Investing In Palantir Before May 5th: A Detailed Analysis

Table of Contents

Palantir's Recent Financial Performance and Future Projections

Q4 2022 Earnings Report Analysis: Palantir's Q4 2022 earnings report offered a mixed bag. While the company exceeded revenue expectations, profitability remained a key focus area. Let's analyze the key metrics:

- Revenue Growth: [Insert actual Q4 2022 revenue growth percentage]. While this represents [positive/negative] growth compared to the previous quarter, it's [higher/lower] than analysts' average prediction of [insert analyst prediction].

- Net Income: [Insert actual net income figure]. This shows [improvement/decline] compared to the same period last year.

- EPS (Earnings Per Share): [Insert actual EPS figure]. This is [higher/lower] than the previous quarter and [higher/lower] than analysts’ consensus estimate.

Compared to competitors like [mention 1-2 competitors], Palantir's performance shows [positive/negative] aspects in terms of growth and profitability. Analyst ratings currently range from [lowest rating] to [highest rating], reflecting the varied perspectives on the company's future trajectory.

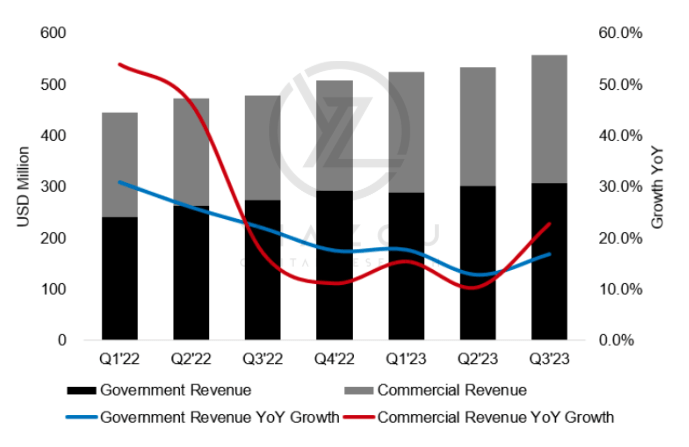

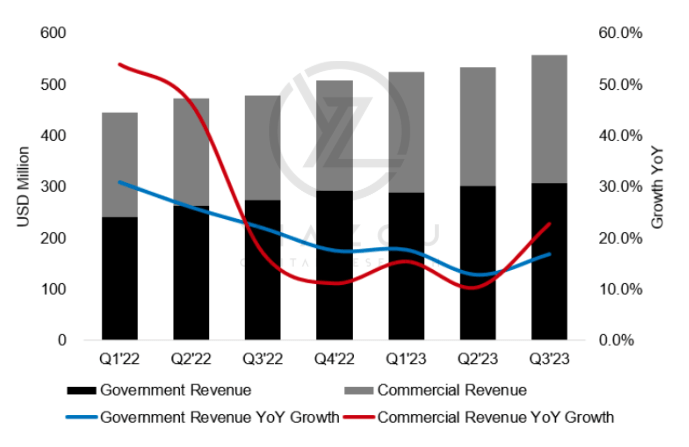

Long-Term Growth Potential: Palantir's long-term strategy centers around expanding its presence in both the government and commercial sectors, leveraging its advanced data analytics platforms and AI capabilities. Key growth drivers include:

- Increased AI Adoption: Palantir is actively integrating AI into its offerings, positioning itself to capitalize on the growing demand for AI-driven solutions in various industries.

- Expanding Customer Base: The company continues to secure new contracts, demonstrating its ability to attract clients across different sectors.

- Government Contracts: Palantir's strong relationship with government agencies provides a stable revenue stream, but also presents challenges associated with government procurement processes and budget cycles.

However, potential challenges include intense competition from established tech giants and the need to consistently innovate to maintain its competitive edge. The successful execution of its strategic initiatives will be crucial to achieving its long-term growth objectives.

