ING Group's 2024 Performance: Insights From The Form 20-F

Table of Contents

Key Financial Highlights from ING Group's 20-F Filing

ING Group's 20-F filing reveals key financial metrics that paint a picture of its 2024 performance. Analyzing these metrics against previous years and industry benchmarks is critical for a comprehensive understanding. Key performance indicators (KPIs) such as revenue, net income, profitability, Earnings per Share (EPS), Return on Equity (ROE), and Return on Assets (ROA) provide a detailed financial snapshot. (Note: Specific data points would need to be inserted here, referencing page numbers from the actual 20-F filing for accuracy and citation. This analysis is hypothetical pending access to the actual 2024 filing.)

- Revenue Growth: Analysis of revenue growth in key segments like Wholesale Banking, Retail Banking, and Investment Management would be presented here, showing percentage changes and comparing them to previous years. For example, "Wholesale Banking revenue increased by X%, driven by Y."

- Net Income and Profitability: A detailed look at net income trends, comparing them to previous years, and analyzing the factors impacting profitability. This section would include relevant calculations and ratios, potentially including a comparison to competitor profitability. For instance, "Net income increased by Z%, primarily due to A and B."

- EPS and its Drivers: An in-depth examination of Earnings Per Share (EPS) and the factors influencing its fluctuations. This might include explanations of increases or decreases based on factors like increased revenue, cost-cutting measures, or one-off events.

- ROE and ROA Compared to Competitors: A comparison of ING Group's Return on Equity (ROE) and Return on Assets (ROA) to industry benchmarks and key competitors. This would provide context and allow for a relative assessment of performance.

ING Group's Risk Management and Capital Adequacy in 2024

Effective risk management is paramount for financial institutions, and ING Group's 20-F filing provides crucial information on its approach. Understanding their capital adequacy, regulatory compliance, and strategies for managing credit, market, and operational risks is essential. This section will analyze their adherence to Basel III standards and their overall solvency.

- Credit Risk Exposure and Mitigation: An analysis of ING Group's exposure to credit risk, including strategies employed to mitigate potential losses. This could involve discussing loan portfolio diversification, credit scoring models, and loss provisioning.

- Market Risk and Global Economic Conditions: An assessment of market risk, considering the impact of global economic conditions on ING Group's portfolio and profitability. This section would analyze their hedging strategies and exposure to various market factors.

- Operational Risk Management and Internal Controls: A discussion of ING Group's operational risk management framework and the internal controls implemented to mitigate operational disruptions and fraud.

- Capital Adequacy Ratios and Regulatory Compliance: An examination of ING Group's capital adequacy ratios (e.g., CET1 ratio) and their compliance with regulatory requirements. This section would involve comparing their ratios to regulatory minimums and industry averages.

Geographic Performance and Strategic Initiatives

ING Group operates in numerous geographic markets. Analyzing their performance across different regions provides valuable insight into their overall success. This section examines growth, challenges, and strategic initiatives undertaken.

- Performance in Key Geographic Markets: An analysis of ING Group's performance in major markets such as Europe, Asia, and North America, highlighting successes and challenges faced in each region. This would involve looking at revenue growth, profitability, and market share in each geographic area.

- Market Share Trends and Competitive Landscape: An assessment of ING Group's market share trends in its key markets and analysis of the competitive landscape, highlighting key competitors and their strategic moves.

- New Strategic Initiatives and Impact: A discussion of any significant strategic initiatives undertaken by ING Group during 2024 and their anticipated impact on future performance. This could include discussions of digital transformation initiatives, expansion into new markets, or mergers and acquisitions.

- Significant Acquisitions or Mergers: Details of any major acquisitions or mergers undertaken by ING Group during 2024, including their rationale, financial implications, and integration process.

Future Outlook and Investment Implications from the 20-F

The 20-F provides valuable clues regarding ING Group's future outlook. Analyzing management's guidance, potential catalysts for growth, and potential risks helps investors assess investment prospects.

- Management's Guidance for the Coming Year: An overview of ING Group's management guidance for the upcoming year, including their projections for revenue growth, profitability, and other key metrics.

- Potential Catalysts for Share Price Growth: Identification of potential factors that could drive share price growth, such as successful strategic initiatives, improved profitability, or positive industry trends.

- Discussion of Dividend Policy and Sustainability: Analysis of ING Group's dividend policy and its sustainability in light of their financial performance and future outlook.

- Overall Assessment of Investment Prospects: A summary of the overall investment prospects for ING Group, considering the factors discussed in this section, and offering a balanced view of potential risks and rewards.

Conclusion

ING Group's 2024 performance, as reflected in its 20-F filing, provides a complex picture requiring careful analysis. While specific numerical data requires accessing the official filing, this overview highlights the key areas to examine: robust financial highlights, a considered approach to risk management, varied geographic performance, and a promising outlook. Understanding these aspects is crucial for making informed investment decisions. To gain a complete understanding of ING Group's 2024 financial results, download the full ING Group 20-F filing and conduct your own thorough analysis. Stay informed about ING Group's performance by regularly reviewing their 20-F filings and related financial disclosures.

