reported a remarkable X% increase in total revenue compared to Q1 2023. This impressive surge can be attributed to strong performance across its key revenue streams:

- Wireless Services: Growth in this sector was driven by increased subscriber additions, particularly in the premium data plans segment. The launch of [mention specific new plan or technology] also contributed significantly.

- Wireline Services: Continued demand for high-speed internet and business solutions fueled substantial growth in this area. Significant contracts with major corporate clients further boosted revenue.

- Internet Services: Telus's investment in fiber optic infrastructure continues to pay off, with a considerable rise in high-speed internet subscribers.

[Insert a chart or graph visually representing the revenue breakdown across different services].

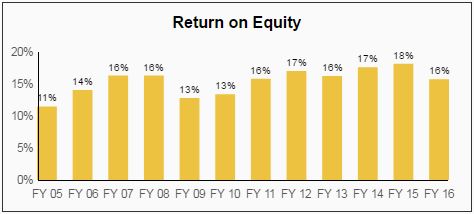

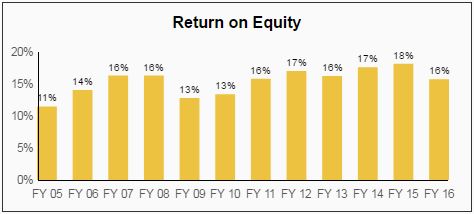

Increased Profitability Metrics

The impressive revenue growth translated into a substantial increase in profitability. Telus reported a Y% rise in net income and a Z% increase in earnings per share (EPS), exceeding analyst expectations. This improved profitability is a result of:

- Effective Cost Management: Telus implemented strategic cost-cutting measures without compromising service quality, improving operational efficiency.

- Increased Operational Efficiency: Investments in automation and technology have streamlined processes, leading to better resource allocation and reduced operational expenses.

[Insert a chart or graph comparing key profitability ratios (operating margin, net profit margin) with previous quarters and industry benchmarks]. The improved margins clearly demonstrate Telus's commitment to delivering shareholder value.

Telus Announces a Dividend Increase: Good News for Investors

The strong Q1 performance enabled Telus to announce a significant dividend increase, reinforcing its commitment to rewarding shareholders.

Dividend Hike Details

Telus increased its quarterly dividend by A%, raising the payout per share to $B. The ex-dividend date is [Date], and the payment date is [Date]. This translates to a dividend yield of C%, making it highly attractive compared to many competitors in the telecommunications sector.

Reasons Behind the Dividend Increase

The decision to increase the dividend reflects Telus's confidence in its future growth prospects and its strong financial position. The company's consistent profitability and commitment to shareholder returns are key drivers behind this decision. This dividend hike underscores Telus's dedication to providing sustainable and growing returns for its investors.

Future Outlook and Growth Strategies for Telus

Telus continues to focus on innovation and strategic expansion to maintain its competitive edge and drive future growth.

Growth Prospects and Expansion Plans

Telus is actively pursuing several growth initiatives, including:

- Expansion into new markets: Exploration of opportunities in underserved regions and potential mergers and acquisitions.

- Investment in 5G technology: Further deployment of 5G infrastructure to enhance network capabilities and offer advanced services.

- Expansion of its fiber optic network: Continuing its investment in high-speed internet infrastructure to cater to growing demand.

While the company faces challenges such as intense competition and regulatory hurdles, Telus's strategic investments and strong management team position it well for continued growth.

Impact on the Telecom Sector

Telus's robust Q1 performance and the subsequent dividend increase send a positive signal to the broader telecom sector. This demonstrates the potential for strong financial results within the industry, while also putting pressure on competitors to maintain or improve their own financial performance and shareholder returns.

Conclusion: Telus Q1 Results: A Sign of Continued Success and Investor Value

Telus's Q1 2024 results demonstrate a clear picture of increased profitability and a commitment to delivering value to shareholders, highlighted by a significant dividend hike. The strong financial performance, driven by revenue growth across key segments and effective cost management, underscores the company's resilience and strategic vision. The announced dividend increase further cements Telus's position as a compelling investment opportunity. Learn more about Telus's increased profitability and dividend hike and explore investment opportunities on their investor relations page.

