India's Nifty Index: Understanding The Current Bullish Trend

Table of Contents

Economic Fundamentals Supporting the Nifty's Rise

Several strong economic fundamentals are fueling the Nifty Index's bullish trend. Analyzing these factors provides a clearer picture of the market's health and potential for future growth.

Strong Corporate Earnings

The first quarter (Q1) and second quarter (Q2) of the fiscal year have witnessed robust earnings reports from major Nifty 50 companies. Many sectors are showing exceptional growth, particularly Information Technology (IT) and Financials. For example, leading IT companies have reported significant revenue increases driven by strong global demand and successful project execution. Similarly, the financial sector has benefited from increased lending activity and improved asset quality.

- Increased profitability: Numerous Nifty 50 companies reported significant year-on-year increases in net profit.

- Improved margins: Efficient cost management and increased pricing power have led to improved operating margins for many businesses.

- Positive revenue growth forecasts: Many companies have provided optimistic revenue growth forecasts for the remainder of the fiscal year, further bolstering investor confidence in the Nifty Index.

Government Policies and Initiatives

The Indian government's proactive policies and initiatives have also played a crucial role in boosting investor sentiment and contributing to the bullish trend in the Indian Stock Market. Several key measures have fostered economic growth and improved the ease of doing business.

- Infrastructure development plans: Massive investments in infrastructure projects—roads, railways, and renewable energy—are generating employment and stimulating economic activity.

- Digitalization initiatives: The government's continued push for digitalization is improving efficiency and transparency across various sectors, further driving economic growth.

- Ease of doing business reforms: Streamlined regulations and simplified processes are making it easier for businesses to operate and attract investment, thus contributing to a positive outlook for the Nifty 50.

Foreign Institutional Investor (FII) Inflows

Significant Foreign Institutional Investor (FII) inflows have been a key driver of the Nifty's bullish trend. Increased FII confidence in the Indian economy reflects a positive global outlook on India's growth prospects.

- Increased FII investments: Significant capital inflows from FIIs have injected liquidity into the Indian stock market, pushing up prices.

- Positive outlook on Indian economy: FIIs are increasingly optimistic about India's long-term growth potential, driven by factors like a young and growing population, a large domestic market, and government reforms.

- Diversification strategies: Many global investors are looking to diversify their portfolios, and India's emerging market status makes it an attractive destination for investment.

Technical Analysis of the Nifty Index's Bullish Trend

Analyzing the Nifty Index through a technical lens provides further insights into the current bullish trend and its potential trajectory.

Chart Patterns and Indicators

Various chart patterns and indicators confirm the bullish sentiment. The Nifty Index has consistently shown higher highs and higher lows, a classic sign of an uptrend.

- Rising volume: Increased trading volume accompanying price increases confirms the strength of the bullish momentum.

- Positive momentum indicators: Technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are currently displaying positive signals, suggesting further upward potential.

- Breakout from resistance levels: The Nifty Index has successfully broken through several key resistance levels, further supporting the bullish trend. (Include relevant charts and visuals here).

Support and Resistance Levels

Identifying key support and resistance levels is crucial for understanding potential future price movements. Support levels represent prices where buying pressure is likely to outweigh selling pressure, potentially preventing further price declines. Resistance levels are prices where selling pressure might outweigh buying pressure, potentially halting further price increases. (Include a chart showing support and resistance levels here).

- Critical support levels to watch: Identifying these levels helps investors gauge potential downside risks.

- Potential resistance levels that could cap gains: Recognizing these levels allows investors to anticipate potential price corrections.

Potential Risks and Challenges

While the current outlook for the Nifty Index is positive, it is crucial to acknowledge potential risks and challenges that could impact the bullish trend.

Global Economic Uncertainty

Global economic headwinds, such as inflation and recessionary fears, can significantly impact the Indian stock market. These external factors can create uncertainty and potentially trigger corrections.

- Global inflation concerns: High inflation in major economies can lead to tighter monetary policies, potentially impacting investor sentiment and capital flows into emerging markets like India.

- Potential interest rate hikes: Interest rate hikes by central banks globally can increase borrowing costs for businesses and reduce investment, thus impacting the Nifty 50.

- Geopolitical risks: Global geopolitical events can also create market volatility and negatively impact investor sentiment.

Valuation Concerns

While the Nifty Index's upward trajectory is impressive, it's essential to evaluate whether the current valuations are sustainable. Overvaluation can make the market susceptible to corrections.

- Price-to-earnings ratios: Analyzing price-to-earnings ratios (P/E) across various sectors can help assess whether valuations are justified by future earnings potential.

- Sector-specific valuations: Some sectors may be more overvalued than others, necessitating a careful sector-wise assessment.

- Potential market corrections: While a bullish trend is underway, investors should be prepared for potential market corrections, which are normal parts of any market cycle.

Conclusion

The Nifty Index's current bullish trend is underpinned by robust economic fundamentals, supportive government policies, and substantial FII inflows. Technical indicators also suggest continued upward momentum in the short-term. However, investors must remain vigilant about global economic uncertainties and potential valuation concerns. Understanding these factors is paramount for effective navigation of the Indian stock market. To stay informed on the latest developments impacting the Nifty Index and make well-informed investment decisions, continue to monitor economic data, technical analysis, and global market trends. Stay tuned for further updates on the evolving dynamics of the Nifty Index and its bullish trajectory. Regularly review your investment strategy and consider seeking professional financial advice to manage risk effectively within the Indian Stock Market.