Analyzing Palantir's Valuation and Stock Price

Current Market Capitalization and P/E Ratio: As of [date], Palantir's market capitalization is approximately [insert market cap]. Its P/E ratio stands at [insert P/E ratio], which is [higher/lower] than the average P/E ratio for comparable companies in the data analytics sector. This valuation reflects [investors' optimism/concerns] regarding its future growth prospects.

- Price-to-Sales Ratio: [Insert Price-to-Sales ratio] providing an alternative valuation metric.

- Stock Price Volatility: Palantir's stock price has historically exhibited significant volatility, reflecting the inherent risks associated with investing in a high-growth technology company.

Potential Catalysts Affecting Stock Price Before May 5th: The period leading up to May 5th could see several events impacting Palantir's stock price. These include:

- Potential New Product Launches: Announcements of new products or significant software updates could positively impact investor sentiment.

- Strategic Partnerships: Formation of key partnerships with other technology companies could expand Palantir's reach and capabilities, bolstering investor confidence.

- Regulatory Changes: Changes in government regulations could either positively or negatively impact Palantir's revenue streams, depending on the nature of the changes.

However, it's important to note the inherent uncertainty surrounding these potential catalysts. Their impact on the stock price is difficult to predict with precision.

Risk Assessment for Investing in Palantir

Market Risks: Investing in Palantir stock carries inherent market risks. Factors such as interest rate hikes, inflation, and overall economic downturns can significantly affect the stock's performance.

- Macroeconomic Factors: A general economic slowdown could reduce demand for Palantir's services, particularly in the commercial sector.

- Market Sentiment: Negative market sentiment can lead to decreased investor confidence and a decline in the stock price.

Company-Specific Risks: Palantir faces several company-specific risks, including:

- Competition: The data analytics market is highly competitive, with established players and new entrants constantly vying for market share.

- Dependence on Government Contracts: A significant portion of Palantir's revenue comes from government contracts. Changes in government spending or procurement policies could adversely affect the company's financial performance.

- Execution Risks: The company's success depends on its ability to successfully execute its long-term strategic initiatives. Failure to do so could lead to disappointing financial results.

Palantir is mitigating these risks through diversification, continuous innovation, and strengthening its commercial partnerships.

Conclusion

Investing in Palantir before May 5th requires a careful assessment of its financial performance, valuation, potential catalysts, and associated risks. While Palantir demonstrates long-term growth potential, fueled by AI adoption and strategic market expansion, significant short-term volatility is likely. The upcoming period leading to May 5th presents both opportunities and uncertainties. Our analysis suggests [positive/neutral/negative] outlook for Palantir, however, it's crucial to remember this is not financial advice.

While this analysis provides valuable insights into investing in Palantir before May 5th, remember to conduct your own comprehensive due diligence before making any investment decisions. Consider consulting with a financial advisor before making any significant investments in Palantir stock or similar assets. Thorough research is vital before engaging in any investment strategy involving Palantir shares.

Featured Posts

-

Victory Day Ceasefire Assessing Putins Motives

May 09, 2025

Victory Day Ceasefire Assessing Putins Motives

May 09, 2025 -

Makron Starmer Merts I Tusk Proignorirovali Priglashenie V Kiev 9 Maya

May 09, 2025

Makron Starmer Merts I Tusk Proignorirovali Priglashenie V Kiev 9 Maya

May 09, 2025 -

Edmonton Oilers Leon Draisaitl Finalist For The Prestigious Hart Trophy

May 09, 2025

Edmonton Oilers Leon Draisaitl Finalist For The Prestigious Hart Trophy

May 09, 2025 -

High Potential Season 1s Underrated Character A Prime Target For Season 2

May 09, 2025

High Potential Season 1s Underrated Character A Prime Target For Season 2

May 09, 2025 -

The Great Decoupling Separating Fact From Fiction

May 09, 2025

The Great Decoupling Separating Fact From Fiction

May 09, 2025