Is Foot Locker (FL) A Genuine Winner? Jim Cramer's Take

Table of Contents

Jim Cramer's Stance on Foot Locker (FL): A Deep Dive

Analyzing Jim Cramer's pronouncements on Foot Locker offers a valuable, albeit subjective, perspective on the stock. His opinions, while not investment advice, provide insight into market sentiment and potential investment strategies.

Analyzing Cramer's Past Comments on FL:

Pinpointing exact dates and specific price targets from Cramer’s extensive commentary requires extensive research across his various platforms. However, a general overview reveals a mixed bag of opinions.

- Example 1 (Hypothetical): In a hypothetical segment of Mad Money from October 2022, Cramer might have expressed concerns about Foot Locker's reliance on Nike and Adidas, potentially suggesting a cautious approach.

- Example 2 (Hypothetical): Conversely, a later segment in 2023 could have highlighted Foot Locker's successful e-commerce initiatives and improved inventory management, leading him to be more optimistic.

- Example 3 (Hypothetical): Cramer may have mentioned a hypothetical price target of $X per share based on specific financial projections.

(Note: Replace the hypothetical examples with actual verifiable instances from Jim Cramer's shows and provide links to video clips or transcripts wherever possible.)

Understanding Cramer's Investment Philosophy and its Applicability to FL:

Cramer's investment style blends elements of value and growth investing. He emphasizes the importance of understanding a company's fundamentals and assessing its future growth potential.

- Focus on Earnings: Cramer typically favors companies with strong and consistent earnings growth.

- Market Sentiment: He also considers investor sentiment and market trends.

- Risk Tolerance: His recommendations often imply a moderate-to-high risk tolerance.

Whether Cramer's philosophy aligns with Foot Locker's business model depends on the current market conditions and the company's financial performance. Following Cramer's advice on any stock, including Foot Locker, involves inherent risk.

Foot Locker's (FL) Financial Performance and Future Prospects

Analyzing Foot Locker's financial health is crucial in assessing its investment potential. Examining key financial metrics provides a more objective view compared to subjective commentary.

Recent Financial Results and Key Metrics:

Foot Locker's recent performance should be carefully reviewed using publicly available financial reports. Key metrics to analyze include:

- Revenue Growth: Analyze the percentage change in revenue year-over-year and quarter-over-quarter. Identify any trends, like acceleration or deceleration.

- Profitability: Evaluate profit margins (gross, operating, and net) to determine the company's ability to generate profit from its sales.

- Earnings Per Share (EPS): Track EPS to gauge the profitability on a per-share basis.

- Competitor Comparison: Benchmarks against key competitors like JD Sports and Hibbett Sports offer valuable context.

(Note: Insert actual charts and graphs visualizing Foot Locker's financial data obtained from reliable sources such as SEC filings.)

Growth Strategies and Market Position:

Foot Locker's growth strategy relies on several pillars:

- E-commerce Expansion: Investing in online sales channels is vital in the current retail environment.

- Brand Partnerships: Collaborations with popular brands and designers can attract customers.

- Inventory Management: Efficient inventory control minimizes losses from excess stock.

- Store Optimization: Improving the in-store experience can boost foot traffic and sales.

Assessing the effectiveness of these strategies requires analyzing market share data and tracking customer response. Potential challenges include increasing competition and shifts in consumer preferences.

Considering the Risks: Is Foot Locker (FL) a Risky Investment?

While Foot Locker offers potential for returns, investors must carefully consider the inherent risks involved.

Market Volatility and External Factors:

Several external factors can significantly impact Foot Locker's stock price:

- Economic Downturn: A recession can significantly reduce consumer spending on discretionary items like athletic footwear.

- Inflation: Rising prices can affect both consumer spending and Foot Locker's operating costs.

- Supply Chain Disruptions: Global supply chain issues can impact product availability and profitability.

These factors highlight the inherent volatility in the retail sector and its influence on Foot Locker's stock.

