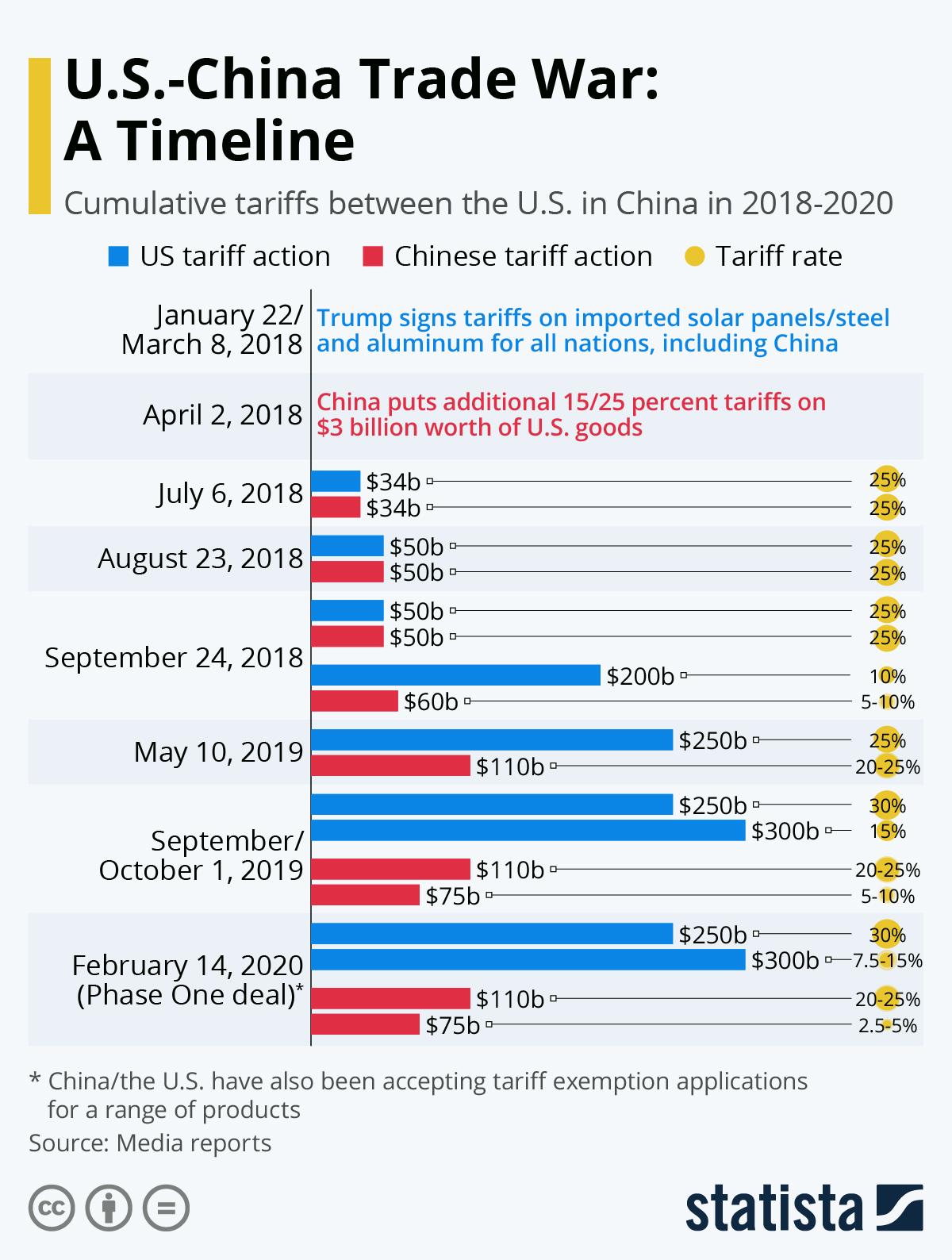

Infineon's (IFX) Revised Sales Forecast: Impact Of Tariffs And Trade Tensions

Table of Contents

Infineon Technologies AG (IFX), a leading semiconductor manufacturer, recently announced a downward revision to its sales forecast. This significant adjustment underscores the escalating impact of global trade tensions and tariffs on the company's operations and the wider semiconductor industry. This article delves into the specific challenges posed by these external factors, examining the reasons behind Infineon's revised forecast and its implications for the future.

The Impact of Tariffs on Infineon's Operations

Keywords: Tariffs, import tariffs, export tariffs, trade barriers, cost increase, pricing pressure, profitability, semiconductor manufacturing

The imposition of tariffs represents a major headwind for Infineon. These trade barriers directly increase the cost of doing business in several key ways:

-

Increased Costs of Raw Materials and Finished Goods: Infineon, like many semiconductor manufacturers, relies on a global supply chain. Tariffs on imported raw materials, such as silicon wafers and specialized chemicals, directly increase production costs. Similarly, tariffs on exported finished goods reduce profitability in international markets.

-

Reduced Profitability: Higher production expenses due to tariffs squeeze profit margins. This is particularly challenging in a competitive market where pricing pressure already exists. Infineon faces a difficult decision: absorb these increased costs, impacting profitability, or pass them on to customers, risking reduced competitiveness.

-

Pressure to Absorb Costs: In a fiercely competitive market, increasing prices to offset tariff costs may alienate customers. This forces companies like Infineon to carefully balance maintaining profitability against the risk of losing market share.

-

Reduced Global Competitiveness: The cumulative effect of higher production costs due to tariffs reduces Infineon's price competitiveness in international markets. This necessitates a strategic reassessment of market positioning and potential adjustments to pricing strategies.

