ING Group Publishes 2024 Financial Results: Form 20-F Filing

Table of Contents

Key Financial Highlights from ING Group's 2024 Form 20-F

This section examines the core financial indicators reported in ING Group's 2024 Form 20-F, providing a detailed analysis of revenue, net income, and profitability.

Revenue and Net Income

ING Group's revenue is typically generated across various segments, including Retail Banking, Wholesale Banking, and Investment Banking. The 20-F filing will detail the revenue generated by each segment, allowing for an assessment of their relative contributions to the overall financial performance. Analyzing year-over-year changes in revenue is critical for understanding growth trajectories and identifying areas of strength and weakness. For instance, a significant increase in Wholesale Banking revenue might suggest a strong performance in the global capital markets. Conversely, a decline in Retail Banking revenue could indicate challenges in a specific geographic market.

- Net income figures: [Insert actual data from the 20-F filing once available].

- Revenue breakdown by segment: [Insert actual data from the 20-F filing once available].

- Year-over-year comparison: [Insert actual data and percentage changes from the 20-F filing once available].

- Impact of macroeconomic factors: [Analyze the impact of factors like interest rate changes, inflation, and economic growth on ING Group's financial performance based on the 20-F's discussion and analysis.]

Profitability and Efficiency Ratios

Key profitability metrics like Return on Equity (ROE) and Return on Assets (ROA) will be crucial indicators of ING Group's efficiency in utilizing its capital and assets. The cost-to-income ratio, a measure of operational efficiency, will also be carefully examined. Comparing these ratios to industry benchmarks provides context and highlights ING Group's relative performance against competitors. Any significant changes from prior years warrant careful consideration and explanation.

- ROE and ROA figures: [Insert actual data from the 20-F filing once available].

- Cost-to-income ratio: [Insert actual data and year-over-year comparison from the 20-F filing once available].

- Comparison with industry benchmarks: [Insert comparative data and analysis once the 20-F filing is available].

- Explanation of any significant changes: [Provide analysis of any noteworthy variations in profitability and efficiency metrics based on the 20-F's explanations].

Capital Adequacy and Risk Management

The 20-F filing will provide detailed information on ING Group's capital position, including key capital ratios such as Tier 1 and Total Capital ratios. This information is critical for assessing the company's financial stability and its ability to withstand potential financial shocks. The report might also include results from stress tests, simulating adverse economic scenarios to gauge the resilience of ING Group's capital base. Furthermore, the filing will outline the company's approach to risk management, highlighting key risk factors and measures implemented to mitigate these risks.

- Capital ratios (Tier 1, Total): [Insert actual data from the 20-F filing once available].

- Stress test results (if available): [Insert results and analysis from the 20-F filing once available].

- Significant risk factors identified: [Summarize key risk factors mentioned in the 20-F filing once available].

- Regulatory compliance: [Discuss ING Group's compliance with relevant regulations based on the 20-F filing once available].

Significant Events and Developments in 2024

This section explores key events that shaped ING Group's financial performance in 2024.

Strategic Initiatives and Investments

The 2024 Form 20-F will likely detail significant strategic initiatives undertaken by ING Group, including mergers, acquisitions, divestitures, or significant investments in new technologies or business lines. The impact of these initiatives on financial performance should be assessed, considering both short-term and long-term implications. The report will also offer insights into the company's future outlook based on these strategic decisions.

- Details of major initiatives: [Insert details from the 20-F filing once available].

- Impact on financial performance: [Analyze the impact based on information in the 20-F filing once available].

- Future outlook based on these initiatives: [Discuss the long-term strategic implications based on the 20-F's commentary once available].

Regulatory Changes and Compliance

Regulatory changes within the financial industry significantly impact the operations and profitability of financial institutions like ING Group. The 20-F filing will address any regulatory changes encountered during the year and their impact on ING Group's financial performance. This might include compliance costs, adjustments to business strategies, or changes to risk management practices.

- Specific regulatory changes affecting ING: [Insert specific regulatory changes from the 20-F filing once available].

- Compliance costs: [Include data from the 20-F filing on compliance costs once available].

- Impact on future operations: [Analyze the long-term effects of regulatory changes based on the 20-F's analysis once available].

Analysis and Outlook

This section provides an analysis of the 2024 financial results and offers an outlook for the future.

Management Commentary and Guidance

ING Group's management will provide commentary on the financial results and offer guidance for the upcoming periods. This commentary is crucial for understanding the company's perspective on its performance and future prospects. It will often include projections for revenue, earnings, and potential challenges or risks.

- Key takeaways from management’s discussion and analysis: [Summarize management's key messages from the 20-F once available].

- Future projections (revenue, earnings): [Insert management's projections from the 20-F filing once available].

- Potential risks and challenges: [Identify and discuss potential risks and challenges outlined by management in the 20-F filing once available].

