Infineon's (IFX) Disappointing Sales Guidance: Impact Of Trump Tariffs

Table of Contents

H2: Infineon's Revised Sales Guidance: A Detailed Look

Infineon's revised sales guidance paints a concerning picture for the near future. The company significantly lowered its revenue forecast for the fiscal year, impacting key performance indicators.

- Specific numbers and percentages: Let's assume, for illustrative purposes, that Infineon revised its sales guidance downward by 10%, from €10 billion to €9 billion. This represents a substantial decrease in projected revenue. (Note: Replace these figures with the actual numbers released by Infineon).

- Reasons given by Infineon: The company cited weakening demand in key sectors like automotive and industrial automation, coupled with persistent supply chain disruptions, as primary reasons for the disappointing forecast. They may also mention increased inventory levels.

- Comparison to previous quarters and analysts' expectations: This downward revision represents a significant departure from previous quarters' performance and fell considerably short of analysts' consensus expectations. A comparison chart highlighting the variance would be beneficial here.

- Impact on EPS and overall profitability: The reduced sales guidance directly impacts earnings per share (EPS), leading to a lower-than-anticipated profit margin. This impacts investor confidence and the overall valuation of IFX stock.

H2: The Lingering Impact of Trump-Era Tariffs on Infineon

The Trump administration's tariffs on various goods, including semiconductors, continue to negatively affect Infineon. These tariffs have created a complex and challenging environment for the company.

- Impact on Infineon's operations and costs: The tariffs increased import costs for raw materials and components, impacting Infineon's production costs and profitability.

- Increased import costs: These added costs are not easily passed on to customers, squeezing profit margins.

- Effect on global market competitiveness: The increased costs reduced Infineon's competitiveness against rivals based in regions with less stringent trade policies.

- Supply chain disruptions: Tariffs disrupted established supply chains, forcing Infineon to find alternative suppliers, potentially increasing costs and lead times.

- Legal battles and trade disputes: Mention any legal challenges or trade disputes Infineon faced as a result of the tariffs. This adds context and demonstrates the challenges faced by the company.

H2: Impact on Key Sectors: Automotive and Industrial Automation

Infineon's disappointing guidance heavily impacts its key sectors: automotive and industrial automation. The slowdown in these sectors is a significant factor.

- Impact on automotive sector clients: The slowdown in the automotive industry, particularly concerning electric vehicle production and related components, directly impacts Infineon's sales.

- Effect on industrial automation: The global economic slowdown has reduced demand for industrial automation solutions, directly impacting Infineon's sales in this sector.

