Investing In Quantum Computing Stocks: Rigetti (RGTI) And Beyond In 2025

Table of Contents

Understanding the Quantum Computing Investment Landscape in 2025

The quantum computing market is projected to experience explosive growth by 2025. Reports from leading market research firms like Gartner and IDC predict substantial increases in market size, driven by advancements in hardware and software, and increasing adoption across various sectors. Understanding this growth trajectory is crucial for anyone considering investing in quantum computing stocks.

Different quantum computing technologies, each with its own investment implications, are vying for dominance. Superconducting qubits, currently a leading approach, are utilized by companies like Rigetti Computing. Trapped ion systems, another promising technology, offer alternative pathways to building scalable quantum computers. The investment landscape is diverse, influenced by the specific technological approach and the company's stage of development.

- Market size projections for 2025: Estimates vary, but many analysts predict a market exceeding several billion dollars.

- Key technological advancements driving growth: Improved qubit coherence times, higher qubit counts, and the development of error correction techniques are critical factors.

- Potential risks and challenges in the quantum computing sector: High development costs, technological hurdles, and the competitive landscape pose significant risks.

Deep Dive into Rigetti Computing (RGTI) Stock

Rigetti Computing (RGTI) is a prominent player in the quantum computing space, known for its focus on superconducting quantum processors. The company's business model centers around designing, manufacturing, and selling quantum computers and offering cloud access to its quantum computing resources. Analyzing RGTI's financial performance, including revenue, expenses, and profitability, requires careful consideration of its stage of development as a relatively young company. While profitability remains a future goal, investors should focus on key metrics indicative of technological progress and market traction.

RGTI's competitive advantages lie in its advanced fabrication techniques and its focus on building modular quantum computers. However, intense competition from established tech giants like IBM and Google, as well as other startups like IonQ, poses a significant challenge. Investing in RGTI stock involves accepting the risks associated with a company operating in a highly volatile and competitive market.

- Key technological milestones achieved by RGTI: Successfully building and deploying multi-qubit processors is a crucial achievement.

- Analysis of RGTI's financial statements: Investors should focus on research and development spending, technological progress, and securing strategic partnerships.

- Comparison with key competitors like IBM, Google, and IonQ: This comparison should focus on technology, market share, and overall business strategy.

- Assessment of RGTI's long-term growth potential: This depends heavily on continued technological breakthroughs, securing funding, and establishing a strong market position.

Beyond Rigetti: Other Promising Quantum Computing Stocks in 2025

The quantum computing sector boasts several other publicly traded companies with promising futures. IonQ, for example, employs trapped-ion technology, offering a different approach to building quantum computers. D-Wave Systems, while focusing on adiabatic quantum computing, represents another significant player. A diversified investment strategy in the quantum computing market is advisable.

Comparing and contrasting these companies based on their technologies, business models, and potential for growth is crucial for effective portfolio management. Analyzing their financial performance and market positioning provides valuable insights for informed investment decisions.

- Company names and brief descriptions (e.g., IonQ, D-Wave): Research each company's technology, market position, and financial performance.

- Comparison of their technologies and business models: Identify the strengths and weaknesses of each approach.

- Assessment of their respective strengths and weaknesses: Consider factors like scalability, error correction, and market traction.

- Tips for diversifying your quantum computing stock portfolio: Spread your investments across different companies and technologies to mitigate risk.

Strategies for Investing in Quantum Computing Stocks: Risk Management and Due Diligence

Investing in quantum computing stocks, like any investment in emerging technologies, requires thorough due diligence. Understanding the inherent risks and implementing appropriate risk mitigation strategies is paramount. This includes scrutinizing financial statements, researching market trends, and evaluating the technological feasibility and commercial viability of the underlying technology.

Investing in quantum computing stocks is inherently risky, given the nascent nature of the field and the rapid technological advancements. Therefore, aligning your investment strategy with your individual risk tolerance and financial goals is essential.

- Steps for conducting thorough due diligence: Analyze financial reports, read industry publications, and assess the company's competitive landscape.

- Strategies for diversifying your investment portfolio: Spread investments across multiple companies and asset classes to reduce risk.

- Importance of understanding financial statements and market trends: Keep up-to-date on financial news and industry reports to inform your investment decisions.

- Tips for managing investment risks effectively: Diversify, invest only what you can afford to lose, and set realistic expectations.

Conclusion: Investing in Quantum Computing Stocks: A Future-Forward Approach

The quantum computing investment landscape in 2025 presents both significant opportunities and considerable risks. While Rigetti (RGTI) is a compelling example, a diverse approach focusing on thorough research and robust risk management is crucial for success in this field. The long-term growth potential of quantum computing is undeniable, offering significant rewards for investors willing to navigate the complexities of this emerging sector. Conduct further research, and consider including quantum computing stocks in your diversified investment portfolio. The future of technology is quantum, and the opportunity to identify "the next Rigetti" among the emerging players is real. Start your research today and position yourself for success in this groundbreaking technological revolution!

