Investor Concerns: Deciphering The Scholar Rock Stock Dip On Monday

Table of Contents

Clinical Trial Updates and Investor Sentiment

Recent news and updates regarding Scholar Rock's ongoing clinical trials likely played a significant role in Monday's stock decline. Investor sentiment in the biotech stock market is heavily influenced by clinical trial results. Any perceived setbacks or delays can trigger immediate negative reactions.

- Specific Clinical Trials: Scholar Rock has several clinical trials underway, focusing on various therapeutic areas. The phase and specific results of these trials are crucial. For example, a potential delay in a Phase 3 trial for a key drug candidate could negatively impact investor confidence.

- Potential Setbacks and Delays: Any unforeseen issues encountered during clinical development, such as unexpected side effects or recruitment challenges, can lead to investor concerns and a subsequent stock dip. Transparency in communicating these challenges is vital to maintaining investor trust.

- Impact of Data Releases: Both positive and negative clinical trial data releases directly impact investor sentiment. Positive data usually boosts SRRK stock price, while negative data or inconclusive results can lead to significant drops, as seen on Monday. The interpretation of this clinical trial results is key for investors and analysts alike. A thorough analysis of the clinical development process and future outlook is needed to understand the long-term impact.

Broader Market Trends and Their Influence

Monday's Scholar Rock stock dip didn't occur in isolation. The overall performance of the stock market and broader market trends also significantly influenced SRRK stock.

- Nasdaq Biotech Index Performance: The biotech sector is highly volatile, often reacting strongly to macroeconomic news and overall market sentiment. A negative trend in the Nasdaq Biotech Index would likely impact individual biotech stocks like Scholar Rock.

- Macroeconomic Factors: Factors like inflation, interest rate hikes, and geopolitical instability can significantly influence investor confidence and risk appetite, leading to widespread market downturns that can impact even fundamentally strong companies. These macroeconomic factors often cause market volatility.

- Correlation with Market Downturn: To understand Monday's stock dip, it's essential to analyze the correlation between Scholar Rock's performance and the overall market downturn. If the broader market volatility was high, it's likely that SRRK’s decline was partially attributable to this general market weakness and not solely company-specific issues.

Analyst Ratings and Price Target Adjustments

Changes in analyst ratings and price targets for Scholar Rock could contribute to the stock price decline. Analyst opinions hold significant influence over investor decisions.

- Specific Analyst Ratings: Tracking changes in ratings from prominent analysts covering Scholar Rock is crucial. A downgrade from a "buy" to a "hold" or "sell" rating can significantly impact investor perception.

- Price Target Adjustments: Lowered price target projections by analysts often lead to downward pressure on the stock price. These adjustments reflect analysts' revised expectations for the company's future performance and potential. Analyzing the reasons behind price target reductions, such as concerns about clinical trial timelines or market competition, is important.

- Investment Ratings and Stock Recommendations: The overall consensus among analysts, reflected in the collective investment rating, offers a broad perspective on the market sentiment toward SRRK. A shift in the consensus stock recommendations may have influenced Monday's drop.

Speculation and Rumor Impact

Market rumors and speculation, while not always based on facts, can cause significant stock price volatility. It's crucial to approach such information with caution, relying only on verified information.

- Market Rumors and Their Impact: While unsubstantiated rumors should be treated with skepticism, their potential to influence short-term stock price movements should not be ignored. Reliable sources should always be cited when discussing such speculation.

- Investment Risk and Market Speculation: Understanding the risks associated with market speculation is vital. Investors should never base investment decisions solely on unsubstantiated rumors or speculation, as this can lead to significant financial losses.

Conclusion: Navigating the Scholar Rock Stock Dip and Future Outlook

Monday's Scholar Rock stock dip resulted from a combination of factors: updates (or lack thereof) on clinical trials impacting investor sentiment, broader market trends affecting the entire biotech sector, and shifts in analyst ratings and price target projections. While short-term market fluctuations are inherent in the stock market, a comprehensive analysis of these contributing factors is crucial for investors. The future outlook for SRRK stock price remains uncertain, highlighting the importance of thorough stock market analysis and risk assessment. Conduct your own research, considering the long-term investment potential while acknowledging the inherent risks. Stay informed on the latest developments regarding Scholar Rock stock and make informed investment strategy decisions based on thorough research.

Featured Posts

-

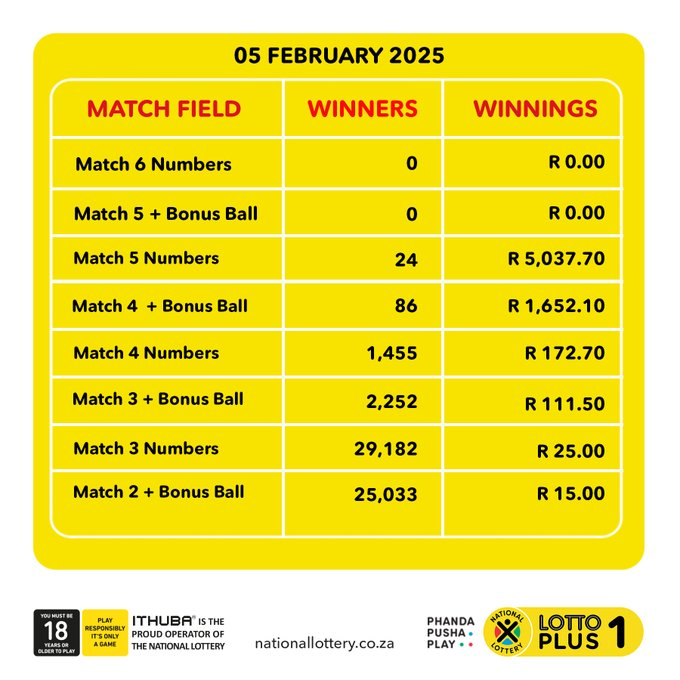

Where To Find The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Numbers

May 08, 2025

Where To Find The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Numbers

May 08, 2025 -

Checken Sie Ihre Zahlen Lotto 6aus49 Vom Mittwoch 9 4 2025

May 08, 2025

Checken Sie Ihre Zahlen Lotto 6aus49 Vom Mittwoch 9 4 2025

May 08, 2025 -

Mookie Betts Absence Illness Impacts Dodgers Freeway Series Start

May 08, 2025

Mookie Betts Absence Illness Impacts Dodgers Freeway Series Start

May 08, 2025 -

Xrp Etf Approval Analyzing The Potential For 800 Million In First Week Investment

May 08, 2025

Xrp Etf Approval Analyzing The Potential For 800 Million In First Week Investment

May 08, 2025 -

New Uber Shuttle Option 5 Rides From United Center For Fans

May 08, 2025

New Uber Shuttle Option 5 Rides From United Center For Fans

May 08, 2025