Is A Bond Market Crisis Brewing? Understanding The Risks

Table of Contents

Rising Interest Rates and Their Impact on Bond Prices

Rising interest rates pose a significant threat to the bond market. This section explores the mechanics of this threat and the role of the Federal Reserve.

The Inverse Relationship Between Interest Rates and Bond Prices

Rising interest rates make existing bonds less attractive, leading to price declines. This is because:

- Higher yields on new bonds reduce the value of older bonds with lower yields. When interest rates increase, newly issued bonds offer higher yields, making older bonds with lower coupon payments less appealing. Investors will demand a discount on these older bonds to compensate for the lower yield.

- This effect is particularly pronounced for longer-maturity bonds. Longer-term bonds are more sensitive to interest rate changes because their cash flows are further into the future and therefore more discounted by higher rates. A small increase in interest rates can significantly impact the present value of a long-term bond.

- Investors may sell existing bonds to buy higher-yielding alternatives. To maximize returns, investors might sell their lower-yielding bonds and reinvest in bonds with higher yields offered by the current market. This increased selling pressure further drives down prices of existing bonds.

The Federal Reserve's Role in Interest Rate Hikes

The Federal Reserve (Fed) plays a crucial role in influencing interest rates. Its actions to combat inflation have significant implications for the bond market.

- Analyze the Fed's mandate to control inflation and its impact on interest rates. The Fed's primary mandate is to maintain price stability and full employment. To control inflation, the Fed often raises interest rates, making borrowing more expensive and slowing economic growth.

- Discuss the potential for aggressive rate hikes and their consequences. Aggressive rate hikes, while effective in curbing inflation, can also trigger a bond market crisis by sharply reducing bond prices and increasing borrowing costs for businesses and consumers.

- Examine the challenges the Fed faces in balancing inflation control and economic growth. The Fed walks a tightrope, trying to cool inflation without triggering a recession. Finding the right balance is crucial and highly challenging, particularly in the current economic environment.

Inflation and its Erosive Effect on Bond Returns

High inflation significantly erodes the real return on bond investments.

The Impact of High Inflation on Bond Yields

Inflation diminishes the purchasing power of future bond payments.

- Define real yield and how it's calculated. Real yield represents the return on a bond after adjusting for inflation. It is calculated by subtracting the inflation rate from the nominal yield.

- Show the relationship between inflation and real bond yields. High inflation leads to lower real yields, meaning investors receive a smaller real return on their investment after accounting for inflation.

- Discuss the implications for investors seeking to preserve capital. For investors focused on capital preservation, high inflation coupled with low real yields poses a substantial threat to their investment goals.

Inflation Expectations and Bond Market Volatility

Changing inflation expectations directly influence bond prices and market volatility.

- Discuss the role of inflation forecasts in shaping investor behavior. Investors closely monitor inflation forecasts to adjust their bond investment strategies. Unexpected increases in inflation can trigger significant market volatility.

- Explain how unexpected inflation shocks can impact bond markets. Sudden and unexpected jumps in inflation can lead to sharp declines in bond prices as investors recalibrate their expectations for future returns.

- Describe the impact on long-term bond investors. Long-term bond investors are particularly vulnerable to inflation shocks, as the impact of inflation compounds over time, eroding the real value of their future bond payments.

Geopolitical Risks and Their Influence on Bond Market Stability

Geopolitical events significantly impact investor sentiment and bond market stability.

The Impact of Global Uncertainty on Investor Sentiment

Global uncertainty reduces investor risk appetite and increases demand for safe-haven assets.

- Discuss the effect of war, political instability, and trade disputes. Geopolitical risks such as war and political instability often cause investors to flee to the perceived safety of government bonds, potentially driving up bond prices temporarily. However, prolonged uncertainty can lead to market instability.

- Explain how "flight to safety" affects bond prices. During times of crisis, investors often seek the safety of government bonds, increasing demand and driving up prices. This is commonly known as a "flight to safety."

- Analyze the impact of specific geopolitical events on bond markets. Major geopolitical events, such as wars or major political upheavals, can cause significant and immediate volatility in the bond market.

Diversification Strategies to Mitigate Geopolitical Risks

Diversification is crucial to reduce the impact of geopolitical risks.

- Recommend diversifying across different bond markets and asset classes. Investors can spread their risk by investing in bonds from different countries and asset classes, reducing dependence on a single market or region.

- Discuss the importance of due diligence and professional financial advice. Thorough research and professional advice are critical in navigating geopolitical risks and making informed investment decisions.

- Mention alternative investments that might offer better protection. Some alternative investments, like gold or other precious metals, might provide better protection against geopolitical risks than traditional bonds.

