Investor Sentiment Shifts Amidst Japan's Steepening Bond Curve

Table of Contents

The Mechanics of Japan's Steepening Yield Curve

A steepening yield curve refers to the widening gap between short-term and long-term Japanese government bond (JGB) yields. This phenomenon typically reflects changing expectations about future interest rates and economic growth. Several factors contribute to the current steepening of Japan's yield curve:

- Increased Inflation Expectations: While still relatively low by global standards, inflation in Japan is rising, leading investors to anticipate future interest rate hikes by the Bank of Japan (BOJ). This expectation drives up long-term yields.

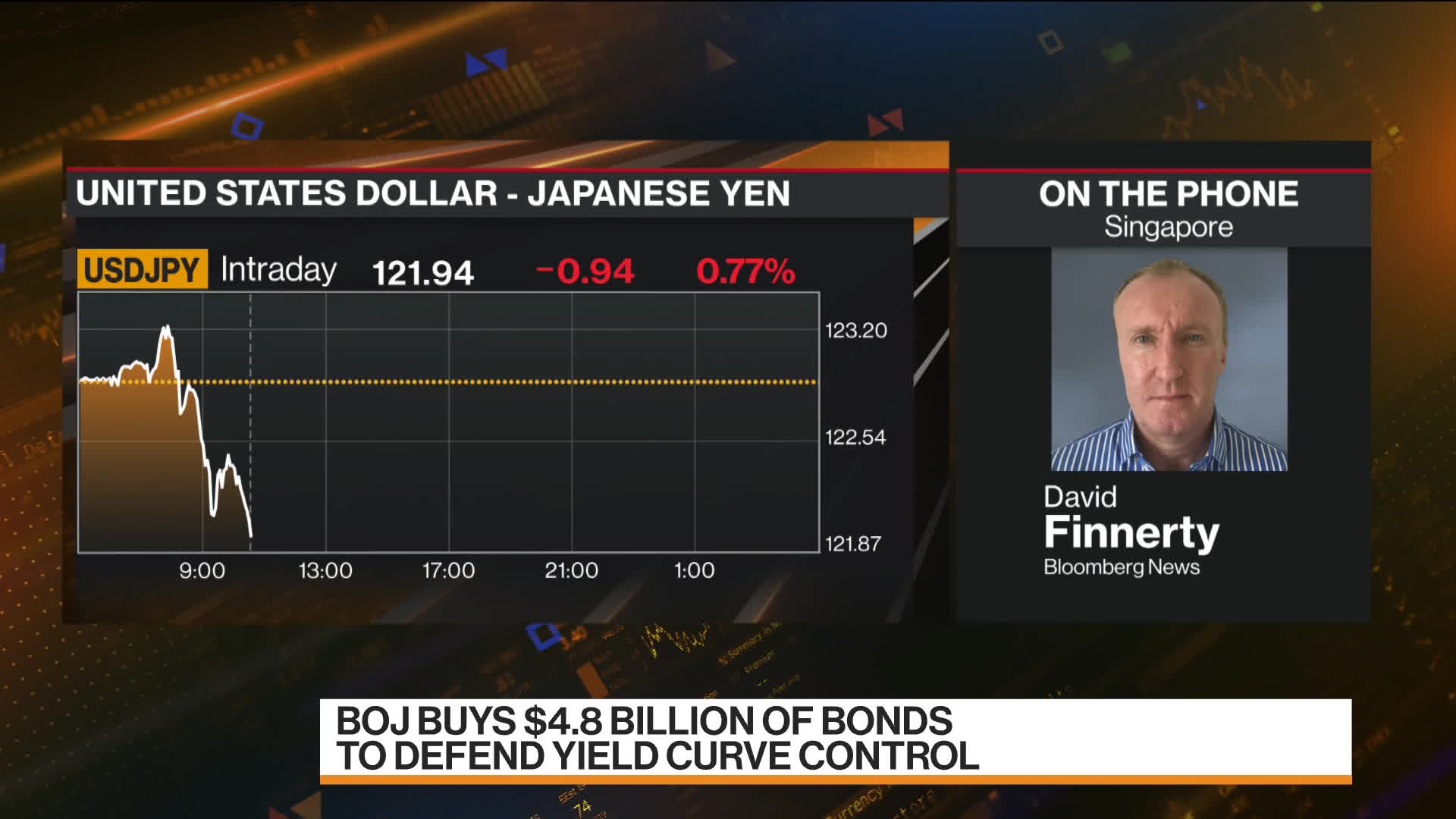

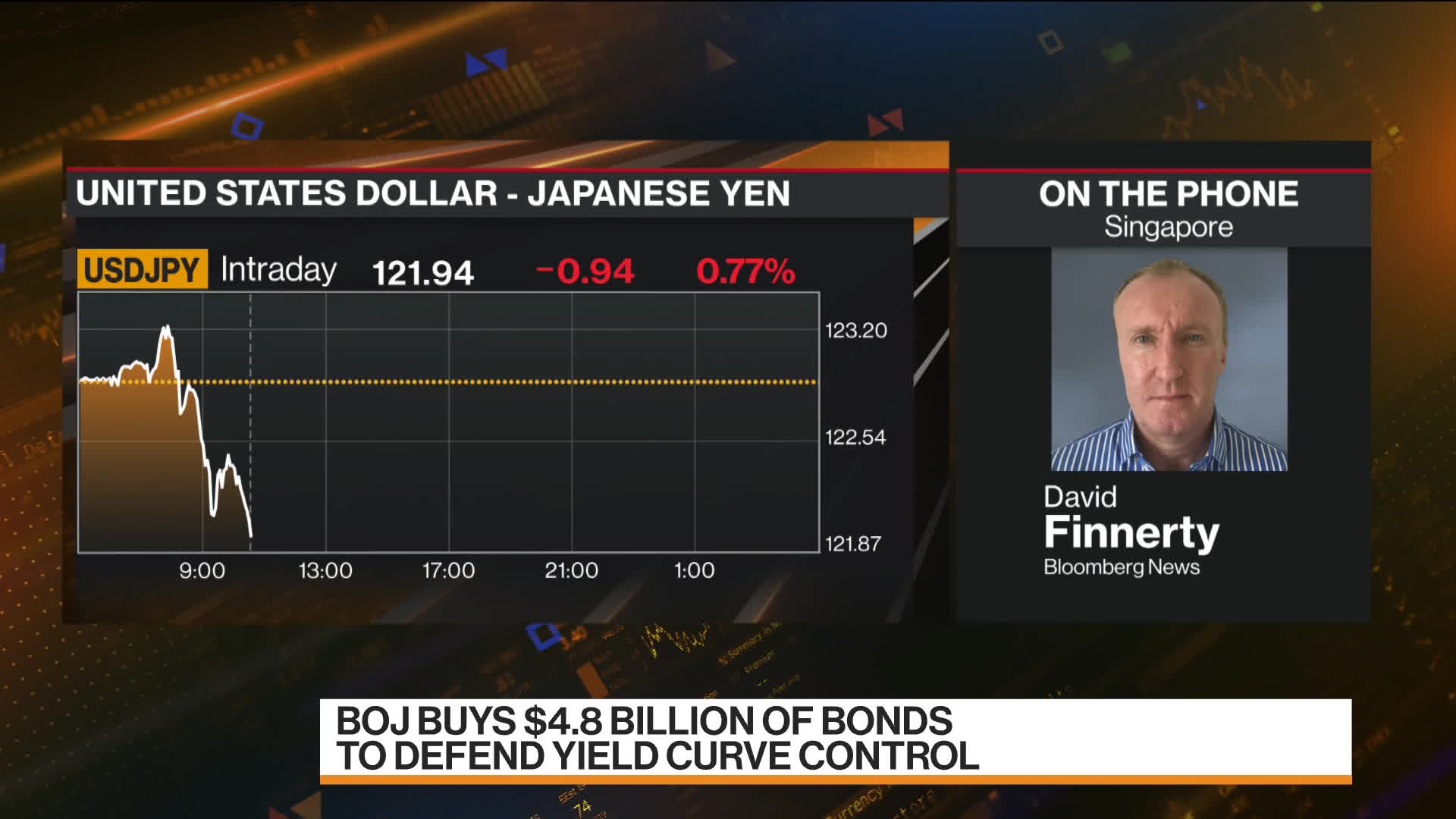

- Shifting Market Sentiment Regarding BOJ Policy Adjustments: Speculation about the BOJ potentially abandoning its ultra-loose monetary policy, including its yield curve control (YCC) program, is fueling the steepening curve. Market participants are pricing in the possibility of future policy changes.

- Impact of Global Interest Rate Hikes: Global central banks, including the Federal Reserve, have been aggressively raising interest rates to combat inflation. This global trend influences Japanese bond yields, making Japanese assets relatively less attractive compared to higher-yielding alternatives.

