Investigating The Factors Behind CoreWeave, Inc.'s (CRWV) Recent Stock Price Jump

Table of Contents

Main Points:

H2: Strong Financial Performance and Growth Prospects

H3: Revenue Growth and Profitability

CoreWeave's recent financial reports showcase impressive growth. Analyzing key metrics reveals a compelling narrative. For example:

- Revenue Growth: [Insert specific percentage increase in revenue compared to previous quarters/years. E.g., "Q2 2024 revenue increased by 35% year-over-year."]

- Profitability Margins: [Insert data on improving profit margins. E.g., "Operating margins improved to 15%, exceeding analyst expectations."]

- Customer Acquisition: [Include data on customer growth. E.g., "The company added over 500 new enterprise clients in the last quarter."]

These positive numbers, coupled with consistently upgraded analyst ratings from firms like [mention specific firms and their ratings], further solidify CoreWeave's strong financial position and suggest a promising future.

H3: Market Demand for AI and Cloud Computing

CoreWeave's success is inextricably linked to the booming AI and cloud computing markets. The demand for powerful, scalable infrastructure to support AI workloads is experiencing exponential growth.

- Market Statistics: [Include statistics on the projected growth of the AI and cloud computing markets. E.g., "The global AI market is projected to reach $XXX billion by 2028, according to [Source]."]

- CoreWeave's Competitive Advantage: CoreWeave differentiates itself through [explain CoreWeave's unique selling propositions, such as specialized GPUs, sustainable infrastructure, or superior customer service]. This positions them ideally to capitalize on this burgeoning market.

H3: Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions can significantly boost a company's growth trajectory. CoreWeave's recent activities in this area might have contributed to the stock price jump.

- Partnership Example: [Describe a key partnership and its potential impact on CRWV's revenue and market share. E.g., "The partnership with [Partner Name] provides access to a wider customer base and expands CoreWeave's service offerings."]

- Acquisition Example: [Describe a significant acquisition and how it strengthens CoreWeave's position. E.g., "The acquisition of [Acquired Company] enhances CoreWeave's capabilities in [Specific area], leading to increased efficiency and innovation."]

H2: Investor Sentiment and Market Speculation

H3: Positive Media Coverage and Analyst Ratings

Positive media coverage and favorable analyst ratings can significantly influence investor sentiment.

- Media Examples: [Mention specific news articles or publications that have highlighted CoreWeave's positive developments.]

- Analyst Upgrades: [Mention specific analysts and their upgrades, citing target price increases if applicable.]

This collective positive sentiment creates a snowball effect, attracting more investors and driving up demand for CRWV shares.

H3: Short Squeeze Potential

The possibility of a short squeeze cannot be ignored. A short squeeze occurs when a heavily shorted stock experiences a rapid price increase, forcing short sellers to buy back shares to limit their losses, further fueling the price rise.

- Short Interest Data: [If available, include data on short interest in CRWV shares. E.g., "Short interest in CRWV was at X% as of [Date]."]

- Impact on Price: A significant short squeeze could contribute significantly to the observed "CoreWeave stock price jump."

H3: Overall Market Conditions

Broader market conditions play a role. A positive overall market sentiment, low interest rates, and a higher investor risk appetite can all contribute to increased demand for growth stocks like CRWV.

H2: Technical Analysis of CRWV Stock Chart

H3: Chart Patterns and Indicators

Technical analysis offers another perspective. Examining the CRWV stock chart reveals:

- Moving Averages: [Describe the behavior of moving averages and their implications for the price trend. Include a chart if possible.]

- RSI (Relative Strength Index): [Discuss the RSI readings and what they suggest about the stock's momentum.]

- MACD (Moving Average Convergence Divergence): [Analyze the MACD indicator and its potential signals.]

These technical indicators provide valuable insights into the price movement and potential future trends.

H3: Support and Resistance Levels

Identifying key support and resistance levels is crucial for understanding price action.

- Support Levels: [Identify significant support levels on the chart and explain their potential impact.]

- Resistance Levels: [Identify significant resistance levels and their potential to limit further price increases.]

Breaching these levels can signal significant shifts in the price trend.

H3: Trading Volume

Analyzing trading volume provides context for the price movement. High volume accompanying price increases indicates strong conviction behind the rally.

