Iron Ore Falls As China Curbs Steel Output: Market Impact Analysis

Table of Contents

China's Steel Production Curbs: The Driving Force

China, the world's largest steel producer and iron ore consumer, has implemented stringent measures to reduce its steel output. This significant move is driven by a confluence of factors, each playing a crucial role in shaping the current market dynamics.

Environmental Regulations and Their Role

The Chinese government has significantly tightened environmental regulations targeting the steel industry. These regulations aim to reduce carbon emissions and improve air quality, combating severe pollution problems. Specific policies include:

- Stricter emission standards: Steel mills are now held to much higher standards for particulate matter, sulfur dioxide, and nitrogen oxide emissions. Failure to comply results in hefty fines and even production shutdowns.

- Increased monitoring and enforcement: The government has increased its monitoring of steel mills, utilizing advanced technologies to track emissions and ensure compliance. Penalties for violations are significantly harsher.

- Production quotas and capacity limits: Certain regions have imposed production quotas on steel mills, limiting their output to specific levels. This directly impacts the overall steel production capacity.

These measures are having a direct and immediate impact on the China steel industry, forcing mills to either invest heavily in cleaner technologies or reduce their steel production capacity. The resulting decrease in steel production is a major contributor to the falling demand for iron ore.

Economic Slowdown and Reduced Demand

China's economic growth has slowed in recent years, impacting the demand for steel across various sectors. Key factors include:

- Reduced infrastructure spending: Large-scale infrastructure projects, traditionally significant steel consumers, have been scaled back, leading to lower steel consumption.

- Weakening property market: The real estate sector, another major steel consumer, is experiencing a slowdown, further reducing demand.

- Shifting economic priorities: The government is actively pursuing a transition towards a more sustainable and consumption-driven economy, reducing reliance on heavy industry.

The correlation between China's economy and steel demand is undeniable. As the economy slows, so does the demand for steel, directly impacting the iron ore market.

Government Policies Aiming for Sustainable Growth

China's steel production curbs are not merely reactive measures; they're integral to the country's broader strategy for sustainable growth. The government is actively pursuing:

- A shift towards higher-value-added industries: The focus is shifting from heavy industry to sectors like technology, renewable energy, and services.

- Improved energy efficiency: The government is actively promoting the adoption of cleaner and more efficient technologies across various sectors, including steel production.

- Carbon neutrality targets: China has committed to achieving carbon neutrality by 2060, requiring a significant reduction in carbon emissions from industries like steel production.

These long-term goals necessitate a restructuring of the Chinese economy, including the reduction of steel production capacity as part of a larger economic transition.

Impact on the Global Iron Ore Market

The reduced demand for steel from China has had a profound impact on the global iron ore market, leading to significant disruptions across the supply chain.

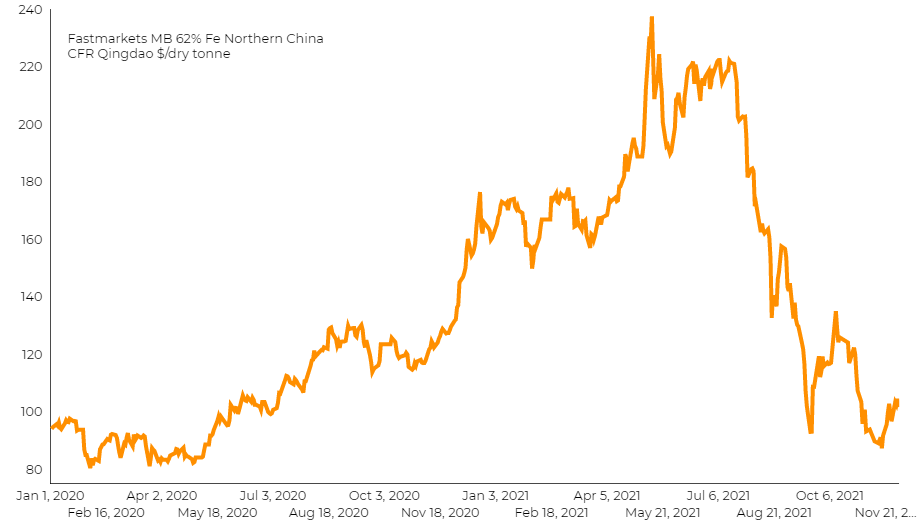

Price Volatility and Fluctuations

The iron ore price has experienced significant volatility in recent months, with sharp drops following China's production cuts. This price volatility has directly impacted:

- Iron ore producers: Companies like BHP, Rio Tinto, and Vale have seen their profits decline as prices fall.