Featured Posts

-

Instagrams Latest Weapon A Powerful New Video Editing App

Apr 24, 2025

Instagrams Latest Weapon A Powerful New Video Editing App

Apr 24, 2025 -

Decoding The India Market Rally Factors Behind Niftys Gains

Apr 24, 2025

Decoding The India Market Rally Factors Behind Niftys Gains

Apr 24, 2025 -

Chinas Rare Earth Export Curbs Hamper Teslas Optimus Robot Development

Apr 24, 2025

Chinas Rare Earth Export Curbs Hamper Teslas Optimus Robot Development

Apr 24, 2025 -

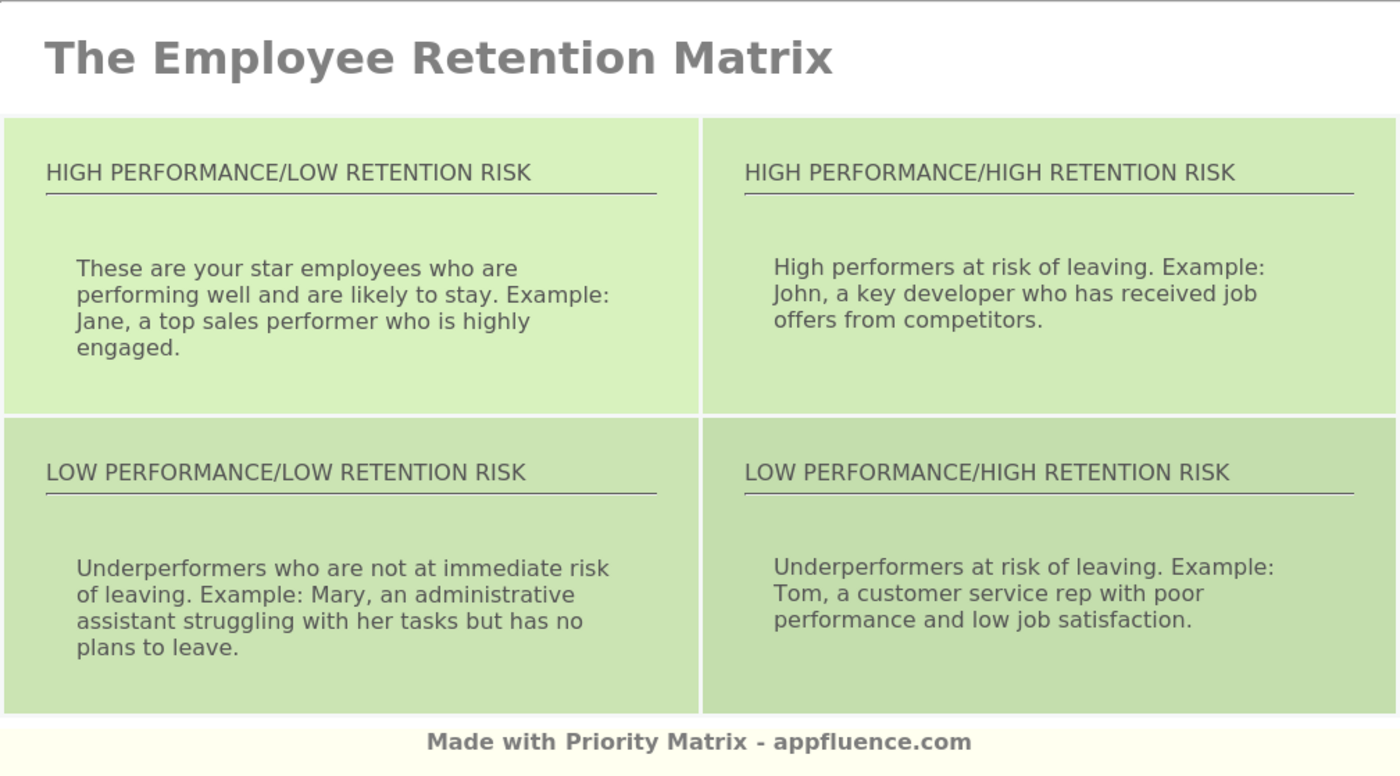

Investing In Middle Management A Strategic Approach To Business Growth And Employee Retention

Apr 24, 2025

Investing In Middle Management A Strategic Approach To Business Growth And Employee Retention

Apr 24, 2025 -

Gambling On Disaster Examining The La Wildfire Betting Phenomenon

Apr 24, 2025

Gambling On Disaster Examining The La Wildfire Betting Phenomenon

Apr 24, 2025

Latest Posts

-

Live Music And Events Your Easter Weekend Guide To Lake Charles

May 09, 2025

Live Music And Events Your Easter Weekend Guide To Lake Charles

May 09, 2025 -

The Rise Of A Football Star From Wolves Rejection To European Glory

May 09, 2025

The Rise Of A Football Star From Wolves Rejection To European Glory

May 09, 2025 -

From Wolves To Europes Best The Unlikely Success Story

May 09, 2025

From Wolves To Europes Best The Unlikely Success Story

May 09, 2025 -

Once Rejected Now A European Champion The Story Of Players Name

May 09, 2025

Once Rejected Now A European Champion The Story Of Players Name

May 09, 2025 -

Review St Albert Dinner Theatres Hilarious New Production

May 09, 2025

Review St Albert Dinner Theatres Hilarious New Production

May 09, 2025