Investing In Amundi MSCI All Country World UCITS ETF USD Acc: A NAV Perspective

Table of Contents

Understanding the Amundi MSCI All Country World UCITS ETF USD Acc

This section delves into the key features of the Amundi MSCI All Country World UCITS ETF USD Acc, providing a foundational understanding for investors.

The Underlying Index: MSCI All Country World Index

The Amundi MSCI All Country World UCITS ETF USD Acc tracks the MSCI All Country World Index, a widely recognized benchmark representing large, mid, and small-cap equities across developed and emerging markets. This comprehensive index:

- Global Coverage: Provides exposure to a vast universe of companies across nearly all countries globally, offering unparalleled diversification.

- Developed and Emerging Markets: Includes both established and rapidly growing economies, capturing a broad spectrum of investment opportunities.

- Weighting Methodology: Employs a market-capitalization weighting, meaning larger companies have a greater influence on the index's performance. This reflects the market's overall valuation of these companies.

- Benefits of Tracking: By tracking this index, the ETF aims to mirror its performance, providing investors with efficient access to global market trends without the need for individual stock picking.

UCITS ETF Structure and Regulatory Benefits

The "UCITS" designation (Undertakings for Collective Investment in Transferable Securities) signifies that this ETF adheres to strict European Union regulatory standards. This offers several key advantages:

- Regulatory Oversight: UCITS ETFs are subject to robust regulatory oversight, ensuring transparency and investor protection.

- Cross-Border Investing: The UCITS structure facilitates cross-border investment, allowing investors from various jurisdictions to participate easily.

- Investor Protection: Strong regulations provide increased investor protection compared to some other ETF structures.

USD Accumulation (Acc) Share Class

The USD Acc share class means that all dividends generated by the underlying holdings are automatically reinvested, compounding your returns over time.

- Dividend Reinvestment: This feature simplifies the investment process and maximizes long-term growth potential by avoiding the need to manually reinvest dividends.

- Long-Term Growth: Reinvesting dividends contributes significantly to long-term capital appreciation, leading to greater overall returns over time.

- Comparison to Distributing Share Class: While an accumulation share class automatically reinvests dividends, a distributing share class pays out dividends periodically. The choice depends on individual investor preferences and tax situations.

Analyzing NAV Performance and its Implications

Monitoring the Net Asset Value (NAV) is essential for understanding the Amundi MSCI All Country World UCITS ETF USD Acc's performance.

Factors Affecting NAV Fluctuations

Several factors influence the ETF's NAV:

- Global Market Movements: Changes in global equity markets directly impact the value of the underlying holdings and, consequently, the NAV.

- Currency Fluctuations (USD): As the ETF is denominated in USD, fluctuations in exchange rates against other currencies can affect the NAV for investors holding the ETF in different currencies.

- Underlying Index Composition: Changes to the MSCI All Country World Index, such as additions or removals of companies, can impact the ETF's NAV.

Interpreting NAV Data for Investment Decisions

Understanding NAV charts and trends is critical for effective investment decision-making:

- NAV Charts: Analyze historical NAV data to identify trends, growth patterns, and potential volatility.

- NAV and ETF Market Price: While the ETF's market price usually closely tracks its NAV, there can be small discrepancies (tracking difference).

- Long-Term Perspective: Focus on long-term NAV growth rather than short-term fluctuations. Consistent long-term growth is a more reliable indicator of the ETF's underlying value.

Comparing NAV Performance to Benchmarks

Comparing the ETF's NAV performance against relevant benchmarks helps gauge its effectiveness:

- Relevant Benchmarks: Compare the Amundi MSCI All Country World UCITS ETF USD Acc's NAV to other global equity ETFs, such as those tracking similar indices.

- Performance Metrics: Use metrics like annualized returns and Sharpe ratios (risk-adjusted returns) to assess performance relative to risk.

- Data Visualization: Use charts and graphs to visually compare performance and highlight key trends.

Amundi MSCI All Country World UCITS ETF USD Acc: Investment Strategies and Considerations

This section explores how to integrate the Amundi MSCI All Country World UCITS ETF USD Acc into a broader investment strategy.

Strategic Asset Allocation

The ETF is a valuable tool for strategic asset allocation:

- Global Market Exposure: Provides broad global market exposure, complementing other investments in your portfolio.

- Diversified Portfolio: Incorporates this ETF to diversify across geographies and sectors.

- Asset Allocation Models: The ETF can easily be integrated into various asset allocation strategies, including those targeting specific risk tolerances and return objectives.

Risk Management and Diversification

While offering diversification benefits, it's important to acknowledge the inherent risks:

- Global Equity Risk: Exposure to global equity markets involves inherent market risk and the potential for losses.

- Diversification Benefits: The ETF's broad diversification helps mitigate the risk associated with investing in individual stocks or specific market segments.

- Portfolio Volatility Reduction: Diversification through this ETF contributes to reduced overall portfolio volatility.

Costs and Fees

Transparency on costs is crucial:

- Expense Ratio: The expense ratio is a key consideration; compare it to other similar ETFs.

- Other Fees: Be aware of any additional fees or charges.

- Long-Term Impact: Even small differences in expense ratios can have a significant impact on long-term investment returns.

