Indian Insurers Push For Relaxed Bond Forward Regulations

Table of Contents

Current Bond Forward Regulations in India and Their Impact

Current regulations surrounding bond forwards for insurance companies in India impose several limitations on their investment activities. These restrictions significantly impact investment strategies and risk mitigation techniques. The Insurance Regulatory and Development Authority of India (IRDAI) has implemented rules designed to ensure financial stability, but some insurers argue these rules are overly restrictive.

-

Specific Restrictive Regulations: Current regulations often limit the amount of exposure insurers can have to bond forwards, restricting their ability to leverage these instruments effectively for hedging and investment purposes. Specific limits on notional amounts and counterparty risk exposure often hinder diversification efforts.

-

Hindered Investment Diversification: The existing regulations make it difficult for Indian insurers to diversify their investment portfolios effectively. This lack of diversification increases their vulnerability to market fluctuations and interest rate changes. For example, limitations on foreign bond holdings reduce opportunities for global diversification.

-

Impact on Risk Management Capabilities: The inability to fully utilize bond forwards restricts insurers' capacity to effectively manage interest rate risk and other market risks. This can result in significant financial losses during periods of market volatility. Proper hedging strategies using bond forwards are often curtailed.

-

Potential Losses Due to Regulatory Constraints: The stringent regulations could lead to lost investment opportunities and reduced returns compared to their global counterparts who have more flexible frameworks. This directly impacts the profitability of Indian insurance companies.

Arguments for Relaxed Bond Forward Regulations

Indian insurers argue that easing bond forward regulations would yield substantial benefits for the insurance sector and the broader Indian economy. The primary argument revolves around unlocking greater investment potential and improving risk management capabilities.

-

Improved Portfolio Diversification and Better Returns: Relaxed regulations would allow insurers to better diversify their investments, potentially leading to higher returns and improved financial stability. Access to a wider range of bond instruments would reduce concentration risk.

-

Enhanced Ability to Hedge Against Interest Rate Risk: Bond forwards provide a crucial tool for hedging against interest rate risk. Easing regulations would empower insurers to better manage this risk, protecting policyholder funds and enhancing long-term solvency.

-

Increased Liquidity in the Indian Bond Market: Increased participation by insurers, enabled by relaxed regulations, would inject greater liquidity into the Indian bond market, making it more efficient and attractive to both domestic and international investors.

-

Potential for Greater Foreign Investment in Indian Bonds: A more liberal regulatory environment could attract increased foreign investment into the Indian bond market, boosting economic growth and providing a broader investor base for Indian debt.

-

Stimulating Economic Growth Through Increased Investment Activity: Greater investment activity within the insurance sector, facilitated by access to a wider range of investment instruments, could contribute significantly to overall economic growth.

Potential Concerns and Counterarguments

While the arguments for relaxing bond forward regulations are compelling, concerns remain regarding the potential for increased systemic risk and market volatility. However, these concerns can be addressed through careful consideration and robust mitigation strategies.

-

Potential Risks Associated with Increased Leverage: Easing regulations could potentially lead to increased leverage by insurers, increasing their vulnerability to market downturns. This risk needs to be carefully managed through stricter oversight.

-

The Need for Robust Risk Management Frameworks: Relaxing regulations does not negate the need for robust risk management frameworks. In fact, it necessitates even more rigorous risk assessment and monitoring within insurance companies.

-

Measures to Prevent Market Manipulation: Regulatory oversight must be strengthened to prevent market manipulation and ensure fair practices, even with a more relaxed regulatory environment. Stricter monitoring mechanisms can prevent abuse.

-

The Role of Regulatory Oversight in Mitigating Risks: The IRDAI must play a crucial role in mitigating risks associated with relaxed regulations through ongoing monitoring, supervision, and timely intervention. Proactive regulatory oversight is key.

-

Balancing Deregulation with Financial Stability: The challenge lies in finding the right balance between deregulation to foster growth and maintaining sufficient regulatory oversight to preserve financial stability. A phased approach with gradual relaxation could be considered.

The Role of the IRDAI (Insurance Regulatory and Development Authority of India)

The IRDAI's role in this debate is critical. Its response to the insurers' demands will significantly shape the future of bond forward regulations in India. The IRDAI’s past actions and its understanding of global best practices in insurance regulation will be instrumental in determining the future course of action. A careful balance between promoting investment opportunities for insurers and maintaining the stability of the financial system is essential. The IRDAI's consultation process with stakeholders will be crucial in shaping any potential policy changes.

Conclusion

The debate surrounding relaxed bond forward regulations for Indian insurers is crucial for the future health of the Indian financial sector. While a more flexible regulatory environment offers significant benefits—improved risk management, increased investment, and market development—careful consideration must be given to potential risks. The key lies in finding a balance that fosters growth while ensuring financial stability. Further discussion, a thorough evaluation of potential changes, and proactive regulatory oversight are necessary to ensure a balanced and beneficial approach. Continued monitoring of the IRDAI’s response and the evolution of the Indian bond market are essential to fully understand the impact of any regulatory changes regarding Indian Insurers and Bond Forward Regulations.

Featured Posts

-

Abcs High Potential A Ballsy Season 1 Finale

May 09, 2025

Abcs High Potential A Ballsy Season 1 Finale

May 09, 2025 -

Find Live Music And Events In Lake Charles This Easter

May 09, 2025

Find Live Music And Events In Lake Charles This Easter

May 09, 2025 -

Gods Mercy In 1889 A Diverse Tapestry Of Faith

May 09, 2025

Gods Mercy In 1889 A Diverse Tapestry Of Faith

May 09, 2025 -

Inter Milan Vs Bayern Munich A Detailed Match Preview

May 09, 2025

Inter Milan Vs Bayern Munich A Detailed Match Preview

May 09, 2025 -

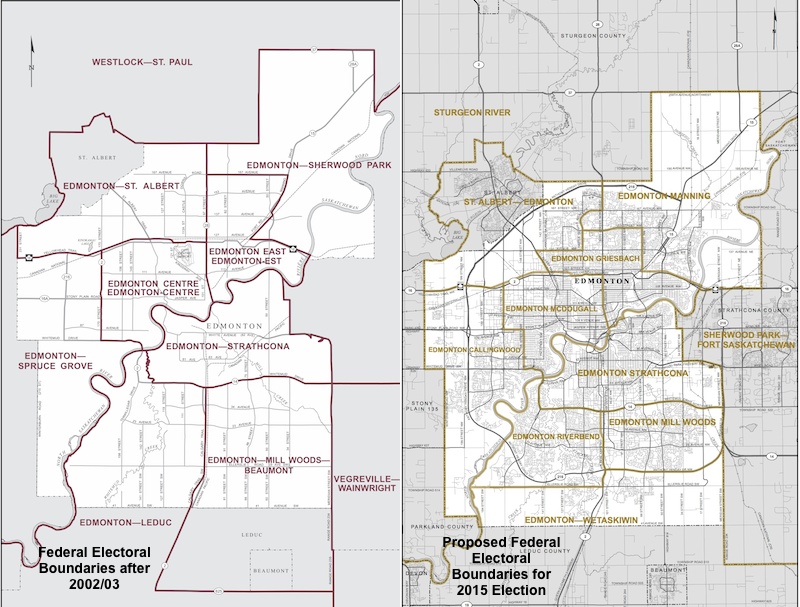

Greater Edmontons New Federal Ridings An Analysis Of Voter Impact

May 09, 2025

Greater Edmontons New Federal Ridings An Analysis Of Voter Impact

May 09, 2025