Investigating BigBear.ai (BBAI): Important Information For Investors

Table of Contents

BigBear.ai (BBAI) Company Overview and Business Model

BigBear.ai (BBAI) is a leading provider of AI-powered solutions for government and commercial clients. Their mission is to leverage cutting-edge artificial intelligence and data analytics to solve complex challenges across various sectors. BigBear.ai's vision is to be the premier provider of AI-driven insights, empowering organizations to make better decisions faster.

Key clients include various government agencies and major corporations, although specific contract details are often confidential due to the sensitive nature of the work. BigBear.ai focuses on providing mission-critical solutions.

Key aspects of the BigBear.ai (BBAI) business model:

- Government Contracts: A significant portion of BigBear.ai's revenue comes from contracts with government agencies, particularly in the defense, intelligence, and cybersecurity sectors. This reliance on government contracts presents both opportunities and risks (discussed later).

- AI-Driven Solutions: BigBear.ai offers a range of AI-powered solutions, including data analytics, predictive modeling, and machine learning, tailored to the specific needs of its clients. Their solutions assist in areas such as threat detection, risk assessment, and operational efficiency.

- Revenue Streams and Growth Strategy: BigBear.ai's revenue is primarily generated through project-based contracts and subscription services. Their growth strategy focuses on expanding their client base, developing new AI solutions, and securing larger government contracts.

Financial Performance and Analysis of BigBear.ai (BBAI)

Analyzing BigBear.ai's (BBAI) financial performance requires careful examination of recent reports. Investors should review revenue growth, profitability, and debt levels. Remember to consult official financial statements and SEC filings for the most accurate and up-to-date information. This section provides a general overview and should not be considered financial advice.

Financial Highlights (or Concerns – Always verify with current reports):

- Revenue Growth Rate: Assess the year-over-year and quarter-over-quarter revenue growth to gauge the company's financial health and market traction. Consistent and substantial growth is a positive sign.

- Profitability Margins: Evaluate the gross and operating profit margins to understand the profitability of BigBear.ai's operations. High margins suggest efficient operations and strong pricing power.

- Debt Levels: Examine the company's debt-to-equity ratio to assess its financial leverage. High debt levels could indicate financial risk.

- Cash on Hand: A strong cash position indicates financial stability and the ability to weather economic downturns.

Risks and Challenges Facing BigBear.ai (BBAI)

While BigBear.ai (BBAI) presents investment opportunities, it's crucial to acknowledge potential risks.

Significant Risks:

- Competition from Larger Tech Companies: BigBear.ai faces competition from larger, more established tech companies with significant resources and market share in the AI and data analytics space.

- Dependence on Government Contracts: A substantial portion of BigBear.ai's revenue comes from government contracts. Changes in government spending or priorities could significantly impact their financial performance.

- Technological Disruptions: Rapid technological advancements in the AI field could render BigBear.ai's existing solutions obsolete, requiring significant investment in research and development to remain competitive.

- Economic Downturns: Economic downturns can reduce government spending and corporate investment, negatively affecting BigBear.ai's revenue and profitability.

- Regulatory Risks and Compliance Issues: Operating in the government and defense sectors exposes BigBear.ai to regulatory risks and compliance issues, which could result in penalties or lost contracts.

BigBear.ai (BBAI) Stock Valuation and Investment Considerations

The valuation of BBAI stock is crucial for any investor. Analyzing the price-to-earnings ratio (P/E), market capitalization, historical stock performance, and analyst ratings provides valuable insights. Comparing BBAI's valuation with its competitors helps determine whether it's undervalued or overvalued. Remember that past performance is not indicative of future results.

Key Valuation Aspects:

- Price-to-earnings ratio (P/E): A lower P/E ratio might suggest that the stock is undervalued compared to its earnings, while a higher P/E ratio might suggest it's overvalued.

- Market Capitalization: This reflects the total value of the company's outstanding shares.

- Historical Stock Performance: Reviewing historical price trends and volatility can help you understand the stock's risk profile.

- Analyst Ratings and Price Targets: Consult financial analysts' reports and ratings to get a sense of market sentiment and price expectations.

Investing in BigBear.ai (BBAI): A Final Assessment

BigBear.ai (BBAI) presents a compelling investment opportunity with its focus on AI-powered solutions for government and commercial clients. However, it's essential to understand the company's strengths and weaknesses, opportunities, and threats (SWOT analysis). The reliance on government contracts, competition from larger tech firms, and the rapid pace of technological change pose significant risks. Investors should carefully weigh these factors against the potential for growth and profitability.

Before investing in BigBear.ai (BBAI), always conduct your own in-depth research and consult with a qualified financial advisor. Utilize resources such as SEC filings, financial news websites, and analyst reports to gather comprehensive information before making any investment decisions. Remember, this article is for informational purposes only and is not financial advice.