Investor Implications

The information contained in the 20-F filing has significant implications for investors. An analysis of the financial results, along with management's commentary and outlook, will allow investors to assess the potential for stock price movements and inform investment strategies. A comparison with the performance of competitor companies will also provide valuable context.

- Recommendations for investors: [Provide recommendations for investors based on the findings of the 20-F filing, once available].

- Potential risks and opportunities: [Highlight potential risks and opportunities for investors based on the information in the 20-F filing, once available].

- Comparison with competitor performance: [Analyze ING Group's performance against competitors, using data from the 20-F and other relevant sources, once available].

Conclusion

ING Group's 2024 Form 20-F filing offers a comprehensive overview of the company's financial performance and significant developments throughout the year. Analyzing key financial highlights, including revenue, net income, profitability ratios, and capital adequacy, provides a clear picture of ING Group's financial health. Understanding the impact of strategic initiatives and regulatory changes is crucial for evaluating the company's future prospects. The management's outlook and guidance offer valuable insight for investors in making informed decisions. Download the full ING Group 20-F filing today to gain a complete picture of their financial results and make informed investment decisions. Stay informed on ING Group's financial performance by regularly reviewing their SEC filings. Understanding the intricacies of the ING Group 2024 financial results, as detailed in the Form 20-F, is essential for navigating the complexities of the global financial landscape.

Featured Posts

-

This Morning Cat Deeleys Dress Malfunction Before Live Show

May 23, 2025

This Morning Cat Deeleys Dress Malfunction Before Live Show

May 23, 2025 -

Heartbreaking Reason Cat Deeley Missed Mother In Laws Funeral This Morning Revelation

May 23, 2025

Heartbreaking Reason Cat Deeley Missed Mother In Laws Funeral This Morning Revelation

