Is BigBear.ai Stock A Buy? A Motley Fool Analysis

Table of Contents

BigBear.ai's Financial Performance and Growth Prospects

Revenue Growth and Profitability

BigBear.ai's recent financial reports paint a complex picture. While the company has shown revenue growth, profitability remains a challenge. Analyzing key financial metrics is crucial for assessing the company's long-term viability.

- Year-over-year revenue growth: (Insert actual data here, citing the source). Note any significant increases or decreases and explain the underlying reasons. For example, a surge in revenue could be attributed to a large contract win, while a decline might signal competitive pressures.

- Profit margins: (Insert actual data here, citing the source). Low or negative profit margins are a significant red flag, indicating the company may be struggling to manage costs effectively. Explain any trends observed in profit margin performance.

- Debt levels: (Insert actual data here, citing the source). High debt levels can significantly impact a company's financial health and its ability to invest in future growth. Analyze the company's debt-to-equity ratio and other relevant metrics.

- Cash flow: (Insert actual data here, citing the source). Strong positive cash flow is a positive indicator, demonstrating the company's ability to generate cash from its operations. Analyze the company's operating cash flow and free cash flow.

[Insert chart/graph illustrating revenue growth and profitability here]

Future Projections and Analyst Estimates

Analyst estimates for BigBear.ai's future growth are varied. While some analysts express optimism, others highlight potential risks.

- Consensus price target: (Insert data and source here). The consensus price target represents the average price target set by analysts covering the stock.

- Range of analyst predictions: (Insert data and source here). A wide range of predictions indicates uncertainty surrounding the company's future prospects.

- Potential catalysts for growth: New contracts with government agencies or large corporations, successful product launches, and expansion into new markets could significantly boost BigBear.ai's growth.

- Potential headwinds: Increased competition, an economic downturn, and difficulties in scaling operations could hinder the company's growth trajectory.

Competitive Landscape and Market Position

Key Competitors and Market Share

BigBear.ai operates in a competitive market dominated by established players. Understanding its competitive positioning is essential.

- Key competitors: BigBear.ai faces competition from large technology companies like Palantir Technologies, as well as smaller, specialized firms in the AI and big data analytics space. (List key competitors here).

- BigBear.ai's unique selling propositions (USPs): Identify BigBear.ai's strengths and what differentiates it from competitors. This might include specialized expertise in a particular industry, proprietary technology, or strong relationships with government clients.

- Market share data: (Insert data and source here, if available). If market share data is available, analyze BigBear.ai's position relative to its competitors.

Industry Trends and Market Growth

The AI and big data analytics market is experiencing rapid growth, driven by increasing adoption of AI technologies across various sectors.

- Market size projections: (Insert data and source here). Research and cite projections for the growth of the overall market.

- Growth drivers: Factors such as the increasing availability of data, advancements in AI algorithms, and rising demand for data-driven decision-making are driving the growth of the market.

- Technological advancements: Keep an eye on emerging technologies and their potential impact on BigBear.ai's competitive landscape.

- Government regulations: Government regulations related to data privacy and AI ethics can significantly impact the market.

Risks and Potential Downsides of Investing in BigBear.ai Stock

Financial Risks

Investing in BigBear.ai stock involves several financial risks.

- High debt levels: (Refer back to the debt levels discussed earlier). High debt can make the company vulnerable to economic downturns.

- Potential losses: The company might not achieve its projected growth, leading to potential financial losses.

- Dependence on a few key clients: BigBear.ai's revenue might be heavily concentrated among a few clients, making it vulnerable to losing those clients.

Market Risks

The technology sector is inherently volatile, and BigBear.ai is not immune to market risks.

- Overall market volatility: Changes in investor sentiment can significantly impact the stock price.

- Competition: Intense competition could erode BigBear.ai's market share and profitability.

- Changes in technology: Rapid technological advancements could render BigBear.ai's technology obsolete.

- Regulatory changes: Changes in government regulations could significantly impact the company's operations.

Management and Governance

The quality of BigBear.ai's management and corporate governance is crucial for long-term success.

- Key executives' experience: (Research and list key executives and their experience). Assess the experience and track record of the management team.

- History of successful leadership: Evaluate the management team's past performance in guiding the company towards success.

- Corporate governance structure: Research and assess the strength of the company's corporate governance structure.

Conclusion: Should You Buy BigBear.ai Stock? A Final Verdict

Our analysis of BigBear.ai stock reveals a company with growth potential operating in a rapidly expanding market. However, significant financial risks and intense competition exist. The company's profitability remains a concern, and its dependence on a few key clients presents a vulnerability. While the long-term outlook for the AI and big data analytics market is positive, BigBear.ai's ability to successfully navigate its competitive landscape and achieve profitability remains uncertain.

Based on this analysis, we currently recommend a Hold rating for BigBear.ai stock. Further improvements in profitability and a reduction in reliance on a few key clients would be needed to justify a "Buy" recommendation.

Ultimately, the decision of whether to buy BigBear.ai stock rests with you. We encourage you to conduct thorough research and consider your own risk tolerance before investing in BB.ai. Remember, this analysis is for informational purposes only and is not financial advice. Further due diligence, including reviewing BigBear.ai's financial statements and SEC filings, is strongly recommended before making any investment decisions regarding BigBear.ai stock or any other security.

