Is It Too Late To Buy Palantir Stock? Potential 40% Growth By 2025 Analyzed.

Table of Contents

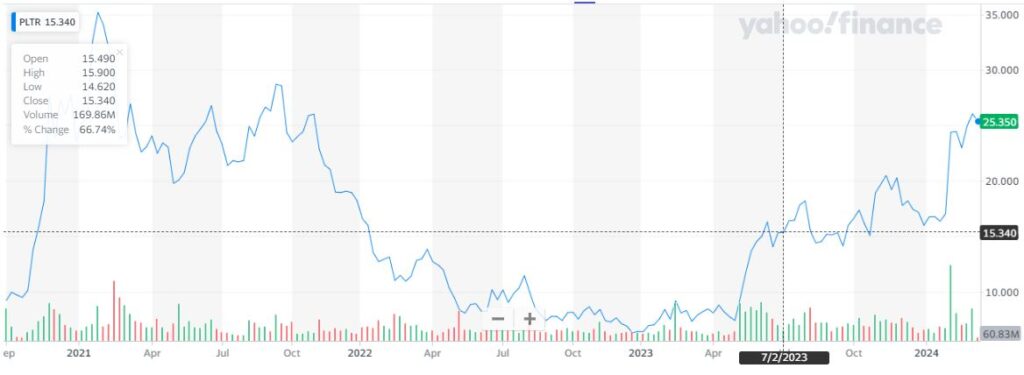

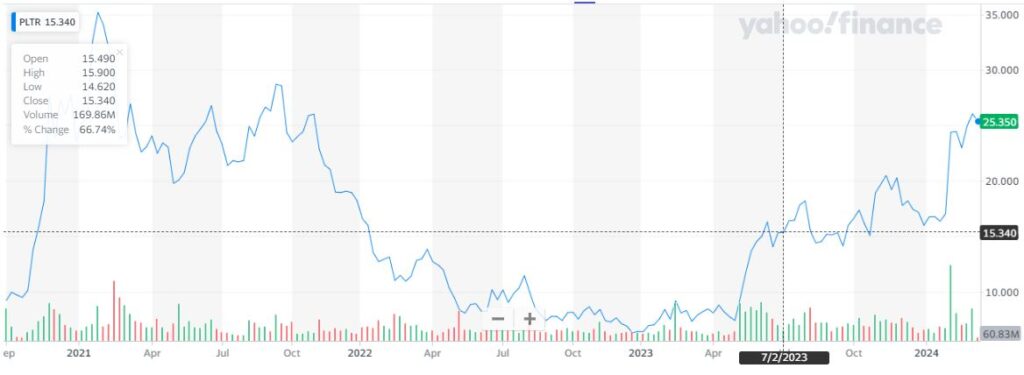

Palantir Technologies (PLTR) has experienced a volatile journey since its IPO, leaving many investors questioning whether it's too late to enter the market. While past performance isn't indicative of future results, analysts predict significant growth potential for Palantir. This in-depth analysis explores Palantir's current standing, future projections, and inherent risks to determine if investing in Palantir stock in 2024 could realistically yield a substantial 40% increase by 2025.

Palantir's Current Market Position and Competitive Advantages

Dominating the Government and Commercial Data Analytics Markets

Palantir holds a commanding position in both the government and commercial data analytics sectors. Its strong presence in government contracts, including significant partnerships with agencies like the CIA, provides a stable revenue stream and showcases its ability to handle highly sensitive data. Simultaneously, Palantir is aggressively expanding its commercial clientele, leveraging its unique data integration and analysis capabilities to attract major corporations across various industries.

- Key Government Contracts: Numerous undisclosed contracts with US intelligence agencies, along with partnerships with other government bodies worldwide.

- Major Commercial Partnerships: Collaborations with Fortune 500 companies in sectors like finance, healthcare, and manufacturing, demonstrating the versatility of Palantir's platforms.

- Successful Case Studies: Publicly available examples demonstrate Palantir's success in improving operational efficiency, fraud detection, and risk management for its clients.

Technological Innovation and Future Product Development

Palantir consistently invests heavily in research and development, constantly refining its core platforms, Foundry and Gotham. These platforms provide powerful data integration, analysis, and visualization tools, facilitating better decision-making for its clients. The company is also actively integrating advancements in artificial intelligence (AI) and machine learning (ML), enhancing the capabilities of its platforms and driving further innovation.

- New Product Features: Regular updates and additions to Foundry and Gotham, enhancing functionality and user experience.

- Planned Releases: Public announcements regarding upcoming product releases and technological advancements often signal future growth potential for Palantir stock.

