Indian Stock Market Soars: 5 Key Factors Behind Sensex And Nifty's Sharp Rise

Table of Contents

Strong Corporate Earnings Drive Market Growth

Improved profitability across various sectors is a primary driver of the recent Indian stock market rally. Strong corporate earnings reports consistently boost investor confidence, leading to increased investment and higher stock prices.

Improved Profitability Across Sectors

Many major Indian companies across diverse sectors are showcasing significantly improved profitability. This positive trend reflects the overall health and growth of the Indian economy.

- Information Technology (IT): Companies like Infosys and TCS have reported impressive profit margins due to increased global demand for IT services. Profit increases in this sector have averaged 15-20% year-on-year.

- Fast-Moving Consumer Goods (FMCG): FMCG giants like Hindustan Unilever and Nestle India have benefited from robust domestic consumption, resulting in substantial profit growth. Many reported a double-digit percentage increase in profits.

- Banking: Leading public and private sector banks have seen improved Non-Performing Asset (NPA) resolution and increased lending, contributing to stronger earnings. Profitability is up significantly compared to previous years.

Positive Future Outlook and Guidance

Positive future projections from leading Indian companies further bolster investor confidence. This optimistic outlook is based on various factors, indicating continued growth potential.

- Reliance Industries: Their expansion into new energy sectors and strong performance in existing businesses have fueled positive future projections.

- Tata Motors: Growth in the electric vehicle (EV) market and strong global demand for their vehicles contribute to a positive outlook. [Link to relevant financial news article]

- Bharti Airtel: Expansion in 5G services and strong subscriber growth are major factors driving optimistic future guidance. [Link to relevant financial news article]

Foreign Institutional Investor (FII) Inflows

Significant Foreign Institutional Investor (FII) inflows have played a pivotal role in the recent Indian stock market rise. Increased investment from FIIs reflects growing global confidence in the Indian economy.

Increased Investment in Indian Equities

FIIs have poured billions of dollars into Indian equities in recent months. This influx of foreign capital has directly contributed to the upward trend in Sensex and Nifty.

- Data Point: FII inflows increased by X% in [Month/Year], injecting significant liquidity into the market.

- Reason: Improving macroeconomic conditions and attractive valuations compared to other global markets have drawn substantial FII interest.

Global Macroeconomic Factors Influencing FII Flows

Global macroeconomic factors also influence FII investment decisions. While geopolitical instability in other regions may push capital towards perceived safer havens like India, interest rate changes in developed economies impact investment flows.

- Geopolitical Uncertainty: Global instability often leads to a flight to safety, with India benefiting from its relatively stable political and economic environment.

- Interest Rate Differentials: Higher interest rates in developed economies can draw investment away from emerging markets; however, India's growth story often compensates for this.

Government Initiatives and Policy Reforms

Government initiatives and policy reforms have created a positive environment for investment and growth, contributing to the rise of the Indian stock market.

Positive Government Policies Boosting Investor Sentiment

Pro-business policies and reforms have significantly impacted investor sentiment and confidence in the Indian market.

- Infrastructure Development: Massive investments in infrastructure projects, such as roads, railways, and ports, create a positive ripple effect across the economy.

- Tax Reforms: Simplification of the tax system and rationalization of tax rates have improved the ease of doing business.

- Digital India Initiatives: Promoting digitalization across various sectors has boosted efficiency and transparency.

Ease of Doing Business and Regulatory Improvements

Improvements in the ease of doing business and regulatory reforms have further attracted investments and boosted market confidence.

- Data Point: India's ranking in the World Bank's Ease of Doing Business index has improved significantly over the past few years.

- Regulatory Reforms: Streamlining of bureaucratic processes and reduction in regulatory hurdles have facilitated faster project implementation and increased business activity.

Improving Macroeconomic Indicators

Stable inflation, strong economic growth, and a strengthening rupee are key macroeconomic indicators that are positively influencing the Indian stock market.

Stable Inflation and Economic Growth

Stable inflation and robust economic growth are crucial for sustained market growth. These indicators reflect the overall health of the Indian economy.

- Data Point: India's GDP growth rate is projected at X% for [Year], indicating strong economic expansion.