Featured Posts

-

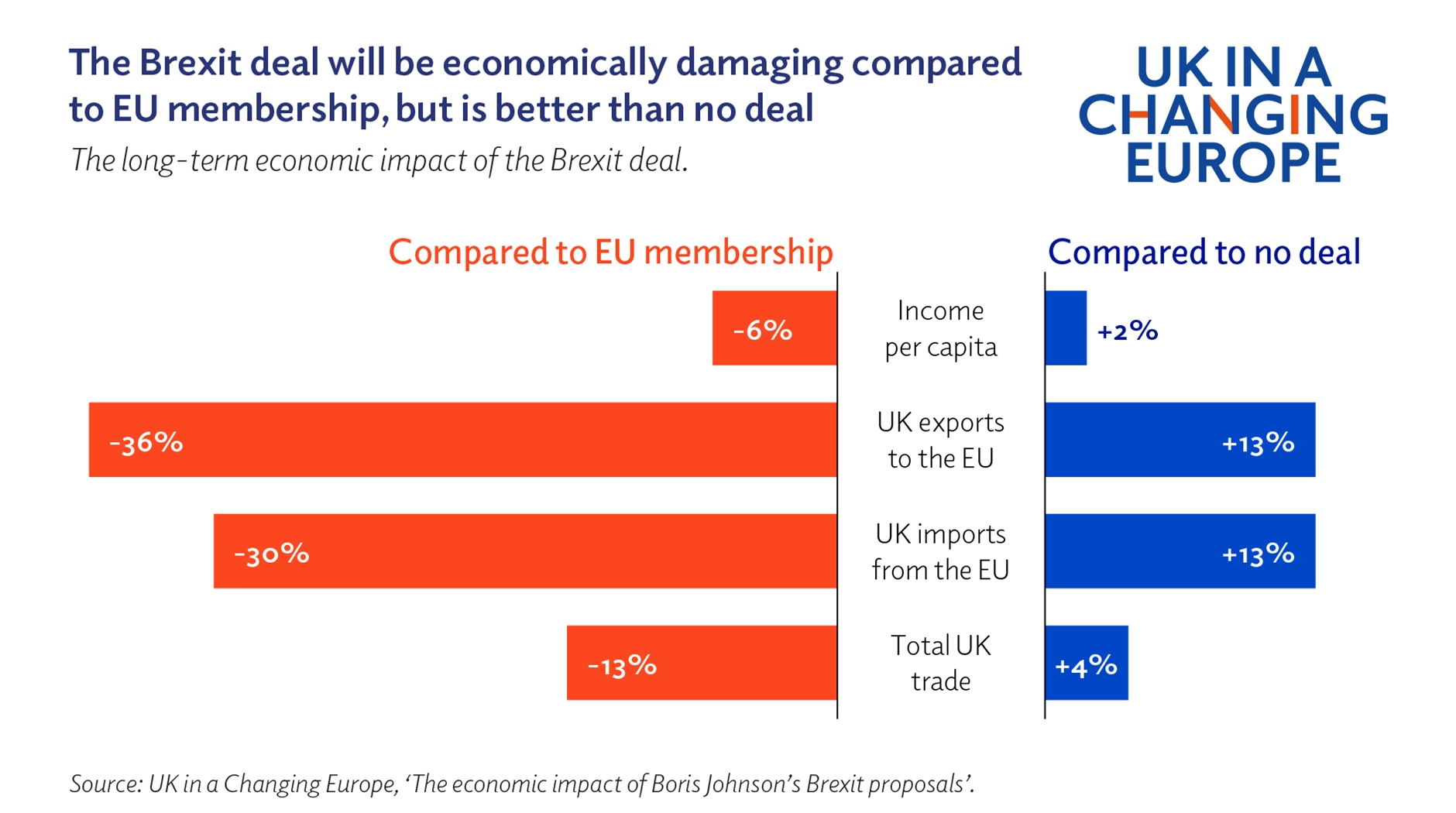

The Brexit Effect Uk Luxury Brands Struggle With Eu Trade

May 21, 2025

The Brexit Effect Uk Luxury Brands Struggle With Eu Trade

May 21, 2025 -

High Ranking Navy Official Convicted In Unprecedented Corruption Scandal

May 21, 2025

High Ranking Navy Official Convicted In Unprecedented Corruption Scandal

May 21, 2025 -

Trinidad And Tobago Newsday Kartels Security Restrictions Explained

May 21, 2025

Trinidad And Tobago Newsday Kartels Security Restrictions Explained

May 21, 2025 -

Problemen Met Online Betalen Naar Abn Amro Opslag

May 21, 2025

Problemen Met Online Betalen Naar Abn Amro Opslag

May 21, 2025 -

D Wave Quantum Qbts Stock Performance Analyzing The Impact Of Kerrisdale Capitals Report

May 21, 2025

D Wave Quantum Qbts Stock Performance Analyzing The Impact Of Kerrisdale Capitals Report

May 21, 2025