Conclusion

Investing in the Amundi MSCI All Country World UCITS ETF USD Acc offers a compelling way to gain diversified exposure to the global equity market. By understanding its underlying index, the UCITS structure, and the implications of its NAV, investors can make well-informed decisions. Regularly monitoring the NAV, comparing it to benchmarks, and considering its role within a broader investment strategy are crucial for maximizing its benefits. Begin your journey towards global diversification with the Amundi MSCI All Country World UCITS ETF USD Acc today! Learn more about optimizing your portfolio with the Amundi MSCI All Country World UCITS ETF USD Acc. Visit [link to Amundi website].

Featured Posts

-

Major Losses Continue At Amsterdam Stock Exchange 11 Drop Since Wednesday

May 25, 2025

Major Losses Continue At Amsterdam Stock Exchange 11 Drop Since Wednesday

May 25, 2025 -

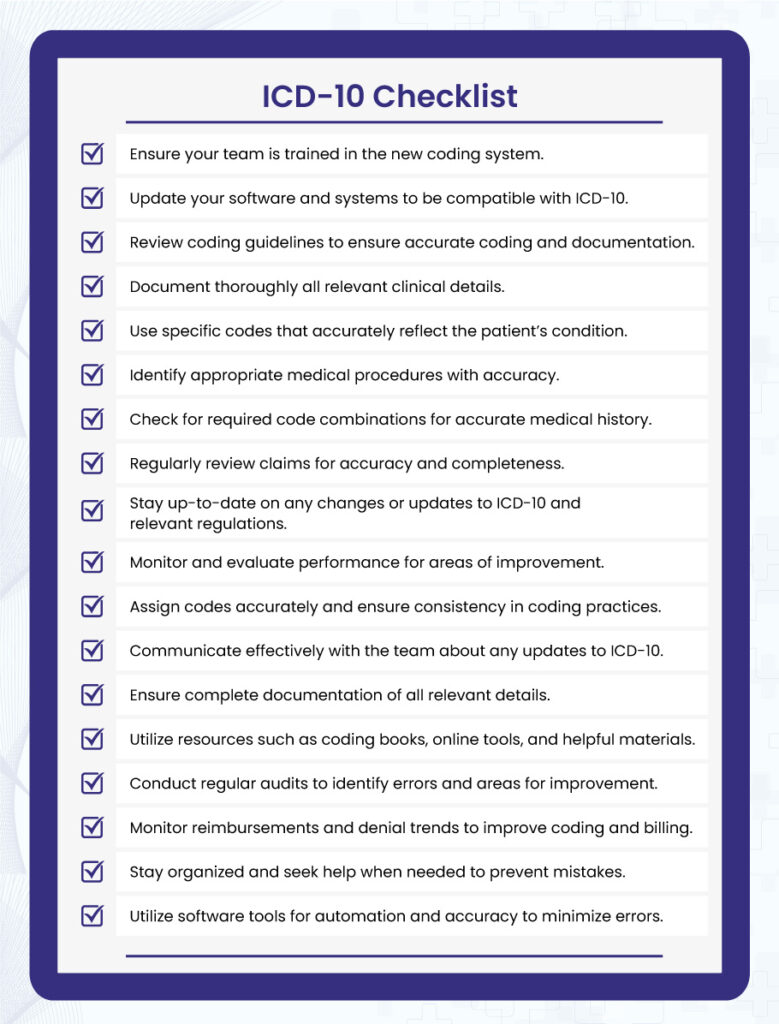

Your Escape To The Country A Checklist For A Smooth Transition

May 25, 2025

Your Escape To The Country A Checklist For A Smooth Transition

May 25, 2025 -

La Dispute Ardisson Baffie Connerie Machisme Et Consequences

May 25, 2025

La Dispute Ardisson Baffie Connerie Machisme Et Consequences

May 25, 2025 -

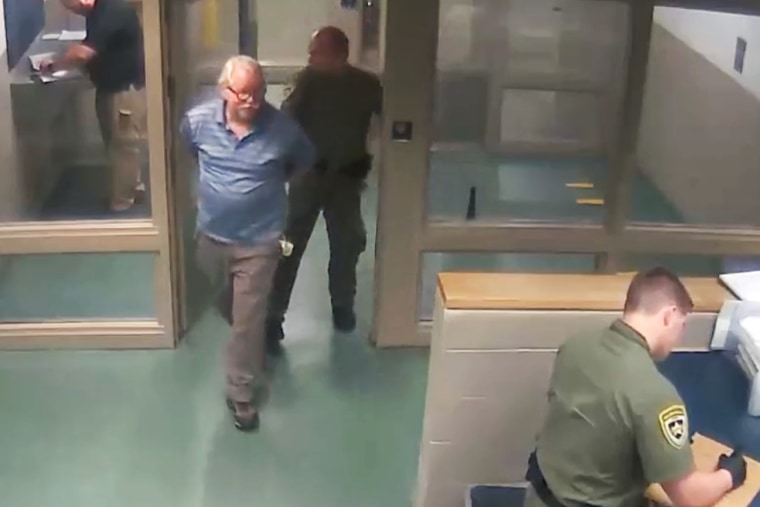

Dave Turmel Canadas Most Wanted Arrested In Italy

May 25, 2025

Dave Turmel Canadas Most Wanted Arrested In Italy

May 25, 2025 -

Analysis Of The Hells Angels Business Practices The Mandarin Killings Case

May 25, 2025

Analysis Of The Hells Angels Business Practices The Mandarin Killings Case

May 25, 2025