ING Group Publishes 2024 Financial Results: Form 20-F Analysis

Table of Contents

Key Financial Highlights from ING Group's Form 20-F

The Form 20-F reveals a mixed bag for ING Group in 2024. While some areas showed strong performance, others presented challenges reflecting the broader economic climate. Let's break down the key highlights:

-

Net Income: ING Group reported a net income of [Insert Net Income Figure from 20-F] for 2024. This represents a [Insert Percentage Change] compared to 2023. [Provide context for the change – e.g., positive growth driven by strong performance in X segment, or a decrease due to Y factor]. Comparing this to industry benchmarks, ING Group’s net income performance [Insert Comparison – e.g., is above/below/in line with] average profitability for similar-sized banks.

-

Revenue Growth: Total revenue reached [Insert Revenue Figure from 20-F], showing a [Insert Percentage Change] increase compared to the previous year. Significant contributions came from [Mention specific business segments and their contribution – e.g., Wholesale Banking, particularly in capital markets activities, and Retail Banking, fueled by growth in mortgage lending].

-

Profitability Ratios:

- Return on Equity (ROE): [Insert ROE figure from 20-F]. This indicates [Interpretation of ROE, e.g., a healthy return on shareholder investments].

- Return on Assets (ROA): [Insert ROA figure from 20-F]. This shows [Interpretation of ROA, e.g., efficient utilization of assets].

- Net Interest Margin (NIM): [Insert NIM figure from 20-F]. The NIM reflects [Interpretation of NIM, e.g., the bank's ability to generate profit from lending activities].

-

Balance Sheet Strength: ING Group’s balance sheet demonstrates [Overall assessment – e.g., solid capital adequacy, strong liquidity, and good asset quality]. Capital adequacy ratios remain comfortably above regulatory requirements. [Mention any specific data from the 20-F supporting this assessment].

Risk Factors and Challenges Identified in the Form 20-F

The Form 20-F also highlights several risk factors that could impact ING Group's future performance. Understanding these is critical for any investor.

-

Credit Risk: ING Group acknowledges exposure to credit risk across various geographies and sectors. [Mention specific examples from the 20-F – e.g., increased exposure to commercial real estate loans in a specific region]. The company's risk mitigation strategies include [Mention specific mitigation strategies from 20-F].

-

Market Risk: Market volatility, particularly in interest rates and equity markets, poses a significant risk to ING Group’s trading activities and investment portfolio. The Form 20-F details their strategies for managing market risk, including [Mention specific strategies from 20-F].

-

Regulatory Changes: The ever-evolving regulatory landscape in the financial industry presents ongoing challenges. [Mention specific regulatory changes mentioned in 20-F and their potential impact].

-

Geopolitical Risks: Geopolitical instability in various parts of the world can impact ING Group's operations and financial performance. [Mention specific geopolitical risks outlined in the 20-F and their potential impact]. The Form 20-F indicates that [mention company’s strategy to handle these risks].

Investment Implications and Future Outlook Based on the Form 20-F

Based on the information presented in the Form 20-F, several investment implications emerge.

-

Stock Valuation: ING Group’s 2024 performance [positively/negatively] impacts its stock valuation. [Explain the impact – e.g., strong earnings could lead to higher stock prices, while weaker performance might put downward pressure].

-

Dividend Policy: The Form 20-F outlines [Describe the dividend policy, e.g., a maintained/increased/decreased dividend]. This has implications for investors seeking dividend income.

-

Growth Prospects: ING Group's long-term strategic goals, as mentioned in the Form 20-F, suggest [Summarize the growth prospects, highlighting positive aspects and potential challenges].

-

Comparison with Competitors: A comparison with competitors like [Name competitors] shows that ING Group's performance [Compare against competitors, e.g., is competitive/lags behind/outperforms] in key areas.

Conclusion: Understanding ING Group's 2024 Performance Through Form 20-F Analysis

This analysis of ING Group's 2024 financial results, as presented in the Form 20-F, reveals a complex picture. While the company demonstrates strengths in certain areas, such as [Mention specific strengths], it also faces challenges related to [Mention specific challenges]. Understanding these factors is crucial for investors evaluating the company's long-term prospects. The Form 20-F provides critical information for making informed investment decisions. We encourage you to download and thoroughly review the complete Form 20-F for a deeper understanding of ING Group's 2024 financial results and to conduct further research into ING Group's investment strategy and future outlook. This will allow for a comprehensive evaluation of this major global financial institution.