-

Specific Tariff Impacts: While specific product lines impacted by tariffs may not be publicly disclosed for competitive reasons, it’s safe to assume that Infineon's automotive, industrial, and power semiconductors are all potentially affected given their global supply chains and distribution networks.

Trade Tensions and Supply Chain Disruptions

Keywords: Trade tensions, supply chain disruption, geopolitical risk, global supply chains, semiconductor supply chain, logistics, manufacturing delays

Beyond tariffs, broader trade tensions create significant uncertainty within Infineon's global supply chain, resulting in substantial disruption:

-

Uncertainty Impacts Timelines: The unpredictable nature of ongoing trade disputes makes it difficult to accurately forecast procurement and delivery timelines for essential components and materials. This uncertainty extends throughout the entire supply chain, from raw material sourcing to final product delivery.

-

Securing Key Components: Trade restrictions and sanctions can limit access to crucial components sourced from specific regions. This necessitates exploring alternative suppliers, increasing costs and adding complexity to the procurement process.

-

Increased Logistical Complexities: Navigating trade restrictions and navigating shifting global trade routes increases logistical complexities and transportation costs. Delays at customs and increased documentation requirements further impact efficiency.

-

Production Delays and Decreased Output: Supply chain disruptions inevitably lead to production delays and a decrease in overall output. This reduction in production capacity directly impacts Infineon’s ability to meet customer demand and maintain its market position.

-

Impact on Customer Orders: Delays and uncertainties in the supply chain inevitably impact the timely fulfillment of customer orders, potentially leading to lost sales and reputational damage.

Infineon's Response to the Revised Forecast

Keywords: Revised forecast, cost-cutting measures, strategic adjustments, risk mitigation, business strategy, financial performance

In response to the challenges posed by tariffs and trade tensions, Infineon is undertaking several strategic actions:

-

Cost-Cutting Initiatives: The company is likely implementing various cost-cutting measures to offset the impact of increased expenses, focusing on operational efficiency and streamlining processes.

-

Supply Chain Diversification: Infineon is likely actively diversifying its supply chain to reduce its reliance on any single region or supplier, mitigating risks associated with geopolitical instability. This may involve sourcing components from a wider range of countries.

-

Strategic Adjustments to Production: Infineon might be adjusting its production strategies to prioritize higher-margin products or those less affected by tariffs, optimizing production to minimize losses.

-

Reassessment of Investment Plans: Given the uncertain global economic climate, Infineon is likely reassessing its long-term investment plans, prioritizing projects with higher returns and lower exposure to trade risks.

-

Communication with Stakeholders: Open and transparent communication with investors and other stakeholders is crucial in managing the negative effects of the revised forecast and maintaining confidence in the company's long-term viability.

Analysis of Infineon's Financial Performance in Relation to the Revised Forecast

Keywords: Financial results, earnings, revenue, profitability, stock price, investor sentiment, financial analysis

(Note: This section would require access to specific financial data released by Infineon following the revised forecast announcement. The following is a template for how this section would be populated with such data.)

-

Comparison of Forecasts: A detailed comparison of the previous sales forecast and the revised forecast would highlight the magnitude of the downward revision and pinpoint the specific areas most significantly impacted.

-

Impact on Key Metrics: The impact of the revised forecast on key financial metrics like revenue, earnings per share (EPS), and operating margins needs to be analyzed. This analysis would quantify the financial implications of the trade-related challenges.

-

Investor Sentiment: The market's reaction to the revised forecast, reflected in the stock price and trading volume, would indicate investor sentiment toward Infineon's ability to navigate the current challenges.

-

Long-Term Impact: A thorough assessment of the potential long-term effects of tariffs and trade tensions on Infineon's financial performance is crucial for understanding the company's future outlook.

Conclusion

Infineon's revised sales forecast serves as a stark reminder of the significant challenges posed by escalating tariffs and global trade tensions within the semiconductor industry. The company's proactive response reflects the need for agile strategic adjustments and effective risk mitigation strategies in an increasingly uncertain global environment. Understanding the impact of these external factors is crucial for investors, industry analysts, and stakeholders alike.

Call to Action: Stay informed on the evolving situation surrounding Infineon (IFX) and its response to the changing dynamics of global trade. Follow our updates for further analysis of Infineon's revised sales forecast and the broader implications of tariffs and trade tensions on the semiconductor market. Continue to monitor the situation surrounding Infineon’s (IFX) performance as the impact of tariffs and trade tensions unfolds.

Featured Posts

-

Bangkok Post Reports On The Mounting Pressure For Transgender Rights

May 10, 2025

Bangkok Post Reports On The Mounting Pressure For Transgender Rights

May 10, 2025 -

Golden Knights Vs Wild Game 4 Barbashevs Ot Goal Secures Victory Series Tied 2 2

May 10, 2025

Golden Knights Vs Wild Game 4 Barbashevs Ot Goal Secures Victory Series Tied 2 2

May 10, 2025 -

Spring Style Inspiration Dakota Johnson And Melanie Griffith

May 10, 2025

Spring Style Inspiration Dakota Johnson And Melanie Griffith

May 10, 2025 -

25 Million Shortfall Analysing West Hams Financial Position And Future Prospects

May 10, 2025

25 Million Shortfall Analysing West Hams Financial Position And Future Prospects

May 10, 2025 -

Tragedie A Dijon Mort D Un Ouvrier Apres Une Chute De Quatre Etages

May 10, 2025

Tragedie A Dijon Mort D Un Ouvrier Apres Une Chute De Quatre Etages

May 10, 2025