Is BigBear.ai Holdings, Inc. (NYSE: BBAI) A Top Penny Stock To Watch?

Table of Contents

BigBear.ai's Business Model and Technology

BigBear.ai's core business revolves around providing AI-powered solutions to both government and commercial clients. Their technology tackles complex data challenges, offering significant advantages in mission-critical applications.

AI-Powered Solutions for Government and Commercial Clients

BigBear.ai leverages advanced AI techniques to solve intricate problems across various sectors. Their expertise spans:

- Intelligence and Defense: Developing AI-driven systems for threat detection, predictive analysis, and improving operational efficiency for national security agencies. They utilize machine learning algorithms to analyze vast datasets, providing critical insights for strategic decision-making.

- Commercial Applications: Offering data analytics and AI solutions for businesses seeking to optimize their operations, enhance customer experiences, and improve predictive modeling. This includes applications in areas like supply chain management, fraud detection, and customer relationship management (CRM).

- Key Technologies: BigBear.ai utilizes a range of advanced technologies including machine learning, deep learning, natural language processing (NLP), and computer vision to build robust and scalable solutions. Their unique approach involves combining these technologies with domain expertise to provide tailored solutions for each client.

Their unique selling proposition lies in their ability to integrate diverse data sources, apply sophisticated AI algorithms, and deliver actionable intelligence to their clients – offering a significant competitive advantage in the rapidly evolving AI market.

Competitive Landscape and Market Position

BigBear.ai operates in a highly competitive AI and data analytics market. Major competitors include established players like Palantir Technologies, IBM, and smaller, specialized AI firms.

- Competitive Advantages: While facing stiff competition, BigBear.ai differentiates itself through its:

- Focus on mission-critical applications for government agencies, providing a unique niche.

- Strong partnerships and collaborations with leading technology providers, enhancing its technological capabilities.

- Experienced team with deep expertise in both AI and the specific industries they serve.

- Market Share and Growth Potential: BigBear.ai's market share is relatively small compared to the giants in the AI market. However, its focus on high-value contracts and strategic partnerships presents significant growth potential, particularly within the government and defense sectors. The growth potential in AI applications across diverse industries is substantial, offering ample opportunity for BBAI to expand its market presence.

Financial Performance and Investment Risks

Analyzing BBAI's financial performance is crucial for any potential investor.

Recent Financial Results and Growth Prospects

Recent financial results should be carefully examined, considering key metrics like:

- Revenue Growth: Assess the trend of revenue growth over the past few quarters or years. Significant and consistent growth indicates strong market demand and successful business execution.

- Profitability: Analyze profit margins and the path to profitability. A company's ability to generate profits is a key indicator of long-term sustainability.

- Cash Flow: Examine the cash flow statement to assess the company's ability to manage its finances effectively. Positive cash flow suggests a healthy financial position.

- Debt-to-Equity Ratio: This ratio reveals the company's financial leverage. A high ratio indicates higher financial risk.

Investors should also consider recent funding rounds, major contract wins, and any significant partnerships as indicators of future growth. Analyzing these factors along with market forecasts will provide a more informed assessment of BBAI's future financial performance.

Potential Risks and Challenges

Investing in BBAI, like any penny stock, comes with significant risks:

- Market Volatility: Penny stocks are notoriously volatile, susceptible to dramatic price swings based on market sentiment and news events.

- Competition Risks: The AI market is intensely competitive, with established players and new entrants constantly vying for market share.

- Financial Instability Risks: As a growth company, BBAI may face financial challenges, particularly if revenue growth doesn't meet expectations or if costs escalate.

- Technological Disruption Risks: Rapid technological advancements could render current technologies obsolete, requiring significant investment in research and development to stay competitive.

- Regulatory Compliance Risks: Operating in sectors like government and defense involves navigating complex regulatory landscapes, which can lead to compliance costs and potential legal risks.

