IPO Activity Halts Amid Tariff-Driven Market Chaos: A Deep Dive

Table of Contents

The Direct Impact of Tariffs on IPO Readiness

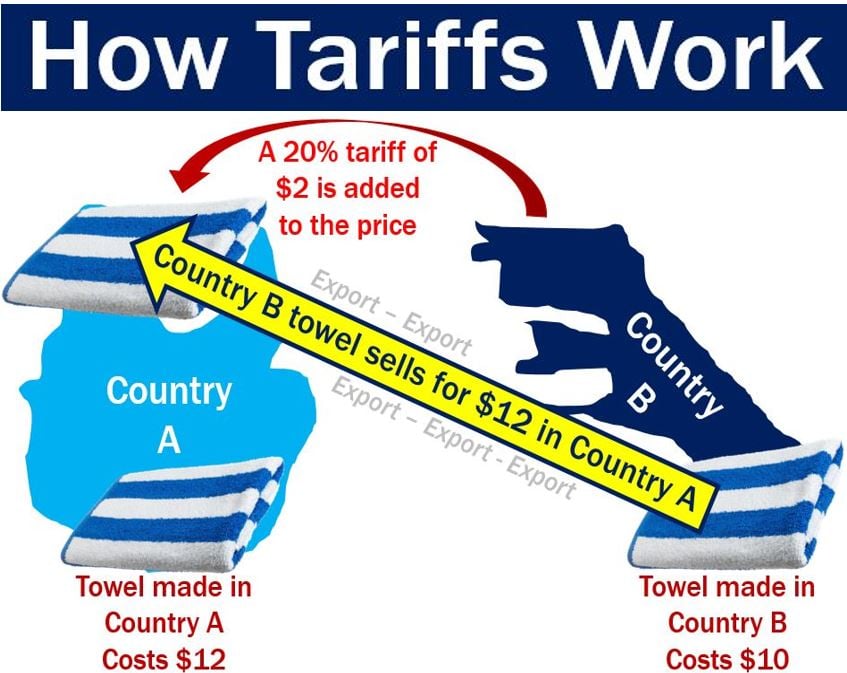

Tariffs inject a significant dose of uncertainty into the equation for companies considering an IPO. The increased costs associated with imported goods directly impact projected revenues and profitability. This uncertainty makes it incredibly difficult for businesses to present a stable and predictable financial picture to potential investors, a critical element for a successful IPO. The impact on supply chains is equally profound. Disruptions caused by tariffs lead to delays, increased costs, and a general lack of predictability, making it harder to forecast future performance.

- Increased operational costs due to tariffs: Higher import duties translate directly into increased production costs, squeezing profit margins and making it harder to meet projected financial targets.

- Uncertainty in forecasting future profits: Fluctuating tariff rates make it almost impossible to accurately predict future earnings, a key concern for investors evaluating the risk of an IPO.

- Difficulty in attracting investors in a volatile market: Investors are naturally risk-averse, and the current volatile market, fueled by tariff uncertainty, makes them less likely to invest in new, unproven companies.

- Potential for reduced valuations due to market uncertainty: The overall market uncertainty driven by tariffs can lead to lower valuations for IPOs, potentially discouraging companies from going public.

Investor Sentiment and Risk Aversion in the Current Climate

The current global economic uncertainty, largely fueled by tariffs and trade wars, has caused a significant shift in investor sentiment. We're seeing a move away from growth-oriented investments and a clear preference for risk aversion. Investors are increasingly prioritizing stability and established companies with proven track records over the perceived higher risk associated with IPOs. This shift is making it substantially harder for new companies to attract the necessary capital to go public.

- Flight to safety: Investors are flocking to established, less volatile assets like government bonds and blue-chip stocks, leaving less capital available for riskier IPOs.

- Decreased appetite for risk: IPOs are inherently riskier than investing in established companies. In uncertain times, this risk is amplified, further diminishing investor interest.

- Increased scrutiny of IPOs: Investors are demanding stronger fundamentals, more detailed financial projections, and a clearer path to profitability before committing capital to an IPO.