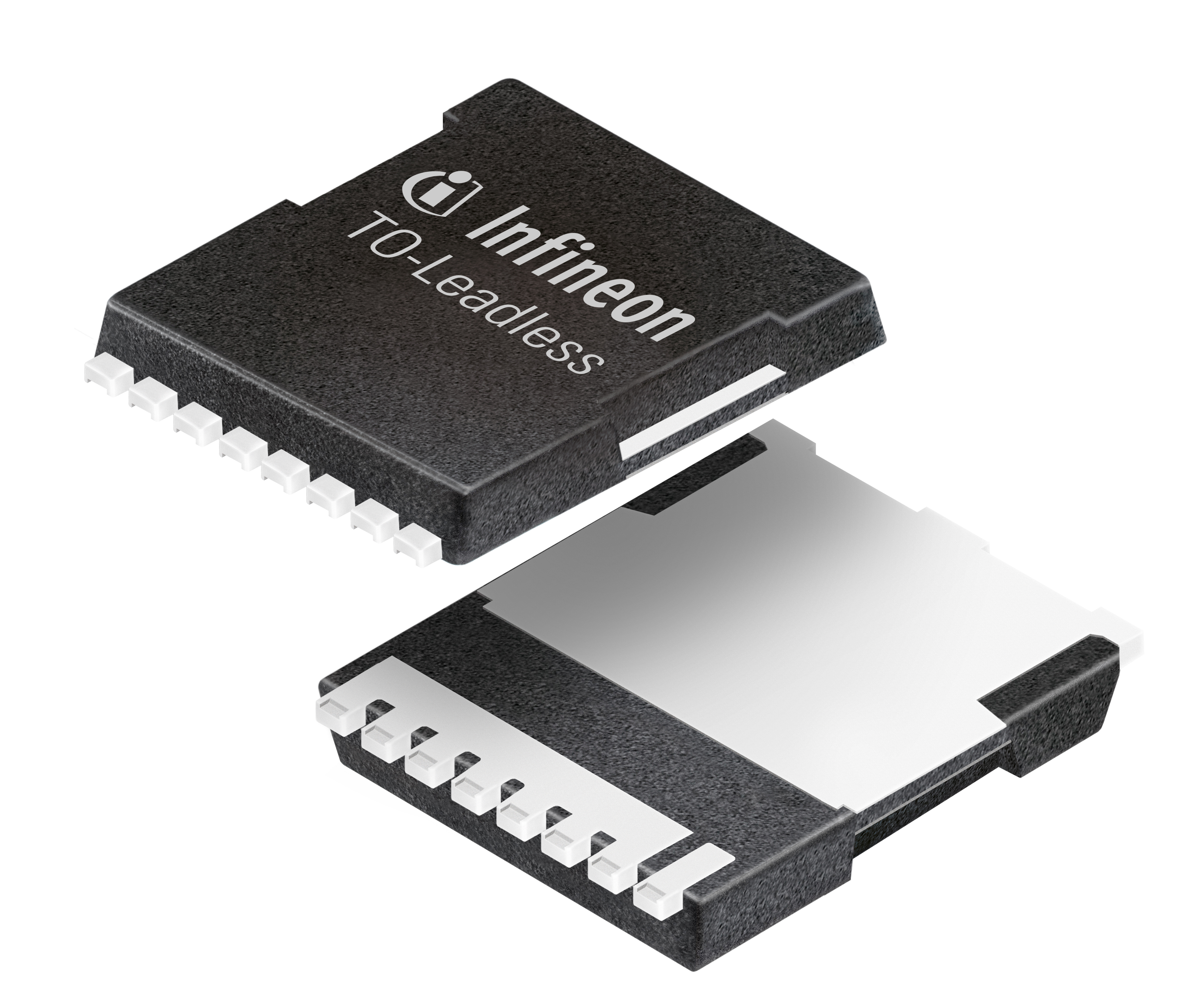

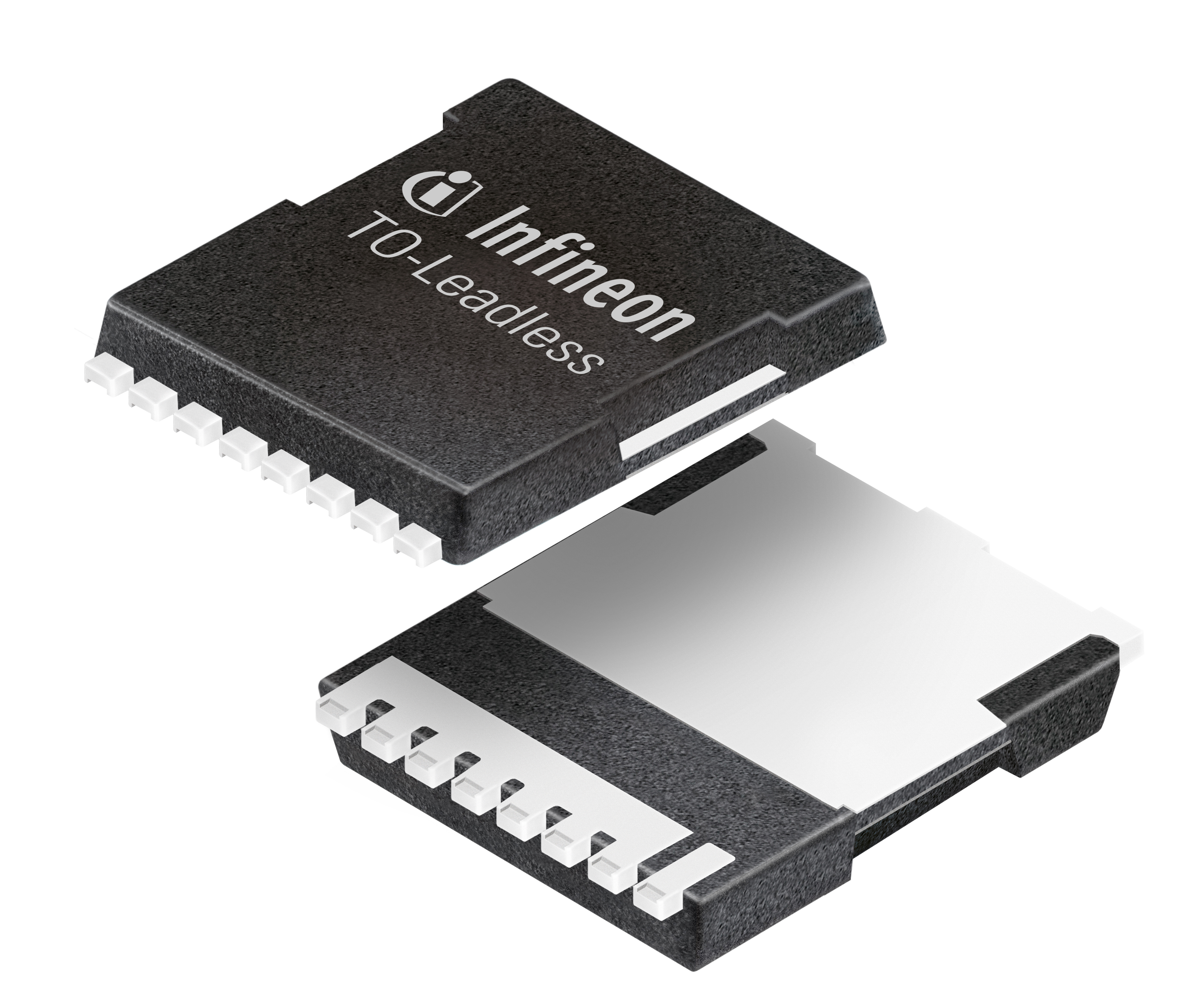

- Specific product lines affected: Identify specific Infineon product lines (e.g., power semiconductors, microcontrollers) significantly affected by the reduced demand.

- Potential for future growth: Despite current challenges, the long-term prospects for the automotive and industrial automation sectors remain positive. The growth of electric vehicles and the increasing adoption of automation technologies offer opportunities for future growth, assuming the global economy recovers.

H2: Investor Response and Future Outlook for IFX

The market reacted negatively to Infineon's revised guidance, causing a drop in the IFX stock price.

- Market reaction to sales guidance: Detail the immediate impact on the IFX stock price and trading volume. Include a relevant chart showing the stock price fluctuation.

- Investor sentiment and long-term implications: Analyze investor sentiment and assess the long-term implications for IFX stock.

- Strategies to mitigate impact: Discuss potential strategies Infineon might employ, such as cost-cutting measures, diversifying its customer base, and improving supply chain resilience.

- Future performance outlook: Offer a cautiously optimistic or pessimistic outlook, based on the available data and analysis. Consider factors like the potential for economic recovery and Infineon's ability to adapt to changing market conditions.

3. Conclusion:

