Interpreting The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF Dist

Table of Contents

Factors Affecting the Amundi MSCI World II UCITS ETF Dist NAV

The Amundi MSCI World II UCITS ETF Dist NAV, like any ETF's NAV, is dynamic and influenced by various internal and external factors. Understanding these factors is crucial to interpreting the NAV accurately and making informed investment decisions.

Underlying Asset Performance

The primary driver of the Amundi MSCI World II UCITS ETF Dist NAV is the performance of the underlying assets. This ETF tracks the MSCI World Index, a broad market-capitalization weighted index representing large and mid-cap equities across developed markets globally.

- Market Fluctuations: Broad market movements significantly impact the NAV. A bull market generally leads to an increase in NAV, while a bear market results in a decrease.

- Sector Performance: The performance of individual sectors within the MSCI World Index also plays a role. Strong performance in technology, for example, will positively impact the overall NAV, while underperformance in other sectors might have a negative effect.

- Individual Stock Movements: Changes in the prices of individual companies within the index, even small ones, cumulatively affect the overall index performance and subsequently the ETF's NAV. The weighting of each stock within the index determines its relative influence on the NAV.

- Index Performance and ETF NAV Relationship: The ETF's NAV directly mirrors the performance of the MSCI World Index, albeit with minor discrepancies due to factors explained later. A rise in the index typically results in a proportional rise in the ETF's NAV.

Currency Fluctuations

As the MSCI World Index includes companies from various countries, currency fluctuations can significantly impact the Amundi MSCI World II UCITS ETF Dist NAV. The ETF is likely denominated in Euros (EUR), but holds assets in various currencies, primarily USD.

- Exchange Rate Impact: Changes in exchange rates between the Euro and other currencies (e.g., USD) directly affect the value of the ETF's holdings when converted back to Euros. A strengthening Euro against the USD would generally increase the NAV, while a weakening Euro would decrease it.

- Currency Movement Examples: For example, if the USD strengthens against the EUR, the value of US-based companies within the index, when converted to EUR, will decrease, thus reducing the NAV. Conversely, a weakening USD would have the opposite effect.

Expense Ratio and Management Fees

The Amundi MSCI World II UCITS ETF Dist, like all investment funds, incurs expenses related to management, administration, and operation. These costs are deducted from the fund's assets, impacting the NAV over time.

- Expense Ratio Definition: The expense ratio represents the annual cost of owning the ETF, expressed as a percentage of the assets under management.

- Impact on NAV: While the expense ratio's daily impact might be negligible, it cumulatively reduces the NAV over time. This should be considered when comparing the ETF's long-term performance to other investments.

- Expense Ratio Comparison: Investors should compare the expense ratio of the Amundi MSCI World II UCITS ETF Dist to similar ETFs to assess its competitiveness and potential cost savings.

How to Interpret the Amundi MSCI World II UCITS ETF Dist NAV

Understanding the difference between NAV and market price, and how to use NAV data effectively, are crucial for successful investment management.

NAV vs. Market Price

The Amundi MSCI World II UCITS ETF Dist NAV represents the theoretical value of one ETF unit, calculated daily based on the net asset value of the underlying holdings. The market price, however, is the actual price at which the ETF is traded on the exchange.

- Discrepancies: Small discrepancies between NAV and market price can arise due to factors like bid-ask spread (the difference between the buying and selling price) and trading volume. These discrepancies are usually minor and tend to even out over time.

- Informed Decisions: Understanding this difference helps avoid misinterpretations. While the NAV provides a fair valuation, the market price reflects the real-time trading dynamics.

