Is David Solomon A Banker Or A Private Equity Leader? Goldman Sachs Pay Row Reveals Key Differences

Table of Contents

H2: The Traditional Banker Model vs. The Private Equity Approach

H3: Traditional Banking Focus:

Traditional banking emphasizes long-term client relationships and steady revenue streams. Key characteristics include:

- Relationship Building: A cornerstone of success, fostering trust and enduring partnerships with clients.

- Investment Banking Activities: Focuses on mergers and acquisitions (M&A) advisory, underwriting securities, and trading.

- Stable Revenue: Prioritizes consistent profitability through diverse revenue streams and established client bases.

- Compensation: Often tied to overall firm profitability and long-term client success.

Examples of firms embodying this model include Morgan Stanley and JPMorgan Chase. These institutions are known for their established client networks and emphasis on long-term investment strategies.

H3: Private Equity Focus:

In contrast, private equity prioritizes short-term gains and rapid returns on investment. Its hallmarks are:

- Short-Term Gains: Focus is on quick profits and maximizing returns within a defined timeframe.

- Leveraged Buyouts: Employing significant debt to acquire companies and restructure operations.

- Aggressive Strategies: Using assertive tactics to enhance value and secure returns.

- Performance-Based Compensation: Heavily reliant on performance fees and carried interest, directly linked to investment success.

Firms like KKR, Blackstone, and Carlyle Group exemplify this approach, renowned for their aggressive investment strategies and short-term focus.

H3: Solomon's Leadership Style and its Alignment:

David Solomon's tenure at Goldman Sachs has seen a push towards consumer banking and a diversification of revenue streams. His compensation structure reflects a blend of traditional salary and performance-based bonuses, raising questions about the dominance of each approach. Some argue that his emphasis on certain areas, coupled with the firm's foray into consumer lending, indicates a private equity-style pursuit of rapid expansion and market share. Others maintain that his actions are simply adapting Goldman Sachs to the evolving financial landscape. A thorough analysis of his decisions – particularly those involving resource allocation and strategic investments – is crucial to determine the true nature of his leadership.

H2: The Goldman Sachs Pay Row and its Implications

H3: The Controversy Explained:

The Goldman Sachs pay controversy centers around significant disparities in compensation, particularly concerning the disparity between executive pay and the compensation of other employees. Critics argue that these discrepancies reflect a prioritization of short-term gains over long-term stability and employee morale. The controversy has led to concerns about fairness, transparency, and Goldman Sachs's overall corporate culture.

H3: How Pay Reflects Strategic Priorities:

The compensation structure at Goldman Sachs, with its emphasis on performance-based bonuses, suggests a tilt towards the private equity model. High bonuses incentivize short-term gains, potentially at the expense of long-term sustainability and employee retention. This is a crucial aspect to consider when evaluating Solomon's strategic goals for the firm.

H3: Performance Metrics and the Debate:

Goldman Sachs's recent financial performance provides mixed signals. While certain divisions have seen strong growth, reflecting the success of specific private equity-style investments, other areas have faced challenges. Examining key performance indicators (KPIs) such as return on equity (ROE), revenue growth across different sectors, and employee satisfaction are essential to ascertain whether the firm’s success aligns more with traditional banking principles or a private equity model. Analyzing these KPIs helps unravel whether Solomon's strategies are bearing fruit and their long-term implications.

H2: The Future of Goldman Sachs Under Solomon's Leadership

H3: Potential Scenarios:

Several scenarios could unfold. Goldman Sachs might further integrate private equity strategies, leading to increased emphasis on short-term returns and aggressive investment approaches. Conversely, it might pivot towards a more traditional banking model, focusing on client relationships and sustainable growth. A hybrid model, blending aspects of both, also remains a possibility. These scenarios have major implications for Goldman Sachs's future.

H3: Impact on the Broader Financial Industry:

Solomon's approach at Goldman Sachs has broader implications. Other financial institutions may follow suit, adopting similar strategies, potentially shifting the balance within the investment banking landscape. This could lead to increased competition and a reshaping of the industry's long-term outlook.

3. Conclusion:

The debate over David Solomon's leadership at Goldman Sachs illuminates the evolving relationship between traditional banking and private equity. While his background is rooted in investment banking, his actions and Goldman Sachs's compensation structure reveal a significant alignment with private equity principles. The recent pay controversy underscores the potential conflicts arising when a firm tries to reconcile these two distinct models. To fully understand the long-term impact of this leadership style, continued analysis of David Solomon's actions and Goldman Sachs's performance is crucial. Further explore the complexities of David Solomon’s leadership and its impact on the future of Goldman Sachs, and participate in the conversation.

