InterRent REIT Acquisition: Sovereign Wealth Fund And Executive Chair's Bid

Table of Contents

Keywords: InterRent REIT, REIT acquisition, sovereign wealth fund, executive chair bid, real estate investment trust, takeover bid, investment strategy, shareholder value, real estate sector

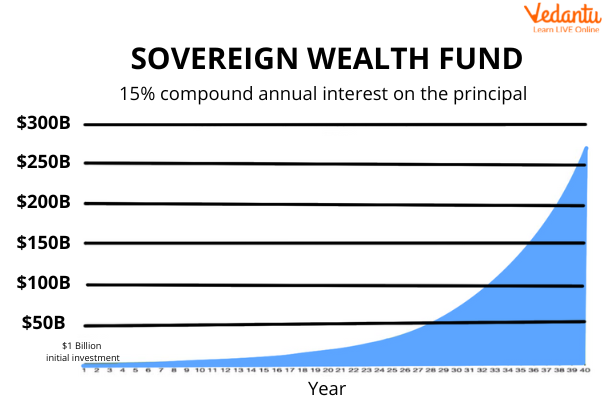

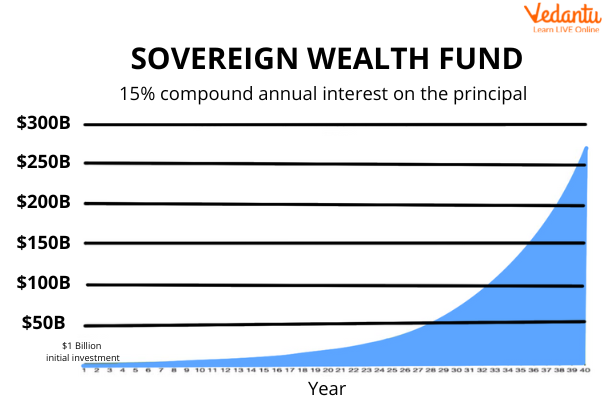

The InterRent REIT acquisition is captivating the financial world, pitting a powerful sovereign wealth fund against the company's executive chair in a high-stakes battle for control. This article dissects this compelling competition, examining the strategies, motivations, and potential outcomes for all stakeholders involved in this real estate investment trust (REIT) takeover bid. Understanding the nuances of this acquisition is crucial for anyone invested in the real estate sector or interested in the dynamics of large-scale corporate takeovers.

The Sovereign Wealth Fund's Bid

Strategic Rationale

The sovereign wealth fund's interest in acquiring InterRent REIT likely stems from several strategic objectives. Their investment strategy probably involves:

- Diversification: Expanding their portfolio beyond existing holdings to mitigate risk and capture opportunities in the North American real estate market.

- Portfolio Expansion: Adding a significant, established REIT like InterRent enhances their holdings in the multifamily residential sector, a stable and growing asset class.

- Long-Term Investment: Sovereign wealth funds often favor long-term investments, viewing InterRent REIT's stable cash flows as a reliable addition to their portfolio.

Previous investments in similar real estate sectors, perhaps including other REITs or large-scale property developments, would further support this long-term investment strategy. Synergies between InterRent's portfolio and the sovereign wealth fund's existing holdings could also be a key driver, creating operational efficiencies and added value.

Financial Strength and Capacity

The sovereign wealth fund possesses considerable financial firepower. Their vast asset size and significant investment capacity make a substantial acquisition like InterRent entirely feasible.

- Asset Size and Investment Capacity: Their immense reserves provide ample capital to fund the acquisition, potentially even exceeding the executive chair's counter-offer.

- Track Record: A history of successful large-scale acquisitions demonstrates their competence in managing complex transactions and integrating acquired entities.

- Financing Sources: The fund likely has access to various financing options, including its own reserves, loans, and potentially other investments, ensuring they can readily meet the financial demands of the acquisition. The terms of their bid would reflect this robust financial position.