Featured Posts

-

Abc News Show Future Uncertain Following Mass Layoffs

May 21, 2025

Abc News Show Future Uncertain Following Mass Layoffs

May 21, 2025 -

Switzerland And China Advocate For Tariff Dialogue

May 21, 2025

Switzerland And China Advocate For Tariff Dialogue

May 21, 2025 -

The Curious Case Of Gumballs Next Adventure Teaser

May 21, 2025

The Curious Case Of Gumballs Next Adventure Teaser

May 21, 2025 -

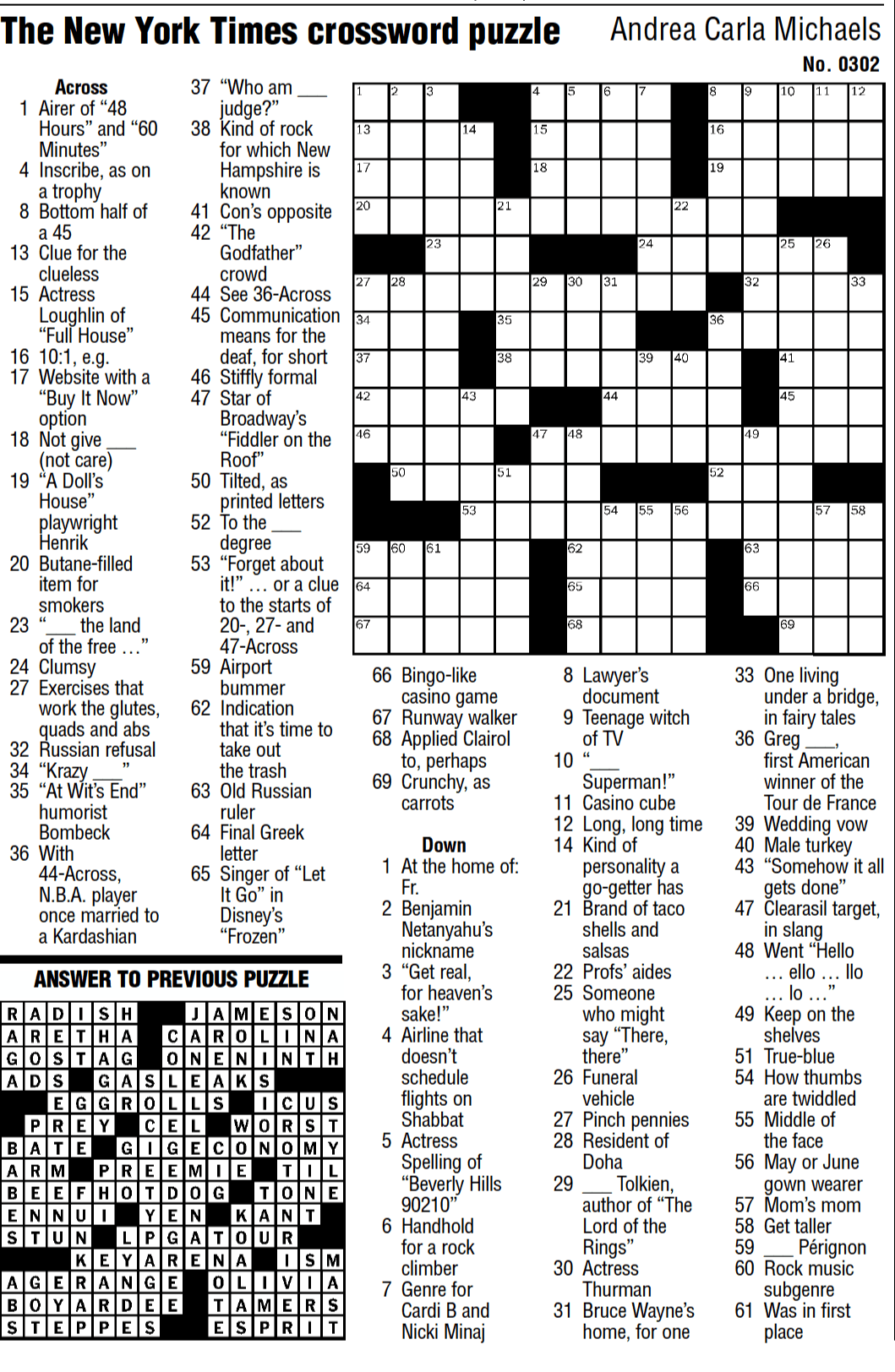

Nyt Mini Crossword Clues And Answers March 13 2025

May 21, 2025

Nyt Mini Crossword Clues And Answers March 13 2025

May 21, 2025 -

Huuhkajat Kaksikko Kaellman Ja Hoskonen Palaavat Kotiin

May 21, 2025

Huuhkajat Kaksikko Kaellman Ja Hoskonen Palaavat Kotiin

May 21, 2025