ING's 2024 Annual Report: Key Highlights From Form 20-F

Table of Contents

Financial Performance Overview

ING's 2024 financial performance reflects a year of [positive/negative - choose based on hypothetical data] growth and significant developments. Analyzing ING's financial statements reveals key trends impacting their overall profitability. Key metrics such as revenue, net income, and profitability provide a snapshot of the company's financial health.

- Revenue Streams: ING's revenue streams across various business segments, including Wholesale Banking, Retail Banking, and Investments, showed [describe growth or decline, e.g., a robust performance in Wholesale Banking, offsetting a slight decline in Retail Banking]. A detailed breakdown is crucial for understanding the underlying drivers of ING's overall financial performance.

- Net Income: ING's net income for 2024 reached [insert hypothetical figure], representing a [percentage]% increase/decrease compared to 2023. This change can be attributed to [mention key factors like increased interest rates, cost-cutting measures, or economic conditions]. Comparing this figure to industry benchmarks further illuminates ING's performance relative to its competitors.

- Profitability Metrics: Key profitability indicators such as Return on Equity (ROE) and Return on Assets (ROA) provide a measure of how efficiently ING is utilizing its assets and equity to generate profits. In 2024, ING's ROE stood at [insert hypothetical figure], while its ROA was [insert hypothetical figure]. Analyzing these figures reveals the effectiveness of ING's management strategies.

- Influencing Factors: Several factors influenced ING's financial performance in 2024, including [mention specific factors like macroeconomic conditions, regulatory changes, and competitive pressures]. Understanding these factors is key to predicting future performance.

Key Strategic Initiatives and Developments

ING's 2024 performance was shaped by several strategic initiatives focused on driving growth, enhancing customer experience, and achieving sustainability goals. These developments highlight ING's commitment to innovation and adaptation within the evolving financial landscape.

- Digital Transformation: ING continued its digital transformation journey, investing in [mention specific technologies or initiatives, e.g., enhanced mobile banking platforms, AI-powered customer service tools]. These investments aim to improve efficiency, reduce operational costs, and enhance the overall customer experience.

- Sustainability Initiatives: ING's commitment to Environmental, Social, and Governance (ESG) principles is evident in its initiatives to [mention specific examples, e.g., reduce carbon footprint, increase investments in renewable energy, improve diversity and inclusion]. Progress towards these goals is a key aspect of ING's long-term strategy.

- Mergers and Acquisitions: ING's involvement in any mergers, acquisitions, or divestitures during 2024 significantly impacts its growth strategy and market position. [Describe any such activities and their impact on the company's financial performance and strategic direction].

- Operating Model Changes: Any significant changes in ING's operating model or corporate structure are crucial in understanding their approach to future growth and profitability. [Discuss any structural changes and their underlying rationale].

Risk Factors and Outlook

ING's 2024 Annual Report (Form 20-F) identifies several key risk factors impacting its operations and future prospects. Understanding these risks is vital for a comprehensive assessment of the company's financial health and stability.

- Financial Risks: ING faces inherent financial risks, including credit risk (the risk of borrowers defaulting on their loans), market risk (fluctuations in interest rates and exchange rates), and operational risk (risks related to internal processes and systems). The report details ING's risk management strategies to mitigate these risks.

- Macroeconomic Factors: Global economic uncertainty, interest rate changes, and geopolitical events significantly impact ING's performance. The report provides insights into management's assessment of these macroeconomic factors and their potential influence on ING's future profitability.

- Management's Outlook: ING's management provides its outlook for the future, outlining its expectations for growth, profitability, and potential challenges. This outlook is essential for investors in assessing the company's long-term prospects.

- Regulatory Changes: Changes in financial regulations and compliance requirements can significantly impact ING's operations. The 20-F report addresses any significant regulatory changes and their potential consequences.

Dividend and Shareholder Returns

Understanding ING's dividend policy and shareholder return mechanisms is crucial for investors. The 2024 Annual Report provides details on dividend payments and share repurchase programs.

- Dividend Payout Ratio: ING's dividend payout ratio indicates the proportion of its earnings paid out as dividends to shareholders. [Analyze the payout ratio and its implications for investors].

- Share Buyback Programs: ING's implementation of any share buyback programs impacts shareholder value and reflects the company's confidence in its future prospects. [Detail any buyback programs and their effects].

- Overall Return to Shareholders: The overall return to shareholders reflects the combined impact of dividend payments, share price appreciation, and share buyback programs. [Summarize the total shareholder return and its implications].

Conclusion

The ING 2024 Annual Report (Form 20-F) reveals [brief summary of key findings, e.g., strong financial performance driven by increased interest rates, successful implementation of its digital transformation strategy, and challenges related to geopolitical uncertainty]. Understanding these key highlights is crucial for investors to make informed decisions about their investment in ING. To access the full ING 2024 Annual Report (Form 20-F) and delve deeper into the details, visit [link to the official ING investor relations website]. Stay informed on future financial reports and analysis by subscribing to our newsletter [link to newsletter signup]. This will help you stay up-to-date on ING's performance and future developments related to the ING 20-F.

