Investing In 2025: MicroStrategy Stock Vs. Bitcoin – A Detailed Analysis

Table of Contents

Understanding MicroStrategy's Bitcoin Strategy

MicroStrategy's CEO, Michael Saylor, has famously championed Bitcoin, adopting it as a primary treasury reserve asset. This unconventional strategy, starting in 2020, has seen the company accumulate a substantial Bitcoin hoard. The rationale behind this move is multifaceted:

- Inflation Hedge: Saylor and MicroStrategy view Bitcoin as a hedge against inflation, believing its limited supply will protect its value against currency devaluation.

- Long-Term Growth Potential: They see Bitcoin as a disruptive technology with immense long-term growth potential, surpassing traditional financial assets.

- Technological Advancement: They believe in the underlying technology of Bitcoin and its potential to revolutionize financial systems.

However, this strategy is not without its critics. Bitcoin's price is notoriously volatile, directly impacting MicroStrategy's financial statements and stock price.

- Risks Associated with MicroStrategy's Bitcoin Strategy: Significant price drops in Bitcoin could lead to substantial losses for MicroStrategy, affecting its stock value. Regulatory uncertainty around cryptocurrencies also poses a risk.

- Potential Rewards of MicroStrategy's Bitcoin Strategy: If Bitcoin’s price appreciates significantly, MicroStrategy could see substantial gains, boosting its stock price. The company also benefits from the increased attention and market interest generated by its Bitcoin holdings.

- Comparison of MicroStrategy's stock performance with and without its Bitcoin holdings: Analyzing MicroStrategy's stock performance before and after its Bitcoin investments reveals a strong correlation between Bitcoin's price and MicroStrategy's stock price, although other factors undoubtedly influence the latter.

Bitcoin's Potential as a Long-Term Investment in 2025

Bitcoin's inherent characteristics contribute to its appeal as a long-term investment:

- Decentralization: Bitcoin operates independently of central banks and governments, making it resistant to censorship and manipulation.

- Scarcity: Only 21 million Bitcoins will ever exist, creating inherent scarcity and potentially driving up its value over time.

However, several factors could influence Bitcoin's future:

- Increased Institutional Adoption: Growing adoption by institutional investors could significantly boost Bitcoin's price.

- Government Regulation: Government regulations, whether favorable or restrictive, will significantly impact Bitcoin's price and accessibility.

Let's consider some potential scenarios:

- Factors that could contribute to Bitcoin's price appreciation in 2025: Widespread institutional adoption, positive regulatory developments, and increasing global demand.

- Risks associated with investing in Bitcoin: Extreme price volatility, security risks related to exchanges and private wallets, and potential regulatory crackdowns.

- Comparison of Bitcoin's past performance with predicted future performance: Predicting future performance is inherently speculative, but analyzing past trends and considering potential future drivers can inform investment decisions.

Direct Comparison: MicroStrategy Stock vs. Bitcoin in 2025

Investing in MicroStrategy stock versus Bitcoin directly presents different risk-reward profiles:

| Feature | MicroStrategy Stock | Bitcoin |

|---|---|---|

| Risk | Moderate to High (correlated with Bitcoin price) | High (extremely volatile) |

| Liquidity | Relatively High (publicly traded) | Relatively High (major exchanges) |

| Accessibility | Easily accessible through brokerage accounts | Requires access to cryptocurrency exchanges |

| Diversification | Offers some diversification within the tech sector | Less diversified (standalone cryptocurrency) |

| Correlation | Strongly correlated with Bitcoin's price | Not directly correlated with MicroStrategy's stock |

Investing in both could offer a degree of diversification, but it also increases the overall risk exposure to the cryptocurrency market. Asset allocation should depend on your risk tolerance: aggressive investors might favor a higher allocation to Bitcoin, while conservative investors might prefer MicroStrategy stock or a balanced approach.

Factors Influencing Your Investment Decision

Before investing in either MicroStrategy stock or Bitcoin, carefully consider:

- Personal Risk Tolerance: How much risk are you willing to accept for the potential of higher returns?

- Investment Goals: What are your investment goals (short-term gains, long-term growth, retirement planning)?

Conduct thorough due diligence:

- Questions to ask yourself: What is my investment horizon? What is my risk tolerance? What are the potential downsides? What are the alternatives?

- Resources for conducting further research: Consult reputable financial news sources, analyze financial statements, and seek professional advice.

- Importance of diversifying investment portfolio: Never put all your eggs in one basket. Diversification is crucial for mitigating risk.

Consult a qualified financial advisor to help you create a personalized investment strategy aligned with your goals and risk profile.

Conclusion

Investing in 2025 presents a complex choice between the established but Bitcoin-exposed MicroStrategy stock and the volatile but potentially rewarding Bitcoin itself. Both options carry substantial risk, but the potential rewards are significant. Understanding the unique characteristics of each investment, carefully assessing your personal risk tolerance and investment goals, and conducting thorough research are crucial steps in making an informed decision. Consider consulting a financial advisor before investing in either MicroStrategy stock or Bitcoin. Remember, the success of your Investing in 2025: MicroStrategy Stock vs. Bitcoin strategy hinges on informed choices and diligent planning.

Featured Posts

-

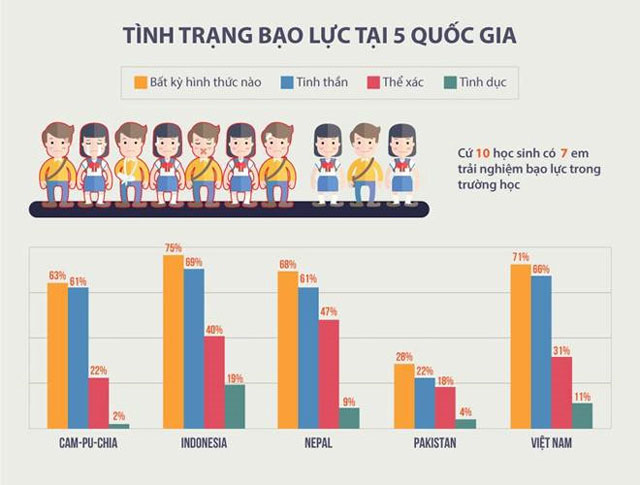

Tien Giang Xu Ly Dut Diem Vu Bao Hanh Tre Em Tai Co So Giu Tre

May 09, 2025

Tien Giang Xu Ly Dut Diem Vu Bao Hanh Tre Em Tai Co So Giu Tre

May 09, 2025 -

R3 2

May 09, 2025

R3 2

May 09, 2025 -

Le Role De La Ville De Dijon Face Aux Difficultes D Epicure A La Cite De La Gastronomie

May 09, 2025

Le Role De La Ville De Dijon Face Aux Difficultes D Epicure A La Cite De La Gastronomie

May 09, 2025 -

Su That Ve Vu Bao Hanh Tre O Tien Giang Loi Khai Cua Bao Mau

May 09, 2025

Su That Ve Vu Bao Hanh Tre O Tien Giang Loi Khai Cua Bao Mau

May 09, 2025 -

Jeffrey Epstein Files Examining Ag Pam Bondis Decision And The Public Vote

May 09, 2025

Jeffrey Epstein Files Examining Ag Pam Bondis Decision And The Public Vote

May 09, 2025