Invesco And Barings Expand Private Credit Access For Everyday Investors

Table of Contents

Invesco's Initiatives in Expanding Private Credit Access

Invesco, a global investment management firm, is leading the charge in making private credit investment opportunities available to a broader range of investors. Their strategy focuses on two key areas: lowering minimum investment requirements and offering innovative fund structures.

Lowering Minimum Investment Requirements

Invesco is actively lowering the minimum investment thresholds for its private credit funds. This directly addresses the historical barrier to entry for retail investors.

- Specific examples: Previously, many Invesco private credit funds required minimum investments of $1 million or more. Recently, they've launched funds with minimums as low as $10,000, significantly broadening access.

- Comparisons to previous minimums: This represents a 99% reduction in the minimum investment for some funds, opening the door to a much larger pool of potential investors.

- Impact on investor participation: This reduction has led to a noticeable increase in participation from individual investors seeking diversification beyond traditional markets. The implications are significant; smaller investors can now access an asset class previously out of reach. This increased participation helps to fuel the growth of the private credit market as a whole.

Innovative Fund Structures and Product Offerings

Invesco is also innovating its fund structures to make private credit investment more user-friendly and accessible.

- Examples of new fund structures: Invesco is offering access to private credit through ETFs (Exchange Traded Funds) and mutual funds, providing greater liquidity and transparency compared to traditional private credit vehicles.

- Key features: These new structures offer benefits such as daily liquidity (in the case of ETFs), lower expense ratios compared to direct investment in private debt, and built-in diversification across multiple borrowers.

- Benefits for the average investor: The ease of access through established brokerage accounts and lower minimum investments makes these funds much more approachable for everyday investors. The transparency offered by the fund structures reduces the information asymmetry often associated with private credit.

Barings' Strategies for Democratizing Private Credit Investment

Barings, another prominent investment management firm, is employing a different, yet equally effective, strategy to democratize access to private credit. Their focus is on transparency, education, and strategic partnerships.

Focus on Transparency and Education

Barings understands that investor confidence is crucial for expanding participation in private credit. Their strategy emphasizes transparency and education.

- Examples of educational resources: Barings offers a range of educational resources, including webinars on understanding private credit, white papers detailing investment strategies, and investor guides explaining the risks and rewards.

- Importance of transparency and education: This proactive approach helps investors understand the complexities of private credit, mitigating concerns and building confidence. It equips them to make informed decisions about incorporating private credit into their portfolios. Greater transparency reduces the perceived risk associated with this asset class, encouraging more participation.

Strategic Partnerships and Distribution Channels

Barings is also leveraging strategic partnerships to expand the reach of its private credit offerings.

- Examples of partnerships and distribution channels: They are partnering with a network of brokerage firms and financial advisors to make their private credit funds available through existing investor platforms.

- Broadening access: These partnerships significantly broaden access to private credit for a wider range of investors, making it easier to integrate into existing investment strategies. This expansion of distribution channels dramatically increases the accessibility of private credit for the average investor.

The Benefits of Private Credit Investment for Everyday Investors

The increased accessibility of private credit investment offers several compelling benefits for everyday investors.

Higher Potential Returns

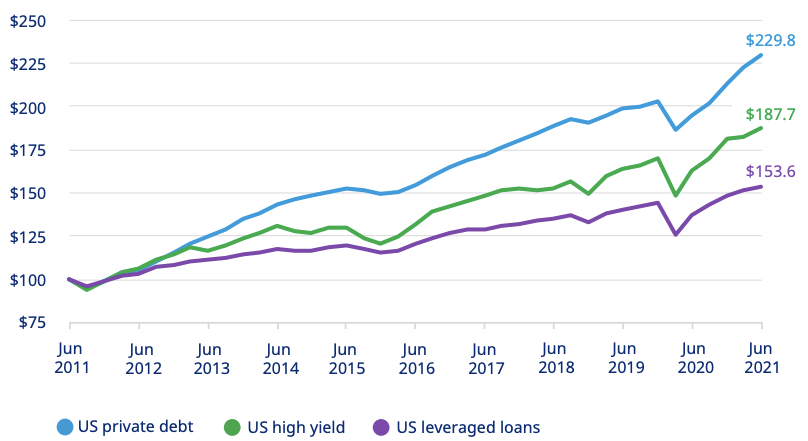

Private credit can offer the potential for higher returns compared to traditional investment options, such as bonds and certain equities.

- Comparison with other asset classes: Historically, private credit has demonstrated a potential for higher risk-adjusted returns than traditional fixed-income investments.

- Factors contributing to higher returns: This potential stems from the direct lending nature of private credit, allowing for higher yields compared to publicly traded debt. However, it's crucial to understand that private credit also carries a degree of illiquidity risk.

Diversification and Risk Management

Incorporating private credit into an investment portfolio can enhance diversification and mitigate overall risk.

- Hedge against market fluctuations: Private credit often demonstrates a lower correlation with traditional equity markets, providing a potential hedge during periods of market volatility.

- Importance of diversification: Diversification is a cornerstone of a well-rounded investment strategy. Adding private credit can provide a valuable source of diversification and potential risk reduction. This helps to smooth out the overall performance of the portfolio over time.

Conclusion

Invesco and Barings are playing a pivotal role in making private credit investment accessible to everyday investors. By lowering minimum investment requirements, creating innovative fund structures, focusing on transparency and education, and building strategic partnerships, these firms are breaking down the barriers that previously limited participation in this asset class. This increased access offers everyday investors the opportunity to explore an asset class with the potential for higher returns and enhanced portfolio diversification. Don't miss out on this growing segment of the investment market – research the offerings from Invesco and Barings to discover opportunities for diversification and potentially higher returns within your own investment portfolio. Consider speaking to a financial advisor to determine if private credit investments are a suitable addition to your investment strategy. Learn more about how you can access the potential of private credit investments today.

