Infineon (IFX) Sales Guidance Misses Estimates Amidst Trump Tariff Uncertainty

Table of Contents

Infineon's Disappointing Sales Figures and Revised Guidance

Infineon's revised sales guidance represents a substantial drop compared to analyst expectations. Instead of the previously anticipated [Insert Expected Sales Figure in Euros or USD], the company now projects sales of [Insert Revised Sales Figure in Euros or USD] for [Specify Time Period, e.g., the current quarter/fiscal year]. This represents a [Percentage]% decrease.

Key financial metrics have been impacted:

- Revenue: A significant decline in revenue across multiple segments.

- Earnings Per Share (EPS): A substantial reduction in EPS, impacting investor returns.

- Operating Margin: Compression of operating margins due to increased costs and reduced sales volume.

Infineon attributed the lower guidance to several factors, including weaker-than-expected demand in certain key markets and increased component costs. However, the lingering effects of past trade policies clearly play a significant role in their challenges.

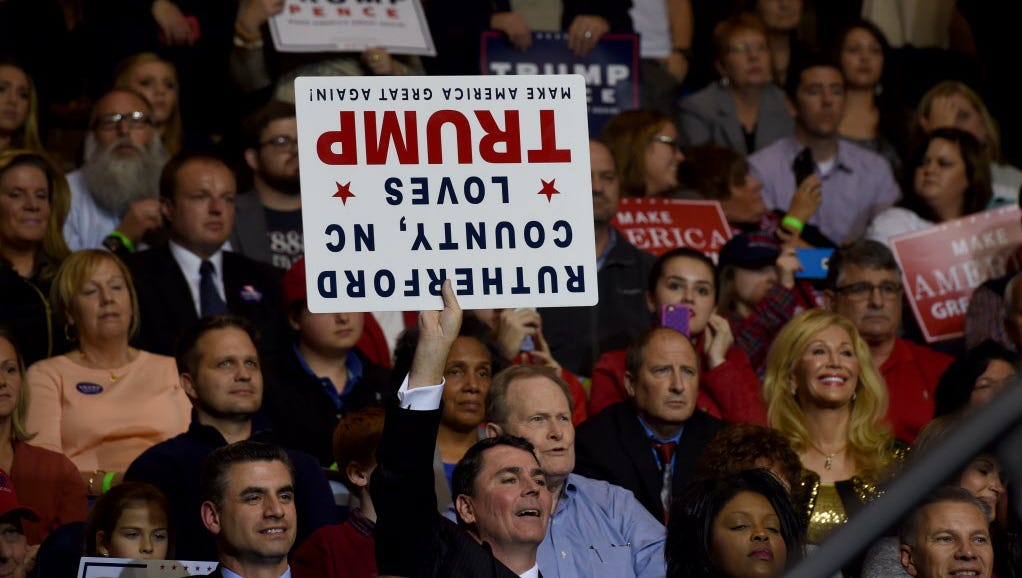

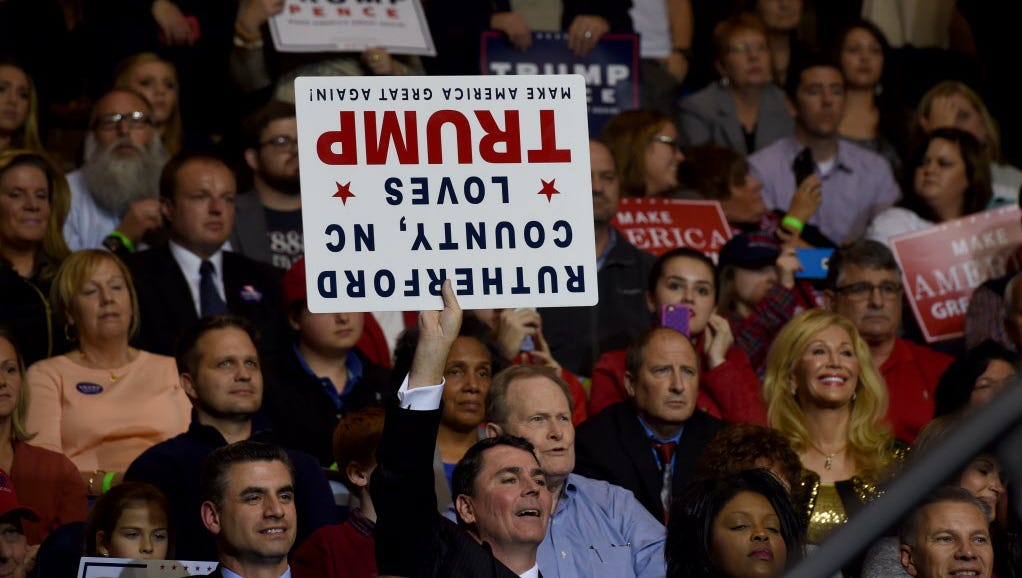

The Role of Trump-Era Tariffs (or Current Trade Tensions)

The impact of tariffs and trade tensions on Infineon's operations is undeniable. The Trump administration's tariffs on various goods, including semiconductor components and related materials, significantly increased production costs for Infineon.