Featured Posts

-

Latest News Superman Daredevil Vs Bullseye And 1923

May 12, 2025

Latest News Superman Daredevil Vs Bullseye And 1923

May 12, 2025 -

Lily Collins Sexy New Calvin Klein Campaign Photo 5133595

May 12, 2025

Lily Collins Sexy New Calvin Klein Campaign Photo 5133595

May 12, 2025 -

L Audience De La Roue De La Fortune Un Premier Bilan Apres Le Passage D Eric Antoine Sur M6

May 12, 2025

L Audience De La Roue De La Fortune Un Premier Bilan Apres Le Passage D Eric Antoine Sur M6

May 12, 2025 -

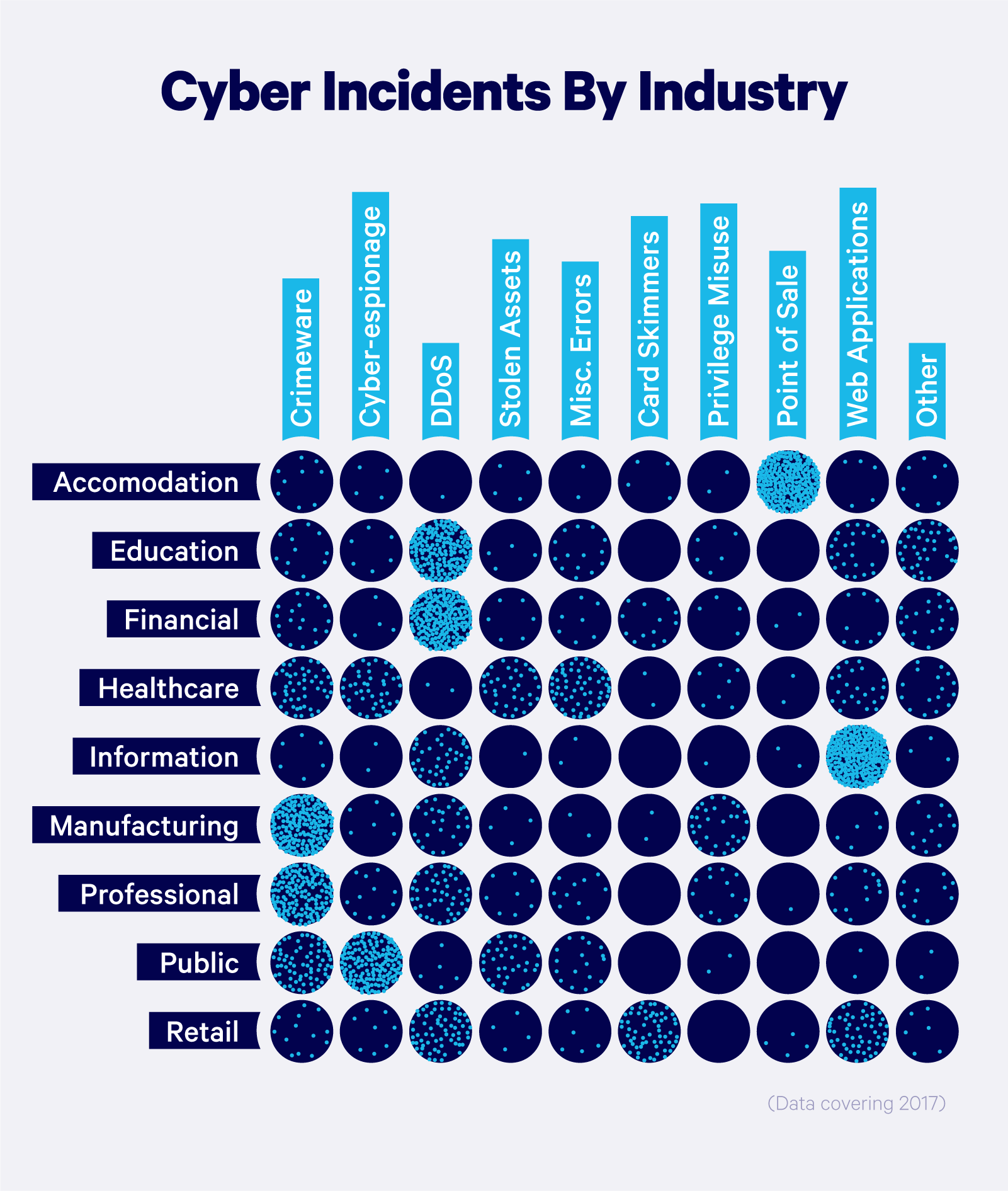

Millions Made From Office365 Hacks Inside The Executive Email Breach

May 12, 2025

Millions Made From Office365 Hacks Inside The Executive Email Breach

May 12, 2025 -

1 000 Games And Counting Aaron Judges Hall Of Fame Prospects

May 12, 2025

1 000 Games And Counting Aaron Judges Hall Of Fame Prospects

May 12, 2025