Is Foot Locker (FL) A Genuine Winner? Jim Cramer Weighs In

Table of Contents

Foot Locker's Current Market Position and Performance

H3: Financial Performance Analysis:

Foot Locker's recent financial performance offers a mixed bag. Analyzing quarterly and annual reports reveals fluctuations in key metrics. While revenue growth has shown periods of strength, it's been inconsistent, impacted by factors such as supply chain disruptions and evolving consumer preferences. Earnings per share (EPS) have also experienced volatility. Profit margins, while generally healthy, have faced pressure from increased operating costs. Comparing Foot Locker's financials to competitors like Nike and Adidas reveals a competitive landscape, with Foot Locker needing to strategically adapt to maintain its market share and profitability. Analyzing Foot Locker financials, including FL earnings and revenue growth, requires a nuanced understanding of the broader athletic footwear market. Key metrics such as EPS and profit margin are crucial for a thorough assessment of Foot Locker's financial health.

- Revenue Growth: Analyze year-over-year revenue growth percentages for the past few years.

- EPS: Track the trend in earnings per share to gauge profitability.

- Profit Margins: Assess gross and net profit margins to understand profitability relative to revenue.

- Competitor Analysis: Compare key metrics to Nike, Adidas, and other major competitors.

H3: Market Share and Brand Perception:

Foot Locker maintains a significant market share in the athletic footwear and apparel industry, benefiting from its extensive retail network and established brand recognition. However, consumer loyalty is increasingly challenged by online retailers and direct-to-consumer brands. While Foot Locker's brand strength remains considerable, it faces pressure to innovate and adapt to changing trends. The company’s ability to maintain its market share within the fiercely competitive athletic footwear market will be key to its future success.

- Market Share Data: Research independent market analysis reports to determine Foot Locker's precise market share.

- Brand Perception Studies: Examine consumer surveys and brand perception analyses to gauge consumer sentiment.

- Competitive Advantages: Identify Foot Locker's key competitive advantages (e.g., exclusive collaborations, strong retail presence).

- Weaknesses: Acknowledge Foot Locker's weaknesses (e.g., reliance on a few key brands, potential for higher online competition).