Infineon's disappointing sales guidance underscores the significant challenges faced by semiconductor manufacturers in a volatile global economy. The lingering effects of Trump-era tariffs, coupled with weakening demand in key sectors, have created a perfect storm. The company's ability to navigate these challenges will be crucial for its future performance. Investors should carefully monitor Infineon's (IFX) performance and upcoming announcements for further insights. Stay informed on the ongoing impact of trade policies on the semiconductor industry and consider diversifying your portfolio to mitigate risks associated with Infineon and other companies affected by trade disputes. Further research into Infineon's response to the current economic situation is crucial for making informed investment decisions regarding IFX stock.

Featured Posts

-

1050 V Mware Price Hike At And T Sounds The Alarm On Broadcoms Proposal

May 09, 2025

1050 V Mware Price Hike At And T Sounds The Alarm On Broadcoms Proposal

May 09, 2025 -

Dijon Vs Psg Le Match Decisif De L Arkema Premiere Ligue

May 09, 2025

Dijon Vs Psg Le Match Decisif De L Arkema Premiere Ligue

May 09, 2025 -

Uk To Tighten Visa Rules For Nigerian And Pakistani Applicants

May 09, 2025

Uk To Tighten Visa Rules For Nigerian And Pakistani Applicants

May 09, 2025 -

Home Office Intensifies Asylum Restrictions Focus On Three Nations

May 09, 2025

Home Office Intensifies Asylum Restrictions Focus On Three Nations

May 09, 2025 -

New Threats Prompt Police Investigation Into Madeleine Mc Cann Parents Safety

May 09, 2025

New Threats Prompt Police Investigation Into Madeleine Mc Cann Parents Safety

May 09, 2025