Investing In Uber (UBER): What To Consider

Table of Contents

Uber's Business Model and Market Position

Uber's core business revolves around connecting passengers with drivers through its ride-hailing app, a service that has become synonymous with modern transportation. Beyond ride-hailing, Uber has significantly expanded its operations to include Uber Eats, a leading food delivery platform, and Uber Freight, targeting the logistics and transportation industry. This diversification strengthens its revenue streams and reduces reliance on any single service.

Uber holds a substantial market share in the ride-sharing industry, though its dominance is challenged by competitors like Lyft. The competitive landscape is also evolving with the emergence of new players and the increasing integration of ride-sharing into broader mobility solutions. The food delivery market is equally competitive, with established players like DoorDash and Grubhub vying for market share.

- Market dominance in ride-sharing: While facing competition, Uber remains a major player globally.

- Expansion into food delivery and freight: This diversification mitigates risk and opens new avenues for growth.

- Competitive pressures and market saturation risks: Intense competition and potential market saturation in established areas pose challenges.

- Geographic diversification and international growth opportunities: Expanding into new markets remains a key strategy for future growth. Analyzing Uber's international performance is crucial for any investor.

Financial Performance and Growth Prospects

Analyzing Uber's financial performance requires a careful review of its recent financial reports. Key metrics like revenue growth, earnings per share (EPS), price-to-earnings ratio (P/E), and overall profitability provide insights into the company's financial health. While Uber has demonstrated significant revenue growth, profitability remains a focus area. Understanding the factors impacting Uber's profitability, including fluctuating fuel prices and operational costs, is critical.

Future growth prospects hinge on several factors. Continued expansion into new markets, both domestically and internationally, will be vital. The success of Uber Eats and Uber Freight will also significantly influence the company's overall financial performance. Moreover, technological advancements, such as the development of autonomous vehicle technology, could have a profound impact on Uber's long-term growth trajectory. Market forecasts and industry analysts' projections should be considered when evaluating potential returns.

- Revenue growth trends and profitability analysis: Examining historical trends and future projections is crucial.

- Key financial metrics (EPS, P/E ratio, revenue growth): Understanding these metrics is essential for evaluating investment potential.

- Long-term growth projections and market forecasts: Analyzing industry trends and market forecasts provides a broader perspective.

- Impact of economic downturns and fluctuating fuel prices on profitability: Understanding these external factors is key to assessing risk.

Risks and Challenges Facing Uber

Investing in UBER involves considering several inherent risks. Regulatory hurdles and legal battles in various jurisdictions pose a significant challenge. Driver compensation and labor relations remain a contentious issue, with potential for increased costs and negative publicity. Technological disruption, from competitors or advancements in autonomous vehicles, could drastically alter the company's landscape.

Macroeconomic conditions significantly impact Uber's performance. Economic downturns could reduce demand for ride-sharing and food delivery services. Cybersecurity threats and data privacy concerns also pose risks, particularly given the sensitive nature of the data Uber handles.

- Regulatory challenges and legal battles: Ongoing legal battles and regulatory changes can impact operations and profitability.

- Driver compensation and labor relations: This remains a significant cost factor and potential source of disruption.

- Technological disruption and innovation: Rapid technological change could render existing business models obsolete.

- Economic sensitivity and recessionary risks: Uber's business is highly sensitive to economic fluctuations.

- Cybersecurity and data privacy concerns: Data breaches and privacy violations could severely damage the company's reputation and incur significant costs.

Valuation and Investment Strategy

Evaluating Uber's current stock valuation involves comparing its metrics (like P/E ratio and market capitalization) with those of its competitors, such as Lyft. Analyzing the historical stock price and predicting future price movements requires careful consideration of the factors discussed above. Investors should also consider whether a long-term or short-term investment strategy aligns best with their risk tolerance and financial goals.

Diversification is crucial in any investment portfolio. Investing in Uber should be part of a broader strategy, not a sole focus. Various options exist, from purchasing UBER stock directly to investing through exchange-traded funds (ETFs) that include UBER as a holding.

- Stock price analysis and valuation metrics: Utilize various valuation methods to assess Uber's intrinsic value.

- Comparison with competitor valuations (Lyft, etc.): Benchmarking against competitors provides valuable context.

- Long-term investment potential versus short-term trading: Consider your time horizon and risk tolerance.

