Is CoreWeave Stock A Good Investment? A Current Market Analysis

Table of Contents

CoreWeave's Business Model and Competitive Advantage

CoreWeave's business model centers around providing high-performance cloud computing infrastructure, specializing in NVIDIA GPU-powered solutions. This focus positions them perfectly to capitalize on the exploding demand for AI and machine learning applications. Their target clientele includes a diverse range of companies, from rapidly scaling AI startups to large enterprises needing powerful, scalable computing resources.

- Focus on NVIDIA GPU-powered cloud infrastructure: CoreWeave leverages the superior processing power of NVIDIA GPUs, providing clients with unparalleled performance for demanding workloads. This commitment to cutting-edge technology is a key differentiator.

- Target clientele: Their diverse client base, encompassing both startups and established corporations, reduces dependence on any single customer and ensures consistent demand.

- Competitive advantages: CoreWeave emphasizes scalability, providing clients with the flexibility to adjust their computing resources as needed. Their pricing models are often cited as competitive, making their services attractive to budget-conscious companies.

- Comparison to competitors: While facing competition from established giants like AWS, Google Cloud, and Azure, CoreWeave distinguishes itself through its specialization in high-performance computing tailored to the specific needs of the AI and machine learning sector. They often offer a more specialized and potentially cost-effective solution compared to the broader services offered by these larger providers.

- Sustainable Business Practices and Partnerships: CoreWeave's commitment to sustainable energy sources and efficient data center operations is a growing advantage in an increasingly environmentally conscious market. Furthermore, strategic partnerships can provide access to new technologies and expand market reach, contributing to long-term growth.

Financial Performance and Growth Potential

Analyzing CoreWeave's recent financial reports reveals impressive growth trajectories. While specific figures may vary depending on the reporting period, key metrics generally point to strong revenue growth and increasing market share within their niche.

- Key financial metrics: Look for data on revenue growth percentages, profit margins (gross and operating), and debt levels to assess the financial health and stability of the company.

- Future projections and analyst estimates: Research reports from reputable financial analysts will offer projections for future growth, which can provide valuable insight into the potential for future returns.

- Financial stability and risk factors: Scrutinize the balance sheet and cash flow statements to assess the company's financial strength and identify potential risks, such as high debt levels or dependence on specific clients or technologies.

- Investments and Acquisitions: Any significant investments in infrastructure or acquisitions of complementary technologies should be considered as potential indicators of future performance. The scalability of CoreWeave's business model and its potential for exponential growth are significant factors in evaluating its long-term prospects as an AI infrastructure stock.

Market Trends and Industry Outlook

The global market for cloud computing and AI infrastructure is experiencing explosive growth, driven primarily by the increasing demand for AI and machine learning applications across various industries.

- Growing demand for AI and machine learning: The expanding use of AI in healthcare, finance, and numerous other sectors fuels the need for powerful computing resources, creating a fertile ground for companies like CoreWeave to thrive.

- Potential challenges and risks: Competition from established cloud providers, economic downturns affecting technology spending, and potential regulatory hurdles are key risks to consider.

- Long-term growth potential: The long-term outlook for the cloud computing industry remains incredibly positive, suggesting significant growth potential for companies with a strong competitive position like CoreWeave.

- Regulatory Landscape and Disruptive Technologies: Staying informed about changes in data privacy regulations and the emergence of potentially disruptive technologies is crucial for understanding the long-term viability of CoreWeave’s business model.

Risks Associated with Investing in CoreWeave Stock

Investing in CoreWeave stock, like any investment in the stock market, carries inherent risks:

- Market volatility and overall economic conditions: Fluctuations in the stock market and broader economic downturns can significantly impact the price of CoreWeave's stock, regardless of the company's performance.

- Competition from established players: The competitive landscape in cloud computing is intense, with established players constantly innovating and expanding their offerings.

- Dependence on key technologies and partnerships: CoreWeave's reliance on NVIDIA GPUs and strategic partnerships introduces potential risks if these relationships change or if technological advancements render their current offerings obsolete.

- Scaling challenges: The rapid growth of the company may present operational challenges in scaling infrastructure and maintaining service quality.

Conclusion

CoreWeave operates in a high-growth sector with a strong value proposition. Its focus on high-performance computing and AI infrastructure positions it well to benefit from ongoing market trends. However, investment in CoreWeave stock is not without risk, given the competitive landscape and inherent volatility of the stock market. The potential for significant returns is balanced by the challenges of operating in a rapidly evolving technological environment.

Ultimately, the decision of whether CoreWeave stock is a good investment for you depends on your individual financial goals and risk tolerance. Conduct your own thorough research before making any investment in CoreWeave stock or any other cloud computing stock. Remember to consider factors like your investment timeline, diversification strategy, and overall risk tolerance before making any investment decisions.