The Executive Chair's Counter-Bid

Motivations and Strategy

The executive chair's counter-bid is likely driven by a combination of factors:

- Maintaining Control: Protecting their position and influence within the company, and possibly preventing potential changes in management or strategic direction.

- Concerns about the Sovereign Wealth Fund's Strategy: Potential disagreements about the future direction of InterRent, including concerns over short-term vs. long-term growth strategies.

- Personal and Corporate Interests: Protecting significant personal investments in InterRent and maintaining long-term value creation for existing stakeholders.

Any potential conflicts of interest must be carefully considered. The terms of the counter-offer, particularly any stipulations regarding management and future strategy, are crucial in understanding the executive chair's ambitions. Their long-term vision for InterRent could dramatically differ from that of the sovereign wealth fund.

Financial Backing and Support

Securing funding for a competing bid against a sovereign wealth fund is a significant undertaking. The executive chair likely relies on:

- Private Equity Partners: Teaming up with private equity firms provides access to capital and expertise in executing such transactions.

- Other Investors: Attracting other investors, perhaps those already invested in the company, could bolster their bid's financial strength and enhance its attractiveness.

- Feasibility and Stability: The feasibility and financial stability of this counter-offer are critical, as it directly competes with the massive resources of the sovereign wealth fund.

Implications for InterRent REIT Shareholders

Valuation and Share Price

The competing bids have significantly impacted InterRent REIT's share price and market valuation.

- Premium Offers: The bidding war creates a competitive environment, potentially driving up the price offered for InterRent shares, benefiting shareholders.

- Risks and Rewards: Shareholders must weigh the risks and rewards associated with each bid. A sovereign wealth fund may offer financial stability, while the executive chair's bid might offer more continuity in management and strategy.

The final valuation will depend on the ultimate winning bid and its terms.

Future of the Company

The successful bidder will significantly shape InterRent REIT's future trajectory.

- Changes in Management and Strategy: A sovereign wealth fund might prioritize operational efficiency and long-term growth, while the executive chair might maintain existing strategies.

- Long-Term Effects on Shareholder Returns: Each bidder's approach will likely impact shareholder returns differently; some approaches may prioritize dividends, others capital appreciation.

Shareholders must carefully analyze each proposal's long-term implications before deciding which bid better aligns with their investment goals.

Conclusion

The InterRent REIT acquisition showcases a fascinating clash of strategic interests, pitting the substantial resources of a sovereign wealth fund against the determination of the company's executive chair. This real estate investment trust takeover bid highlights the complexities and significant implications of large-scale acquisitions within the real estate sector. The outcome will significantly impact InterRent's future direction and shareholder value. Careful analysis of both bids is essential for understanding the potential consequences for all stakeholders.

Call to Action: Stay tuned for further developments in the InterRent REIT acquisition. Follow reputable financial news sources and analysis websites for updates on this dynamic situation and for in-depth analysis of this significant real estate takeover bid.