May 23, 2025 -

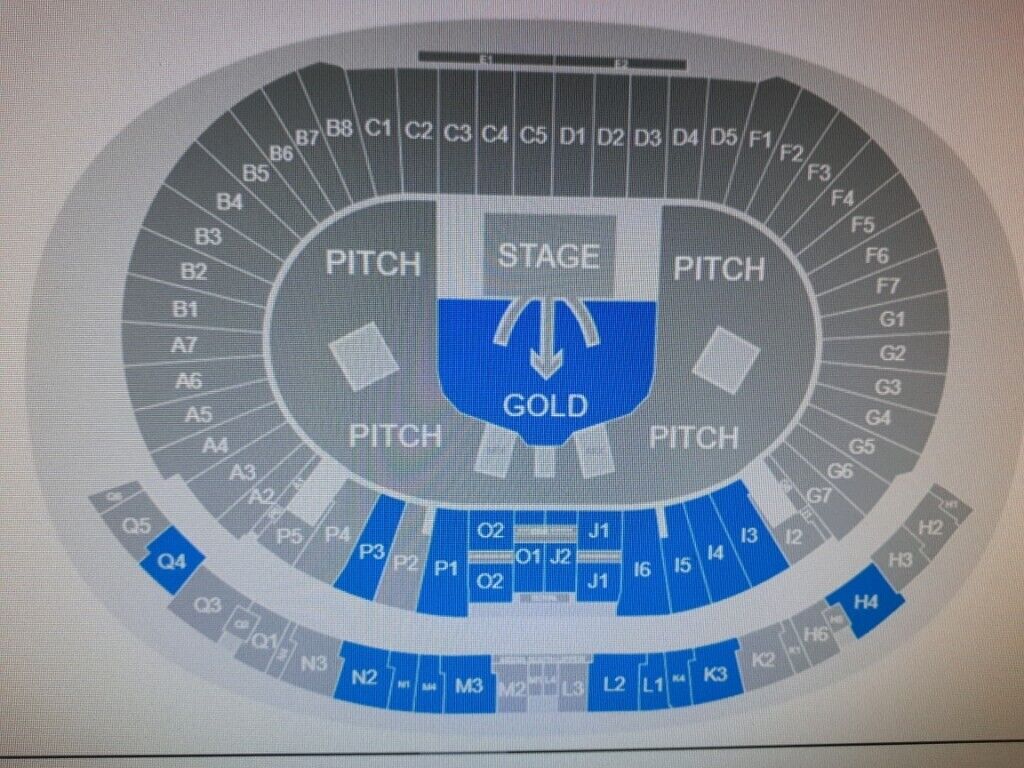

How To Buy Metallica Tickets For The Hampden Park Show In Glasgow

May 23, 2025

How To Buy Metallica Tickets For The Hampden Park Show In Glasgow

May 23, 2025 -

Urgent Action Needed Landslide Danger In Swiss Mountain Village

May 23, 2025

Urgent Action Needed Landslide Danger In Swiss Mountain Village

May 23, 2025 -

Update On My Cousin Vinny Reboot Ralph Macchio Talks Sequel Joe Pescis Role

May 23, 2025

Update On My Cousin Vinny Reboot Ralph Macchio Talks Sequel Joe Pescis Role

May 23, 2025

Latest Posts

-

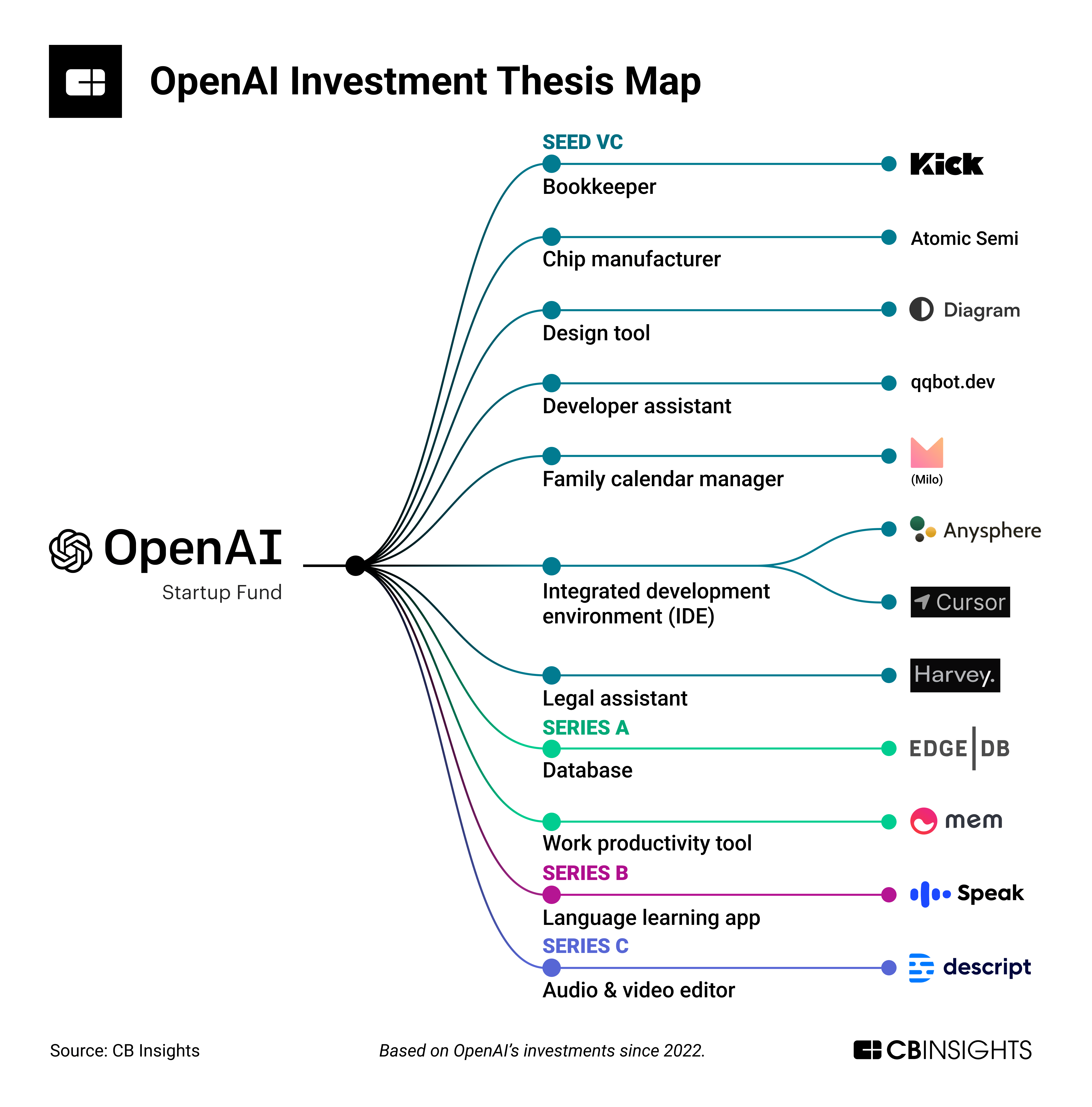

Building Voice Assistants Made Easy Open Ais 2024 Announcements

May 23, 2025

Building Voice Assistants Made Easy Open Ais 2024 Announcements

May 23, 2025 -

Ai Digest Creating A Poop Podcast From Mundane Scatological Documents

May 23, 2025

Ai Digest Creating A Poop Podcast From Mundane Scatological Documents

May 23, 2025 -

Using Ai To Transform Repetitive Scatological Data Into A Compelling Podcast

May 23, 2025

Using Ai To Transform Repetitive Scatological Data Into A Compelling Podcast

May 23, 2025 -

Space Crystals Revolutionizing Drug Development Through Innovative Technologies

May 23, 2025

Space Crystals Revolutionizing Drug Development Through Innovative Technologies

May 23, 2025 -

Exploring The Potential Of Space Grown Crystals For Improved Pharmaceuticals

May 23, 2025

Exploring The Potential Of Space Grown Crystals For Improved Pharmaceuticals

May 23, 2025