Investing In Amundi MSCI World Ex-US UCITS ETF Acc: A NAV Guide

Table of Contents

Understanding the Amundi MSCI World ex-US UCITS ETF Acc

The Amundi MSCI World ex-US UCITS ETF Acc is an exchange-traded fund (ETF) that offers investors exposure to a broad range of international equities, excluding the United States. Its investment objective is to track the performance of the MSCI World ex-US Index, providing diversified exposure to developed and emerging markets across the globe. This makes it particularly attractive to investors seeking to diversify their portfolios beyond the US market and gain exposure to global economic growth. The UCITS (Undertakings for Collective Investment in Transferable Securities) structure ensures the fund complies with stringent EU regulations, offering investors a high level of regulatory protection.

- Diversification benefits beyond US markets: Reduces reliance on the US economy and its potential volatility.

- Exposure to global economic growth: Captures opportunities in rapidly developing economies worldwide.

- Lower correlation with US markets: Can help reduce overall portfolio risk through diversification.

- Potential for higher returns (with higher risk): International markets may offer different growth prospects compared to the US, but also carry increased risk.

Deciphering Net Asset Value (NAV) in the Context of the ETF

The Net Asset Value (NAV) of the Amundi MSCI World ex-US UCITS ETF Acc represents the value of the fund's underlying assets per share. It's calculated daily by taking the total market value of all the securities held in the ETF, subtracting any liabilities, and dividing by the number of outstanding shares. Fluctuations in the daily NAV are primarily driven by changes in the prices of the underlying securities and currency exchange rates. While the NAV is the true value of the ETF, the market price may deviate slightly due to supply and demand.

- Impact of currency fluctuations on NAV: Changes in exchange rates between the currencies of the underlying assets and the ETF's base currency (typically EUR) directly affect the NAV.

- Effect of underlying asset price movements: Price increases in the underlying stocks will generally lead to a higher NAV, and vice versa.

- Understanding the difference between bid and ask price: The bid price is what buyers are willing to pay, while the ask price is what sellers are willing to accept. The difference is the spread.

- Importance of regular NAV monitoring: Tracking NAV changes helps investors assess the fund's performance and make informed investment decisions.

Practical Applications of NAV for Amundi MSCI World ex-US UCITS ETF Acc Investors