Analyst Ratings and Investor Sentiment

Understanding analyst opinions and investor sentiment helps gauge the market’s perception of BBAI.

Analyst Opinions and Price Targets

A review of analyst ratings and price targets offers valuable insights:

- Buy, Sell, or Hold Ratings: Major financial institutions issue ratings reflecting their outlook on the stock. A consensus of positive ratings suggests a favorable view.

- Price Targets: Analysts often provide price targets, indicating their forecast for the stock price over a specific timeframe. These targets vary widely and should be considered with caution.

- Rationale: Understanding the reasons behind analyst ratings and price targets is critical. This helps identify the factors influencing their assessments and aids in forming your own informed opinion.

Social Media and News Sentiment

Monitoring social media and news sentiment can help gauge investor excitement or concern:

- News Coverage: Significant news events, such as contract wins, partnerships, or regulatory announcements, can significantly impact BBAI's stock price.

- Social Media Buzz: The overall tone of social media discussions can provide insights into investor sentiment, though it should be treated cautiously due to potential biases.

Conclusion

Is BigBear.ai (BBAI) a top penny stock to watch? The answer is nuanced. While BBAI possesses strong technology and operates in a high-growth market, it also faces significant risks inherent in the penny stock market and the competitive AI landscape. Its financial performance, future growth prospects, and the inherent volatility of the stock must be carefully evaluated.

The decision to invest in BBAI ultimately depends on your individual investment strategy and risk tolerance. Conduct thorough due diligence, examining financial reports, analyst ratings, and market trends before investing in any penny stock, including BigBear.ai. Always consult with a qualified financial advisor to ensure your investment decisions align with your financial goals and risk profile. Further research on BBAI and careful consideration of the information presented here will help you make an informed investment decision.

Featured Posts

-

Warner Bros Development Reddit Story Headed To The Big Screen With Sydney Sweeney

May 21, 2025

Warner Bros Development Reddit Story Headed To The Big Screen With Sydney Sweeney

May 21, 2025 -

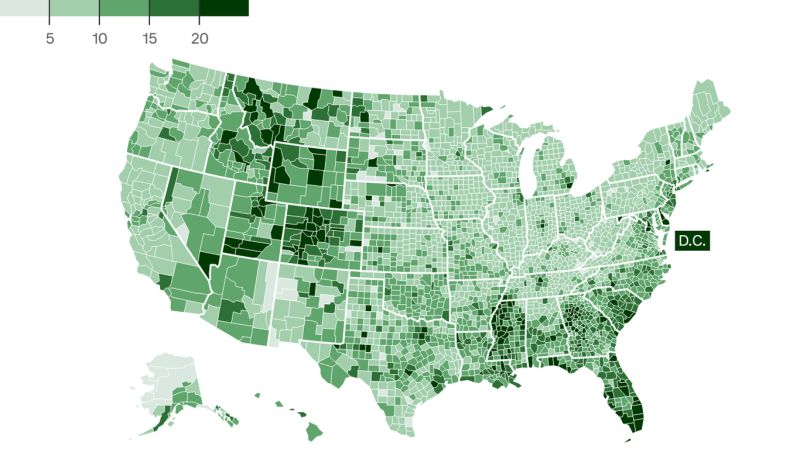

The Countrys New Business Hot Spots A Geographic Overview

May 21, 2025

The Countrys New Business Hot Spots A Geographic Overview

May 21, 2025 -

Ktory Sposob Prace Je Efektivnejsi Home Office Vs Kancelaria

May 21, 2025

Ktory Sposob Prace Je Efektivnejsi Home Office Vs Kancelaria

May 21, 2025 -

At And T Challenges Broadcoms Extreme Price Hike On V Mware

May 21, 2025

At And T Challenges Broadcoms Extreme Price Hike On V Mware

May 21, 2025 -

Switzerland China Joint Call For Tariff Negotiations

May 21, 2025

Switzerland China Joint Call For Tariff Negotiations

May 21, 2025