Competition and Industry Dynamics:

Foot Locker faces fierce competition from several players:

- Direct Competitors: JD Sports, Hibbett Sports, and other specialty retailers.

- Online Retailers: Amazon and other e-commerce giants.

- Brand-Owned Stores: Nike and Adidas operate their own retail stores, potentially competing directly with Foot Locker.

The potential for disruption from new entrants and evolving consumer trends adds complexity to the investment landscape.

Conclusion

Jim Cramer's perspective on Foot Locker, while insightful, represents only one opinion. Foot Locker’s financial performance reveals a mixed bag of trends, suggesting the need for thorough due diligence before making any investment decisions. The company faces significant risks, including market volatility and intense competition. Whether Foot Locker is a genuine winner ultimately depends on your individual risk tolerance and investment strategy.

Final Verdict: Foot Locker presents a complex investment opportunity with both potential rewards and significant risks.

Call to Action: Do your own due diligence before considering Foot Locker (FL) as part of your investment portfolio. Consult with a financial advisor to determine if this stock aligns with your investment objectives and risk tolerance. Remember that past performance is not indicative of future results, and following any pundit's advice on Foot Locker (FL) or any other stock should be done with caution.

Featured Posts

-

Fatih Erbakandan Kibris Aciklamasi Kirmizi Cizgimiz Sehit Kaniyla Cizildi

May 15, 2025

Fatih Erbakandan Kibris Aciklamasi Kirmizi Cizgimiz Sehit Kaniyla Cizildi

May 15, 2025 -

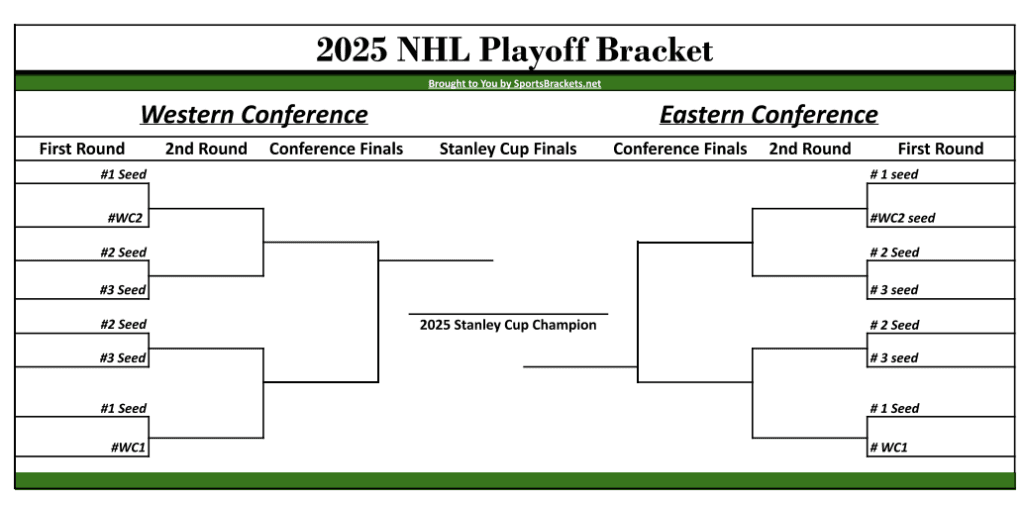

How To Watch The Nhl Playoffs Your Guide To Stanley Cup Glory

May 15, 2025

How To Watch The Nhl Playoffs Your Guide To Stanley Cup Glory

May 15, 2025 -

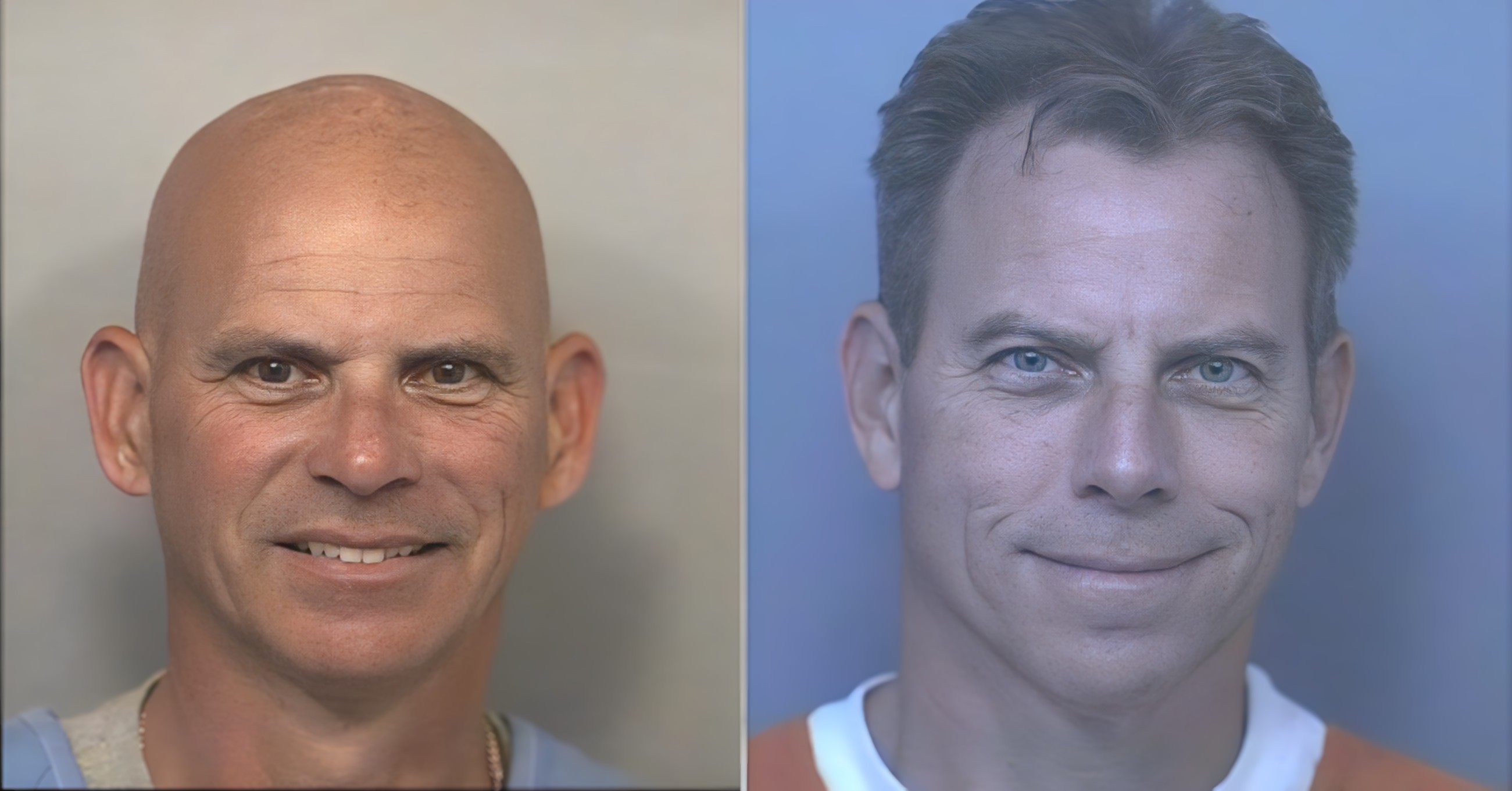

Menendez Brothers New Sentencing Possible After Judges Decision

May 15, 2025

Menendez Brothers New Sentencing Possible After Judges Decision

May 15, 2025 -

Dodgers Muncy Breaks Silence Amidst Arenado Trade Chatter

May 15, 2025

Dodgers Muncy Breaks Silence Amidst Arenado Trade Chatter

May 15, 2025 -

Paddy Pimblett Vs Michael Chandler A Ufc Veterans Perspective

May 15, 2025

Paddy Pimblett Vs Michael Chandler A Ufc Veterans Perspective

May 15, 2025