Investing In Palantir: Analyzing The Projected 40% Increase By 2025

Table of Contents

Palantir's Competitive Advantage in the Data Analytics Market

Palantir Technologies is a leading provider of big data analytics software, offering solutions to both government and commercial clients. Its success stems from a unique combination of proprietary technology and strategic partnerships.

Proprietary Technology and Data Integration Capabilities

Palantir's core offerings, Gotham and Foundry, are powerful platforms designed to handle massive, complex datasets. These platforms are not just data warehouses; they are sophisticated analytical tools capable of uncovering hidden insights. Their advanced data integration capabilities are crucial in today's data-driven world, where information resides in disparate systems.

- Real-time data analysis: Enabling immediate insights and faster decision-making.

- AI-driven insights: Leveraging artificial intelligence and machine learning for predictive analytics.

- Secure data management: Ensuring the confidentiality and integrity of sensitive data.

- Customizable workflows: Adapting to the specific needs of diverse clients.

- Intuitive user interface: Making complex data analysis accessible to a wider range of users.

Strong Government and Commercial Partnerships

Palantir boasts a robust portfolio of government contracts, providing long-term revenue stability and a foundation for future growth. Simultaneously, the company is aggressively expanding its commercial client base, penetrating diverse sectors like healthcare, finance, and manufacturing.

- Key Government Partnerships: The company's long-standing relationship with US intelligence agencies and other government bodies provides a significant revenue stream.

- Expanding Commercial Reach: Palantir is actively signing deals with Fortune 500 companies, solidifying its position in the commercial market. Examples include partnerships with major players in the healthcare and finance sectors.

Factors Driving the Projected 40% Increase by 2025

Several key factors contribute to the optimistic projection of a 40% increase in Palantir's value by 2025.

Growing Demand for Data Analytics Solutions

The demand for sophisticated data analytics is skyrocketing across virtually all industries. Businesses are increasingly recognizing the value of data-driven decision-making for optimizing operations, enhancing customer experiences, and gaining a competitive edge. AI and ML are further accelerating this demand, driving the need for advanced analytical tools like those offered by Palantir.

- Market Growth: The global data analytics market is projected to experience significant growth over the next few years. Several reports estimate double-digit growth rates.

- Palantir's Market Share: Palantir is well-positioned to capture a significant portion of this growing market given its unique technological capabilities.

Successful Product Innovation and Strategic Partnerships

Palantir's commitment to research and development is fueling continuous improvement of its software platforms. Strategic partnerships and acquisitions further strengthen its market position and expand its capabilities.

- Product Launches: Regular updates and new features ensure Palantir remains at the forefront of data analytics innovation.

- Strategic Partnerships: Collaborations with technology leaders broaden Palantir's reach and enhance its platform's capabilities.

- Successful Acquisitions: Strategic acquisitions have expanded Palantir's technological prowess and market presence.

Improving Profitability and Financial Performance

Palantir's progress in achieving profitability is a key factor underpinning investor confidence. Positive financial metrics further support the 40% growth projection.

- Revenue Growth: Consistent revenue growth demonstrates the increasing demand for Palantir's solutions.

- Operating Margins: Improving operating margins signal enhanced operational efficiency and profitability.

- Positive Cash Flow: Strong cash flow supports future investment and expansion.

Potential Risks and Challenges for Palantir Investors

Despite the positive outlook, potential risks and challenges should be considered.

Competition from Established Tech Giants

The data analytics market is competitive, with established tech giants like AWS, Microsoft, and Google posing a significant challenge. Palantir's ability to differentiate itself through innovation and strategic partnerships will be crucial.

- Competitive Landscape: Palantir faces competition from several large technology companies that offer similar services.

- Differentiation Strategy: Palantir focuses on its unique technology and ability to handle extremely complex datasets.

Dependence on Government Contracts

A significant portion of Palantir's revenue is derived from government contracts. Fluctuations in government spending could impact the company's financial performance. However, Palantir is actively diversifying its revenue streams.

- Government Contract Reliance: While a significant revenue source, over-reliance on government contracts poses a potential risk.