Featured Posts

-

Zimbabwes Crucial Test Win Overcoming Bangladesh

May 23, 2025

Zimbabwes Crucial Test Win Overcoming Bangladesh

May 23, 2025 -

Shantos Unbeaten Half Century Extends Bangladeshs Lead In Rain Affected Match

May 23, 2025

Shantos Unbeaten Half Century Extends Bangladeshs Lead In Rain Affected Match

May 23, 2025 -

The Karate Kid Martial Arts Mentorship And Personal Growth

May 23, 2025

The Karate Kid Martial Arts Mentorship And Personal Growth

May 23, 2025 -

How Jesse Eisenberg Cast Kieran Culkin In A Real Pain An Interview

May 23, 2025

How Jesse Eisenberg Cast Kieran Culkin In A Real Pain An Interview

May 23, 2025 -

Andrew Tate Din Dubai Un Nou Inceput Sau Un Nou Scandal

May 23, 2025

Andrew Tate Din Dubai Un Nou Inceput Sau Un Nou Scandal

May 23, 2025

Latest Posts

-

Ai Digest Creating A Poop Podcast From Mundane Scatological Documents

May 23, 2025

Ai Digest Creating A Poop Podcast From Mundane Scatological Documents

May 23, 2025 -

Using Ai To Transform Repetitive Scatological Data Into A Compelling Podcast

May 23, 2025

Using Ai To Transform Repetitive Scatological Data Into A Compelling Podcast

May 23, 2025 -

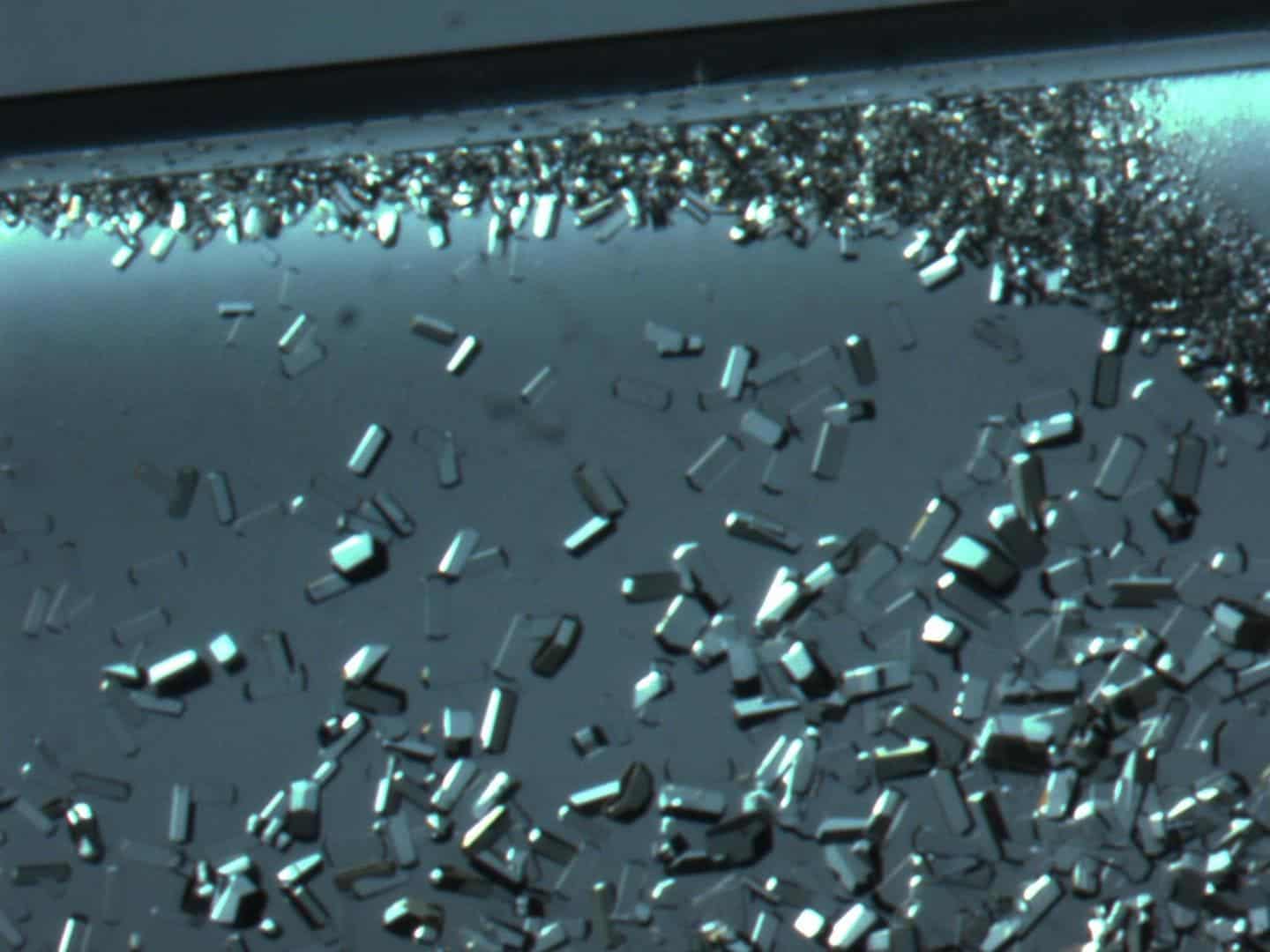

Space Crystals Revolutionizing Drug Development Through Innovative Technologies

May 23, 2025

Space Crystals Revolutionizing Drug Development Through Innovative Technologies

May 23, 2025 -

Exploring The Potential Of Space Grown Crystals For Improved Pharmaceuticals

May 23, 2025

Exploring The Potential Of Space Grown Crystals For Improved Pharmaceuticals

May 23, 2025 -

The Role Of Orbital Space Crystals In Enhancing Drug Production And Quality

May 23, 2025

The Role Of Orbital Space Crystals In Enhancing Drug Production And Quality

May 23, 2025