Is Elon Musk's Anger Good For Tesla's Stock?

Table of Contents

The Negative Impacts of Musk's Anger on Tesla Stock

Musk's anger, frequently expressed through social media and public statements, presents several significant risks to Tesla's financial health.

Damage to Brand Reputation

Negative publicity stemming from controversial tweets and statements can severely erode consumer trust in the Tesla brand. For instance, Musk's past comments about taking Tesla private, his erratic behavior on earnings calls, and his involvement in various controversies have all contributed to periods of stock volatility.

- Alienating potential customers: Controversial statements can alienate potential customers who may be hesitant to associate with a brand perceived as unpredictable or controversial.

- Attracting negative media attention: Negative press coverage fuels further uncertainty and can damage the brand's image in the long term.

- Damaging relationships with investors: Investors may lose confidence in the company's leadership and stability, leading to divestment and decreased stock valuation.

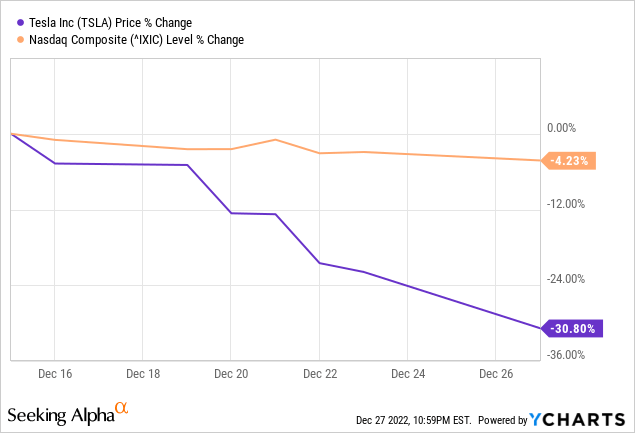

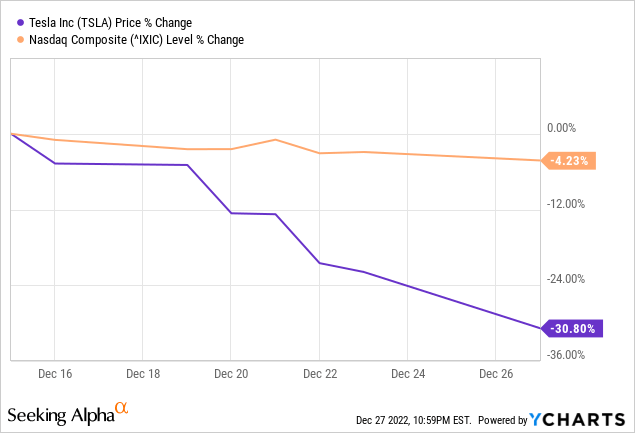

Uncertainty and Investor Volatility

Musk's unpredictable behavior creates significant uncertainty for investors. Sudden announcements, impulsive decisions, and unpredictable market moves directly impact Tesla's stock prices. This volatility makes it difficult for investors to assess risk and make informed decisions.

- Risk of impulsive decisions: Musk's impulsive nature increases the risk of ill-conceived decisions that could negatively affect the company's financial performance.

- Difficulty in predicting company strategy: The lack of transparency and consistency in Musk’s communication makes it challenging to predict Tesla's long-term strategy, further exacerbating investor uncertainty.

- Potential for legal and regulatory challenges: Musk's outspokenness has repeatedly led to legal battles and regulatory scrutiny, adding another layer of risk for investors.

Distractions from Core Business

The constant focus on controversies surrounding Musk distracts from Tesla's core business objectives: product development, innovation, and efficient operations. This distraction can significantly impact employee morale and productivity.

- Slowed innovation cycles: Time and resources spent addressing controversies detract from efforts to develop new technologies and improve existing products.

- Decreased efficiency in operations: Internal disruptions caused by leadership controversies can hinder the smooth functioning of the company.

