Is Canada's Fiscal Health In Jeopardy? A Look At Liberal Spending

Table of Contents

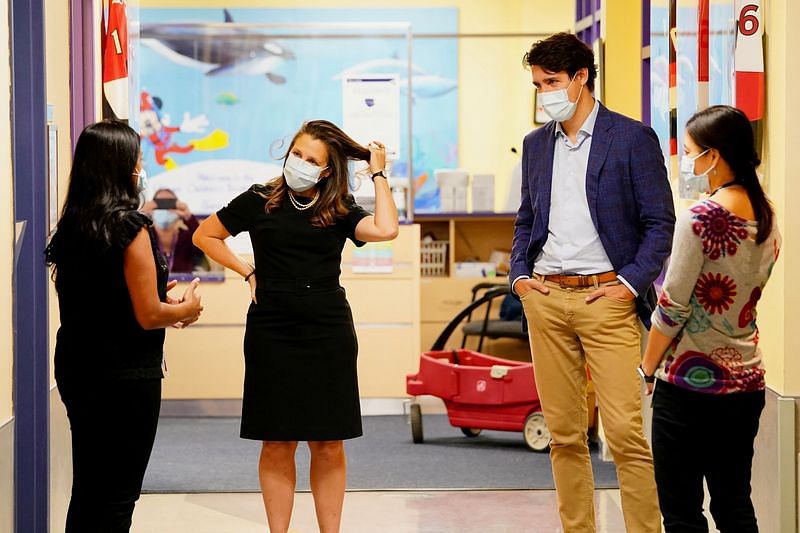

Increased Government Spending Under the Liberals

The Liberal government has overseen significant increases in government spending across several key areas. This increased spending, while intended to stimulate economic growth and improve social programs, has raised concerns about the sustainability of Canada's fiscal health.

Social Programs Expansion

The Liberal government has prioritized expanding Canada's social safety net. This includes substantial increases in spending on healthcare and social security programs.

- Canada Child Benefit (CCB): Significant expansion and increased payments leading to billions in additional annual spending.

- Increased Healthcare Transfers to Provinces: Billions more annually allocated to address healthcare backlogs and improve services, placing further strain on the budget.

- Dental Care Program: A new national dental care program, adding substantial costs to the already burdened healthcare budget. The long-term fiscal impact of this program remains to be seen.

These increases in social program spending, while addressing important social needs, contribute directly to the widening budget deficit and increasing national debt. The long-term sustainability of this level of social program spending within the context of Canada's fiscal health remains a key concern.

Infrastructure Investments

The Liberal government has also invested heavily in infrastructure projects aimed at stimulating economic growth and modernizing Canada's infrastructure.

- National Infrastructure Plan: This plan involves billions of dollars in spending on transportation networks, green infrastructure initiatives, and social infrastructure projects.

- Green Infrastructure Projects: Significant investments in renewable energy, public transit, and energy-efficient buildings aimed at addressing climate change concerns.

- Transportation Infrastructure: Investments in roads, bridges, and public transit systems across the country to improve efficiency and connectivity.

While these infrastructure investments offer potential long-term economic benefits, the immediate impact is a substantial increase in government spending and an added burden on the national debt. The return on investment from these projects will be crucial in determining their overall contribution to Canada's fiscal health.

Other Notable Spending Increases

Beyond social programs and infrastructure, other areas have seen notable spending increases:

- Climate Change Initiatives: Significant funding allocated to various climate change mitigation and adaptation programs.

- Pandemic Relief Spending: Massive emergency spending packages implemented to support individuals, businesses, and healthcare systems during the COVID-19 pandemic.

These additional expenditures, while often justified by pressing needs, have further exacerbated Canada's fiscal challenges. Careful analysis of the effectiveness and long-term fiscal implications of each initiative is necessary to ensure responsible spending and a sustainable fiscal path.

The Impact on Canada's Debt and Deficit

The increased government spending under the Liberal government has had a demonstrable impact on Canada's debt and deficit.

Analysis of Debt-to-GDP Ratio

Canada's debt-to-GDP ratio, a key indicator of fiscal health, has risen steadily in recent years. While still comparatively lower than many other developed nations, projections suggest a continued increase if current spending trends persist. A higher debt-to-GDP ratio increases the risk of fiscal instability and could negatively affect Canada's credit rating.

- Current Debt-to-GDP Ratio: [Insert current data here]

- Projected Debt-to-GDP Ratio (next 5 years): [Insert projected data here - cite source]

- International Comparisons: [Compare to similar countries - cite source]

The Role of Interest Rates

Rising interest rates significantly increase the cost of servicing Canada's national debt. Higher interest payments require reallocation of budget resources, potentially impacting other essential government programs and services.