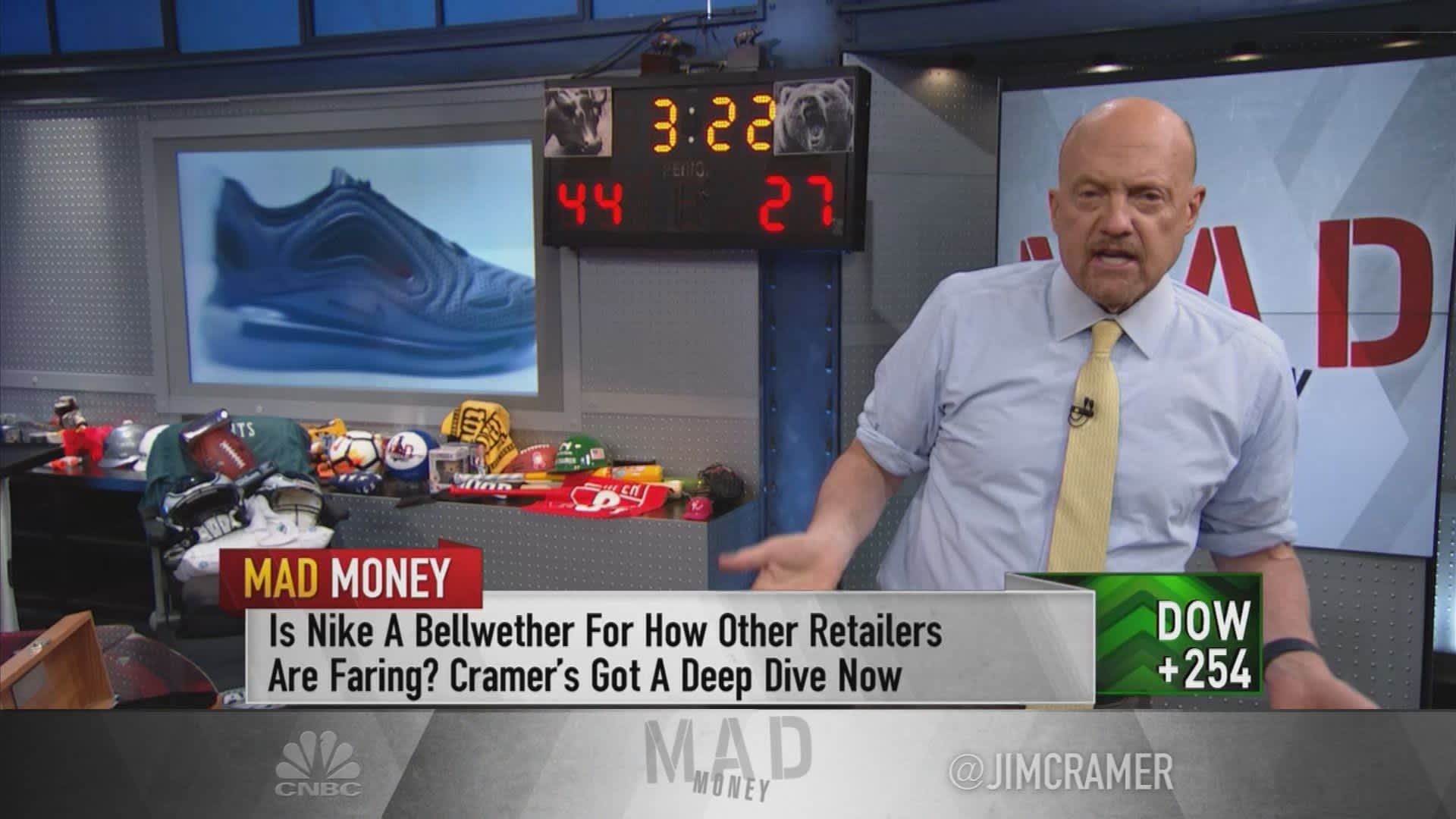

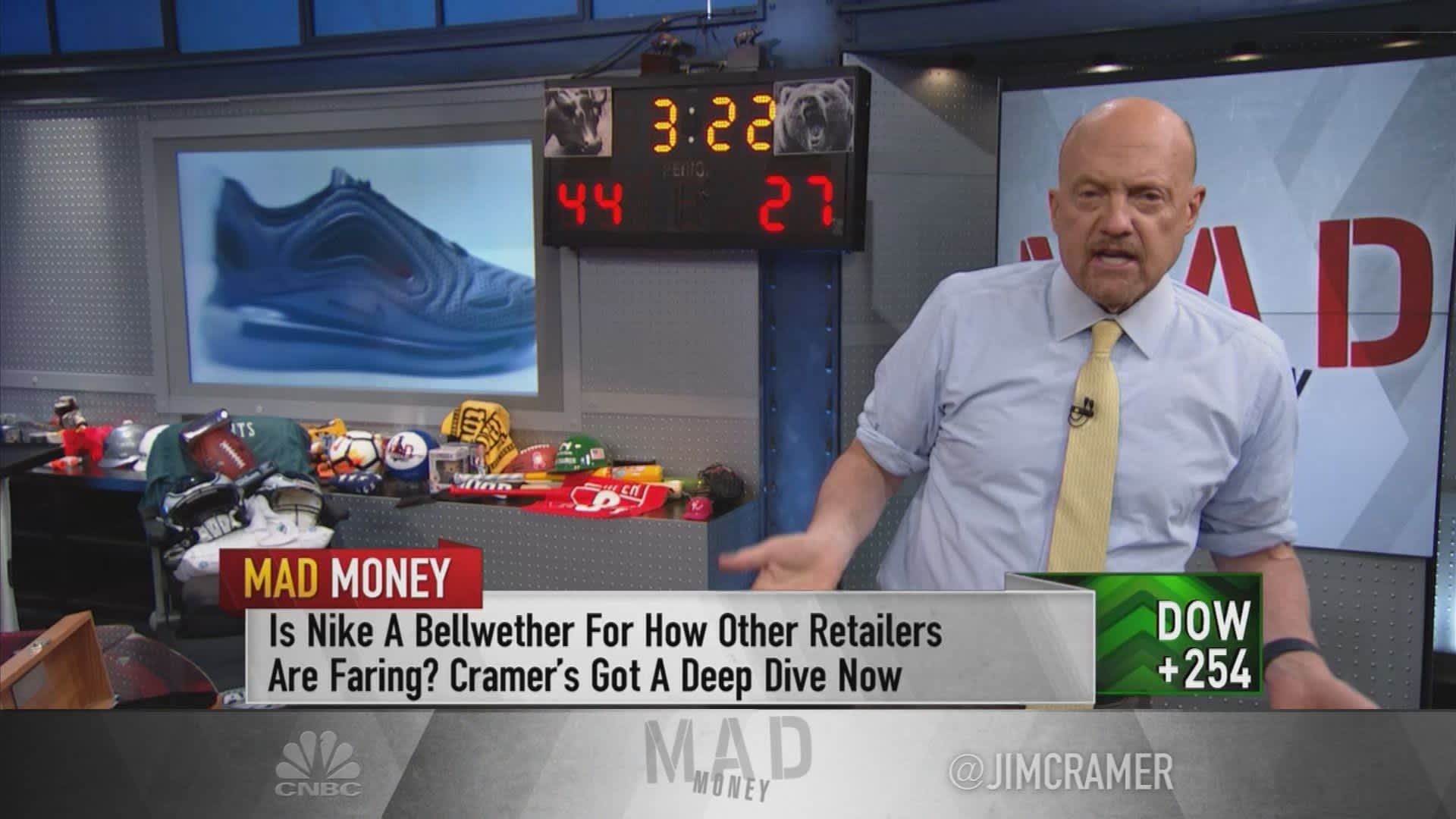

Jim Cramer's Take on Foot Locker (FL):

H3: Summarize Cramer's Recent Statements:

While specific quotes require referencing recent Mad Money episodes or transcripts (links to be included here if available), Jim Cramer's overall stance on Foot Locker (FL) needs to be summarized. His opinions often reflect the broader market sentiment and his assessments of the retail sector. Understanding the context of his recommendations is key to gaining a complete perspective. (Insert direct quotes from Jim Cramer's analysis, if available, with appropriate attribution and links to source material.)

H3: Contextualize Cramer's Perspective:

Jim Cramer's investment strategy is known for its aggressive and often contrarian approach. It's important to note that his opinions represent one perspective among many and may not always align with other market analyses. Understanding potential biases or conflicts of interest is essential when evaluating his assessment of Foot Locker (FL). Considering his overall investment strategy helps us to understand the rationale behind his opinions and potential limitations in their application.

- Cramer's Investment Philosophy: Briefly summarize Jim Cramer's investing philosophy to understand the context of his Foot Locker analysis.

- Potential Biases: Consider any potential biases or conflicts of interest that might influence Cramer's views.

- Alignment with Other Analyses: Compare Cramer's assessment to other reputable financial analyses of Foot Locker.

Future Prospects and Investment Considerations for Foot Locker (FL):

H3: Growth Potential and Challenges:

The athletic footwear market presents significant growth potential, driven by factors such as increasing disposable incomes in developing markets and ongoing demand for athletic apparel. However, Foot Locker faces challenges, including intense competition from both established brands and emerging direct-to-consumer players. Economic downturns can also significantly impact consumer spending on discretionary items like athletic footwear. Foot Locker's strategies for online expansion and introduction of new product lines are crucial in navigating these challenges.