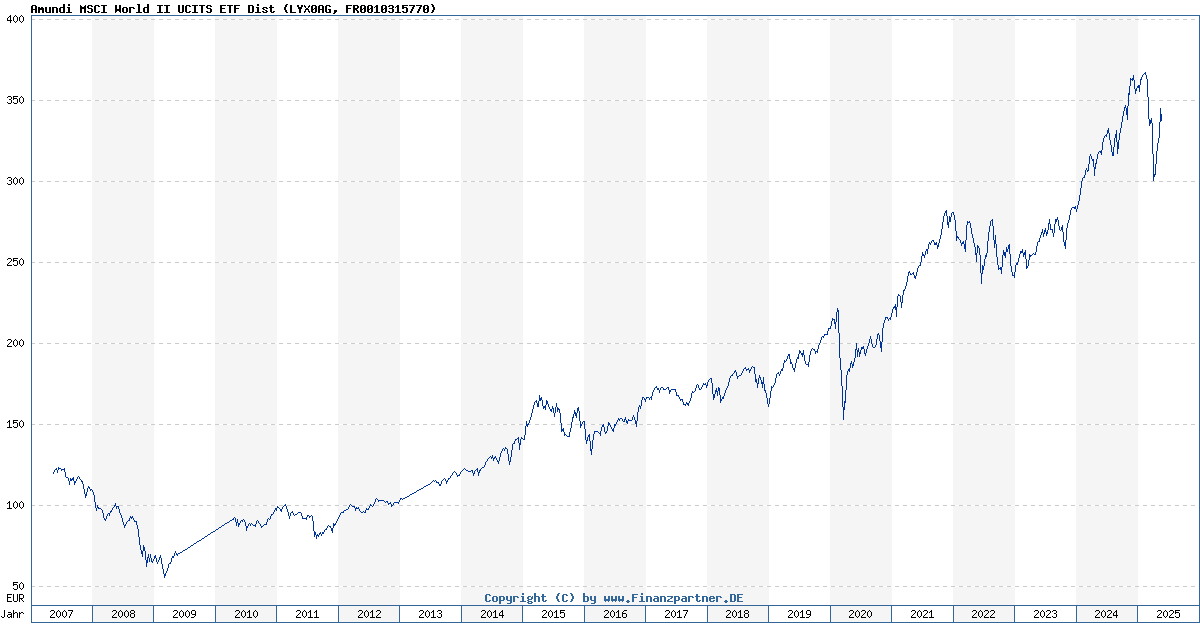

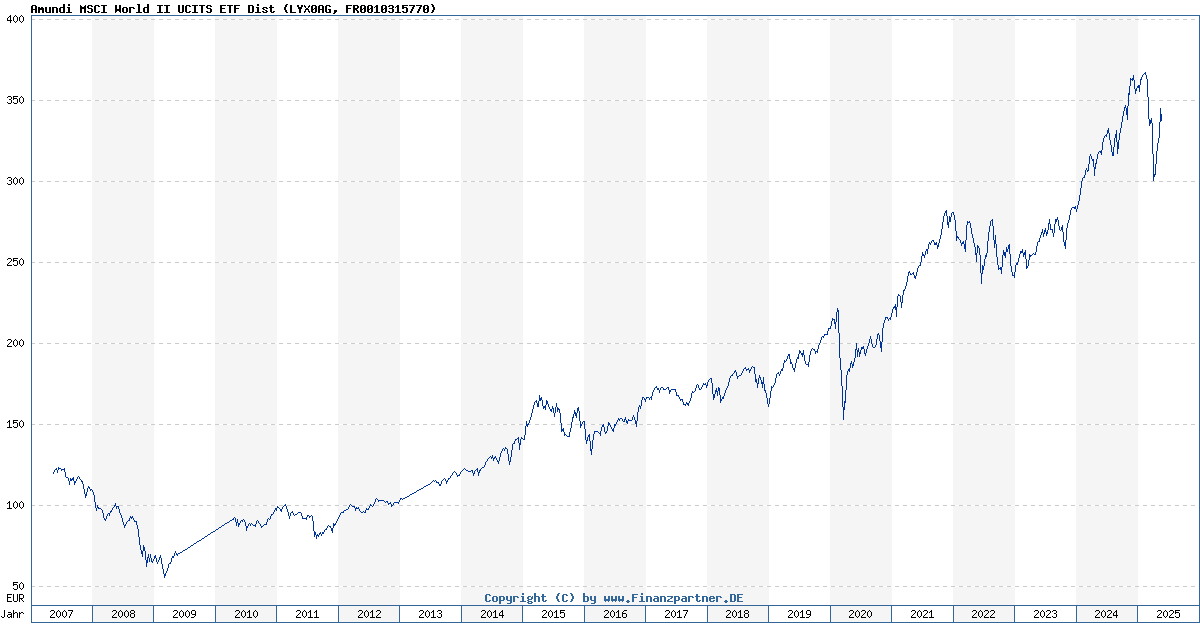

Using NAV to Track Performance

Monitoring the Amundi MSCI World II UCITS ETF Dist NAV over time allows you to track its performance.

- Percentage Change Calculation: Calculating the percentage change in NAV over specific periods (e.g., monthly, yearly) helps assess the ETF's growth or decline. [(NAV_today - NAV_yesterday) / NAV_yesterday] * 100.

- Benchmark Comparison: Comparing the NAV performance to relevant benchmarks, like the MSCI World Index itself, helps evaluate the ETF's effectiveness in tracking its target index.

Accessing NAV Information

The daily Amundi MSCI World II UCITS ETF Dist NAV is readily available through various sources.

- Fund Website: The official website of Amundi is a primary source for this information.

- Financial News Sources: Many reputable financial news websites and platforms provide real-time or delayed NAV data for ETFs.

- Brokerage Accounts: Your brokerage account will also display the current NAV for your holdings.

Making Informed Decisions with Amundi MSCI World II UCITS ETF Dist NAV

Understanding the Amundi MSCI World II UCITS ETF Dist NAV is essential for informed investment decisions. This article highlighted the key factors influencing the NAV: underlying asset performance, currency fluctuations, and expense ratios. By regularly monitoring the Amundi MSCI World II UCITS ETF Dist NAV data and comparing it to benchmarks, you can assess the fund's performance effectively. Remember to consult the fund's prospectus for a comprehensive understanding of its investment strategy and associated risks. Make it a practice to regularly track your Amundi MSCI World II UCITS ETF NAV to ensure you are making the best decisions for your investment portfolio. Understanding your Amundi MSCI World II UCITS ETF NAV is key to long-term investment success.

Featured Posts

-

Thierry Ardisson Et Laurent Baffie Une Querelle Con Et Machiste

May 25, 2025

Thierry Ardisson Et Laurent Baffie Une Querelle Con Et Machiste

May 25, 2025 -

Futbol Duenyasini Sarsacak Gelisme Kuluep Ve Doert Oyuncusu Sorusturmada

May 25, 2025

Futbol Duenyasini Sarsacak Gelisme Kuluep Ve Doert Oyuncusu Sorusturmada

May 25, 2025 -

The Disappearance Case Studies And Analysis

May 25, 2025

The Disappearance Case Studies And Analysis

May 25, 2025 -

Amundi Msci World Ii Ucits Etf Dist A Comprehensive Guide To Net Asset Value

May 25, 2025

Amundi Msci World Ii Ucits Etf Dist A Comprehensive Guide To Net Asset Value

May 25, 2025 -

Trumps Legal Battles Another Setback Against Elite Law Firms

May 25, 2025

Trumps Legal Battles Another Setback Against Elite Law Firms

May 25, 2025