Conclusion: Interpreting the CoreWeave (CRWV) Stock Price Rally and Future Outlook

The CoreWeave stock price jump appears to be a result of a confluence of factors: strong financial performance, positive investor sentiment driven by media coverage and analyst upgrades, potential short squeezes, and favorable market conditions. Technical analysis also supports the observed upward trend. However, investors should remain cautious and acknowledge potential downside risks. While the future looks bright for CoreWeave, given the growing demand for AI and cloud computing, it's crucial to conduct thorough due diligence. To make informed investment decisions, further research into "CoreWeave stock," "CRWV investment," and "CoreWeave future growth" is strongly recommended. Remember to consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Second Colorado Gray Wolf Reintroduced To Wyoming Dies

May 22, 2025

Second Colorado Gray Wolf Reintroduced To Wyoming Dies

May 22, 2025 -

Nfl Draft 2024 Pittsburgh Steelers Quarterback Scouting

May 22, 2025

Nfl Draft 2024 Pittsburgh Steelers Quarterback Scouting

May 22, 2025 -

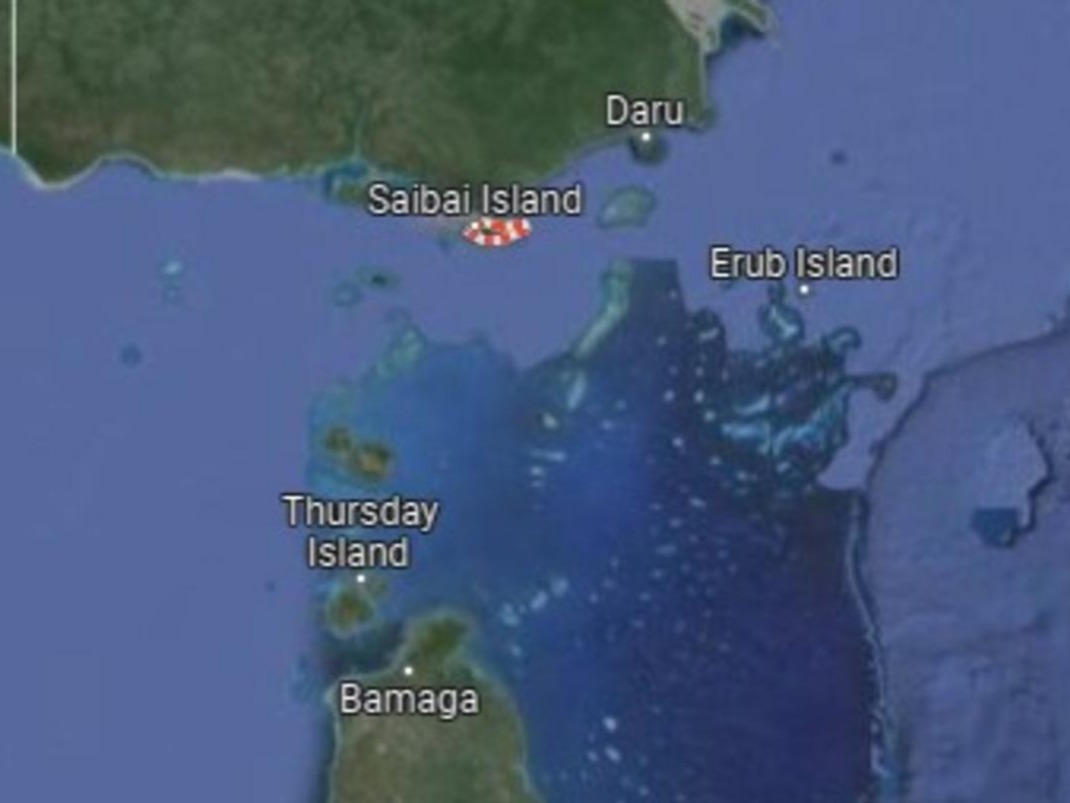

Man Achieves Fastest Ever Foot Crossing Of Australia

May 22, 2025

Man Achieves Fastest Ever Foot Crossing Of Australia

May 22, 2025 -

Real Sociedad El Impacto Del Virus Fifa En El Rendimiento Del Equipo

May 22, 2025

Real Sociedad El Impacto Del Virus Fifa En El Rendimiento Del Equipo

May 22, 2025 -

New The Amazing World Of Gumball Teaser Trailer On Hulu Premiere Date Announced

May 22, 2025

New The Amazing World Of Gumball Teaser Trailer On Hulu Premiere Date Announced

May 22, 2025