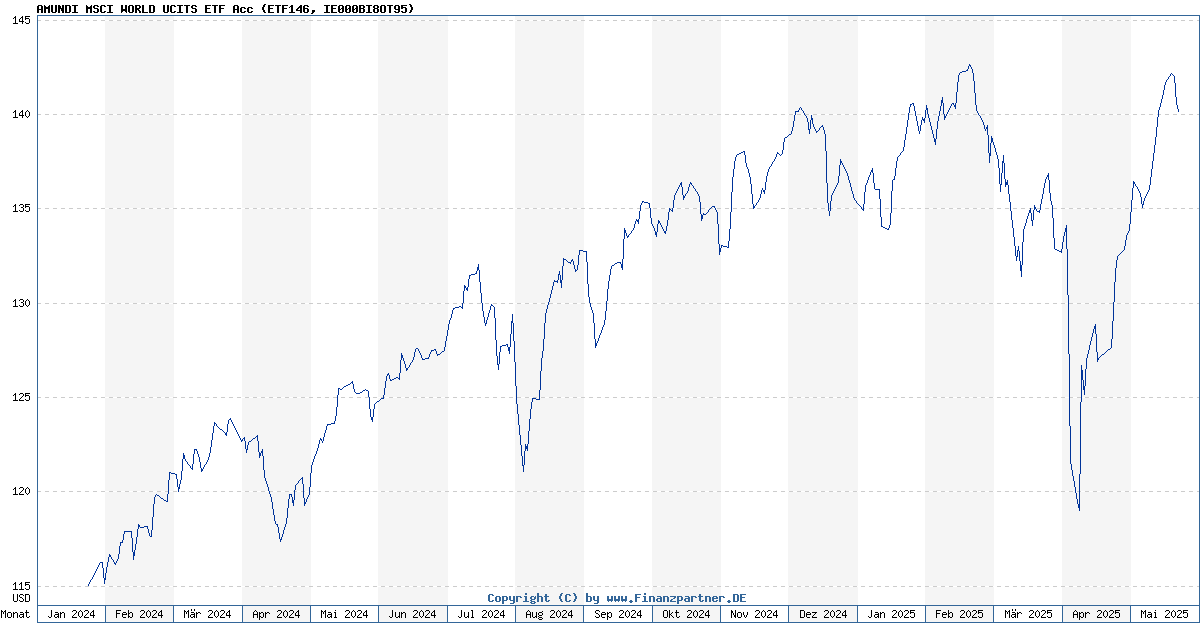

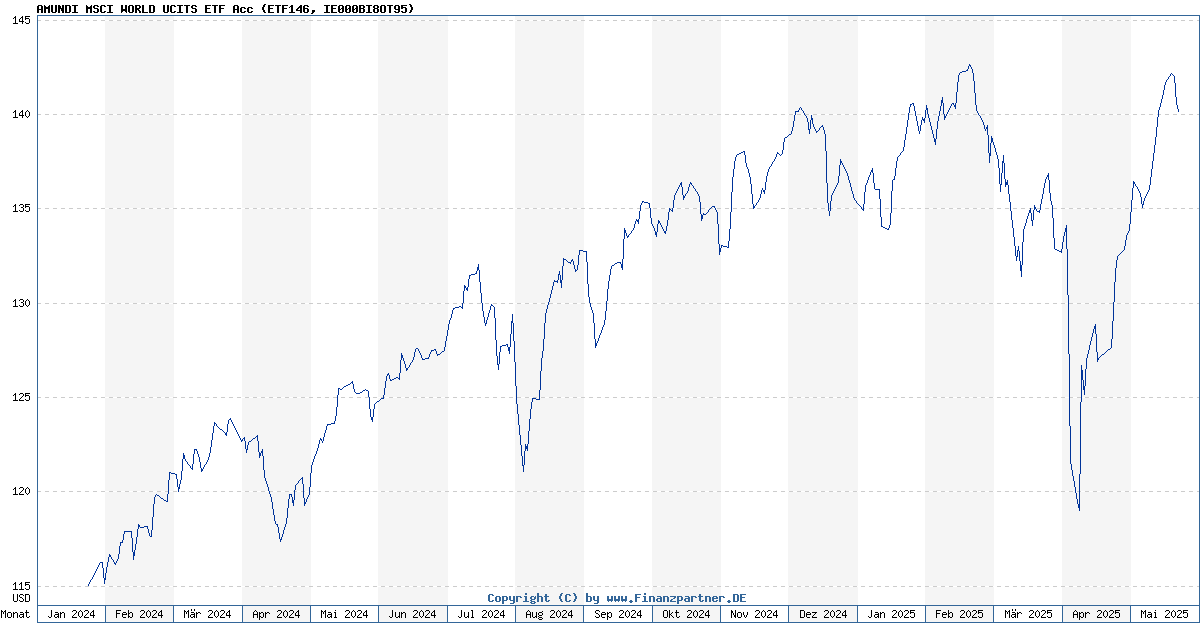

The Amundi MSCI World ex-US UCITS ETF Acc NAV is a critical tool for investors. By regularly monitoring the NAV, you can track the fund's performance over time, compare it to benchmarks, and potentially identify suitable buy or sell points. Many online brokerage platforms and financial websites provide real-time and historical NAV data for this ETF. Analyzing NAV trends can reveal longer-term performance patterns and help in making strategic investment decisions.

- Utilizing online resources and brokerage platforms for NAV data: Access readily available data to track performance.

- Analyzing NAV trends over time: Identify upward or downward trends to inform investment decisions.

- Using NAV to assess long-term performance: Track the NAV's growth over extended periods.

- Comparing NAV performance against benchmarks: Measure the ETF's performance against its reference index.

Risks Associated with Investing in the Amundi MSCI World ex-US UCITS ETF Acc

Investing in the Amundi MSCI World ex-US UCITS ETF Acc, like any investment, involves risks. Market volatility, currency fluctuations, and geopolitical events can all significantly impact the NAV and your returns. It is crucial to understand your risk tolerance before investing. Diversification, including the use of other asset classes, can help mitigate some of these risks.

- Currency risk impact on returns: Fluctuations in exchange rates can negatively or positively affect your returns.

- Geopolitical instability and its influence on NAV: Global events can cause significant market swings.

- Considerations for long-term versus short-term investments: The time horizon significantly impacts your risk profile.

Conclusion

Successfully navigating the global markets requires a clear understanding of your investments. This guide on the Amundi MSCI World ex-US UCITS ETF Acc and its NAV provides essential knowledge for informed decision-making. By regularly monitoring the Amundi MSCI World ex-US UCITS ETF Acc NAV and understanding the factors that influence it, you can effectively manage your risk and potentially maximize your returns. Remember to conduct thorough research and consider seeking professional financial advice before investing in the Amundi MSCI World ex-US UCITS ETF Acc or any other investment vehicle. Start monitoring your Amundi MSCI World ex-US UCITS ETF Acc NAV today and make informed investment choices.

Featured Posts

-

Exploring The Nations Newest Business Hotspots

May 25, 2025

Exploring The Nations Newest Business Hotspots

May 25, 2025 -

Mercati Europei La Borsa Attende La Fed Focus Su Banche E Italgas

May 25, 2025

Mercati Europei La Borsa Attende La Fed Focus Su Banche E Italgas

May 25, 2025 -

Sutton Hoos Mysterious Sixth Century Vessel A Burial Urn For Cremated Remains

May 25, 2025

Sutton Hoos Mysterious Sixth Century Vessel A Burial Urn For Cremated Remains

May 25, 2025 -

Is An Angry Elon Musk Actually Good For Tesla Stock

May 25, 2025

Is An Angry Elon Musk Actually Good For Tesla Stock

May 25, 2025 -

Konchita Vurst Pobeditel Evrovideniya 2014 Kaming Aut V 13 Let I Plany Stat Devushkoy Bonda

May 25, 2025

Konchita Vurst Pobeditel Evrovideniya 2014 Kaming Aut V 13 Let I Plany Stat Devushkoy Bonda

May 25, 2025