Investor Flight To Safety: Gold And Cash ETFs Surge

Table of Contents

The Rise of Gold ETFs as a Safe Haven

Understanding the Appeal of Gold in Times of Uncertainty

Gold has historically served as a reliable hedge against inflation and economic downturns. Its value tends to rise during periods of instability, offering a degree of protection to investors' portfolios. This is because gold's price is often inversely correlated with the US dollar; when the dollar weakens, gold typically strengthens. Furthermore, gold's lack of correlation with other asset classes, such as stocks and bonds, makes it an excellent tool for portfolio diversification. This helps reduce overall portfolio risk by mitigating losses in other asset classes during times of market stress.

The increased demand for physical gold and gold-backed ETFs is a direct response to this inherent stability. Investors are actively seeking ways to protect their capital, and gold, in its various forms, is proving to be a popular choice. For example, the SPDR Gold Shares (GLD), one of the largest gold ETFs, has seen significant increases in trading volume and asset under management in recent months, mirroring a broader trend across the gold ETF market.

- Benefits of Gold ETFs:

- Liquidity: Easily bought and sold on major exchanges.

- Accessibility: Requires less capital than purchasing physical gold.

- Diversification: Reduces portfolio risk by hedging against inflation and market volatility.

- Transparency: Holdings and performance are readily available.

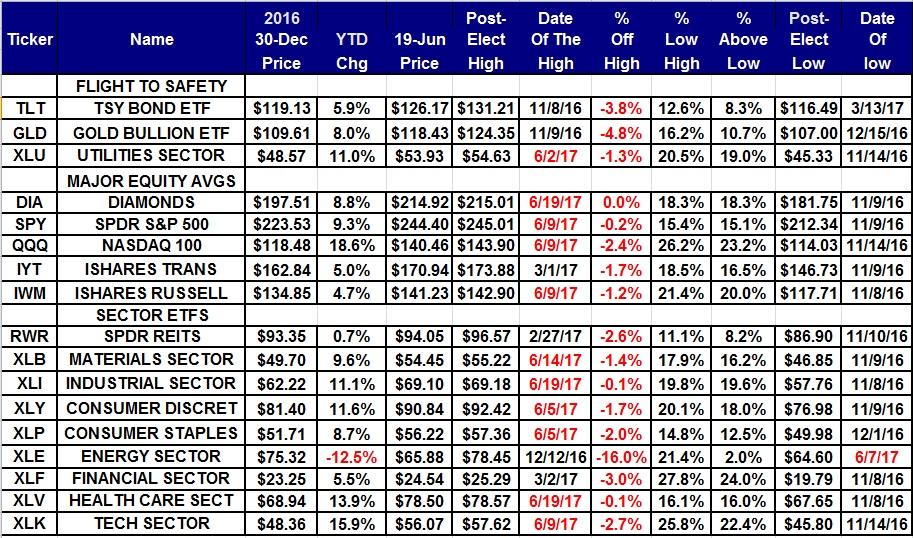

Analyzing Recent Gold ETF Performance

[Insert chart showing recent surge in Gold ETF prices here]

The chart above clearly illustrates the recent surge in Gold ETF prices, reflecting the strong investor demand. Comparing gold ETF performance against other asset classes like stocks (represented by the S&P 500) and bonds (represented by a relevant bond index) reveals a stark contrast. While stocks and bonds may experience significant fluctuations, gold often displays relative stability, even during periods of market downturn. This relative stability is fueled by various factors, including:

- Inflation: High inflation erodes the purchasing power of fiat currencies, increasing the attractiveness of gold as a store of value.

- Geopolitical Events: Global uncertainty and geopolitical instability often lead to increased demand for safe-haven assets like gold.

- Interest Rates: Changes in interest rates can influence the relative attractiveness of gold compared to other investments.

The Surge in Cash ETFs: A Preference for Liquidity

Why Investors are Choosing Cash ETFs

In times of uncertainty, investors often prioritize liquidity and capital preservation. Cash, in its purest form, provides a low-risk, readily accessible asset. Cash ETFs offer the convenience and ease of access of a traditional savings account, but with added transparency and often better yields. They allow investors to quickly access their funds when needed, without the complexities of dealing with individual bank accounts.

Unlike traditional savings accounts, Cash ETFs often offer competitive yields, making them an attractive alternative for investors seeking a combination of safety and return. While the yields may be modest, they often surpass those offered by traditional savings accounts, particularly in a low-interest-rate environment. Furthermore, Cash ETFs play a vital role in managing portfolio risk and preserving capital, offering a safe haven during periods of market volatility.

- Benefits of Cash ETFs:

- Low Risk: Minimal risk of capital loss.

- Liquidity: Easy and quick access to funds.

- Transparency: Clear and readily available information on holdings and performance.

- Efficiency: Streamlined investment and management process.