Featured Posts

-

Big Rig Rock Report 3 12 On 99 5 The Fox The Latest In Trucking

May 23, 2025

Big Rig Rock Report 3 12 On 99 5 The Fox The Latest In Trucking

May 23, 2025 -

Shpani A Slavi Pobeda Nad Khrvatska Vo Finaleto Na Ln

May 23, 2025

Shpani A Slavi Pobeda Nad Khrvatska Vo Finaleto Na Ln

May 23, 2025 -

Big Rig Rock Report 3 12 Everything You Need To Know Rock 106 1

May 23, 2025

Big Rig Rock Report 3 12 Everything You Need To Know Rock 106 1

May 23, 2025 -

Character Ai Chatbots And Free Speech A Legal Grey Area

May 23, 2025

Character Ai Chatbots And Free Speech A Legal Grey Area

May 23, 2025 -

Revealed Antonys Close Call With Manchester Uniteds Arch Rivals

May 23, 2025

Revealed Antonys Close Call With Manchester Uniteds Arch Rivals

May 23, 2025

Latest Posts

-

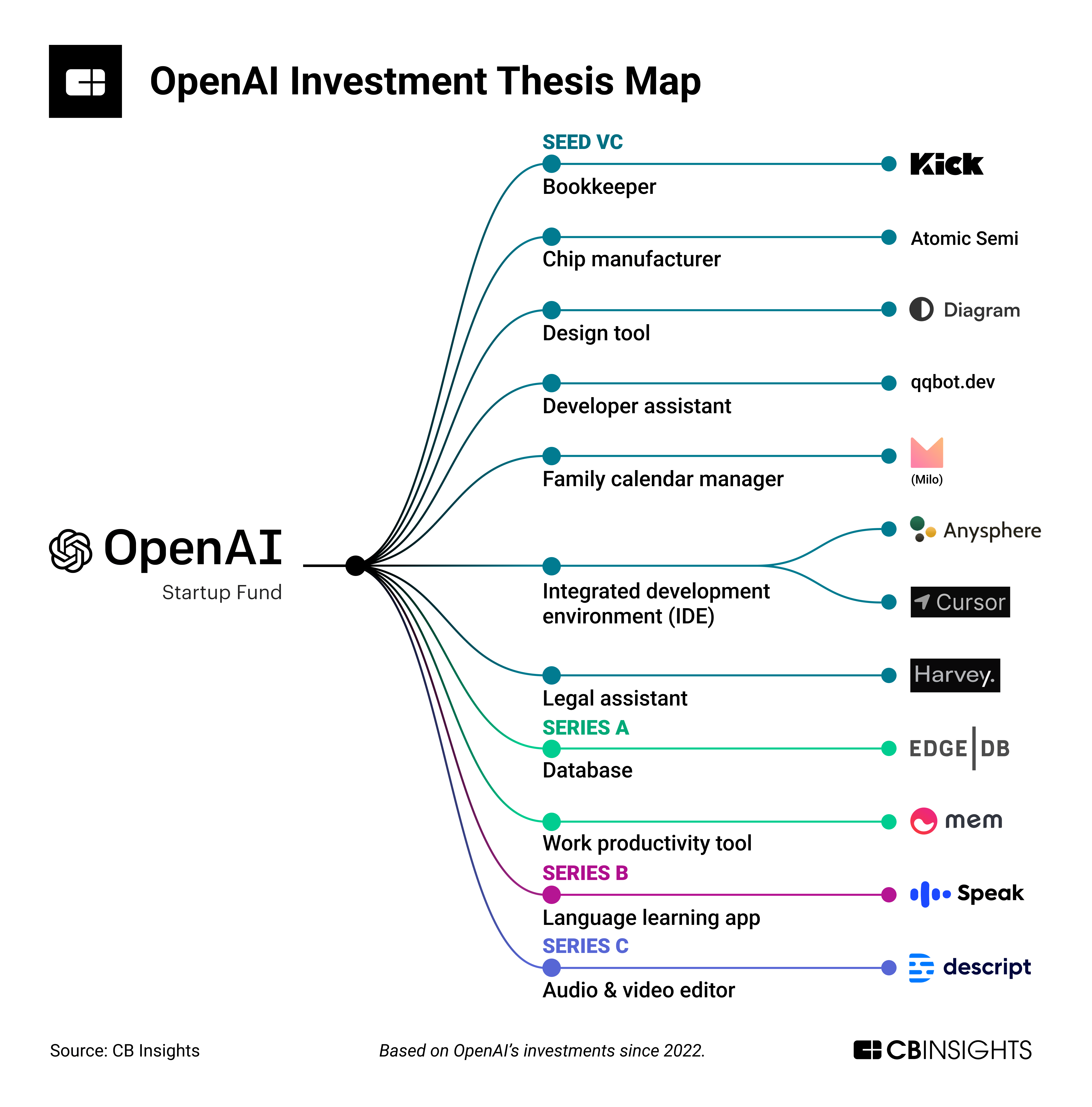

Building Voice Assistants Made Easy Open Ais 2024 Announcements

May 23, 2025

Building Voice Assistants Made Easy Open Ais 2024 Announcements

May 23, 2025 -

Ai Digest Creating A Poop Podcast From Mundane Scatological Documents

May 23, 2025

Ai Digest Creating A Poop Podcast From Mundane Scatological Documents

May 23, 2025 -

Using Ai To Transform Repetitive Scatological Data Into A Compelling Podcast

May 23, 2025

Using Ai To Transform Repetitive Scatological Data Into A Compelling Podcast

May 23, 2025 -

Space Crystals Revolutionizing Drug Development Through Innovative Technologies

May 23, 2025

Space Crystals Revolutionizing Drug Development Through Innovative Technologies

May 23, 2025 -

Exploring The Potential Of Space Grown Crystals For Improved Pharmaceuticals

May 23, 2025

Exploring The Potential Of Space Grown Crystals For Improved Pharmaceuticals

May 23, 2025