Investing In The Future Of Transportation: Uber's Autonomous Vehicle Technology And ETF Opportunities

Table of Contents

Uber's Autonomous Vehicle Strategy and its Market Impact

Uber's ATG (Advanced Technologies Group):

Uber's commitment to autonomous vehicle development is substantial, largely driven by its Advanced Technologies Group (ATG). This division is spearheading the company's efforts to create a fleet of self-driving cars, aiming to revolutionize ride-sharing and potentially other transportation sectors.

- Key Milestones: Uber's ATG has achieved significant milestones, including extensive road testing in various cities, the development of sophisticated sensor technology, and advancements in high-definition mapping systems.

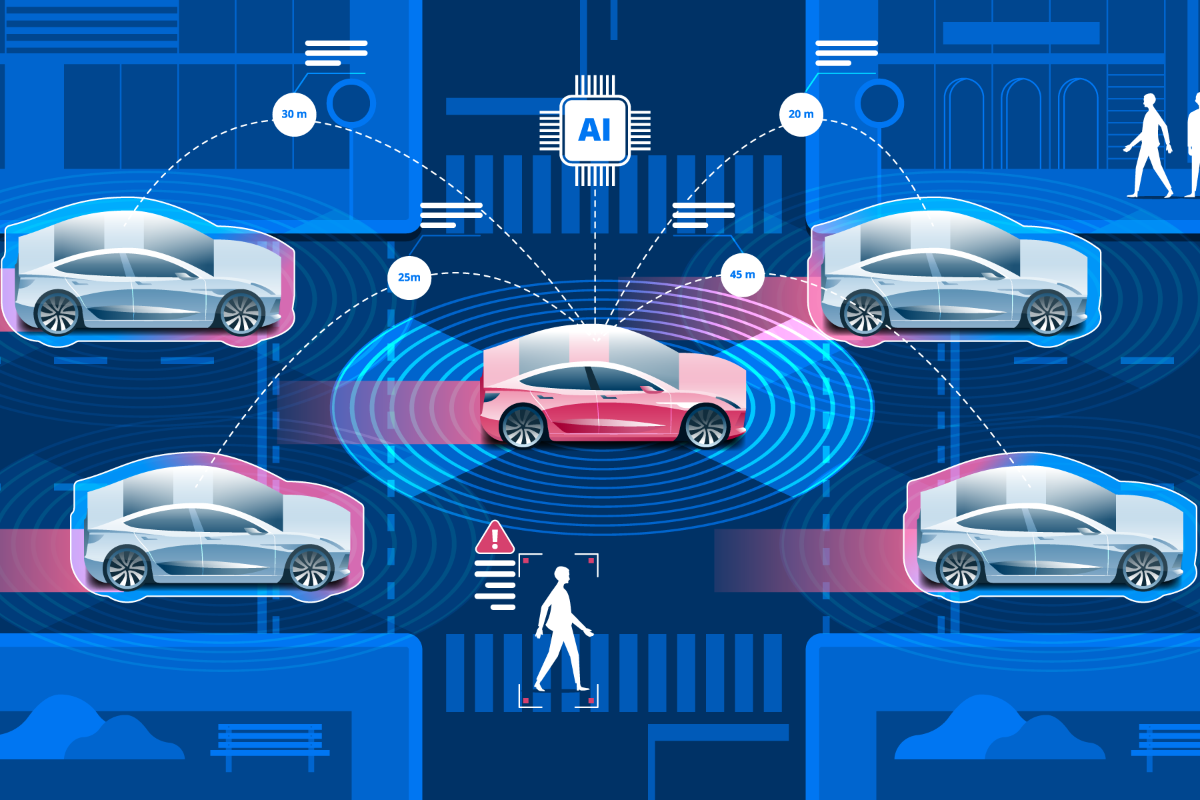

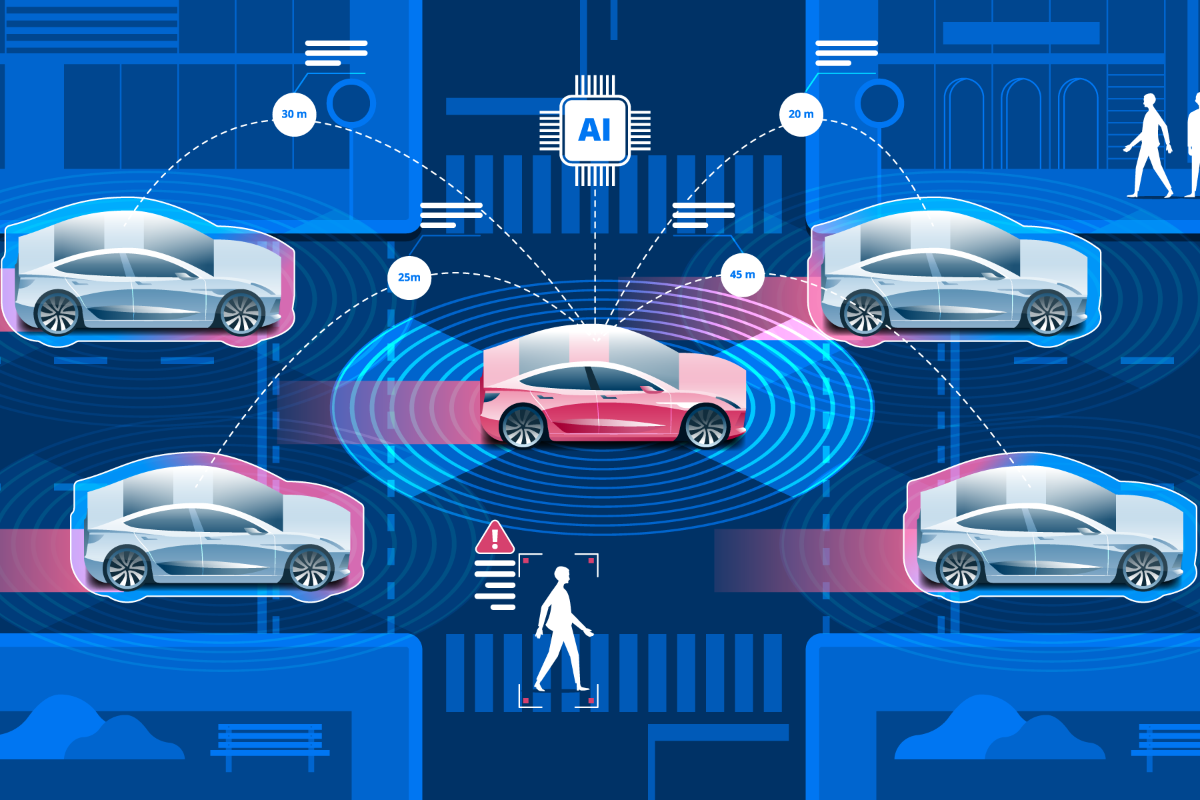

- Technological Advancements: Uber's autonomous vehicle technology utilizes a combination of lidar, radar, cameras, and advanced algorithms to navigate and perceive its environment. The company has invested heavily in machine learning to improve the safety and reliability of its self-driving systems.

- Challenges Faced: The development of fully autonomous vehicles presents numerous technical and regulatory hurdles. Uber has faced setbacks, including accidents and regulatory scrutiny, highlighting the complexities of bringing this technology to market. Competition is fierce and requires continuous innovation.