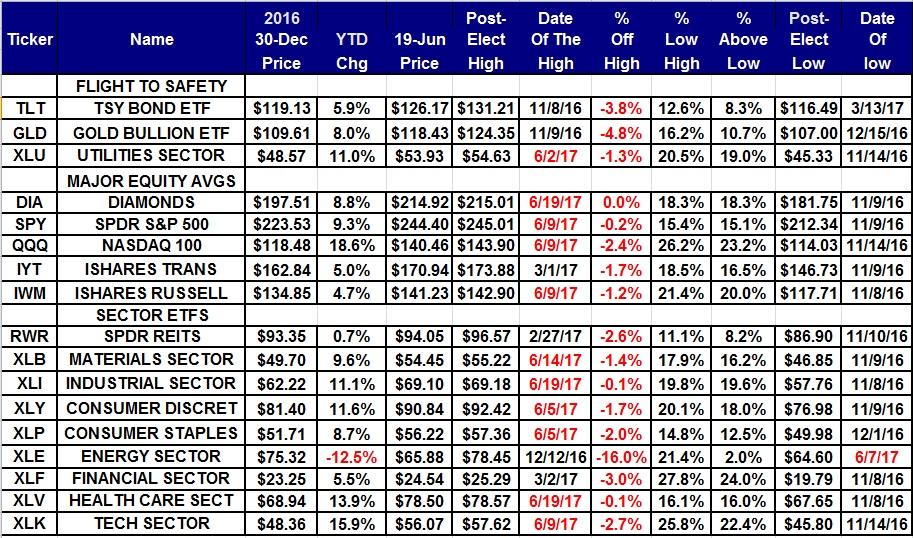

Evaluating the Performance and Outlook for Cash ETFs

[Insert chart showing recent Cash ETF performance data here]

The above chart displays the recent performance of Cash ETFs. While yields may fluctuate depending on prevailing interest rates, they generally provide a stable and predictable return. Changes in interest rates, set by central banks, directly influence the yields offered by Cash ETFs. A rise in interest rates generally leads to higher yields, making Cash ETFs more attractive to investors. Economic forecasts are crucial in predicting future demand for Cash ETFs. In times of economic uncertainty, the demand for these low-risk assets typically rises.

Implications for the Broader Market

Interpreting the Flight to Safety as a Market Indicator

The "investor flight to safety" into Gold and Cash ETFs serves as a significant indicator of broader economic concerns. This shift in investor sentiment reflects a growing apprehension about the potential for further market volatility and economic downturn. The sustained increase in demand for these safe-haven assets suggests a lack of confidence in riskier investments such as stocks and bonds.

This trend has potential implications for various asset classes. A continued "flight to safety" could lead to lower stock prices and potentially depress bond yields. The sustainability of the current trend depends on several factors, including the evolution of global economic conditions, geopolitical stability, and central bank policies.

- Potential Future Scenarios:

- Continued Uncertainty: Sustained demand for Gold and Cash ETFs.

- Economic Recovery: Gradual shift back towards riskier assets.

- Increased Volatility: Further intensification of the "flight to safety."

Conclusion

The significant increase in demand for Gold and Cash ETFs underscores a growing "investor flight to safety" driven by global economic uncertainty. The performance of these assets reflects a clear preference for stability and liquidity amidst market volatility. Understanding this trend is crucial for investors navigating the current economic landscape.

Call to Action: Are you considering adjusting your investment strategy in response to this "investor flight to safety"? Learn more about the benefits of Gold and Cash ETFs and how they can help protect your portfolio during times of uncertainty. Explore your options for diversifying your investments with Gold and Cash ETFs today.

Featured Posts

-

Sf Giants Defeat Brewers Flores And Lees Key Performances

Apr 23, 2025

Sf Giants Defeat Brewers Flores And Lees Key Performances

Apr 23, 2025 -

Pavel Pivovarov Anonsiroval Sovmestniy Merch S Aleksandrom Ovechkinym

Apr 23, 2025

Pavel Pivovarov Anonsiroval Sovmestniy Merch S Aleksandrom Ovechkinym

Apr 23, 2025 -

Ser Aldhhb Eyar 24 Alywm Sbykt 10 Jramat 17 Fbrayr 2025

Apr 23, 2025

Ser Aldhhb Eyar 24 Alywm Sbykt 10 Jramat 17 Fbrayr 2025

Apr 23, 2025 -

Entretien Avec Pascal Boulanger President De La Federation Des Promoteurs Immobiliers

Apr 23, 2025

Entretien Avec Pascal Boulanger President De La Federation Des Promoteurs Immobiliers

Apr 23, 2025 -

French Presidential Election Macrons Gambit For A Fall Vote

Apr 23, 2025

French Presidential Election Macrons Gambit For A Fall Vote

Apr 23, 2025