- Patents and Collaborations: A robust patent portfolio and strategic collaborations with leading technology companies underscore Palantir's commitment to innovation.

Financial Performance and Growth Trajectory

Analyzing Palantir's recent financial reports reveals a complex picture. While the company has shown significant revenue growth, profitability remains a key focus. Examining revenue, earnings, and cash flow trends alongside analyst projections paints a clearer picture of its potential.

- Key Financial Figures: Reviewing quarterly and annual reports for data on revenue growth rates, operating margins, and net income provides a crucial understanding of Palantir's financial health.

- Revenue Growth Rate: Sustained revenue growth, though potentially slowing, suggests the continued adoption of Palantir's services.

- Profit Margins and Debt Levels: Monitoring profit margins and debt levels offers insights into the company's financial stability and long-term sustainability.

Assessing the Potential for 40% Growth by 2025

Market Forecasts and Analyst Predictions

Several market analysts have offered price targets for Palantir stock, suggesting substantial growth potential. These projections often consider factors such as the expanding market for data analytics, the increasing adoption of AI, and Palantir's competitive advantages.

- Specific Price Targets from Different Analysts: Consolidating price predictions from various reputable financial institutions allows for a more balanced view.

- Range of Predictions: Understanding the range of predictions provides a clearer picture of the potential upside and downside risks.

- Sources of Information: Reliable sources like reputable financial news outlets, analyst reports, and SEC filings are crucial for informed decision-making.

Risks and Challenges Facing Palantir

Despite its growth potential, Palantir faces certain challenges. Competition in the data analytics space is intensifying, and regulatory hurdles, particularly concerning data privacy and security, could impact the company's growth trajectory. Economic downturns could also dampen demand for its services.

- Competitor Analysis: Identifying and evaluating key competitors in the data analytics market provides a more comprehensive understanding of the competitive landscape.

- Regulatory Landscape: Keeping abreast of evolving data privacy regulations and their potential impact on Palantir's operations is crucial.

- Economic Sensitivity: Analyzing Palantir's sensitivity to economic downturns helps in assessing the overall risk.

Valuation and Investment Strategies

Palantir's valuation compared to competitors is a crucial factor to consider. Investors should evaluate its price-to-earnings ratio (P/E) and market capitalization in relation to similar companies to gauge its relative value.

- Price-to-Earnings Ratio (P/E): Comparing Palantir's P/E ratio to industry peers offers insights into its valuation relative to its earnings.

- Market Capitalization: Understanding Palantir's market capitalization helps to grasp its overall size and standing within the market.

- Comparison with Competitors: Comparing key metrics with competitors allows for a more informed assessment of Palantir's relative value and growth potential.

- Risk Tolerance Levels: Investors should only invest an amount consistent with their individual risk tolerance. Long-term investors are generally better positioned to weather short-term market fluctuations.

Conclusion

Palantir's strong market position, technological innovation, and potential for growth in the rapidly expanding data analytics market offer a compelling investment case. While a 40% increase by 2025 is a projection, not a guarantee, the analysis suggests considerable potential. However, investors must acknowledge the risks associated with Palantir stock, including competition, regulatory changes, and economic uncertainty.

Call to Action: Is it too late to buy Palantir stock? The potential for significant returns exists, but thorough due diligence and consultation with a financial advisor are essential before investing. Carefully consider your risk tolerance and investment horizon. While past performance is not indicative of future results, the long-term prospects for Palantir and the potential for substantial growth warrant a closer look for those seeking exposure to the data analytics market. Remember to conduct your research and make informed decisions regarding your Palantir investment strategy.

Featured Posts

-

The Monkey 2025 A Potential Low Point In Stephen Kings Cinematic Year

May 09, 2025

The Monkey 2025 A Potential Low Point In Stephen Kings Cinematic Year

May 09, 2025 -

Palantir Stock Is A 40 Rise In 2025 Realistic Should You Invest Now

May 09, 2025

Palantir Stock Is A 40 Rise In 2025 Realistic Should You Invest Now

May 09, 2025 -

Trump Tariffs Devastate Net Worth Of Top Billionaires Including Buffett

May 09, 2025

Trump Tariffs Devastate Net Worth Of Top Billionaires Including Buffett

May 09, 2025 -

Tesla Stock Plunge How Elon Musks Actions Affected Dogecoin

May 09, 2025

Tesla Stock Plunge How Elon Musks Actions Affected Dogecoin

May 09, 2025 -

Edmonton Unlimiteds Global Impact Strategy Scaling Tech And Innovation

May 09, 2025

Edmonton Unlimiteds Global Impact Strategy Scaling Tech And Innovation

May 09, 2025