- Differentiation: Uber's strategy differs from competitors by focusing on a scalable, ride-sharing centric approach, rather than solely focusing on individual vehicle sales. Its vast network of riders and drivers provides a significant advantage in data collection and deployment. Partnerships with mapping companies and other tech firms further accelerate its development.

The Competitive Landscape:

Uber is not alone in the autonomous vehicle race. Companies like Waymo (Alphabet's self-driving car project), Cruise (GM's autonomous vehicle subsidiary), Tesla, and others are aggressively pursuing similar goals.

- Competitive Technologies: Each company utilizes slightly different approaches to autonomous driving, varying in their sensor technology, software algorithms, and mapping strategies. Waymo, for instance, has focused on highly detailed mapping, while Tesla relies heavily on its camera-based system.

- Collaborations and Acquisitions: The autonomous vehicle industry is characterized by frequent collaborations and acquisitions. Partnerships allow companies to share resources and expertise, while acquisitions can bring crucial technology or talent into a company's portfolio. These strategic moves significantly impact the competitive landscape, often reshaping the hierarchy.

ETF Investment Opportunities in the Autonomous Vehicle Sector

Identifying Relevant ETFs:

Investing in the autonomous vehicle sector doesn't require investing in individual companies. Exchange Traded Funds (ETFs) offer diversified exposure to this high-growth area.