- Diversification Efforts: Palantir is actively pursuing commercial contracts to reduce dependence on the government sector.

Conclusion: Investing in Palantir: A Promising Outlook?

The projected 40% increase in Palantir's value by 2025 is supported by several factors: its proprietary technology, strong partnerships, growing demand for data analytics solutions, and improving financial performance. However, investors should also be mindful of the competitive landscape and the risks associated with reliance on government contracts. Conduct thorough research and consider your own risk tolerance before investing in Palantir stock. Weigh the potential for high returns against the inherent uncertainties before making a Palantir investment. Consider diversifying your portfolio appropriately. Further research into Palantir investment opportunities is crucial for informed decision-making.

Featured Posts

-

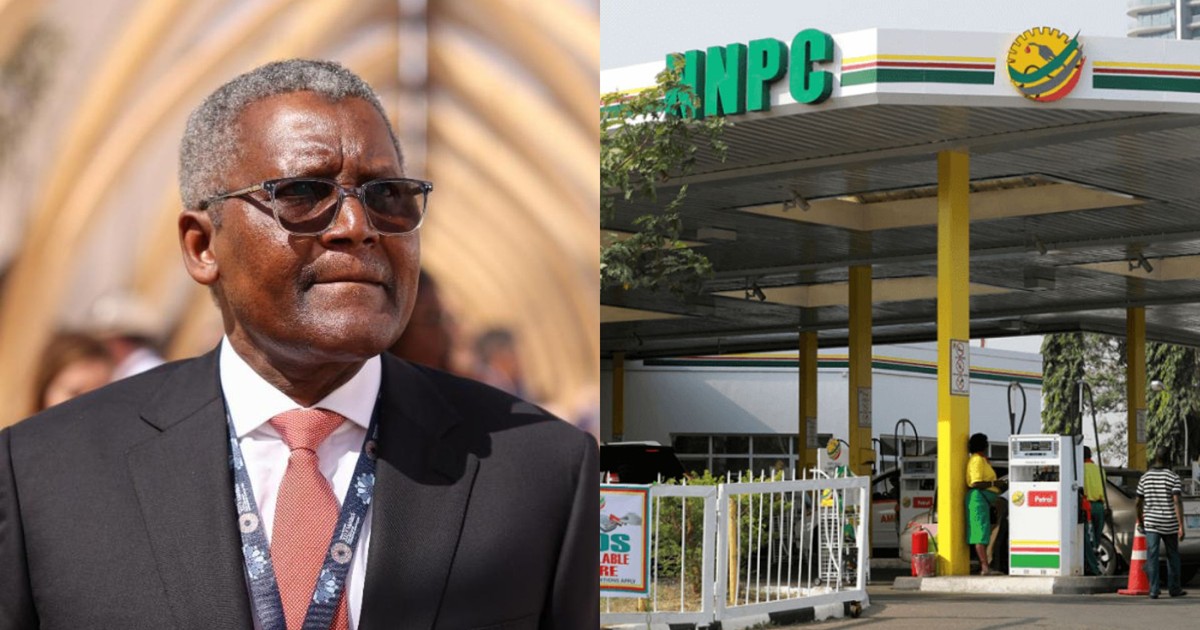

How Dangote And Nnpc Influence Nigerias Petrol Market

May 10, 2025

How Dangote And Nnpc Influence Nigerias Petrol Market

May 10, 2025 -

Chto Skazal Stiven King Ilonu Masku Na X

May 10, 2025

Chto Skazal Stiven King Ilonu Masku Na X

May 10, 2025 -

Palantir Pltr Stock Weighing The Investment Before May 5th

May 10, 2025

Palantir Pltr Stock Weighing The Investment Before May 5th

May 10, 2025 -

Indonesias Foreign Exchange Reserves Plummet Rupiah Weakness Takes Toll

May 10, 2025

Indonesias Foreign Exchange Reserves Plummet Rupiah Weakness Takes Toll

May 10, 2025 -

Inflation And Unemployment The Feds Decision To Hold Rates

May 10, 2025

Inflation And Unemployment The Feds Decision To Hold Rates

May 10, 2025