Featured Posts

-

Rhea Ripley And Roxanne Perez Qualify For Wwe Money In The Bank

May 21, 2025

Rhea Ripley And Roxanne Perez Qualify For Wwe Money In The Bank

May 21, 2025 -

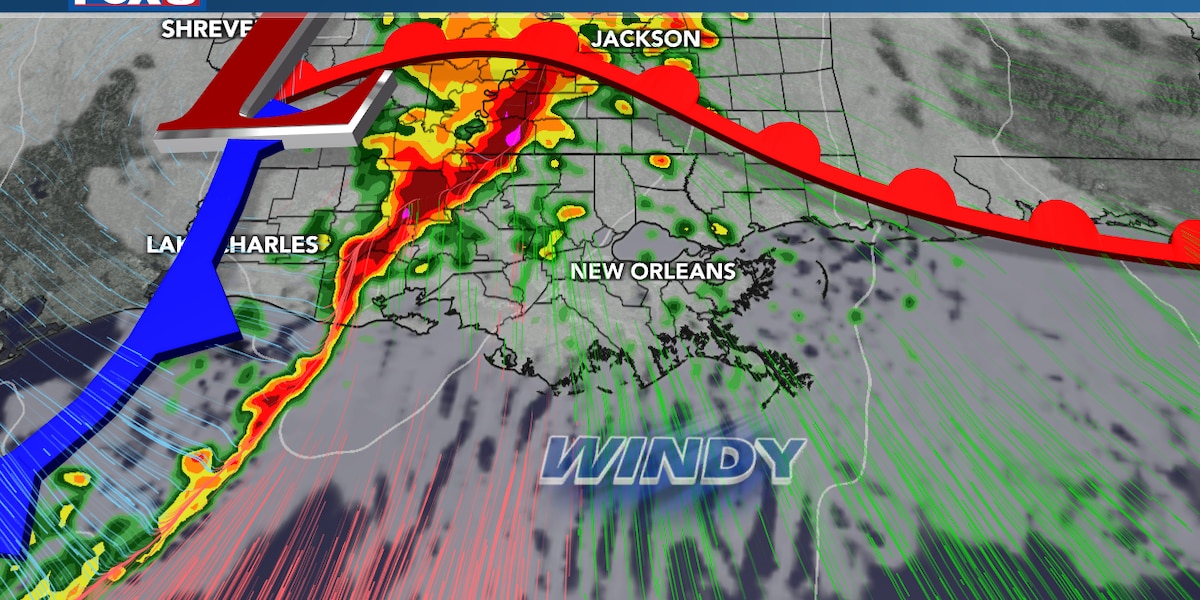

Your First Alert Strong Winds And Severe Storms Expected

May 21, 2025

Your First Alert Strong Winds And Severe Storms Expected

May 21, 2025 -

Patriarxiki Akadimia Kritis Esperida Megalis Tessarakostis

May 21, 2025

Patriarxiki Akadimia Kritis Esperida Megalis Tessarakostis

May 21, 2025 -

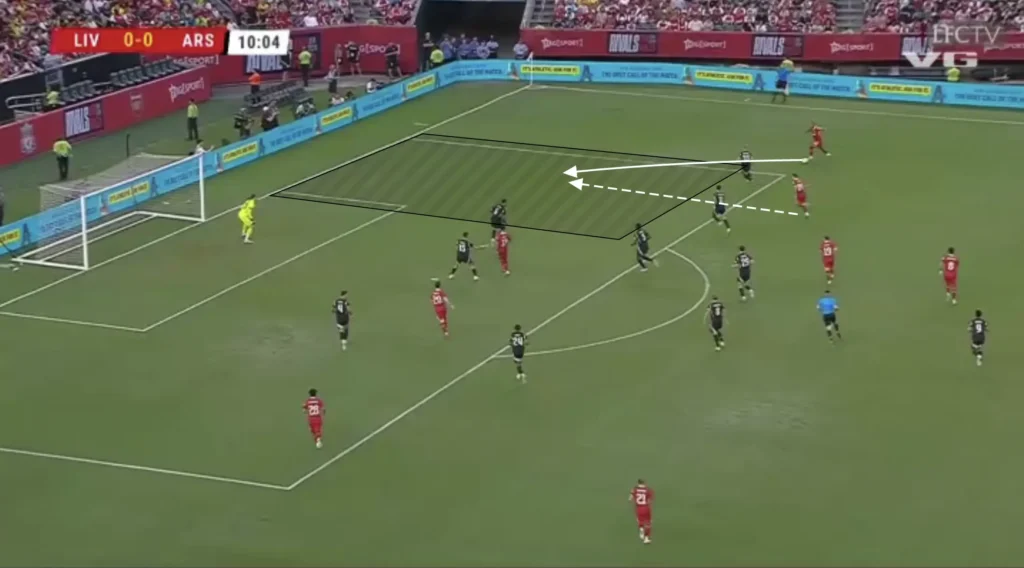

Was Liverpool Lucky To Beat Psg Arne Slots Perspective And Alissons Performance

May 21, 2025

Was Liverpool Lucky To Beat Psg Arne Slots Perspective And Alissons Performance

May 21, 2025 -

Abn Amro Kwartaalcijfers Stuwen Aex Koers Omhoog

May 21, 2025

Abn Amro Kwartaalcijfers Stuwen Aex Koers Omhoog

May 21, 2025