- Technical Factors Affecting Bond Trading Volumes: Increased trading activity and shifts in investor positions can also contribute to the steepening curve, creating momentum and amplifying existing trends.

[Insert chart/graph here illustrating the steepening yield curve in Japan, clearly showing the widening gap between short-term and long-term yields over a specific time period.]

Impact on Japanese Government Bond (JGB) Yields

The steepening yield curve has significant implications for JGB yields across different maturities:

- Rising Short-Term Yields: Short-term JGB yields are increasing as the market anticipates future interest rate adjustments by the BOJ. This reflects the increasing cost of borrowing in the short term.

- Changes in Long-Term Yields: Long-term JGB yields are also rising, though at a potentially slower pace than short-term yields, reflecting a combination of inflation expectations and the changing landscape of global interest rates.

- Impact on JGB Trading Strategies: The changing yield curve necessitates adjustments in trading strategies for both domestic and international investors. Strategies that previously profited from the flat yield curve may now be less effective.

- Potential Implications for Government Borrowing Costs: A steeper yield curve can lead to higher borrowing costs for the Japanese government, as the cost of issuing new JGBs increases. This could impact government spending and fiscal policy.

Shifting Investor Sentiment and Portfolio Adjustments

The steepening bond curve has triggered a shift in investor sentiment and portfolio adjustments:

- Increased Risk Aversion Among Some Investors: Some investors are becoming more risk-averse, reducing their exposure to Japanese assets given the uncertainty surrounding the BOJ's policy and the potential for further yield increases.

- Potential for Capital Flight: As yields rise in other markets, there's a potential for capital flight from Japan, further impacting the demand for JGBs and other Japanese assets.

- Changes in Investment Strategies by Domestic and International Investors: Investors are re-evaluating their strategies to adapt to the new market environment. Some might shift towards shorter-term bonds or explore alternative investments.

- Impact on the Demand for Japanese Assets: The rising yields and uncertainty are impacting the overall demand for Japanese assets, potentially affecting the Japanese yen's exchange rate.

The Bank of Japan's Response and Future Outlook

The BOJ's response to the steepening yield curve will be crucial in shaping the future outlook:

- Potential for Yield Curve Control Adjustments: The BOJ may need to adjust its YCC policy to manage the steepening curve and maintain stability in the bond market. This could involve widening the acceptable yield range or abandoning the program altogether.

- Impact of Future Monetary Policy Decisions: Future monetary policy decisions by the BOJ will significantly impact JGB yields and overall investor sentiment. Any change in policy will have widespread effects.

- Predictions for Future JGB Yields: Predicting future JGB yields remains challenging given the current uncertainty. However, the current trend suggests continued upward pressure on yields in the near term.

- Uncertainty and Volatility in the Market: Uncertainty surrounding the BOJ's actions and the global economic outlook is likely to lead to increased volatility in the Japanese bond market.

Conclusion: Understanding Investor Sentiment Amidst Japan's Steepening Bond Curve

The steepening of Japan's bond curve is a significant development driven by factors including rising inflation expectations, speculation regarding BOJ policy adjustments, and global interest rate hikes. This shift has considerable implications for JGB yields, investor sentiment, and the overall economic outlook. The BOJ's response will be crucial in determining the future trajectory of the market. Staying informed about shifts in investor sentiment and understanding the implications of Japan's steepening bond curve is crucial for navigating the complexities of the Japanese market. Continue your research and make informed decisions regarding your investments in Japanese government bonds and other related assets.

Featured Posts

-

New Orleans Jazz And Heritage Festival A Comprehensive Guide

May 17, 2025

New Orleans Jazz And Heritage Festival A Comprehensive Guide

May 17, 2025 -

Knicks Suffer Devastating Playoff Elimination Against Clippers

May 17, 2025

Knicks Suffer Devastating Playoff Elimination Against Clippers

May 17, 2025 -

Celtics Vs Magic Nba Playoffs Game 1 Where To Watch Time And Live Stream Options

May 17, 2025

Celtics Vs Magic Nba Playoffs Game 1 Where To Watch Time And Live Stream Options

May 17, 2025 -

Cinema Con 2025 A Look At Warner Bros Pictures Slate

May 17, 2025

Cinema Con 2025 A Look At Warner Bros Pictures Slate

May 17, 2025 -

Novak Djokovic In Zirve Doenuesue Kortlarin Hakimi

May 17, 2025

Novak Djokovic In Zirve Doenuesue Kortlarin Hakimi

May 17, 2025