- Current Interest Rates: [Insert current data here]

- Projected Interest Rate Increases: [Insert projected data here - cite source]

- Impact on Budget Allocations: [Explain the implications of higher interest payments on government spending - cite source]

Credit Rating Agencies' Perspectives

Major credit rating agencies closely monitor Canada's fiscal health and provide assessments of the country's creditworthiness. Their perspectives are influential in shaping investor confidence and borrowing costs. Any potential downgrades could lead to increased borrowing costs for the Canadian government.

- Moody's: [Summarize Moody's view on Canada's fiscal outlook]

- S&P: [Summarize S&P's view on Canada's fiscal outlook]

- D&B: [Summarize D&B's view on Canada's fiscal outlook] (If applicable)

Potential Long-Term Consequences for Canada's Fiscal Health

The current trajectory of Canada's fiscal health raises several concerns about the long-term consequences for the nation.

Impact on Future Generations

The accumulated national debt will represent a significant burden for future generations. Higher debt levels could limit the ability of future governments to invest in essential public services, potentially impacting economic growth and social programs.

- Projected Debt Levels (2040, 2050): [Insert projected data, cite source]

- Impact on Social Programs: [Discuss potential cuts or limitations]

- Impact on Economic Growth: [Discuss potential constraints on investment and growth]

Crowding Out Private Investment

High levels of government debt can lead to a crowding-out effect, where government borrowing competes with private sector borrowing for available funds. This can stifle private investment, hindering economic growth and job creation.

- Explanation of Crowding-Out Effect: [Provide a clear explanation]

- Consequences for Economic Growth: [Detail potential negative effects]

- Consequences for Job Creation: [Explain how it impacts job creation]

Potential for Tax Increases

To address the growing debt, future governments may be forced to implement tax increases. This could negatively impact consumer spending, business investment, and overall economic activity.

- Potential Tax Increase Scenarios: [Discuss potential types of tax increases]

- Political Feasibility: [Discuss the likelihood of various tax increase scenarios]

- Impact on the Economy: [Analyze the potential negative economic effects of tax increases]

Conclusion

The increased government spending under the Liberal government has undeniably contributed to a rise in Canada's national debt and deficit, raising significant concerns about the country's long-term fiscal health. The sustainability of current spending levels is questionable, and the potential long-term risks, including the burden on future generations, the crowding-out effect on private investment, and the potential need for future tax increases, are substantial. It is crucial for Canadians to engage in informed discussions about responsible government spending and fiscal policy. Further research into Canada's fiscal health is vital to ensuring a sustainable and prosperous future for the nation. We encourage you to visit the [link to government website with budget information] and [link to another relevant government resource] to learn more and participate in the ongoing conversation about Canada’s fiscal health.

Featured Posts

-

East Palestines Lingering Threat Toxic Chemicals Remain In Buildings Months After Derailment

Apr 24, 2025

East Palestines Lingering Threat Toxic Chemicals Remain In Buildings Months After Derailment

Apr 24, 2025 -

The Importance Of Middle Management Benefits For Companies And Employees

Apr 24, 2025

The Importance Of Middle Management Benefits For Companies And Employees

Apr 24, 2025 -

I Sygkinisi Toy Tzon Travolta Gia Ton Thanato Toy Tzin Xakman

Apr 24, 2025

I Sygkinisi Toy Tzon Travolta Gia Ton Thanato Toy Tzin Xakman

Apr 24, 2025 -

Blue Origin Postpones Launch Details On Vehicle Subsystem Issue

Apr 24, 2025

Blue Origin Postpones Launch Details On Vehicle Subsystem Issue

Apr 24, 2025 -

The Bold And The Beautiful Wednesday April 9 Recap Steffy Bill Finn And Liams Explosive Confrontations

Apr 24, 2025

The Bold And The Beautiful Wednesday April 9 Recap Steffy Bill Finn And Liams Explosive Confrontations

Apr 24, 2025

Latest Posts

-

Analyzing Morgans Strategic Weaknesses In High Potential Season 1

May 10, 2025

Analyzing Morgans Strategic Weaknesses In High Potential Season 1

May 10, 2025 -

Show Name Season 2 A Compelling Replacement Show And Potential Spoilers

May 10, 2025

Show Name Season 2 A Compelling Replacement Show And Potential Spoilers

May 10, 2025 -

Trumps Presidency A Deep Dive Into Day 109 May 8th 2025

May 10, 2025

Trumps Presidency A Deep Dive Into Day 109 May 8th 2025

May 10, 2025 -

High Potential Episode Count Season 2 Renewal Information And Return Date

May 10, 2025

High Potential Episode Count Season 2 Renewal Information And Return Date

May 10, 2025 -

High Potential Season 1 Underrated Characters Season 2 Fate

May 10, 2025

High Potential Season 1 Underrated Characters Season 2 Fate

May 10, 2025