Interpreting The Net Asset Value (NAV) For Amundi MSCI World II UCITS ETF Dist

Table of Contents

What is the NAV and How is it Calculated for the Amundi MSCI World II UCITS ETF Dist?

The Net Asset Value (NAV) represents the total value of an ETF's underlying assets minus its liabilities, divided by the number of outstanding shares. For the Amundi MSCI World II UCITS ETF Dist, this calculation involves several key steps:

- Asset Valuation: This involves determining the market value of all the securities held within the ETF portfolio. The Amundi MSCI World II UCITS ETF Dist invests in a globally diversified range of stocks, so this process involves calculating the market price of each holding and summing them up.

- Liabilities: This includes various expenses associated with running the ETF, such as management fees, administrative costs, and any outstanding liabilities. These are subtracted from the total asset value.

- Number of Outstanding Shares: The total value of the assets, net of liabilities, is then divided by the total number of Amundi MSCI World II UCITS ETF Dist shares currently in circulation.

The Amundi MSCI World II UCITS ETF Dist's NAV is calculated daily, typically at the close of market trading, reflecting the most up-to-date values of its holdings. This daily NAV calculation ensures transparency and accurate reflection of the ETF's underlying value. This daily NAV is then published publicly through various channels. Understanding the Amundi MSCI World II UCITS ETF Dist NAV calculation allows for a clearer grasp of the ETF's true value.

Factors Affecting the Amundi MSCI World II UCITS ETF Dist's NAV

Several factors influence the daily NAV of the Amundi MSCI World II UCITS ETF Dist:

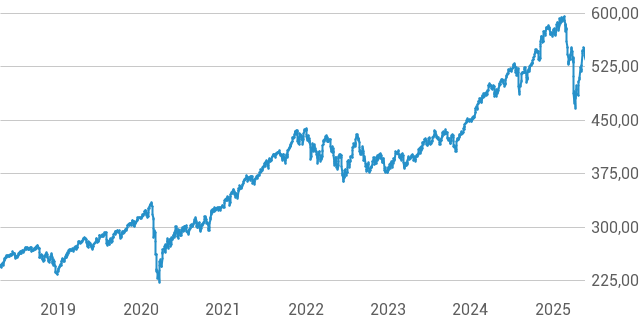

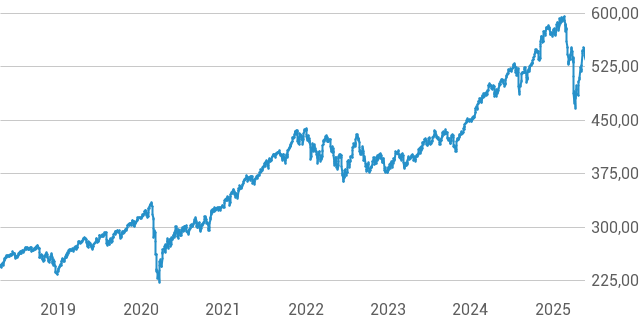

- Market Fluctuations: Changes in the prices of the underlying securities directly impact the NAV. A rising market generally leads to a higher NAV, while a falling market causes a decrease. This is a key driver of NAV fluctuations.

- Currency Exchange Rates: As the Amundi MSCI World II UCITS ETF Dist holds globally diversified assets, currency exchange rate movements between the base currency of the ETF and the currencies of the underlying assets affect the overall NAV.

- Dividend Distributions: When the underlying companies within the ETF pay dividends, this impacts the NAV. While the investor receives the dividend, the NAV is typically adjusted downwards to reflect the distribution. Understanding the dividend impact on NAV is important for long-term analysis.

- Expenses and Management Fees: The expense ratio, which covers management fees and other operational costs, reduces the NAV. A higher expense ratio directly results in a lower NAV compared to ETFs with lower expense ratios. The expense ratio effect on NAV is a crucial consideration for investors.

Analyzing these factors provides insights into the NAV fluctuations and the overall performance of the Amundi MSCI World II UCITS ETF Dist.

Using NAV to Make Informed Investment Decisions with the Amundi MSCI World II UCITS ETF Dist

The Amundi MSCI World II UCITS ETF Dist NAV is a vital tool for making informed investment decisions:

- Benchmark Comparison: Compare the ETF's NAV performance against its benchmark index (MSCI World Index) to assess its relative performance. Analyzing NAV against benchmarks allows for a comprehensive evaluation.

- Buy/Sell Signals: While not the sole indicator, NAV can contribute to buy or sell decisions. A consistently lower-than-expected NAV might suggest an undervalued ETF, while a significantly higher NAV could indicate overvaluation. However, always consider other investment metrics in conjunction with NAV analysis.

- Premium/Discount: The ETF's market price might trade at a premium or discount relative to its NAV. Understanding the reasons behind this premium or discount is vital.

- Consider Holistic Factors: Don't rely solely on NAV. Combine it with other critical investment metrics like the expense ratio, historical performance, and your investment goals.

Where to Find the Amundi MSCI World II UCITS ETF Dist's NAV

Reliable sources for accessing the daily NAV of the Amundi MSCI World II UCITS ETF Dist include:

- Amundi's Website: The official source for the most accurate and up-to-date NAV information.

- Financial News Websites: Reputable financial news sources often publish ETF NAV data.

- Brokerage Platforms: Your brokerage account will usually display the current NAV of your holdings.

Always verify the source's reliability to ensure you're using accurate data. Using official and verified sources for NAV data is crucial.

Conclusion: Mastering NAV Interpretation for the Amundi MSCI World II UCITS ETF Dist

Understanding and interpreting the NAV of the Amundi MSCI World II UCITS ETF Dist is paramount for successful investment management. While NAV is a critical indicator of the ETF's underlying value, it should be used in conjunction with other investment metrics for informed decision-making. Regularly monitoring your Amundi MSCI World II UCITS ETF Dist NAV, and understanding the factors affecting it, allows for a more strategic and effective approach to investment. Track your Amundi MSCI World II UCITS ETF Dist NAV and maximize your Amundi MSCI World II UCITS ETF Dist investment with NAV analysis!

Featured Posts

-

The Thames Water Bonus Scandal Examining The Facts

May 25, 2025

The Thames Water Bonus Scandal Examining The Facts

May 25, 2025 -

Melanie Thierry Une Analyse De Sa Carriere Au Cinema Et A La Television

May 25, 2025

Melanie Thierry Une Analyse De Sa Carriere Au Cinema Et A La Television

May 25, 2025 -

Kudi Podilisya Peremozhtsi Yevrobachennya Za Ostanni 10 Rokiv

May 25, 2025

Kudi Podilisya Peremozhtsi Yevrobachennya Za Ostanni 10 Rokiv

May 25, 2025 -

Les Gens D Ici Diversite Traditions Et Valeurs

May 25, 2025

Les Gens D Ici Diversite Traditions Et Valeurs

May 25, 2025 -

All The Songs From The Picture This Rom Com On Prime Video

May 25, 2025

All The Songs From The Picture This Rom Com On Prime Video

May 25, 2025