- Portfolio diversification and risk management: Diversification minimizes risk and protects against potential losses.

- Considering options for investing (direct stock purchase, ETFs): Choose the investment vehicle that best suits your needs.

Conclusion

Investing in Uber (UBER) presents both exciting opportunities and significant risks. Before making any investment decision, carefully consider Uber's business model, financial performance, competitive landscape, and inherent challenges. Conduct thorough research, diversify your portfolio, and consult with a financial advisor to determine if investing in UBER aligns with your individual risk tolerance and financial goals. Remember, thoroughly researching and understanding the intricacies of Uber (UBER) before committing your capital is crucial. Start your due diligence today and make informed investment decisions about Uber (UBER).

Featured Posts

-

Experience Orlandos Longest Running Arts Performances The Fringe Festival At Loch Haven Park

May 19, 2025

Experience Orlandos Longest Running Arts Performances The Fringe Festival At Loch Haven Park

May 19, 2025 -

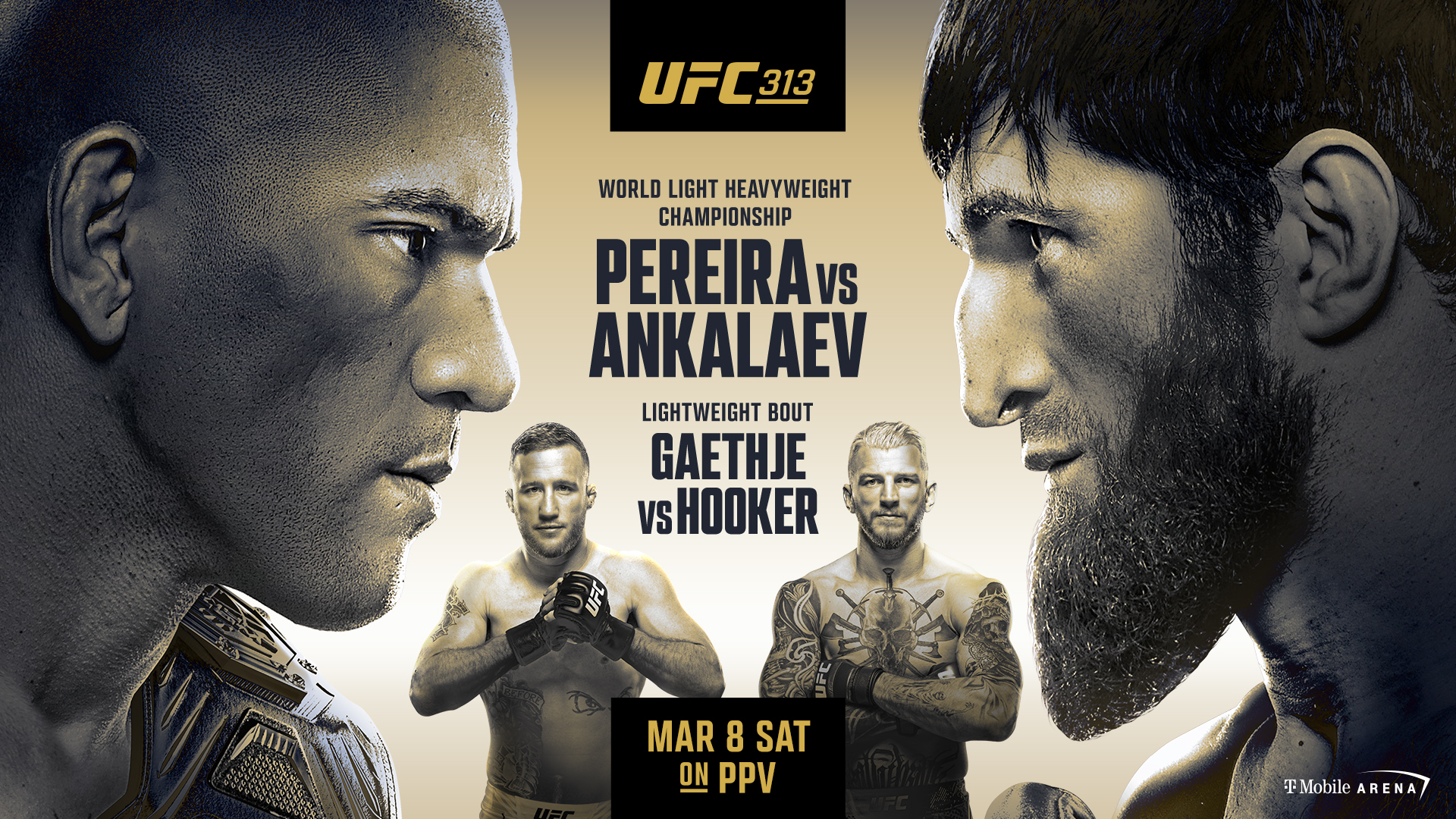

Ufc 313 Post Fight Admission Fuels Robbery Debate

May 19, 2025

Ufc 313 Post Fight Admission Fuels Robbery Debate

May 19, 2025 -

Ufc Vegas 106 Burns Vs Morales Fight Card Odds And Predictions

May 19, 2025

Ufc Vegas 106 Burns Vs Morales Fight Card Odds And Predictions

May 19, 2025 -

Unnecessary Regulation Royal Mail Urges Ofcom To Act

May 19, 2025

Unnecessary Regulation Royal Mail Urges Ofcom To Act

May 19, 2025 -

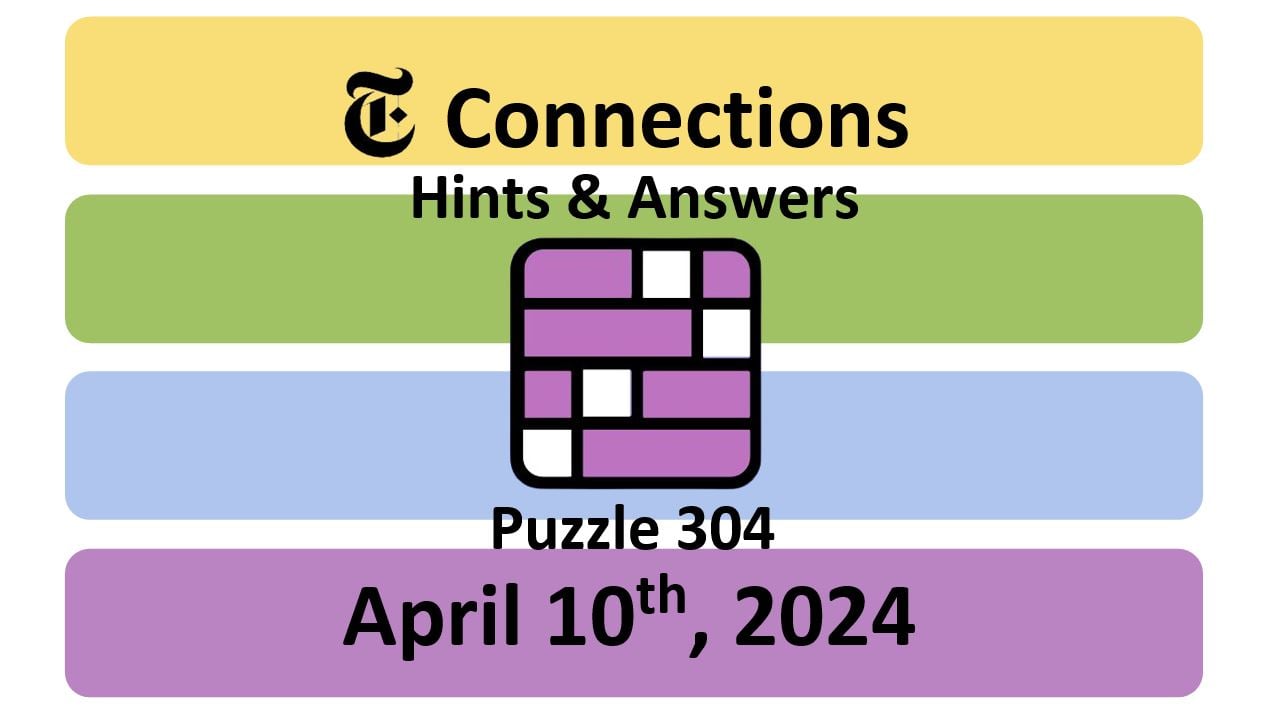

Nyt Connections Puzzle 688 April 29th Hints And Solutions

May 19, 2025

Nyt Connections Puzzle 688 April 29th Hints And Solutions

May 19, 2025