Featured Posts

-

Antalya Da Nato Parlamenter Asamblesi Teroerizm Ve Deniz Guevenligi Odak Noktasi

May 22, 2025

Antalya Da Nato Parlamenter Asamblesi Teroerizm Ve Deniz Guevenligi Odak Noktasi

May 22, 2025 -

John Lithgow And Jimmy Smits Return In Dexter Resurrection Confirmed

May 22, 2025

John Lithgow And Jimmy Smits Return In Dexter Resurrection Confirmed

May 22, 2025 -

Nantes Les Tours Et L Augmentation De La Demande Pour Les Cordistes

May 22, 2025

Nantes Les Tours Et L Augmentation De La Demande Pour Les Cordistes

May 22, 2025 -

Britains Got Talent David Walliams Public Attack On Simon Cowell

May 22, 2025

Britains Got Talent David Walliams Public Attack On Simon Cowell

May 22, 2025 -

Planning A Screen Free Week A Step By Step Guide For Parents

May 22, 2025

Planning A Screen Free Week A Step By Step Guide For Parents

May 22, 2025

Latest Posts

-

Wordle Answer Today March 18 Hints And Help For Nyt Puzzle 1368

May 22, 2025

Wordle Answer Today March 18 Hints And Help For Nyt Puzzle 1368

May 22, 2025 -

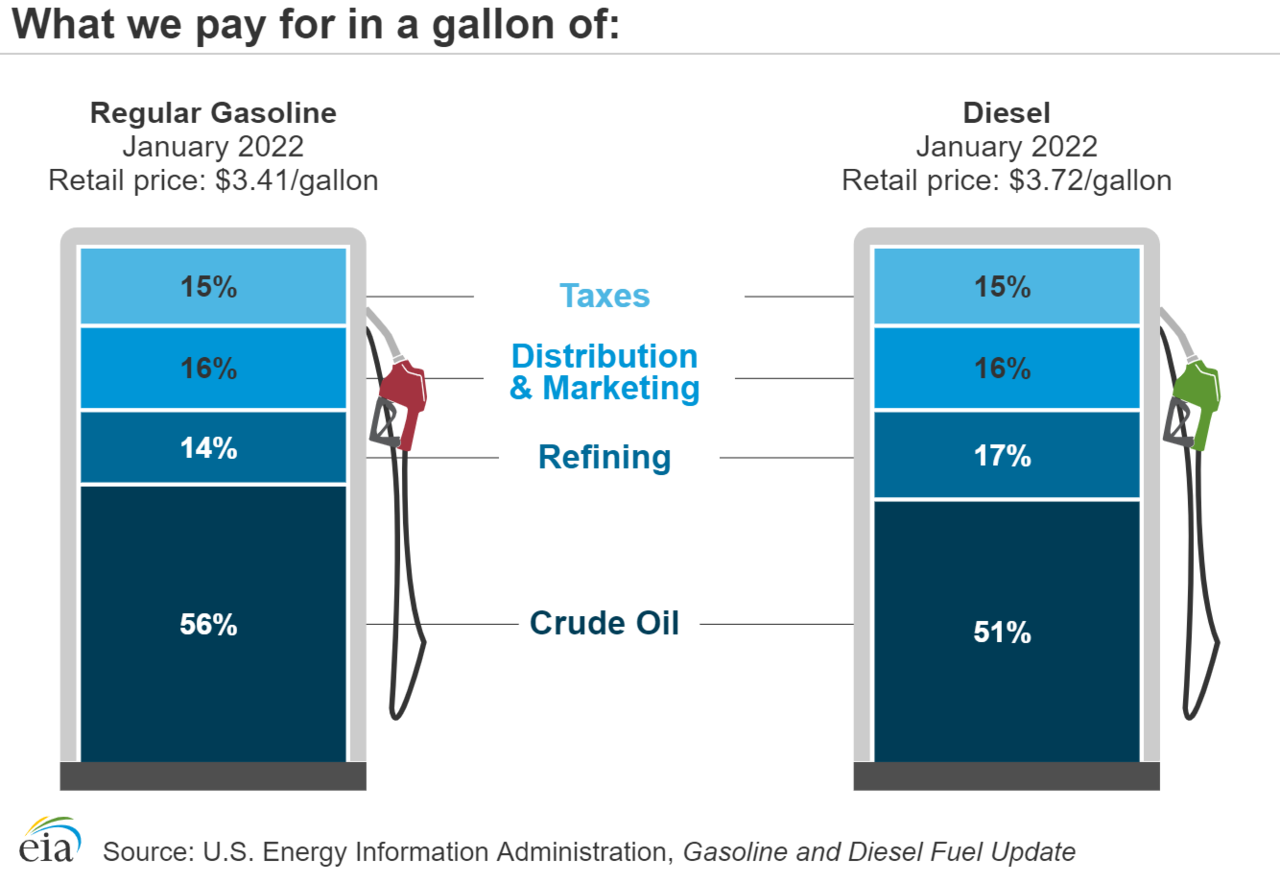

Columbus Fuel Prices Current Costs And Potential Savings

May 22, 2025

Columbus Fuel Prices Current Costs And Potential Savings

May 22, 2025 -

Todays Wordle Nyt March 18th Puzzle 1368 Hints And Answer

May 22, 2025

Todays Wordle Nyt March 18th Puzzle 1368 Hints And Answer

May 22, 2025 -

Wordle 1366 Answer Get Help Solving Todays Puzzle March 16th

May 22, 2025

Wordle 1366 Answer Get Help Solving Todays Puzzle March 16th

May 22, 2025 -

Solve Wordle 1366 Hints And The Answer For March 16th

May 22, 2025

Solve Wordle 1366 Hints And The Answer For March 16th

May 22, 2025