Is Apple Stock Headed To $254? One Analyst's Prediction And Your Investment Strategy

Table of Contents

The $254 Apple Stock Price Prediction: A Closer Look

A recent prediction from renowned analyst [Analyst's Name] at [Analyst's Firm] suggests Apple stock (AAPL) could reach $254 per share. This prediction, made on [Date of Prediction] and detailed in [Report/Publication Name], rests on several key arguments.

The key arguments supporting the $254 Apple stock price prediction include:

- Strong iPhone Sales Growth: Apple continues to dominate the premium smartphone market, with consistent growth in iPhone sales, particularly in emerging markets. This sustained demand is a crucial driver of Apple's overall revenue and profitability. Increased sales of newer models, coupled with strong demand for older models, contributes to this revenue stream.

- Expansion into New Markets (e.g., AR/VR, Services): Apple's diversification beyond its core hardware business into services (like Apple Music, iCloud, and Apple TV+) and emerging technologies (like Augmented Reality and Virtual Reality) offers significant growth potential. These areas provide recurring revenue streams and reduce reliance on fluctuating hardware sales.

- Continued Innovation and Technological Leadership: Apple's reputation for innovation and its consistent release of cutting-edge products ensures strong brand loyalty and attracts new customers. Continued leadership in key technologies positions Apple for future growth.

- Strong Brand Loyalty and Customer Base: Apple boasts an incredibly loyal customer base, ensuring repeat purchases and a stable revenue stream. This loyal following translates to consistent demand for its products, services, and ecosystem.

However, several counterarguments and potential risks exist:

- Global Economic Slowdown and its Impact on Consumer Spending: A global economic downturn could significantly impact consumer spending on discretionary items like smartphones and other Apple products, affecting sales and potentially the Apple stock price forecast.

- Increased Competition in the Tech Sector: Intense competition from companies like Samsung, Google, and other tech giants could pressure Apple's market share and profitability. This competition extends across all product categories, including smartphones, wearables, and services.

- Supply Chain Disruptions or Geopolitical Instability: Geopolitical uncertainty and supply chain disruptions could negatively impact Apple's manufacturing and distribution capabilities, affecting production and potentially leading to lower-than-expected Apple share price.

- Potential Regulatory Scrutiny: Increased regulatory scrutiny concerning antitrust issues or data privacy could lead to legal challenges and increased costs for Apple, impacting the $254 Apple stock prediction.

Analyzing Apple's Financial Performance and Future Outlook

Apple's recent financial results show [Insert recent revenue, earnings per share, and other key financial data]. Key Performance Indicators (KPIs) like revenue growth across different product segments, profit margins, cash flow, and capital expenditure are crucial for assessing the validity of the $254 prediction.

Key financial trends to consider include:

- Revenue Growth Across Different Product Segments: Analyze the growth rates of revenue from iPhones, Macs, iPads, Wearables, and Services to determine the drivers of overall revenue growth.

- Profit Margins and Their Sustainability: Assess the sustainability of Apple's high profit margins in the face of increased competition and potential cost pressures.

- Cash Flow and Capital Expenditure: Examine Apple's cash flow generation capacity and its investments in research and development, which are critical for future innovation and growth.

- Share Buyback Programs and Their Impact on Share Price: Apple's share buyback programs can positively influence the share price by reducing the number of outstanding shares.

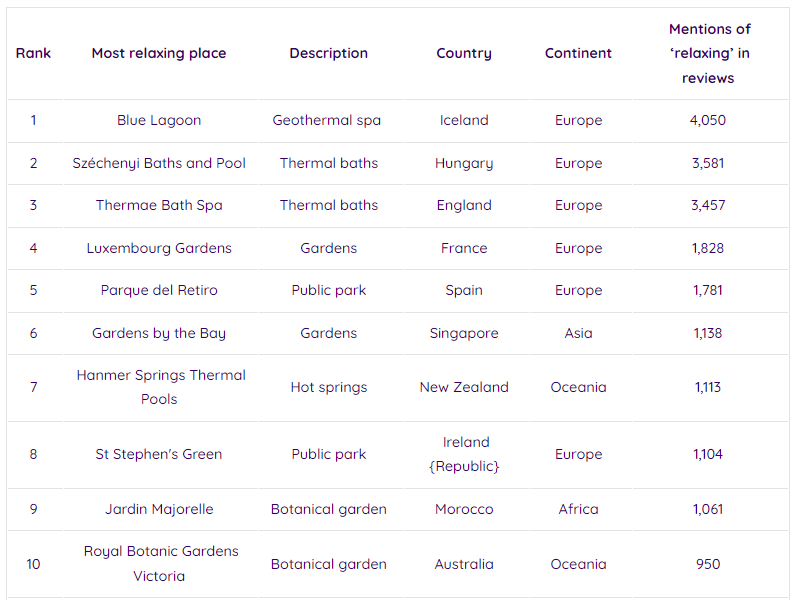

[Insert relevant charts and graphs visualizing Apple's financial data here]

Developing Your Apple Stock Investment Strategy

Investing in Apple stock requires a well-defined strategy considering your risk tolerance and investment goals. Whether you are considering a long-term or short-term investment approach, diversification is paramount.

Key considerations for Apple stock investors include:

- Risk Tolerance and Investment Goals: Assess your comfort level with risk and align your investment strategy with your long-term financial goals.

- Dollar-Cost Averaging Strategy: Consider using dollar-cost averaging to mitigate risk by investing a fixed amount of money at regular intervals.

- Setting Stop-Loss Orders to Manage Potential Losses: Implement stop-loss orders to limit potential losses if the Apple share price falls below a certain level.

- Considering Alternative Investment Options: Diversify your portfolio beyond Apple stock by investing in other assets to mitigate overall risk.

Technical and fundamental analysis can aid your decision-making process. Technical analysis involves studying price charts and trading volume to identify trends, while fundamental analysis focuses on the company’s financial health, management, and competitive landscape.

Conclusion

The prediction of Apple stock reaching $254 is ambitious, based on the analyst's belief in continued strong performance driven by factors including strong iPhone sales, expansion into new markets, and innovation. However, potential risks like economic slowdowns and increased competition need careful consideration. The Apple stock price prediction of $254 is a bold one, contingent upon several factors continuing to align favorably.

Ultimately, deciding whether to invest in Apple stock at its current price depends on your individual risk tolerance and investment goals. Thoroughly research the company's financials, understand the potential risks and rewards, and develop a sound investment strategy before making any decisions regarding Apple stock or other investments. Conduct your own due diligence before investing in Apple stock to determine if a $254 price target aligns with your financial objectives. Remember that past performance is not indicative of future results.

Featured Posts

-

Paris In The Red Luxury Goods Downturn Takes Toll

May 25, 2025

Paris In The Red Luxury Goods Downturn Takes Toll

May 25, 2025 -

Escape To The Country Top Destinations For A Tranquil Life

May 25, 2025

Escape To The Country Top Destinations For A Tranquil Life

May 25, 2025 -

Beloved South Shields Bikers Final Ride A Community Mourns

May 25, 2025

Beloved South Shields Bikers Final Ride A Community Mourns

May 25, 2025 -

Analyzing Trumps Harsh Trade Rhetoric Towards Europe

May 25, 2025

Analyzing Trumps Harsh Trade Rhetoric Towards Europe

May 25, 2025 -

Thierry Ardisson Accusations De Machisme Et La Reaction De Laurent Baffie

May 25, 2025

Thierry Ardisson Accusations De Machisme Et La Reaction De Laurent Baffie

May 25, 2025