Featured Posts

-

Yankees Record Breaking 9 Homer Game Judges Triple Power Surge

Apr 23, 2025

Yankees Record Breaking 9 Homer Game Judges Triple Power Surge

Apr 23, 2025 -

17 Subat Pazartesi Bu Aksam Hangi Diziler Var

Apr 23, 2025

17 Subat Pazartesi Bu Aksam Hangi Diziler Var

Apr 23, 2025 -

Yelich Homers First Time Since Back Surgery Recovery

Apr 23, 2025

Yelich Homers First Time Since Back Surgery Recovery

Apr 23, 2025 -

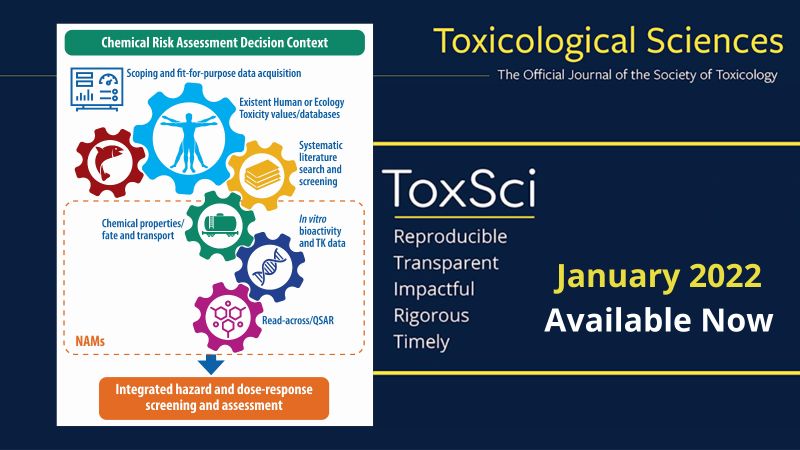

Investigation Reveals Prolonged Presence Of Toxic Chemicals From Ohio Derailment

Apr 23, 2025

Investigation Reveals Prolonged Presence Of Toxic Chemicals From Ohio Derailment

Apr 23, 2025 -

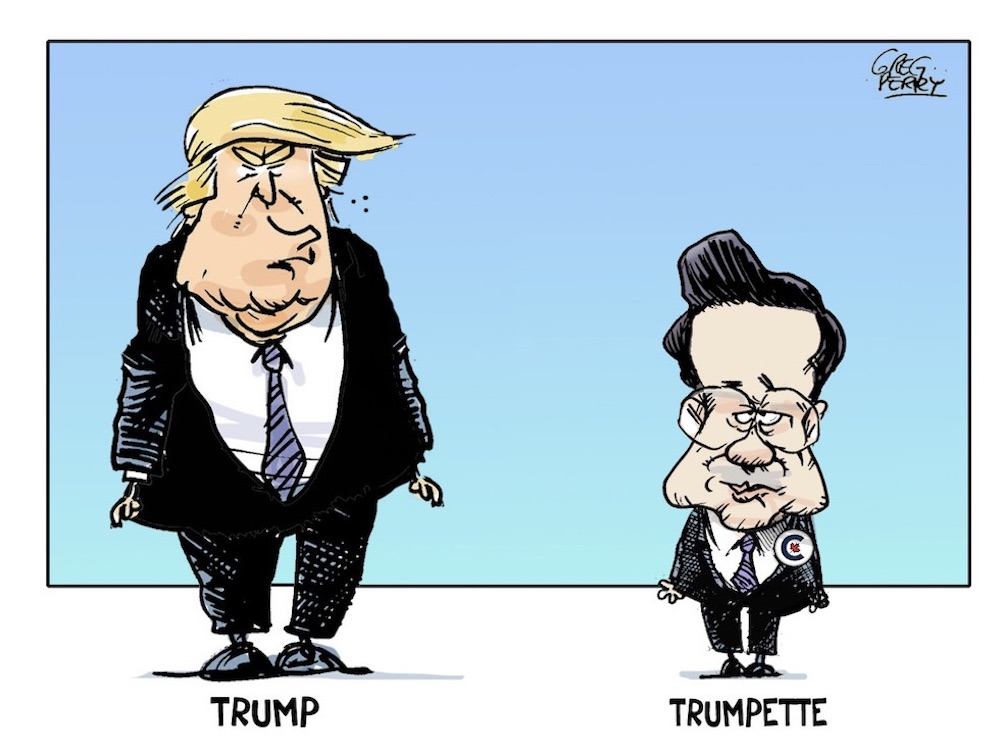

Analyzing The Poilievre Campaign From Leading Candidate To Defeat

Apr 23, 2025

Analyzing The Poilievre Campaign From Leading Candidate To Defeat

Apr 23, 2025