Is Bitcoin's Rebound Just The Beginning? A Comprehensive Analysis

Table of Contents

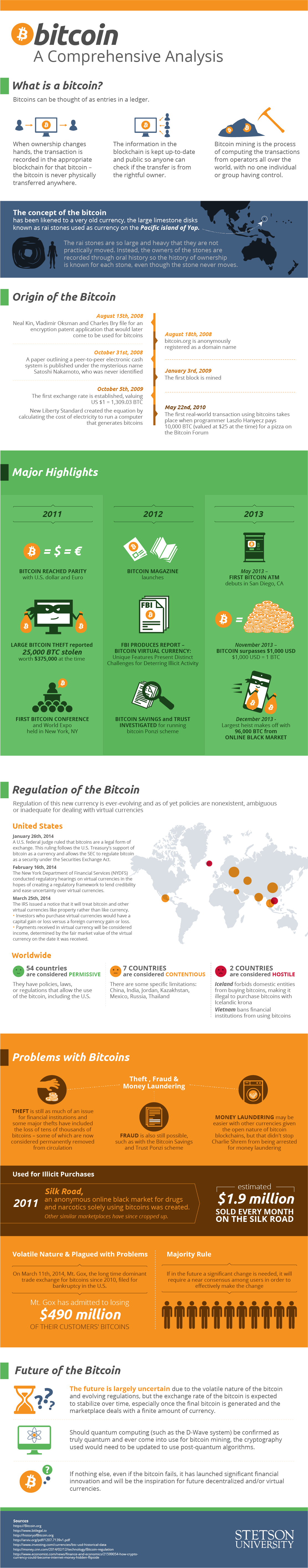

Analyzing the Drivers of Bitcoin's Rebound

Several interconnected factors contribute to Bitcoin's recent price increase. Understanding these drivers is crucial for predicting the future trajectory of Bitcoin's price.

Macroeconomic Factors

Inflationary pressures and the weakening US dollar are significant drivers. Investors are increasingly seeking alternative assets to hedge against inflation, and Bitcoin, with its limited supply, is becoming an attractive option. This is further fueled by increased institutional interest in Bitcoin as a store of value, mirroring a trend seen in gold investment during times of economic uncertainty. Global uncertainty and geopolitical events further enhance Bitcoin's appeal as a safe-haven asset.

- Example: The recent banking crisis in the US and Europe saw a significant influx of capital into Bitcoin as investors sought refuge from traditional financial systems.

- Correlation: While not perfectly correlated, Bitcoin's price often shows an inverse relationship with the US dollar index, suggesting a flight-to-safety narrative.

Technological Advancements

Technological improvements enhance Bitcoin's functionality and appeal, contributing to its price appreciation.

-

The Lightning Network significantly improves Bitcoin's scalability and transaction speed, addressing a long-standing criticism.

-

The development of Bitcoin ETFs (Exchange-Traded Funds) and other investment vehicles makes Bitcoin more accessible to a broader range of investors.

-

Layer-2 solutions, such as the Lightning Network, enhance Bitcoin's usability and efficiency, reducing transaction fees and increasing speed.

-

Taproot's Impact: The Taproot upgrade improved Bitcoin's privacy and scalability, further solidifying its position as a leading cryptocurrency.

-

Mining's Role: Bitcoin mining plays a vital role in securing the network and maintaining price stability. The energy consumption associated with mining is a topic of ongoing debate, but it's essential to its security.

Regulatory Landscape

Evolving regulatory landscapes are playing a crucial role. While regulatory uncertainty remains, gradual clarity in various jurisdictions is fostering greater institutional adoption.

- Jurisdictional Differences: The regulatory landscape varies significantly across jurisdictions. The US, EU, and China each have distinct approaches to regulating cryptocurrencies.

- Impact of Regulation: Increased regulatory scrutiny can impact Bitcoin's price volatility, both positively and negatively. Clear regulations can boost investor confidence, while overly restrictive regulations can stifle growth.

- Government Initiatives: Several governments are exploring initiatives to promote blockchain technology and digital assets, suggesting a potential shift towards greater acceptance of cryptocurrencies.

Potential Scenarios for Bitcoin's Future

Predicting Bitcoin's future price is inherently speculative, but analyzing potential scenarios can provide insights.

Bull Market Continuation

A continued bull run is a possibility, driven by sustained institutional investment, increasing adoption, and positive regulatory developments.

- Price Predictions: While specific price targets are difficult to predict accurately, some analysts forecast significant price increases based on historical bull market cycles.

- Whale Activity: The actions of large Bitcoin holders ("whales") can significantly impact price movements. Their buying and selling activity can influence market sentiment and drive price fluctuations.

Consolidation and Sideways Trading

A period of consolidation and sideways trading is another plausible scenario. This could be caused by regulatory uncertainty, macroeconomic headwinds, and profit-taking by investors.

- Price Range: During periods of consolidation, Bitcoin's price may trade within a specific range, exhibiting lower volatility.

- Bitcoin Halving: The Bitcoin halving event, which reduces the rate of new Bitcoin creation, historically impacts price dynamics. It often leads to periods of price volatility followed by a bull run.

Bear Market Return

A return to a bear market remains a possibility. This could be triggered by significant negative regulatory news, a major market crash, or a loss of investor confidence.

- Bear Market Characteristics: Historical bear markets in Bitcoin have been characterized by significant price declines and prolonged periods of low trading volume.

- Risk Management: Diversification and risk management strategies are crucial for mitigating potential losses during a bear market.

Assessing the Risks and Rewards of Bitcoin Investment

Investing in Bitcoin offers potential for significant returns, but also carries substantial risks.

- Volatility: Bitcoin is highly volatile, with its price subject to significant fluctuations.

- Risk Management: Diversification is vital for managing risk. Don't invest more than you can afford to lose.

- Due Diligence: Thorough research is essential before investing in any cryptocurrency.

- Scams: Be wary of scams and fraudulent activities.

Conclusion

Bitcoin's recent rebound is a complex phenomenon driven by several interacting factors. Whether this marks the start of a new bull run or a temporary reprieve is uncertain. Understanding the interplay between macroeconomic conditions, technological advancements, and regulatory developments is crucial for informed decision-making. While potential rewards are substantial, the inherent risks of Bitcoin investment necessitate a comprehensive risk assessment and a well-defined investment strategy. To stay updated on the Bitcoin rebound and its implications, continue your research and stay informed about the latest market developments. Remember to carefully consider your risk tolerance before investing in Bitcoin.

Featured Posts

-

Is 400 Just The Beginning Analyzing Xrps Potential For Further Growth

May 08, 2025

Is 400 Just The Beginning Analyzing Xrps Potential For Further Growth

May 08, 2025 -

Grbovic O Prelaznoj Vladi Svi Predlozi Su Prihvatljivi

May 08, 2025

Grbovic O Prelaznoj Vladi Svi Predlozi Su Prihvatljivi

May 08, 2025 -

Dojs Proposed Google Changes A Threat To User Trust

May 08, 2025

Dojs Proposed Google Changes A Threat To User Trust

May 08, 2025 -

Activision Blizzard Deal Ftcs Appeal And The Road Ahead

May 08, 2025

Activision Blizzard Deal Ftcs Appeal And The Road Ahead

May 08, 2025 -

13 More Strikeouts Angels Hitters Continue To Struggle Against Twins

May 08, 2025

13 More Strikeouts Angels Hitters Continue To Struggle Against Twins

May 08, 2025