Featured Posts

-

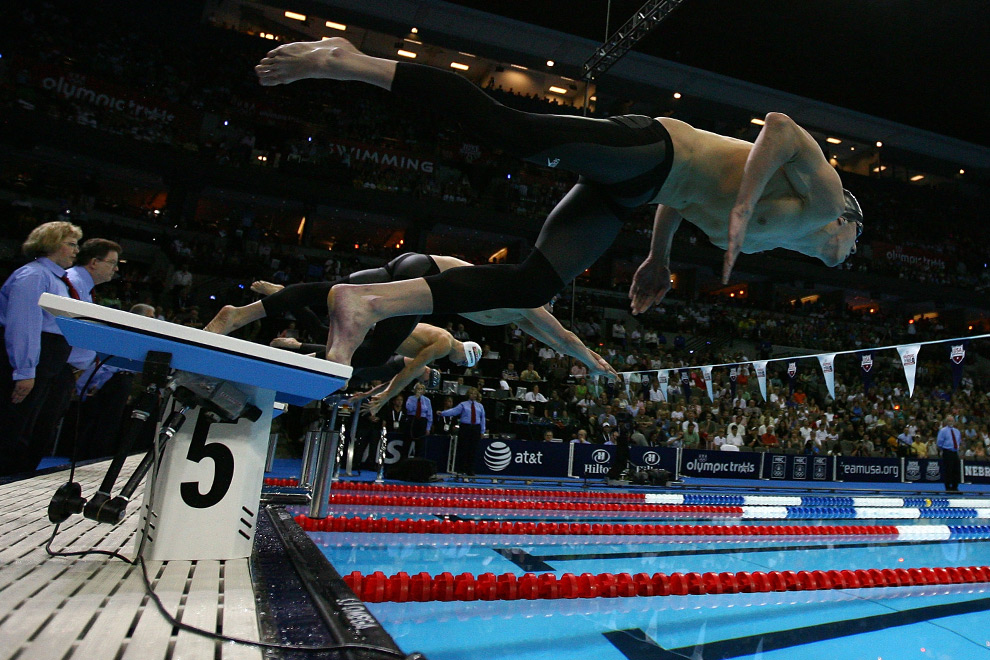

Nice Unveils Major New Olympic Swimming Complex

May 22, 2025

Nice Unveils Major New Olympic Swimming Complex

May 22, 2025 -

Tuerkiye Italya Ortakligi Nato Plani Detaylari Ortaya Cikti

May 22, 2025

Tuerkiye Italya Ortakligi Nato Plani Detaylari Ortaya Cikti

May 22, 2025 -

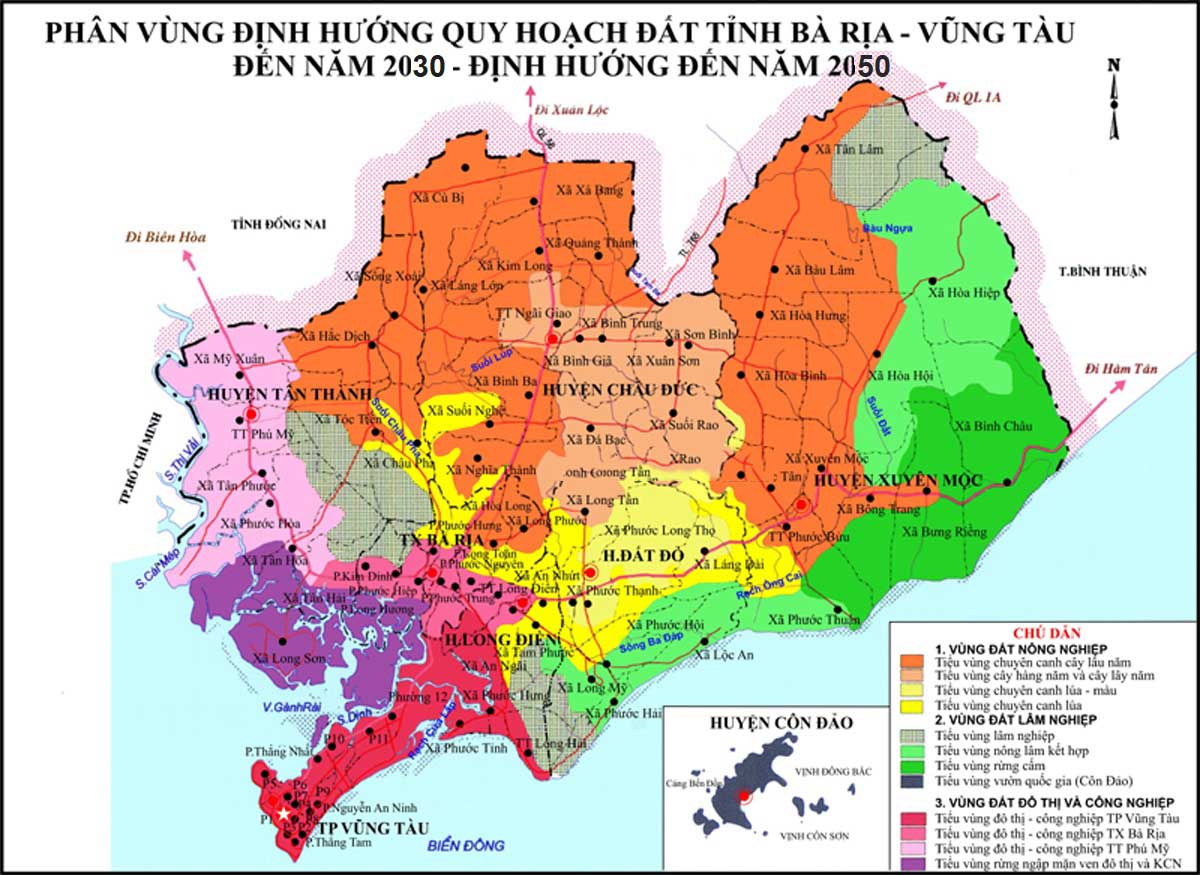

Giao Thong Tp Hcm Ba Ria Vung Tau Huong Dan Duong Di Chi Tiet

May 22, 2025

Giao Thong Tp Hcm Ba Ria Vung Tau Huong Dan Duong Di Chi Tiet

May 22, 2025 -

Ex Tory Councillors Wife Appeals Racial Hatred Tweet Sentence

May 22, 2025

Ex Tory Councillors Wife Appeals Racial Hatred Tweet Sentence

May 22, 2025 -

Graham Threatens Severe Sanctions On Russia Unless Ceasefire Is Accepted

May 22, 2025

Graham Threatens Severe Sanctions On Russia Unless Ceasefire Is Accepted

May 22, 2025