- Supply Chain Disruption: Tariffs disrupted Infineon's global supply chain, leading to delays and increased costs for sourcing vital components.

- Increased Input Costs: The added tariffs directly increased the cost of raw materials and components, squeezing profit margins.

- Geopolitical Risks: The unpredictable nature of international trade policy creates significant geopolitical risks for companies like Infineon, making long-term planning and investment decisions more challenging.

Studies have shown that tariffs imposed on the semiconductor industry have resulted in [Insert Statistics or Data on Tariff Impact, e.g., X% increase in production costs, Y% reduction in global semiconductor trade]. These figures highlight the significant impact of trade uncertainty on the entire sector.

Impact on Investors and Stock Performance

The market reacted negatively to Infineon's lowered sales guidance. The IFX stock price experienced a [Percentage]% drop immediately following the announcement, reflecting investor concern about the company's future performance.

- Investor Sentiment: Investor sentiment turned significantly bearish, with many expressing concerns about the ongoing impact of trade uncertainties.

- Analyst Ratings: Several analysts downgraded their ratings on IFX stock, citing the reduced sales outlook and increased risks associated with the trade environment.

- Long-Term Impact: The long-term impact on Infineon's stock price will depend on the company's ability to effectively mitigate the challenges and restore investor confidence. The volatility of the semiconductor market, exacerbated by trade issues, makes predicting the future price movement challenging.

Infineon's Strategies for Mitigating the Impact

Infineon is actively working to address the challenges posed by the sales shortfall and trade uncertainties. The company has outlined several strategic initiatives:

- Cost-Cutting Measures: Infineon is implementing cost-cutting measures across various departments to improve efficiency and profitability.

- Diversification Strategies: The company is actively diversifying its product portfolio and customer base to reduce reliance on specific markets or regions vulnerable to trade disputes.

- Strategic Partnerships: Infineon is strengthening strategic partnerships with key suppliers and customers to enhance resilience within the supply chain.

Infineon's management has emphasized its commitment to navigating these challenges and remains confident in the long-term prospects of the company, despite the current headwinds.

Conclusion: Analyzing Infineon's (IFX) Future Amidst Uncertainty

Infineon's missed sales estimates underscore the significant impact of ongoing trade uncertainties on the semiconductor industry. The resulting drop in IFX stock price reflects investor concerns. However, Infineon's proactive strategies to mitigate these challenges offer a glimmer of hope. The long-term success of Infineon, and indeed the entire semiconductor sector, will depend on the stability of the global trade environment and the companies' ability to adapt to ever-changing geopolitical landscapes.

To stay informed about Infineon (IFX) sales guidance and the evolving trade landscape, subscribe to our newsletter, follow Infineon's news releases, and conduct thorough research before making any investment decisions in this volatile sector. Understanding the risks associated with investing in the semiconductor sector during periods of trade uncertainty is crucial for informed decision-making.

Featured Posts

-

The Luis Enrique Era A Winning Chapter For Paris Saint Germain

May 10, 2025

The Luis Enrique Era A Winning Chapter For Paris Saint Germain

May 10, 2025 -

Three Actions To Show Allyship On International Transgender Day Of Visibility

May 10, 2025

Three Actions To Show Allyship On International Transgender Day Of Visibility

May 10, 2025 -

Fox News Jeanine Pirro Potential Dc Prosecutor Under Trump

May 10, 2025

Fox News Jeanine Pirro Potential Dc Prosecutor Under Trump

May 10, 2025 -

Palantir Stock A Pre May 5th Investment Analysis

May 10, 2025

Palantir Stock A Pre May 5th Investment Analysis

May 10, 2025 -

Caso De Universitaria Transgenero Derecho A Usar Bano Femenino Cuestionado

May 10, 2025

Caso De Universitaria Transgenero Derecho A Usar Bano Femenino Cuestionado

May 10, 2025