Featured Posts

-

Cory Provus Honors Late Mentor Bob Uecker

Apr 23, 2025

Cory Provus Honors Late Mentor Bob Uecker

Apr 23, 2025 -

Rowdy Tellez Revenge Watch His Performance Against Former Team

Apr 23, 2025

Rowdy Tellez Revenge Watch His Performance Against Former Team

Apr 23, 2025 -

Record Setting Night For Yankees 9 Home Runs In 2025 Opener

Apr 23, 2025

Record Setting Night For Yankees 9 Home Runs In 2025 Opener

Apr 23, 2025 -

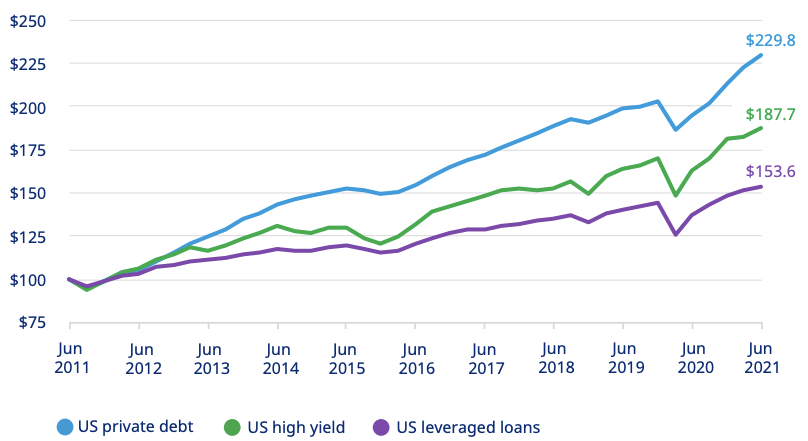

Les Seuils Techniques Incontournables En Alerte Trader Analyse Et Strategie

Apr 23, 2025

Les Seuils Techniques Incontournables En Alerte Trader Analyse Et Strategie

Apr 23, 2025 -

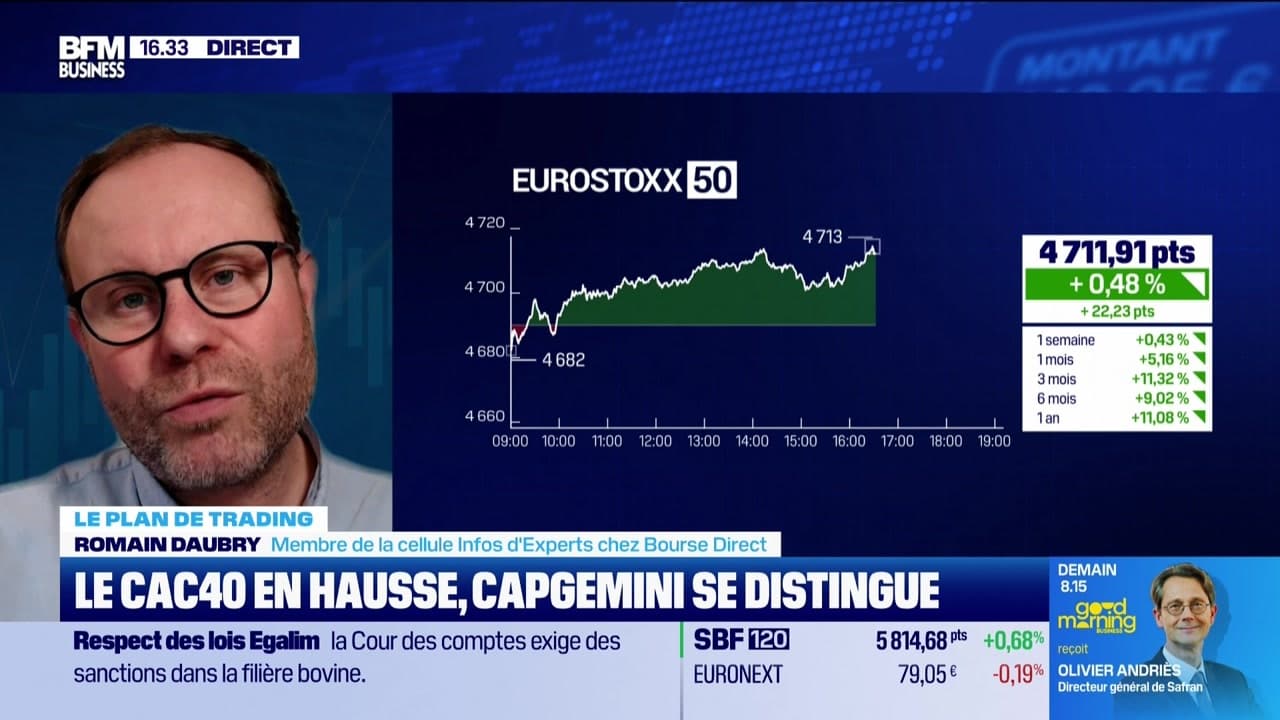

Complete 2025 Us Holiday Calendar Federal And Non Federal Holiday Dates

Apr 23, 2025

Complete 2025 Us Holiday Calendar Federal And Non Federal Holiday Dates

Apr 23, 2025