Is A 10x Bitcoin Multiplier Realistic? A Chart Analysis For Investors

Table of Contents

Historical Bitcoin Price Performance and Growth Cycles

Analyzing past Bitcoin price movements is vital to understanding the potential for future growth. Let's examine previous bull and bear markets to assess the feasibility of a 10x multiplier.

Analyzing Past Bitcoin Bulls and Bears

Bitcoin's history is marked by dramatic price swings. Examining these cycles provides valuable insights.

- 2013 Bull Run: Bitcoin's price increased by over 5,000%, showcasing its explosive growth potential.

- 2017 Bull Run: Another significant surge, with a price increase exceeding 1,000%.

- 2021 Bull Run: A massive rally, although the percentage increase was lower compared to previous cycles. This demonstrates the diminishing returns as Bitcoin's market capitalization increases.

These periods of explosive growth were fueled by several factors:

- Increased adoption: Growing acceptance by businesses and individuals.

- Technological advancements: Network upgrades and developments in the Bitcoin ecosystem.

- Institutional investment: Large-scale investments from corporations and financial institutions.

Understanding Bitcoin's Volatility and Risk

While Bitcoin's potential for growth is substantial, it's crucial to acknowledge its inherent volatility. Chasing a 10x multiplier involves significant risk.

- Market corrections: Sharp and sudden price drops are common in the cryptocurrency market.

- Bear markets: Extended periods of price decline can wipe out significant gains.

- Regulatory uncertainty: Changes in government regulations can significantly impact Bitcoin's price.

Investing in Bitcoin requires a high-risk tolerance and a thorough understanding of the potential downsides.