- Data Point: Inflation is currently within the Reserve Bank of India's target range, promoting investor confidence.

Strengthening Rupee Against Major Currencies

A strengthening rupee against major currencies makes Indian assets more attractive to foreign investors, further boosting the stock market.

- Data Point: The rupee has appreciated by X% against the US dollar in [Period].

- Impact: A stronger rupee reduces the cost of foreign investments in Indian equities, making them more appealing to FIIs.

Positive Investor Sentiment and Market Psychology

Increased retail participation and positive market sentiment are also contributing factors to the recent surge in the Indian stock market.

Increased Retail Participation and Optimism

Growing participation from retail investors reflects increased optimism and confidence in the market's future potential.

- Data Point: The number of retail investors in the Indian stock market has grown by X% in recent years.

- Reason: Positive economic indicators, strong corporate earnings, and government initiatives have fueled retail investor participation.

Speculative Trading and Short-Term Gains

While speculative trading can contribute to short-term market volatility, it's crucial to differentiate this from long-term investment strategies.

- Risk: Speculative trading involves higher risk due to its short-term nature and potential for rapid price fluctuations.

- Long-Term Strategy: A well-diversified, long-term investment strategy in the Indian stock market is generally recommended for sustained growth.

Conclusion

The recent surge in the Indian stock market, as evidenced by the robust performance of the Sensex and Nifty, is a result of a multifaceted confluence of factors: strong corporate earnings, significant FII inflows, supportive government policies, improving macroeconomic indicators, and buoyant investor sentiment. These factors collectively paint a positive picture for the Indian economy and its future growth potential.

Call to Action: Understanding these key drivers of the Indian stock market's rise is crucial for investors seeking to navigate this dynamic landscape. Stay informed about the latest developments and consider carefully diversifying your portfolio within the Indian stock market to capitalize on potential future growth. Further research into individual company performances within the Sensex and Nifty is encouraged to make informed investment decisions in the Indian stock market.

Featured Posts

-

Infineon Ifx Stock Under Pressure Sales Guidance And Tariff Concerns

May 10, 2025

Infineon Ifx Stock Under Pressure Sales Guidance And Tariff Concerns

May 10, 2025 -

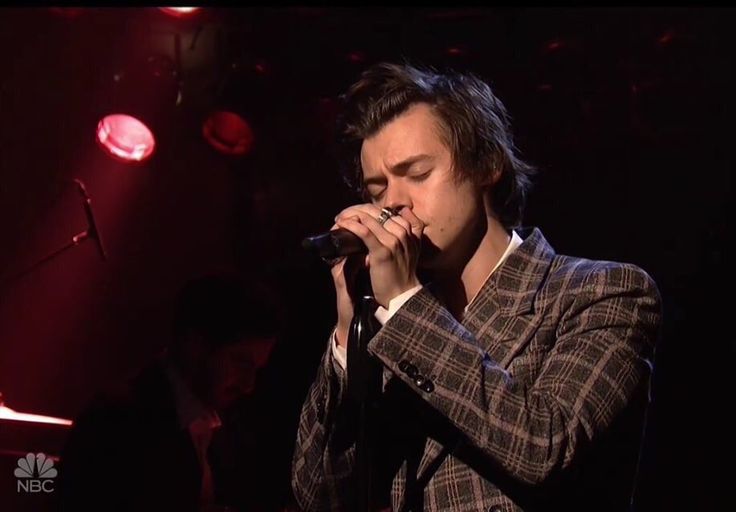

Did Snls Harry Styles Impression Actually Upset Him

May 10, 2025

Did Snls Harry Styles Impression Actually Upset Him

May 10, 2025 -

10 Film Noir Movies Guaranteed To Grip You

May 10, 2025

10 Film Noir Movies Guaranteed To Grip You

May 10, 2025 -

Open Ai 2024 New Tools For Streamlined Voice Assistant Development

May 10, 2025

Open Ai 2024 New Tools For Streamlined Voice Assistant Development

May 10, 2025 -

Disney Profit Outlook Raised Parks And Streaming Drive Growth

May 10, 2025

Disney Profit Outlook Raised Parks And Streaming Drive Growth

May 10, 2025