- Specific ETFs: Several ETFs provide exposure to companies involved in autonomous driving technology, artificial intelligence (AI), robotics, and related sectors. Examples include (Note: Always verify ticker symbols and fund details with your broker before investing):

- [Insert Example ETF 1 with ticker and brief description] (Focus: Technology, Robotics)

- [Insert Example ETF 2 with ticker and brief description] (Focus: Transportation, Infrastructure)

- [Insert Example ETF 3 with ticker and brief description] (Focus: AI and Machine Learning)

- ETFs vs. Individual Stocks: Investing in ETFs offers diversification, reducing risk compared to focusing on a single company's stock in this volatile sector. ETFs also generally have lower expense ratios than actively managed mutual funds. However, ETFs might not offer the same potential high returns as individual high-growth stocks, if those stocks perform exceptionally well.

Evaluating ETF Performance and Risk:

Past performance is not indicative of future results, a crucial caveat when investing in any emerging technology, especially autonomous vehicles.

- Influencing Factors: The performance of autonomous vehicle ETFs is significantly influenced by market volatility, regulatory changes (new safety regulations, liability laws), technological breakthroughs (faster processing speeds, improved sensor technology), and the competitive landscape. Economic downturns can also significantly impact investor sentiment and fund performance.

- Risk Tolerance and Diversification: Investing in autonomous vehicle ETFs involves significant risk due to the nascent nature of the technology. Investors need a high-risk tolerance and should diversify their portfolios beyond this single sector to mitigate potential losses. Always seek professional financial advice before making investment decisions.

The Broader Impact on the Future of Transportation

Beyond Ride-Sharing:

The applications of autonomous vehicle technology extend far beyond ride-sharing services.

- Wider Applications: Autonomous vehicles are poised to transform trucking, delivery services, and public transportation. Self-driving trucks could improve efficiency and reduce transportation costs, while autonomous buses could enhance public transit accessibility and safety.

- Societal Impacts: The widespread adoption of autonomous vehicles will have profound societal impacts, including potential job displacement in the trucking and transportation industries, increased efficiency in logistics and supply chains, and potentially improved road safety through reduced human error. However, new jobs in areas such as autonomous vehicle maintenance and software development are expected to emerge.

Investing in the Infrastructure:

The success of autonomous vehicles relies heavily on supporting infrastructure.

- Infrastructure Investments: Investment opportunities exist in companies and ETFs that focus on 5G network development (essential for real-time data transmission), charging infrastructure for electric autonomous vehicles, and advanced mapping technologies.

- Long-Term Growth: These supporting infrastructure sectors are likely to experience significant long-term growth as autonomous vehicles become more prevalent. Investing in these areas can provide diversified exposure to the broader autonomous vehicle ecosystem.

Conclusion

Uber's significant role in developing autonomous vehicle technology, coupled with the potential for high returns (and risks) through ETF investments, highlights the transformative impact of this sector on the future of transportation and related infrastructure. Investing in the future of transportation through autonomous vehicle technology ETFs can be a strategic move for investors with a high-risk tolerance. Research the ETFs discussed, carefully consider your risk profile, and consult with a financial advisor before investing. Start your journey towards participating in this transformative industry. Learn more about autonomous vehicle technology ETFs and diversify your investment portfolio today!

Featured Posts

-

31st Sedona International Film Festival Pobedata Na Lena I Vladimir

May 17, 2025

31st Sedona International Film Festival Pobedata Na Lena I Vladimir

May 17, 2025 -

Svjontek Pobjeduje Detaljan Pregled Meca I Najnovije Vijesti

May 17, 2025

Svjontek Pobjeduje Detaljan Pregled Meca I Najnovije Vijesti

May 17, 2025 -

Reddit Outage What Happened And When Will It Be Fixed

May 17, 2025

Reddit Outage What Happened And When Will It Be Fixed

May 17, 2025 -

Ftc Appeals Activision Blizzard Acquisition A Deep Dive

May 17, 2025

Ftc Appeals Activision Blizzard Acquisition A Deep Dive

May 17, 2025 -

Analiza Prosvjed U Teslinom Izlozbenom Prostoru U Berlinu I Njegova Simbolika

May 17, 2025

Analiza Prosvjed U Teslinom Izlozbenom Prostoru U Berlinu I Njegova Simbolika

May 17, 2025