Investing In Palantir: A Comprehensive Guide

Table of Contents

Understanding Palantir's Business Model

Palantir's success hinges on its two primary platforms: Palantir Gotham and Palantir Foundry. These platforms leverage advanced data analytics to tackle complex problems for clients across various sectors. Understanding the nuances of each is crucial for a thorough Palantir investment analysis.

-

Palantir Gotham: Primarily serves government and defense clients, assisting in national security, intelligence gathering, and counter-terrorism efforts. This segment delivers substantial recurring revenue through long-term contracts. The nature of these contracts provides a certain level of stability, although they can also carry significant geopolitical risks.

-

Palantir Foundry: Targets commercial clients across various industries, including healthcare, finance, and energy. This platform offers a more flexible and scalable solution, focusing on operational efficiency, fraud detection, and risk management. Foundry's growth potential is significant, as it taps into a much broader market.

-

Competitive Advantages: Palantir boasts several competitive advantages: its proprietary technology, a strong emphasis on data security, deep expertise in data integration, and its long-standing relationships with key clients. This contributes to its strong position in the big data analytics market.

-

Data-as-a-Service (DaaS): Palantir's offering operates increasingly as a data-as-a-service model. Clients pay for access to the platform and its analytical capabilities, generating substantial recurring revenue streams, a key factor in evaluating PLTR stock.

Analyzing Palantir's Financial Performance

Analyzing Palantir's financial performance is critical for any potential investor. Reviewing key financial metrics helps determine the health and sustainability of the business. Key areas to consider when reviewing PLTR financials include:

-

Revenue Growth: Examining historical revenue data reveals the trajectory of Palantir's growth, illustrating the success of its platforms in attracting and retaining clients. Sustained, high revenue growth is a positive indicator for long-term Palantir investment.

-

Profitability: Assessing profitability metrics like operating margins and net income provides insight into Palantir's ability to translate revenue into profit. The path to profitability is a key factor for investors considering a Palantir investment.

-

Cash Flow: Analyzing cash flow from operations indicates the financial strength and sustainability of the company. A robust cash flow is vital for future growth and investment.

-

Debt Levels: Examining Palantir's debt-to-equity ratio helps assess its financial risk. A high debt level might raise concerns about financial stability, impacting the outlook for PLTR stock.

Assessing Palantir's Risks and Opportunities

Like any investment, Palantir presents both risks and opportunities. A balanced perspective is crucial before committing to a Palantir investment.

-

Risks: Competition from established tech giants, regulatory hurdles, geopolitical risks associated with government contracts, and technological obsolescence are significant potential risks. The concentration of its revenue in government contracts presents another element of risk.

-

Opportunities: Expansion into new markets, strategic partnerships, technological advancements (like advancements in AI and machine learning), and increasing demand for advanced data analytics provide ample opportunity for future growth. The growing adoption of data-driven decision-making across all sectors significantly increases the potential of a Palantir investment.

Developing an Investment Strategy for Palantir

Integrating Palantir into your investment portfolio requires a well-defined strategy tailored to your risk tolerance and financial goals.

-

Diversification: Palantir should be considered as part of a diversified investment portfolio. This mitigates the risk associated with any single stock, including PLTR stock.

-

Investment Strategies: Consider various approaches like dollar-cost averaging (investing a fixed amount regularly) or buy-and-hold (holding the stock long-term), depending on your risk profile and investment horizon. Both strategies have potential benefits for a Palantir investment.

-

Long-Term Perspective: Investing in Palantir is generally considered a long-term investment. Short-term market fluctuations should be anticipated and managed as part of any Palantir investment strategy.

Conclusion

Investing in Palantir Technologies (PLTR) demands a thorough understanding of its business model, financial health, inherent risks, and potential opportunities. This requires careful analysis of its revenue streams, profitability, and competitive landscape. By conducting thorough research and developing a robust investment strategy aligned with your risk tolerance and financial goals, you can make an informed decision about whether a Palantir investment is suitable for your portfolio. Remember to always seek professional financial advice before making any investment decisions. Ready to make an informed decision about investing in Palantir? Start your research today and consider consulting a financial advisor to determine if Palantir fits your investment strategy.

Featured Posts

-

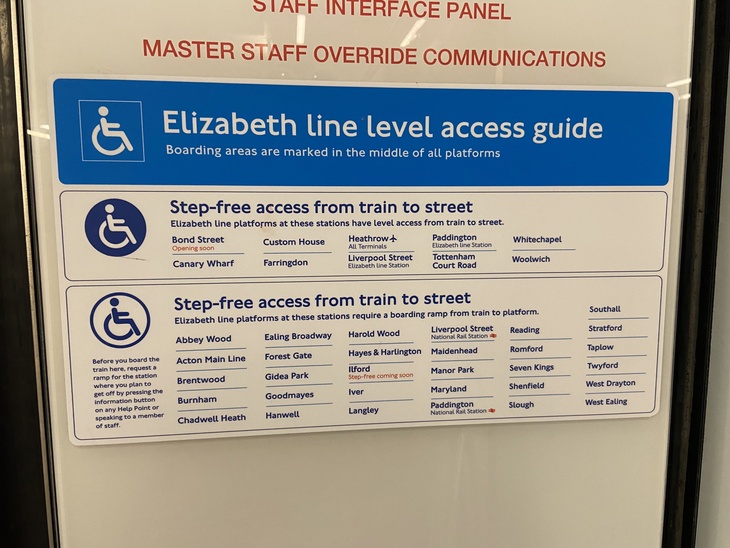

Accessibility Audit The Elizabeth Line And Wheelchair User Experience

May 09, 2025

Accessibility Audit The Elizabeth Line And Wheelchair User Experience

May 09, 2025 -

Despite 100 B Loss Elon Musk Holds Onto Richest Person Title Hurun 2025 List

May 09, 2025

Despite 100 B Loss Elon Musk Holds Onto Richest Person Title Hurun 2025 List

May 09, 2025 -

Rhlt Fyraty Mn Alahly Ila Alerby Njah Am Fshl

May 09, 2025

Rhlt Fyraty Mn Alahly Ila Alerby Njah Am Fshl

May 09, 2025 -

Closing West Hams 25 Million Financial Hole

May 09, 2025

Closing West Hams 25 Million Financial Hole

May 09, 2025 -

Edmonton Oilers Leon Draisaitl Finalist For The Prestigious Hart Trophy

May 09, 2025

Edmonton Oilers Leon Draisaitl Finalist For The Prestigious Hart Trophy

May 09, 2025