- Market Growth Forecasts: Include projections for future growth in the athletic footwear market.

- Competitive Landscape Analysis: Detail the competitive landscape, highlighting key competitors and their strategies.

- Foot Locker's Growth Strategies: Discuss Foot Locker's plans for future growth, including online expansion and new product initiatives.

H3: Risk Assessment and Investment Recommendations:

Investing in Foot Locker (FL) stock carries inherent risks, including the potential for decreased profitability, changes in consumer preferences, and increased competition. Economic downturns can severely impact the retail sector. While Foot Locker has a strong brand presence, its success depends on its ability to adapt to evolving market conditions. This is not financial advice. Potential returns are dependent on a number of factors, and thorough research is crucial. Before considering any investment in Foot Locker (FL) stock, conduct your own due diligence.

- Risk Factors: Identify key risk factors associated with investing in Foot Locker stock.

- Return on Investment (ROI) Potential: Discuss the potential ROI, acknowledging the inherent uncertainties.

- Disclaimer: Clearly state that this is not financial advice and individual investors should conduct their own thorough research.

Conclusion: Is Foot Locker (FL) a Winning Investment?

Foot Locker's performance presents a complex picture, with strong brand recognition and market share balanced against challenges posed by evolving consumer preferences and intense competition. Jim Cramer's perspective offers one viewpoint among many, highlighting the need for comprehensive individual analysis. Ultimately, whether Foot Locker (FL) represents a winning investment depends on an investor's risk tolerance, investment horizon, and individual research. Conduct your own due diligence before investing in Foot Locker (FL) stock. Carefully consider your investment strategy, the Foot Locker investment outlook, and your own risk assessment before making any decisions. A thorough FL stock analysis is vital before committing capital. Consider seeking advice from a qualified financial advisor.