Featured Posts

-

Lana Del Reys Stagecoach Performance The Morgan Wallen Kiss Story

May 29, 2025

Lana Del Reys Stagecoach Performance The Morgan Wallen Kiss Story

May 29, 2025 -

Uerduen Gazze Den Tahliye Edilen Kanser Hastasi Cocuklara Kapilarini Aciyor

May 29, 2025

Uerduen Gazze Den Tahliye Edilen Kanser Hastasi Cocuklara Kapilarini Aciyor

May 29, 2025 -

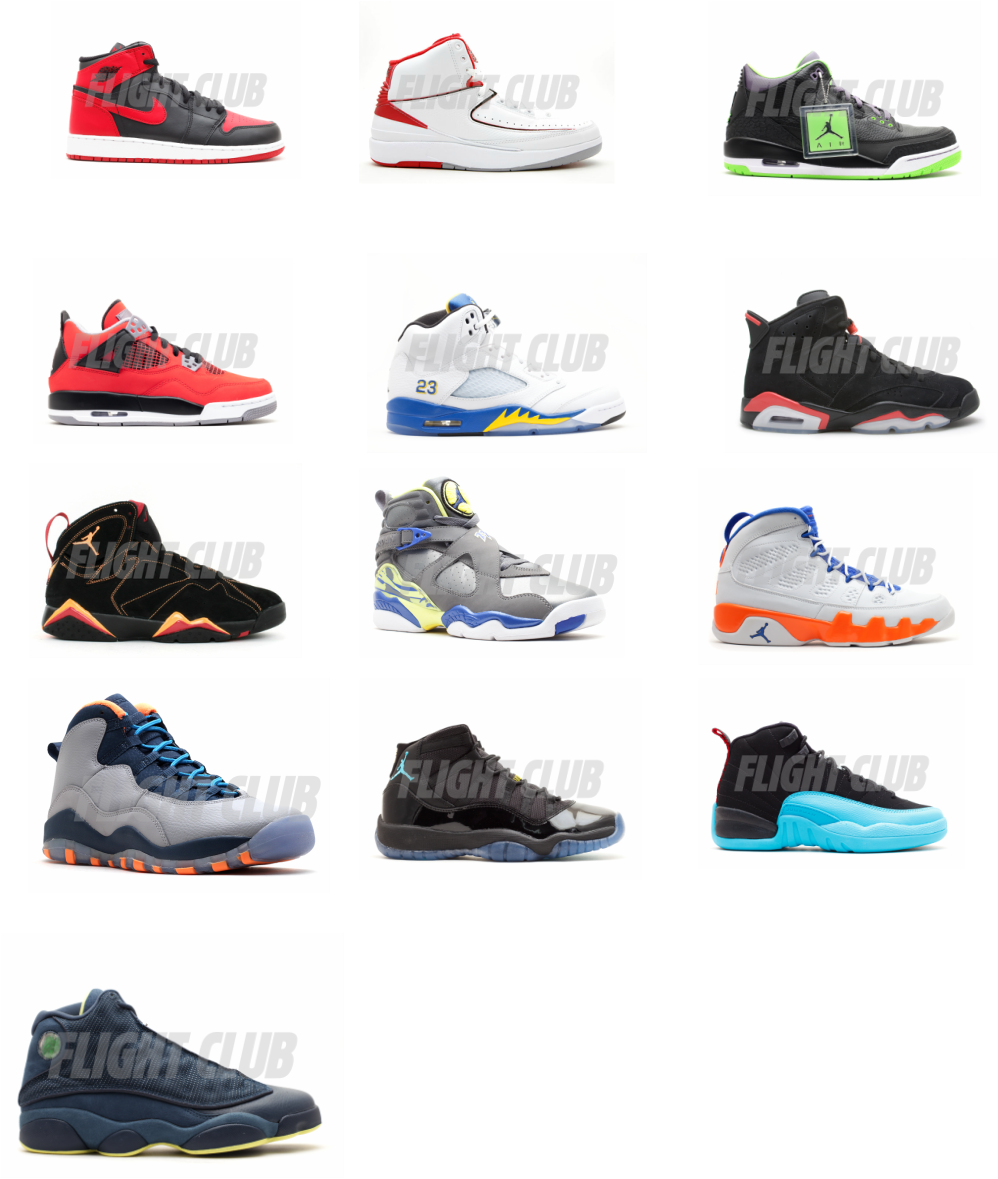

The Definitive Guide To Air Jordans Releasing In June 2025

May 29, 2025

The Definitive Guide To Air Jordans Releasing In June 2025

May 29, 2025 -

Bring Her Back 2025 The Stressful Nightmare You Need To See

May 29, 2025

Bring Her Back 2025 The Stressful Nightmare You Need To See

May 29, 2025 -

Jonathan Tah To Manchester United Transfer Talk And Potential

May 29, 2025

Jonathan Tah To Manchester United Transfer Talk And Potential

May 29, 2025