- Iron ore exporters: Countries like Australia and Brazil, major exporters of iron ore, have experienced a reduction in export revenues.

- Investors: The price fluctuations have created uncertainty in the market, affecting investment decisions.

(Insert chart/graph illustrating iron ore price trends)

Supply Chain Disruptions

The reduced demand for iron ore has created disruptions throughout the supply chain:

- Shipping and logistics: The reduced volume of iron ore being shipped has led to lower demand for shipping services, affecting freight rates and potentially leading to job losses.

- Mining operations: Some iron ore mines have scaled back operations or even temporarily shut down due to lower demand.

- Steel mills globally: Steel mills worldwide are facing challenges, with some experiencing reduced profitability due to higher raw material costs.

Impact on Major Iron Ore Producing Countries

Countries like Australia and Brazil, which are heavily reliant on iron ore exports, are experiencing a significant impact:

- Australia: Australia, the world's largest iron ore exporter, has seen a decline in export revenues and faces challenges in adapting to the changing market conditions.

- Brazil: Brazil, another major iron ore exporter, is also feeling the pressure from falling prices and reduced demand.

- Economic consequences: Reduced iron ore exports can have a considerable impact on the economies of these countries, affecting employment and government revenues.

Future Outlook and Predictions for Iron Ore Prices

Predicting future iron ore prices is challenging, but considering current trends and forecasts, we can offer some insights.

Short-Term Predictions

In the short term, iron ore prices are likely to remain volatile, subject to ongoing changes in China's steel production and global economic conditions. A modest recovery is possible if demand picks up, but significant price increases are unlikely in the near future.

Long-Term Projections

In the long term, the outlook for iron ore prices depends largely on China's economic trajectory and its long-term steel production targets. While demand might decrease in the short to medium term due to China's steel production curbs, the long-term outlook depends on the global shift towards sustainable infrastructure projects utilizing steel.

Potential for Price Recovery

Several factors could lead to a recovery in iron ore prices:

- Increased global steel demand driven by infrastructure projects in other countries.

- Technological advancements leading to more efficient and sustainable steel production.

- A resurgence in Chinese economic activity boosting steel demand.

Conclusion: Navigating the Shifting Sands of the Iron Ore Market

China's crackdown on steel output has triggered a significant decline in iron ore prices, creating ripples across the global iron ore market. Understanding the intricate interplay between China's economic policy, environmental regulations, and global commodity markets is crucial for navigating this dynamic landscape. The future of iron ore prices remains uncertain, with both short-term volatility and long-term structural changes influencing the market. Stay informed about developments in the iron ore market and monitor China's steel production for future insights. Subscribe to our newsletter to receive regular updates and in-depth analysis on this crucial commodity market.

Featured Posts

-

Stock Market Live Sensex And Nifty Gains Key Movers Today

May 10, 2025

Stock Market Live Sensex And Nifty Gains Key Movers Today

May 10, 2025 -

Edmonton School Projects Accelerated 14 Initiatives Approved

May 10, 2025

Edmonton School Projects Accelerated 14 Initiatives Approved

May 10, 2025 -

Nyt Strands Game 405 Solutions And Clues For April 12th

May 10, 2025

Nyt Strands Game 405 Solutions And Clues For April 12th

May 10, 2025 -

Solve Nyt Strands Puzzle 377 March 15 Hints And Answers

May 10, 2025

Solve Nyt Strands Puzzle 377 March 15 Hints And Answers

May 10, 2025 -

Nyt Strands Puzzle Solutions For April 9 2025

May 10, 2025

Nyt Strands Puzzle Solutions For April 9 2025

May 10, 2025