Increased Retail Sales: Implications For Bank Of Canada Interest Rates

Table of Contents

Inflationary Pressures and Retail Sales Growth

Robust retail sales figures directly correlate with inflationary pressures. Increased consumer spending fuels what economists call "demand-pull" inflation. As consumers spend more, demand for goods and services rises, pushing prices upward. This upward pressure on prices is a key indicator of inflation.

- Increased consumer spending fuels demand-pull inflation: The higher demand outpaces the supply, leading to price increases.

- Higher prices for goods and services contribute to inflation: This is a direct consequence of increased demand and potentially constrained supply.

- Strong retail sales data indicates a healthy, but potentially overheating, economy: While strong sales are positive, excessively rapid growth can signal an economy growing too quickly, leading to unsustainable inflation.

- Supply chain issues exacerbate inflationary pressures: Existing supply chain bottlenecks, though easing, can still constrain supply and amplify price increases even with strong demand. This means that even if demand moderates somewhat, price pressures could persist due to supply-side constraints.

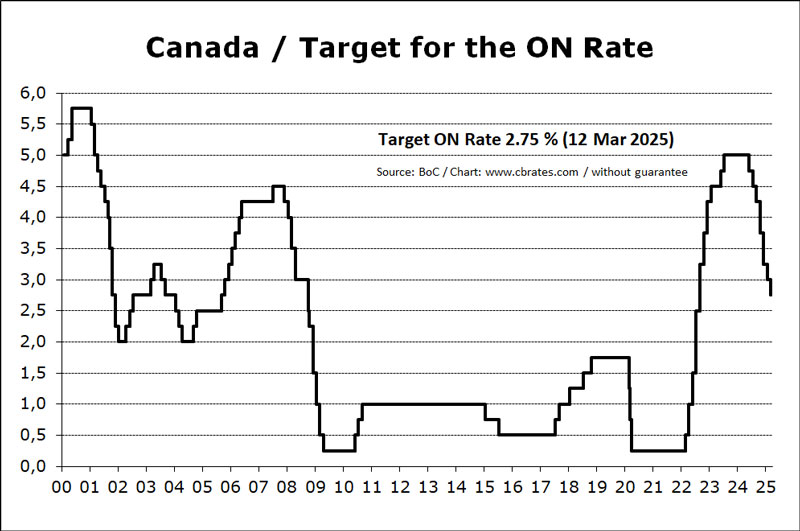

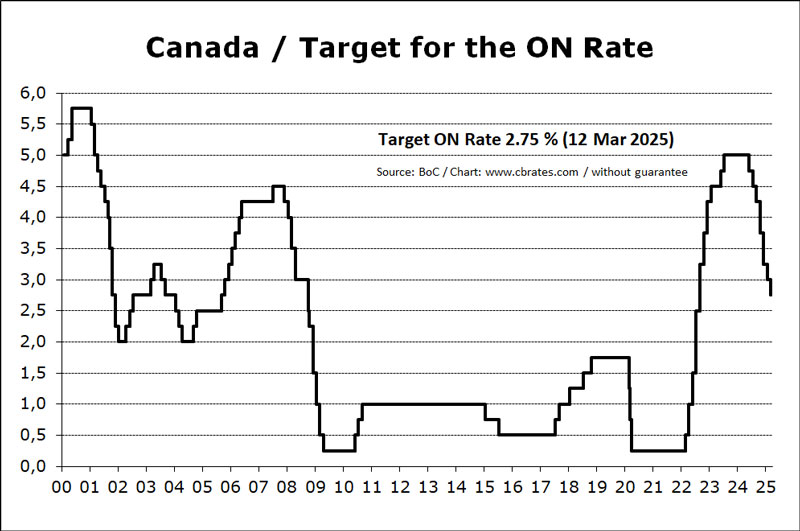

Bank of Canada's Mandate and Reactionary Measures

The Bank of Canada's primary mandate is price stability, maintaining inflation within a target range (currently 1-3%). Increased retail sales, as a strong indicator of economic activity and potential inflation, significantly influence the Bank's assessment of the current economic situation.

- The Bank's inflation target is crucial: Exceeding this target for an extended period necessitates action to cool down the economy.

- Exceeding the inflation target may lead to interest rate hikes: Higher interest rates make borrowing more expensive, discouraging consumer spending and business investment, thus reducing demand and inflationary pressures.

- The Bank uses various tools beyond interest rate adjustments: These may include quantitative tightening (reducing the money supply) or forward guidance (communicating intentions about future monetary policy).

Potential Scenarios and Interest Rate Predictions

Several scenarios could unfold based on future retail sales data and other economic indicators:

- Scenario 1: Continued strong sales lead to further interest rate increases: If retail sales remain robust, the Bank might raise interest rates further to curb inflation.

- Scenario 2: Sales growth moderates, leading to a pause or smaller increase: A slowdown in retail sales growth could signal reduced inflationary pressures, potentially leading to a pause in rate hikes or smaller increases.

- Scenario 3: An unexpected downturn in sales might influence a different monetary policy: A significant drop in retail sales could indicate a weakening economy, prompting the Bank to consider a different monetary policy approach, possibly even interest rate cuts.

- Uncertainty in economic forecasting is inherent: Predicting future economic conditions with absolute certainty is impossible; these scenarios represent potential outcomes, not guaranteed predictions.

Impacts on Consumers and Businesses

Changes in the Bank of Canada's interest rate directly affect consumers and businesses:

- Higher interest rates lead to increased borrowing costs for mortgages and loans: This reduces disposable income for consumers and increases the cost of capital for businesses.

- Impact on consumer spending and investment decisions: Higher interest rates can dampen consumer spending and investment, affecting economic growth.

- Potential effects on business expansion and hiring: Increased borrowing costs can discourage business expansion and hiring, potentially leading to job losses.

- Potential for a slowdown in economic growth: A combination of reduced consumer spending and business investment can lead to a slowdown in overall economic growth.

Conclusion

The strong correlation between increased retail sales and the likelihood of Bank of Canada interest rate adjustments is undeniable. The recent surge in retail sales raises concerns about inflationary pressures, prompting the Bank to consider various monetary policy responses. The potential scenarios outlined above – ranging from further rate hikes to a potential pause or even cuts – highlight the complexities and uncertainties involved in economic forecasting. Understanding the interplay between retail sales growth and interest rate adjustments is crucial for navigating the current economic climate.

Stay updated on the latest developments regarding increased retail sales and their implications for the Bank of Canada interest rates by regularly checking reliable financial news sources. Understanding the impact of retail sales growth on Canadian interest rates is vital for making informed financial decisions.

Featured Posts

-

Paris Roubaix Results Van Der Poel Third Pogacar Significantly Behind

May 26, 2025

Paris Roubaix Results Van Der Poel Third Pogacar Significantly Behind

May 26, 2025 -

Understanding The Dynamics Of The F1 Drivers Press Conference

May 26, 2025

Understanding The Dynamics Of The F1 Drivers Press Conference

May 26, 2025 -

Paris Roubaix Bottle Throwing Spectator Surrenders To Police

May 26, 2025

Paris Roubaix Bottle Throwing Spectator Surrenders To Police

May 26, 2025 -

Italian Authorities Capture Dave Turmel Canadian Fugitive

May 26, 2025

Italian Authorities Capture Dave Turmel Canadian Fugitive

May 26, 2025 -

Wrongful Glasgow Airport Arrest Feature Film In The Works

May 26, 2025

Wrongful Glasgow Airport Arrest Feature Film In The Works

May 26, 2025