Geopolitical Uncertainty and its Role in the IPO Freeze

The current market chaos extends beyond just tariffs. Broader geopolitical factors, including escalating trade wars, Brexit uncertainty, and other global uncertainties, contribute to the overall instability and investor apprehension. This complex web of interconnected global events makes it incredibly challenging for companies to make long-term predictions, a critical factor in IPO planning.

- Global trade disputes fueling market instability: The ongoing trade disputes between major global economies create a volatile environment that discourages investment and dampens IPO activity.

- Brexit uncertainty impacting global economic outlook: The ongoing uncertainty surrounding Brexit continues to cast a shadow over the global economy, adding to the overall sense of instability.

- Overall decreased investor confidence in the global economy: The combination of trade wars, Brexit, and other geopolitical factors has led to a general decrease in investor confidence, making them more hesitant to invest in riskier ventures like IPOs.

Alternative Financing Options and Their Rise in the Current Market

Faced with unfavorable market conditions and the challenges of navigating the tariff-driven market chaos, many companies are turning to alternative financing options. Private equity and venture capital funding have become increasingly attractive alternatives to traditional IPOs. While these options provide immediate capital, they also come with their own set of advantages and disadvantages compared to going public.

- Increased private equity investments in startups: Private equity firms are stepping in to fill the void left by the slowdown in IPO activity, providing crucial funding for companies that might otherwise struggle to secure capital.

- Venture capital funding remains strong despite IPO slowdown: Venture capital continues to be a significant source of funding for startups, even as IPO activity remains subdued.

- Advantages and disadvantages of private vs. public funding: Private funding offers greater control but limits liquidity, whereas public funding provides liquidity but reduces control.

Potential Future Scenarios for the IPO Market

The future of IPO activity hinges largely on how trade tensions and geopolitical uncertainty evolve. Several scenarios are possible, each with different implications for the IPO market recovery timeline.

- Scenario 1: Resolution of trade disputes leading to IPO market recovery: A de-escalation of trade tensions and a resolution of global trade disputes could lead to a swift recovery in IPO activity, restoring investor confidence and unlocking capital for new ventures.

- Scenario 2: Continued uncertainty delaying IPO activity: If trade tensions persist and geopolitical uncertainty remains, the IPO market slowdown could continue for an extended period, forcing companies to rely on alternative financing options.

- Scenario 3: Structural changes in the IPO market as a result of this period: This period of uncertainty could lead to fundamental changes in the IPO market, potentially altering the way companies approach going public and how investors evaluate IPOs.

Conclusion: Navigating the IPO Landscape Amidst Tariff-Driven Market Chaos

This analysis reveals the significant impact of tariffs and broader geopolitical uncertainty on IPO activity. The shift in investor sentiment towards risk aversion, coupled with the exploration of alternative financing options, underscores the challenges companies face when considering an IPO in the current climate. While the current situation presents obstacles, the IPO market has historically shown resilience. Navigating this "tariff-driven market chaos" requires careful consideration and expert guidance. Stay informed about the latest developments in the IPO market and consult with financial experts before making any investment decisions related to IPOs. For further resources and insights, explore reputable financial news sources and consult with your financial advisor.

Featured Posts

-

Improving Online Interactions The Importance Of Dont Hate The Playaz

May 14, 2025

Improving Online Interactions The Importance Of Dont Hate The Playaz

May 14, 2025 -

Public Scrutiny Of Kanye Wests Relationship With Bianca Censori

May 14, 2025

Public Scrutiny Of Kanye Wests Relationship With Bianca Censori

May 14, 2025 -

Moose Jaws Tariff Strategy Aimed At Canadian And Us Markets

May 14, 2025

Moose Jaws Tariff Strategy Aimed At Canadian And Us Markets

May 14, 2025 -

The Power Of Branding Comparing Jannik Sinner And Roger Federers Logos

May 14, 2025

The Power Of Branding Comparing Jannik Sinner And Roger Federers Logos

May 14, 2025 -

Estonian Eurovision Acts Italian Parody A Semi Final Surprise

May 14, 2025

Estonian Eurovision Acts Italian Parody A Semi Final Surprise

May 14, 2025