ING Group's 2024 Form 20-F: A Comprehensive Overview

Table of Contents

Keywords: ING Group, Form 20-F, 2024 financial report, ING financial results, ING investment, ING stock, annual report, Dutch bank, ING Group analysis, ING Group 20-F

ING Group, a leading global financial institution, recently released its 2024 Form 20-F, providing a comprehensive overview of its financial performance and strategic direction. This report is crucial for investors, analysts, and stakeholders seeking to understand the Dutch bank's financial health and future prospects. This article delves into the key highlights and implications of ING Group's 2024 Form 20-F, offering a detailed analysis for informed decision-making.

Key Financial Highlights from ING Group's 2024 Form 20-F

Revenue and Net Income

The 2024 Form 20-F reveals [Insert actual data from the 20-F here – e.g., "a total revenue of €X billion," and "a net income of €Y billion"]. This represents a [Insert percentage change – e.g., "5% increase"] in revenue compared to 2023 and a [Insert percentage change – e.g., "10% increase"] in net income. Several factors contributed to this performance:

- Wholesale Banking: Strong performance in [mention specific area like trading or lending].

- Retail Banking: Growth driven by [mention specific drivers, e.g., mortgage lending, increased customer deposits].

- Investment Management: Positive contributions from [mention specific areas, e.g., asset under management growth].

This positive financial performance reflects ING's strategic focus on [mention key strategic areas based on 20-F].

Balance Sheet and Capital Ratios

ING Group's balance sheet remains strong, showcasing robust liquidity and capital adequacy. Key metrics from the 20-F include:

- Total Assets: [Insert data from 20-F]

- Total Liabilities: [Insert data from 20-F]

- Common Equity Tier 1 (CET1) Ratio: [Insert data from 20-F] – exceeding regulatory requirements.

The strong capital ratios demonstrate ING's resilience and ability to withstand potential economic downturns. Any significant changes in capital structure should also be discussed here, referencing specific information from the 20-F.

Profitability Metrics

ING Group's profitability remains healthy, with key metrics reflecting its efficient operations:

- Return on Equity (ROE): [Insert data from 20-F]

- Return on Assets (ROA): [Insert data from 20-F]

- Net Interest Margin (NIM): [Insert data from 20-F]

These figures compare favorably to [mention industry averages or previous year’s performance] and highlight the bank's successful execution of its strategic priorities. Analyzing the factors influencing these profitability metrics (e.g., interest rate changes, cost management) is critical for a complete understanding.

Strategic Initiatives and Outlook in ING Group's 2024 Form 20-F

Growth Strategies

ING Group's 2024 Form 20-F outlines several key strategic initiatives aimed at driving future growth:

- Expansion into new markets: [mention specific markets from the 20-F].

- Investment in digital technologies: [mention specific examples from the 20-F].

- Launch of new products and services: [mention specific products from the 20-F].

These growth strategies are expected to significantly impact ING's financial performance in the coming years. The potential impact of these strategies should be thoroughly analyzed, referencing projections or forecasts found within the 20-F.

Risk Management and Compliance

ING Group acknowledges various risk factors in its 20-F, including:

- Credit risk: Mitigated through [mention strategies from the 20-F].

- Market risk: Managed through [mention strategies from the 20-F].

- Operational risk: Addressed through [mention strategies from the 20-F].

The 20-F also details the company's commitment to regulatory compliance. A discussion of any significant compliance matters reported and their potential impact on the business is essential here.

Environmental, Social, and Governance (ESG) Initiatives

ING Group's 2024 Form 20-F highlights its commitment to ESG principles. Specific initiatives mentioned include:

- [Insert specific ESG initiatives from the 20-F, e.g., reduction of carbon footprint, promoting diversity and inclusion].

- [Insert specific ESG targets from the 20-F].

The company's ESG performance and targets are crucial for investors increasingly focused on sustainable and responsible investments.

Analysis and Implications of ING Group's 2024 Form 20-F

Investor Implications

The information presented in ING Group's 2024 Form 20-F has significant implications for investors:

- Potential stock price movements: [Analysis based on financial performance and outlook].

- Dividend payouts: [Discuss dividend policy as mentioned in the 20-F].

- Investment opportunities: [Offer insights on investment opportunities based on the 20-F analysis].

A comprehensive valuation analysis, considering future growth prospects outlined in the 20-F, is necessary to offer informed investment recommendations.

Conclusion

This comprehensive overview of ING Group's 2024 Form 20-F provides valuable insights into the company's financial performance, strategic direction, and risk profile. Understanding these key aspects is crucial for investors and stakeholders seeking to assess the financial health and future prospects of ING Group. For a deeper dive into the specifics, we encourage you to access and review the complete ING Group 2024 Form 20-F filing. Stay informed on ING Group's financial performance by regularly consulting their filings and analysis of their financial reports, including future filings of the ING Group Form 20-F.