- Lost opportunities in the market: While competitors focus on product development and market expansion, Tesla might miss valuable opportunities due to internal distractions.

The Potential Positive Impacts of Musk's Anger on Tesla Stock

Despite the significant drawbacks, some argue that Musk's anger, or at least the persona he projects, can positively influence Tesla's stock performance.

Authenticity and Brand Loyalty

Musk's outspoken nature, for some, represents authenticity and resonates with a specific segment of consumers who value his seemingly unfiltered approach. This creates a "cult of personality" that can drive brand loyalty and even influence stock prices.

- Strong appeal to a niche audience: Musk's persona attracts a dedicated fan base willing to overlook controversies to support the brand.

- Increased brand recognition and engagement: His controversies, while negative, generate significant media attention, boosting brand recognition and engagement.

- Perception of a strong, decisive leader: Some view Musk's aggressive style as a sign of strength and decisiveness, which can inspire confidence in investors.

Driving Innovation and Disruption

Musk's intense ambition and demanding leadership style, even if expressed through anger, might serve as a catalyst for innovation and disruption within the electric vehicle and renewable energy sectors.

- Pushing boundaries of technological limits: His relentless pursuit of innovation can push Tesla to achieve breakthroughs that might not be possible under more conventional leadership.

- Accelerating development timelines: His demanding approach can incentivize teams to work faster and achieve ambitious goals.

- Creating disruptive products in the market: Tesla's innovative products are partly a result of Musk's drive to disrupt existing industries.

Maintaining a Competitive Edge

Musk's aggressive approach can be interpreted as a strategy to maintain a competitive edge in a rapidly evolving market. His actions influence the competitive landscape of the electric vehicle market.

- Deterrence against competitors: His aggressive tactics might deter competitors from encroaching on Tesla's market share.

- Maintaining market share and dominance: Musk's ambition fuels a relentless pursuit of market leadership, benefiting Tesla's stock performance.

- Creating a sense of urgency and ambition: His leadership style instills a sense of urgency and ambition within the company, driving innovation and performance.

Conclusion

Elon Musk's anger presents a double-edged sword for Tesla's stock. While it can undeniably generate excitement, drive innovation, and cultivate a strong brand following, it also poses significant risks to the company's reputation and investor confidence. The long-term impact of this complex relationship remains uncertain and heavily dependent on future events and Musk’s own evolving behavior.

Call to Action: What are your thoughts on the relationship between Elon Musk's anger and Tesla's stock performance? Share your opinions and insights in the comments below – let's discuss the multifaceted impact of Elon Musk's leadership style on Tesla's future. Join the conversation about how Elon Musk's leadership, specifically his anger, influences Tesla's stock!

Featured Posts

-

54 Eton Kai Apsegadiasti I Naomi Kampel Stis Maldives Me Tin Oikogeneia Tis

May 26, 2025

54 Eton Kai Apsegadiasti I Naomi Kampel Stis Maldives Me Tin Oikogeneia Tis

May 26, 2025 -

Sketch Controverse Du Grand Cactus Le Csa Tranche Sur La Sequence Du 128e Sexe

May 26, 2025

Sketch Controverse Du Grand Cactus Le Csa Tranche Sur La Sequence Du 128e Sexe

May 26, 2025 -

L Avenir Incertain De La Semaine Des 5 Heures Sur La Premiere

May 26, 2025

L Avenir Incertain De La Semaine Des 5 Heures Sur La Premiere

May 26, 2025 -

Where To Find The Best Shrimp In The Hudson Valley 5 Choices

May 26, 2025

Where To Find The Best Shrimp In The Hudson Valley 5 Choices

May 26, 2025 -

Bueyuek Sok Real Madrid De Doert Yildiza Sorusturma

May 26, 2025

Bueyuek Sok Real Madrid De Doert Yildiza Sorusturma

May 26, 2025