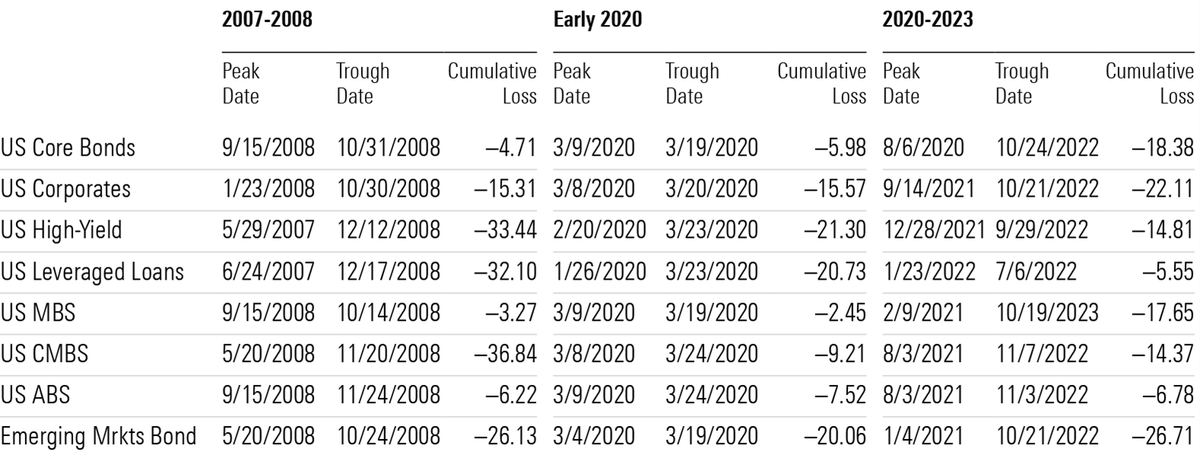

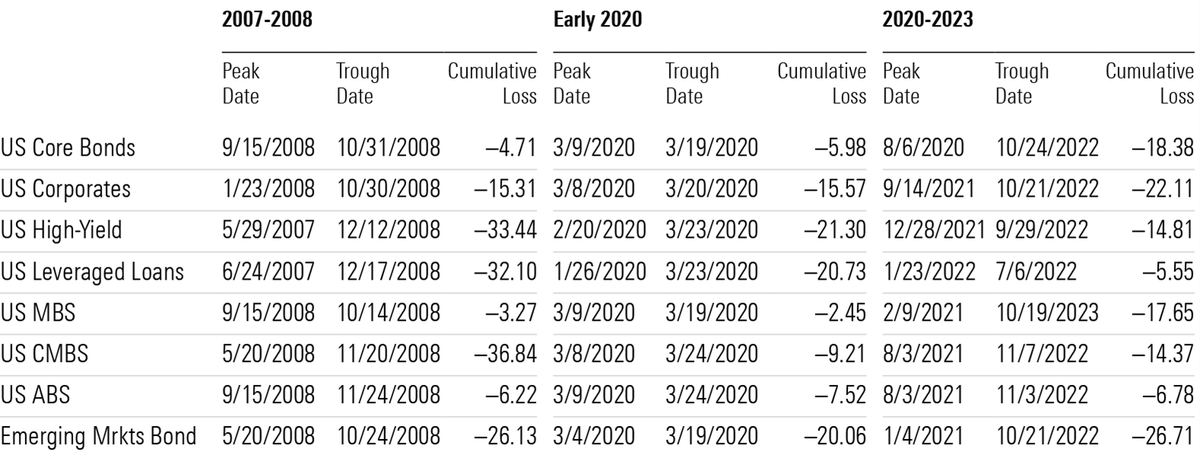

Signs of a Potential Bond Market Crisis

Several indicators can signal a potential bond market crisis.

Credit Spreads and Default Risks

Widening credit spreads, the difference between yields on corporate bonds and government bonds, suggest increasing default risk.

Yield Curve Inversion

An inverted yield curve, where short-term bond yields exceed long-term yields, is often seen as a predictor of economic recession and potential bond market stress.

Decreased Liquidity in the Bond Market

Reduced trading volume and difficulty in buying or selling bonds indicate decreased market liquidity, increasing the risk of sharp price swings.

Conclusion

The possibility of a bond market crisis is a serious concern given the current economic climate. Understanding the potential risks and employing appropriate diversification strategies is crucial for investors seeking to protect their portfolios. By carefully monitoring key indicators like interest rate changes, inflation, geopolitical events, credit spreads, and yield curve behavior, you can navigate the complexities of the bond market and mitigate the potential impact of a future bond market crisis. Don't wait until it's too late; start assessing your exposure to bond market risks today and seek professional financial advice if needed. Proactive management of your bond portfolio is key to weathering potential market storms.

Featured Posts

-

Troy Cassar Daleys Historic Queensland Music Awards Win 2025 Triumph

May 29, 2025

Troy Cassar Daleys Historic Queensland Music Awards Win 2025 Triumph

May 29, 2025 -

Rayquaza Ex Arrives In Pokemon Tcg Pocket 6 Month Anniversary Event Details

May 29, 2025

Rayquaza Ex Arrives In Pokemon Tcg Pocket 6 Month Anniversary Event Details

May 29, 2025 -

Dalton Invests In Fuji Media A Partnership With Murakami Connections

May 29, 2025

Dalton Invests In Fuji Media A Partnership With Murakami Connections

May 29, 2025 -

Discounted Nike Air Max Excee 57 Sale

May 29, 2025

Discounted Nike Air Max Excee 57 Sale

May 29, 2025 -

Waspada Hujan Petir Menerjang Jawa Timur Besok 29 Maret 2024

May 29, 2025

Waspada Hujan Petir Menerjang Jawa Timur Besok 29 Maret 2024

May 29, 2025