Featured Posts

-

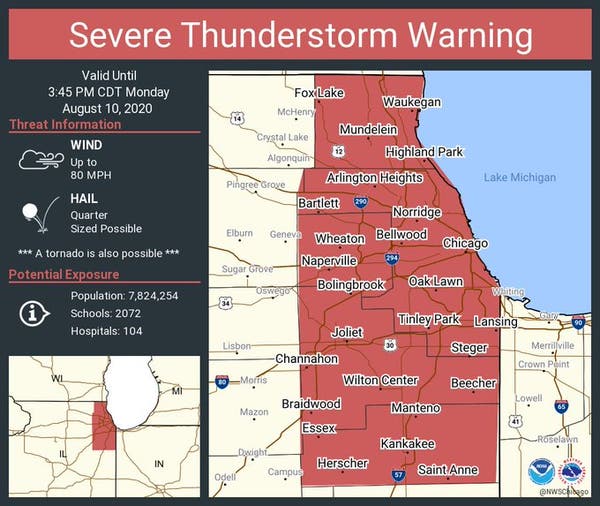

Watch Out For Damaging Winds Fast Moving Storms

May 21, 2025

Watch Out For Damaging Winds Fast Moving Storms

May 21, 2025 -

Avauskokoonpano Julkistettu Kamaran Ja Pukin Asema Epaeselvae

May 21, 2025

Avauskokoonpano Julkistettu Kamaran Ja Pukin Asema Epaeselvae

May 21, 2025 -

Ryanair Flags Tariff Conflicts As Top Growth Obstacle Implements Share Repurchase Program

May 21, 2025

Ryanair Flags Tariff Conflicts As Top Growth Obstacle Implements Share Repurchase Program

May 21, 2025 -

The Goldbergs A Comprehensive Guide To Every Season

May 21, 2025

The Goldbergs A Comprehensive Guide To Every Season

May 21, 2025 -

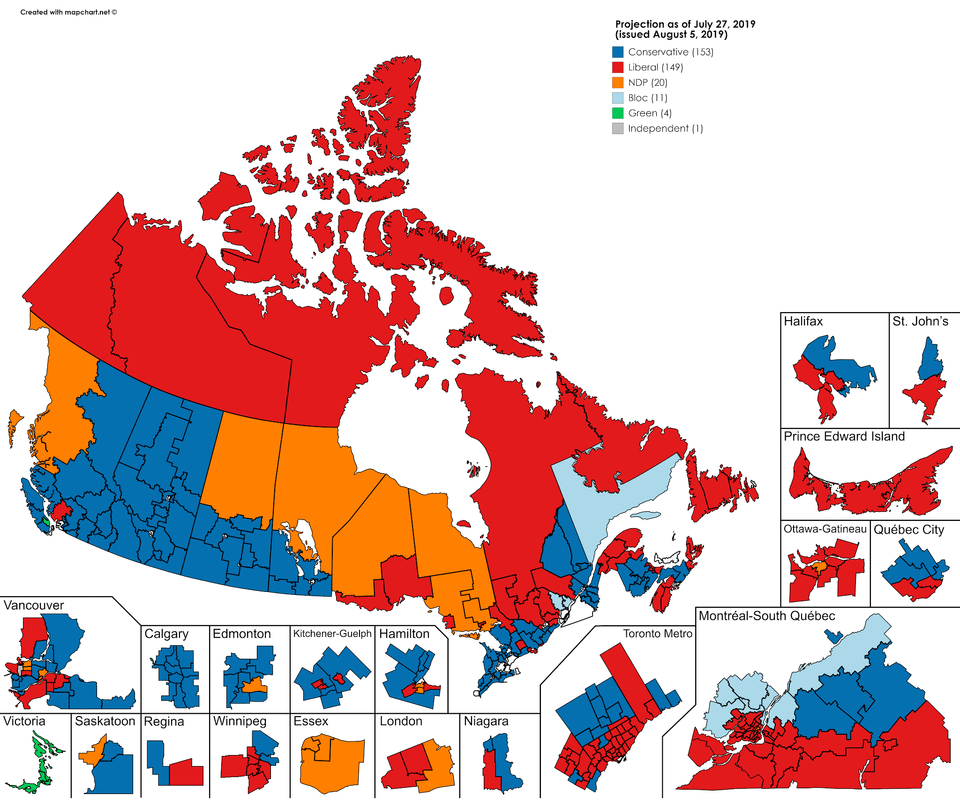

Saskatchewan Political Panel Interpreting The Federal Election Results

May 21, 2025

Saskatchewan Political Panel Interpreting The Federal Election Results

May 21, 2025