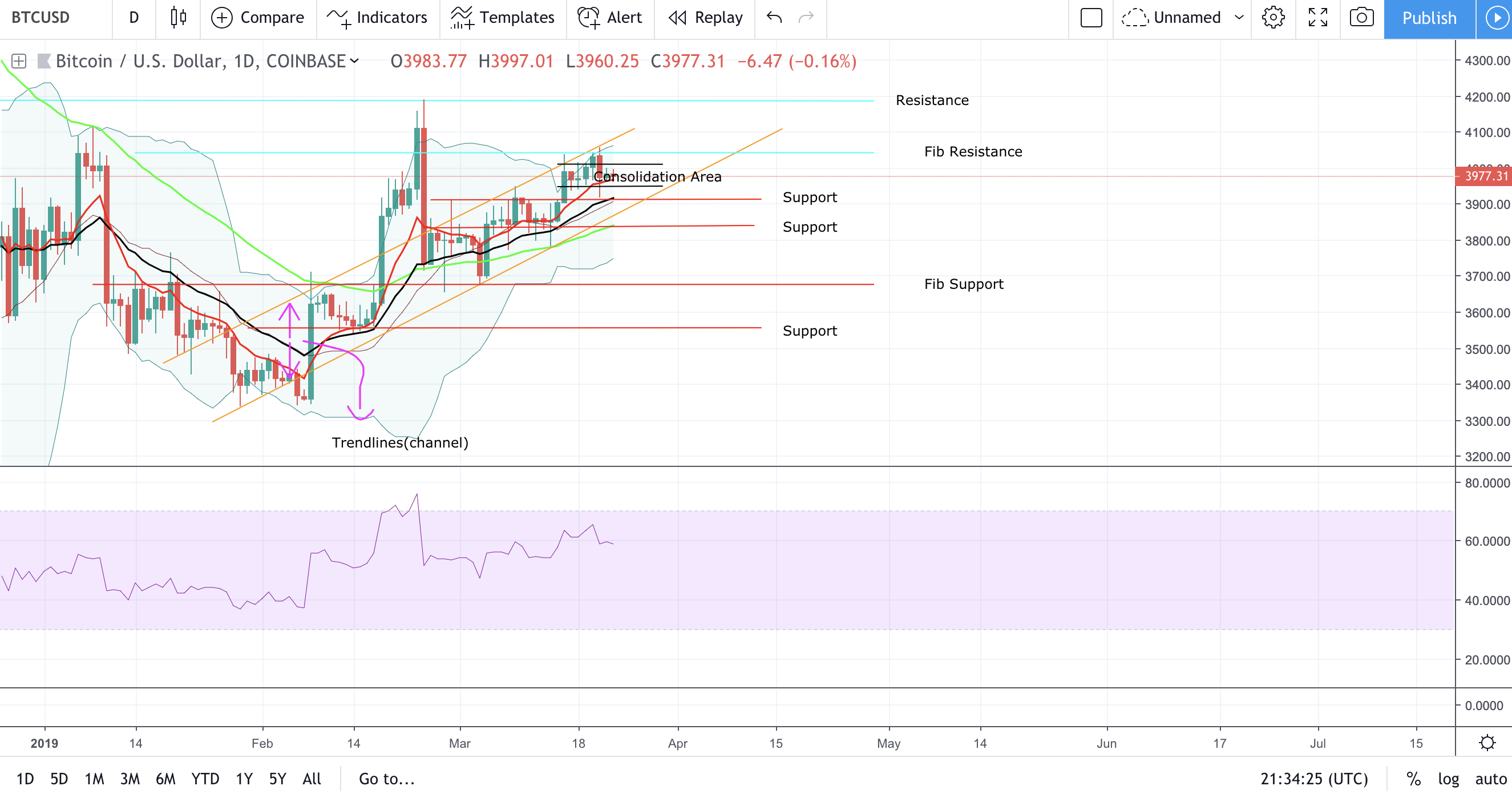

Technical Chart Analysis for Predicting Bitcoin's Future

Technical analysis provides tools to predict potential price movements. Let's explore some key indicators.

Identifying Key Support and Resistance Levels

Technical analysis involves identifying key support and resistance levels on price charts. These levels often represent areas where the price is likely to find buyers (support) or sellers (resistance).

- Moving averages: These are widely used to identify trends and potential reversals.

- Trendlines: Connecting price highs or lows to identify the prevailing trend.

- Technical indicators: Tools such as RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) can help gauge momentum and identify potential overbought or oversold conditions.

Analyzing historical chart patterns can help identify potential future price movements. However, it's important to note that past performance is not necessarily indicative of future results.

Evaluating On-Chain Metrics and Market Sentiment

On-chain data and market sentiment play a crucial role in Bitcoin's price.

- Transaction volume: High transaction volume can indicate strong buying pressure.

- Mining hash rate: A high hash rate indicates a secure and robust network.

- Market sentiment: Gauging investor confidence through social media sentiment analysis and news coverage.

While these indicators can provide valuable insights, relying solely on technical and on-chain analysis can be misleading. A holistic approach is essential.

Macroeconomic Factors Influencing Bitcoin's Price

Macroeconomic factors significantly influence Bitcoin's price.

The Role of Inflation and Global Economic Conditions

Bitcoin is often perceived as a hedge against inflation. During periods of high inflation, investors may flock to Bitcoin as a store of value, potentially driving up its price. Conversely, global economic uncertainty can also increase demand for Bitcoin. However, the correlation between Bitcoin's price and traditional financial markets is not always clear-cut.

Regulatory Landscape and Institutional Adoption

Government regulations and institutional adoption play a pivotal role in shaping Bitcoin's price trajectory.

- Regulatory clarity: Clearer regulatory frameworks can attract institutional investors and boost confidence.

- Institutional adoption: Increased participation by large financial institutions can significantly impact the price.

Examples of regulatory developments and their impact on the market need continuous monitoring.

Conclusion: Is a 10x Bitcoin Multiplier Realistic? A Final Verdict

A 10x Bitcoin multiplier is certainly within the realm of possibility, given its history of explosive growth. However, our analysis highlights the significant risks involved. While historical data, technical indicators, and macroeconomic factors suggest potential for substantial growth, the volatility inherent in Bitcoin necessitates a cautious approach. The unpredictable nature of the cryptocurrency market emphasizes the importance of careful risk management and diversification. While a 10x Bitcoin multiplier is possible, it's crucial to approach Bitcoin investment with a realistic understanding of the market. Continue your research and develop a well-informed strategy for navigating the exciting but volatile world of Bitcoin.

Featured Posts

-

Analysis Ps 5 Pro Sales Fall Short Of Initial Projections

May 08, 2025

Analysis Ps 5 Pro Sales Fall Short Of Initial Projections

May 08, 2025 -

Stephen Kings The Long Walk Official Trailer Drops

May 08, 2025

Stephen Kings The Long Walk Official Trailer Drops

May 08, 2025 -

Canadas Carney Rejects Trumps Overtures A White House Showdown

May 08, 2025

Canadas Carney Rejects Trumps Overtures A White House Showdown

May 08, 2025 -

Calf Injury Could Keep Inters Zielinski Out For Several Weeks

May 08, 2025

Calf Injury Could Keep Inters Zielinski Out For Several Weeks

May 08, 2025 -

Krachy Pwlys Chyf Ka Armghan Kys Myn Naahly Ka Aetraf

May 08, 2025

Krachy Pwlys Chyf Ka Armghan Kys Myn Naahly Ka Aetraf

May 08, 2025