Featured Posts

-

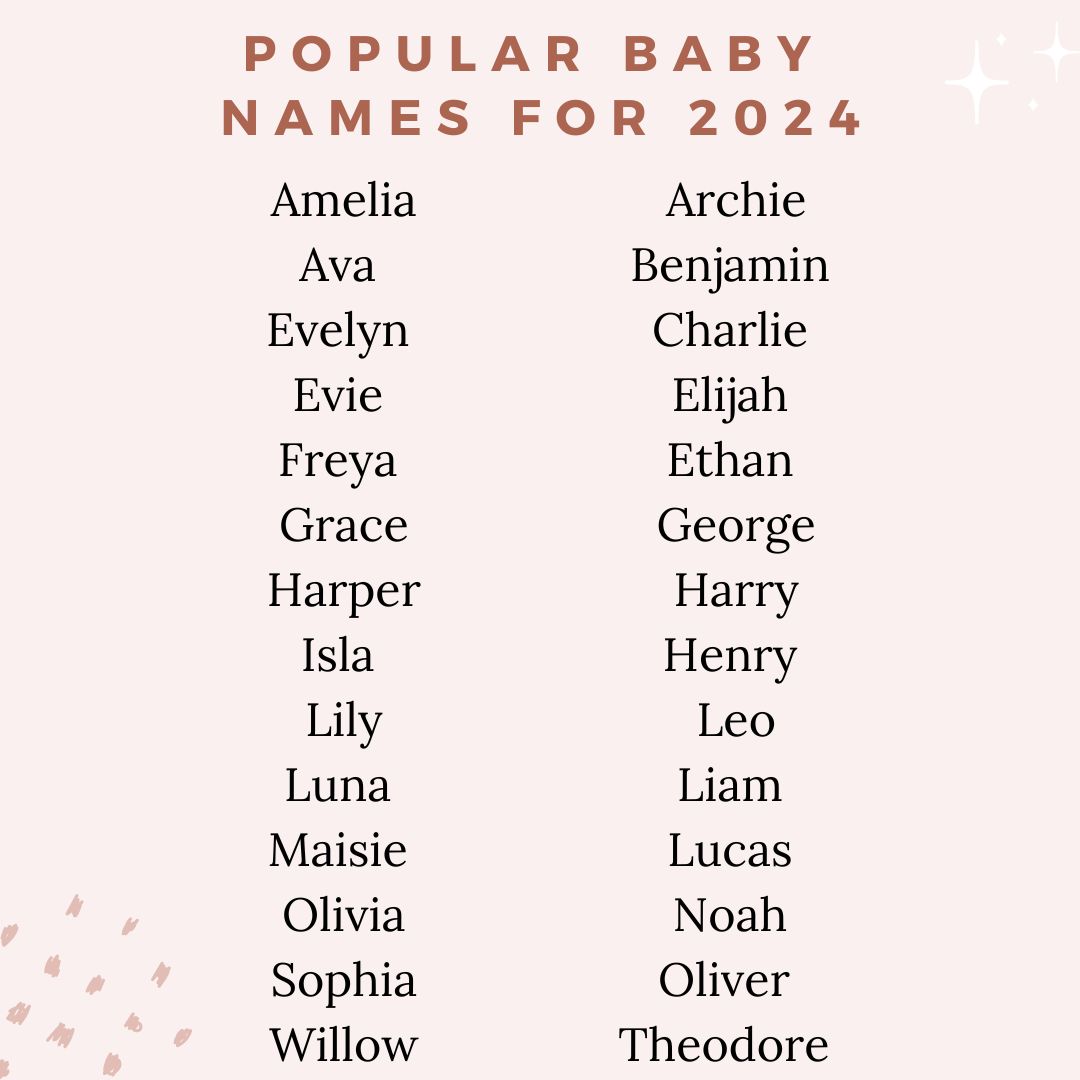

2024 Baby Name Trends Whats Popular This Year

May 16, 2025

2024 Baby Name Trends Whats Popular This Year

May 16, 2025 -

Steam 2025 Sale Dates Predictions And Expectations

May 16, 2025

Steam 2025 Sale Dates Predictions And Expectations

May 16, 2025 -

Nhl Draft Lottery Fan Outrage Over Confusing Rules

May 16, 2025

Nhl Draft Lottery Fan Outrage Over Confusing Rules

May 16, 2025 -

Paddy Pimblett Ufc 314 Champion Goat Legends Backing Fuels Prediction

May 16, 2025

Paddy Pimblett Ufc 314 Champion Goat Legends Backing Fuels Prediction

May 16, 2025 -

Will The Toronto Maple Leafs Clinch A Playoff Spot Against The Florida Panthers

May 16, 2025

Will The Toronto Maple Leafs Clinch A Playoff Spot Against The Florida Panthers

May 16, 2025